May 3, 2016

The Fed could turn hawkish again as global financial conditions change for the better

Commentary by Robert Balan, Chief Market Strategist

"Seen as a whole, the Fed's April FOMC message suggests that the data-dependent central bank is amplifying its signal that the June meeting is “live.” I suspect that the second rate hike in 10 years will depend on a combination of continued gradual improvements in the labor market and wage expectations, along with continued relative economic and financial calm internationally.” Mohamed A. El-Erian, Chief Economic Adviser, Alliance SE, April 27, 2016

The Fed has remained dovish since they tightened policy in December. Tumult in international financial markets stayed the hands of the central bank hawks, and that allowed Fed doves to gain the upper hand in subsequent FOMC deliberations. Thus far, the ascendancy of the "doves" led the Fed to pause in its rate "normalization" it has always wanted to do, and reduced the expected pace of rate hikes in 2016 by half. But the financial turmoil of Q1 this year has morphed into a more stable environment, and the erstwhile "sick man" of the world, China, is showing signs of stability and, indeed, recovery. Be prepared for a change in the Fed's tenor – some Fed doves are already shedding their feathers and are starting to reveal hawkish trims underneath.

Boston Federal Reserve President Eric Rosengren is a very recent example of that shift in mind-set. Mr. Rosengren, a notable dove, in recent weeks has been warning the financial markets not to underestimate the odds of rates hikes this year. He emphasized that the Fed had made clear in the SEP dots they expect at least two hikes, which the financial markets has ignored in anticipating only one, and that is to take place at the end of the year, to boot. This is clearly defying the Fed, which is not happy that markets are writing off a policy tightening in June. For the Fed, the data is not here yet, but it will be folly to believe that the Fed had given up on those hikes just yet.

As we described in a previous CIW report ("Dovish Fed" is an adjective devoid of significance: these are what the Fed really wants to achieve, March 21, 2016) tightened in December after dithering for more than a year. And then they lowered the trajectory of policy rate rise after misjudging the trajectory of US growth in H2 2015. And then the global financial landscape became very dangerous in Q1 2016. The Fed were forced to act like responsible “owls”. The Fed lost some credibility in the process with the flip flops, but they did more than enough to diffuse any charge that they are asleep at the wheel. In March, they became aware of the asymmetric risks that they did not face in December, and hence recognized that they should err on the side of looser policy in an uncertain environment – hence, they paused. The market calls it "dovish" – we call it "prudence".

But one thing to remember is that the Fed still prefers to make another hike early (as far away from the November elections as possible), and slowly if the circumstance allows it. But once the data becomes benevolent, the FOMC may well return to old habits – old habits in this case mean a return to quarterly rate hikes. Should the economic data improves further, we should assume that they want to keep the option to both hike quarterly and hike three times. Now, the Fed indeed showed two rate hikes in the March SEP dots, but the dots are just a forecast. They are not at all a commitment to just two rate hikes -- nowhere in the post-FOMC documents or statements can you see the commitment to only two hikes.

In this scenario, the Fed really need to keep the June option open, otherwise there is that spectre of bunching up the next few tightenings. Therefore, the Fed may want to raise the odds of a June policy hike closer to 50-50. The recent FOMC statement, which declined to mention the risks, was interpreted by the market as a dovish signal – for us, it is an early indication of the direction they want to move, and that is towards tightening. Not mentioning the risks at all, by force of logic, is to us, a de facto recognition that there are balanced risks in the universe of central banking at this time. Otherwise, why not say so? Saying that there are risks would have made their intention clear, if the desire was to project a "dovish" outlook. We can only speculate, but the Fed probably deliberately refrained from using the word "balanced", as at that time, its connotations may be stronger than the nuanced picture they wanted to send. But they did not realize perhaps that by saying nothing about risks, they managed to say a lot without intending to.

We are aware that there are counter arguments to this scenario. Federal Reserve Chair Janet Yellen in recent statements has shown the characteristics of what the market calls "dovish". Can the Fed really change their story that fast? The central bank, indeed, can change their plumage in a period of six weeks (until the June meeting). Witness the change in rhetoric from the December hike to the January climb-down. There was a good reason to change the tenor of the story then – the dramatic change in financial market conditions from benign in December to terrifying in January. That was the proximate cause of the cautious Fed that we are seeing now.

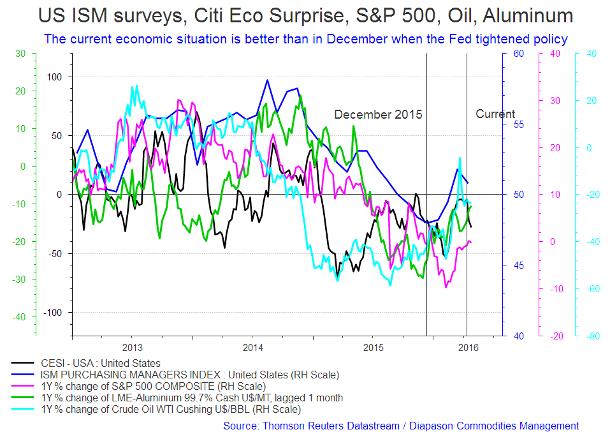

There was a perfect storm of very unfriendly data: a surging dollar, collapsing oil, and a swooning stock market signalled that the Fed's policy stance has turned too hawkish, too fast. A chastised Fed relented and throttled back their desire to normalize policy which is accomplished by raising rates. But the situation today is so much different from January. The equity markets are testing, and indeed may break, previous highs. The US dollar has sold off. High yield rates have fallen more than 50 percent; the volatility index is languishing at previous basement levels. Commodity prices are rising, and crude oil prices are set to test and could break $50/bbl, even after the Doha meeting that brought no agreement to freeze oil output. The Citi Economic Surprise Index continues to surprise. It is such a different financial landscape from the January pits (see the first chart of the week below). The economic situation today is better than when policy was tightened in December. The change will not escape the attention of the hawks at the Federal Reserve. Or, for that matter, including the doves.

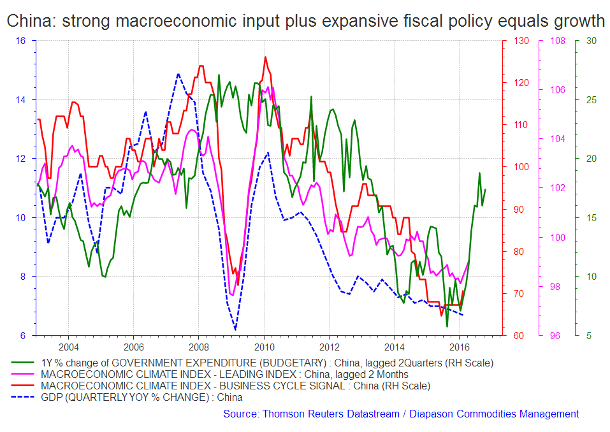

That brings us to the current data. Gavyn Davies, chairman of Fulcrum Asset Management, in an article at the FT suggests that US activity growth nowcast has risen sharply from circa 1.0 percent in February, to around 2.0-2.5 per cent in March and April. This was one of the primers of the rapid rise in risk assets during that period. US initial jobless claims recently fell to a multi-decade low in an April survey week coming before the April payroll data, which we expect will continue the series of good tidings coming from the employment data. Elsewhere, the eurozone’s economy has finally surpassed its pre-crisis high, with 0.6 per cent in the first quarter. The better-than-expected figures took overall gross domestic product past the peak it hit in the opening quarter of 2008. Finally, the fortunes of China, the "sick man of the globe" are changing: official factory gauge showed the nation’s economic rebound stabilized in April as a property recovery and credit surge helped to revive the nation’s old growth engines. The manufacturing purchasing managers index stood at 50.1 last month, compared with 50.2 in March. China had an across-the-board rebound in March as corporate profits jumped, and new credit, investment, industrial output and retail sales all beat economists’ estimates. The macroeconomic case has been primed by an expansive fiscal budget for the next several years (see second chart of the week below).

So a word of caution – the Fed is being primed by the current benevolent financial markets to change the tenor of their story. If the US and global data remains on its current trajectory, the FOMC will be looking hard at the possibility of a June hike. True, there is a lot of data between now and the June meeting. But if conditions remain as is during the next seix weeks, with no major blow-up in the US or elsewhere in the globe. We can not be complacent about a June hike – we believe that it is still pretty much in play.

|

Main drivers this week:

|

Commodities and Economic Highlights

Commentary by Robert Balan, Chief Market Strategist

It is time to refocus on the US Dollar, as a trough may be close

This is a follow-through to our earlier article on the US Dollar ("It is time to refocus on the US Dollar as a key driver of risk-on, risk-off, CIW, April 12, 2016). In that article, we made the following observations:

"Following the recent Fed comments, market participants remain convinced that the US Dollar will have further to go to the downside. The Fed is thought to be dovish; and the market is even more so. Based on this negative currency sentiment, we deduce the following eventualities:(1) the US Dollar (DXY) will probably fall to the area of at least 92.00 perhaps lower; (2) the crude oil price is more likely to go to $45, then to $30 in the short-term; (3) gold prices will likely test $1300 again; (4) base metals could follow through with one more leg up, continuing the uptrend phase which started in February."

"The key factor to all of these (observations) is that the market believes the Fed is unlikely to raise rates, even at the tepid pace that they announced after the March FOMC meeting during which they surprised the entire world by not tightening policy. In the press conference after the meeting, Fed Chair Yellen cited slow global growth, specifically in China and other emerging markets, as concerns."

The US Dollar DXY did fall to as low as 92.55 yesterday, and it looks like the unit will make a robust test of 92.00 later in the week. And as we said before, it may be time to refocus on the US Dollar, because if it will strengthen again, as we expect it would, then many of the market assumptions about the benevolence and longevity of the current risk asset price rally may be put to test. A new USD rally would have unambiguous, negative impact on hard assets. The initial enthusiastic surge in commodity prices and in the assets in the EM space since February, which has continued early this week, would likely be "retraced" and some of the gains would be given up.

Investors should not rejoice too much about the US Dollar being weak. For instance, there has been a dark side to the dollar selloff. The dollar has weakened partly because inflation expectations in Japan and, to a lesser extent the euro area, have declined. The effect of these developments was to push up real yields in these countries, thereby putting upward pressure on the euro and the yen. Japan could not afford to be saddled with a strong currency at this juncture. Neither the Bank of Japan nor the European Central Bank had been happy with rise in their currencies (which have a USD weakness as consequence). The preferable outcome should have been for both currencies to have rallied because a stronger economic outlook in those economies would have given investors hope that the ECB and BoJ could raise rates not too far from now.

The Federal Reserve also had a role to play in the recent USD weakness – a surprisingly more dovish Fed exacerbated the downtrend of the US currency. However, there is a risk that the soothing words from Chairman Janet Yellen in recent weeks could give way to more hawkish rhetoric as the Fed begins to prepare the market for two (or more) additional rate hikes in the second half of the year (see Main Story). Aside from the high likelihood of a change in Fed rhetoric, other economic variables that are within the Fed's remit may act to change market perception as well. Recent US inflation data has surprised on the upside, with core CPI rising at a 3% annualized pace over the past three months. Wage gains have remained muted, it’s true, but just because wages tend to react with a lag to labour market developments. Official statistics may also be not measuring wage growth accurately. The inflow of low-skilled workers back into the job market has artificially depressed average hourly wages. Nonetheless, the Atlanta Fed's Wage Growth Tracker shows that "true" wage growth is now over 3%, double what it was in 2010. These data are consistent with others which suggest that the labour market is tightening. The unemployment rate has fallen to 4.9%, just a smidgen off the Fed's 4.8% estimate of the rate of full employment.

All these factors are supportive of our forecast that the US Dollar should be on the way up over the next few months. It could cause a pullback in the price of risk assets. Nonetheless, we see a forthcoming "correction" as a "healthy" development from a price discovery point of view. The next uptake in risk asset prices should make back the ground that will be yielded in a short-term correction — and gain even more.

Oil inventories vs Oil output - do not count out inventories yet

According to the EIA, the oil supply expanded another week. The agency estimates that crude stocks came in at 540.6 million barrels, representing an increase of 2 million barrels compared to the 538.6 million seen a week earlier. It was also significantly larger than the 1.1 million barrel draw the API (American Petroleum Institute) estimated a day before the release. The Agency also reported that motor gasoline stocks grew by 1.6 million barrels from 239.7 million to 241.3 million. That is not yet considered a condition called glut but any positive build is a negative for the market.

The output data provided some positive news. The EIA report said that domestic oil production for the week came out to 8.938 million barrels per day, a falloff of 15 thousand barrels per day (or 105 thousand for the week) from the 8.953 million barrels per day seen a week earlier. It was the third straight week in a row where production has been below 9 million barrels per day. The long-awaited fall in U.S. output seems to be gathering pace. The Department of Energy also reported lower output in six of the past seven weeks, with production dropping 157,000 barrels per day since mid-January.

We highlight the two primary data in the crude oil fundamentals. Lately, it seems that the market is less concerned about overall build of supplies and is more concerned about the outlook for decreasing output, which would help the market balance out. The market is seems, is now less obsessed with inventory, and has shifted focus to the continuing drop in production, in expectations that they will continue for the foreseeable future. On the other hand, inventories continue to rise, but the weekly changes are no longer moving the market to sell. On the contrary, oil prices have risen when the data was published in each of the past four weeks. So, soaring US oil inventories have had their day as the driver of price, or so it seems.

Indeed, a new concern has emerged. The focus of traders now seems to have switched from an immediate surfeit of oil in inventory, to a possible future shortage due to the severe cut-down in capex. Moreover, the US Department of Energy is becoming more pessimistic about non-OPEC output as a second year of lower investment batters oil-company production plans and low prices encourage the closure of ageing fields and uneconomic wells. The DOE in its latest Short-Term Energy Outlook, forecasts that production outside OPEC will fall by 440,000 barrels per day through 2016. That compares with a drop of just 90,000 barrels per day that it foresaw in January. Also, EIA forecasts that non-OPEC oil production outlook for 2016 will deteriorate rapidly.

So why have traders decided to focus on the output data and ignore the still strong build in reserves? It's probably in part because the inventory build has a strong seasonal factor – US crude inventories always rise in the first quarter. This year's build, even though it's from an abnormally high starting point, is typical of the seasonality moves, and 2016 is no different. There are several sticking points which have to be watched however. Oil prices have jumped 46 percent since mid-February, and higher prices may encourage US shale frackers to begin locking in revenues by hedging this year's production. The higher prices go this spring, the more hedging the price rise will provoke. A concerted action of this nature will limit the rise in price. To add to future woes, if US crude inventories don't begin to fall by late May, builds will come back into focus for traders and the rally could peter out quickly.

Charts of the week: The current economic situation is better than in December when Fed tightened policy; China strong macroeconomic input plus expansive fiscal policy equals growth

|

|

|

|