July 22, 2013

The consequences of “tapering” QE infinity can be very unpleasant

Commentary by Senior Market Strategist Robert Balan

After the June FOMC meeting, Fed Chairman Bernanke indicated that it may be appropriate to slow down and taper the rate at which it purchases assets before the end of this year. This statement took many, including ourselves, by surprise. Indeed, as late as three months ago we felt that the Fed was likely to increase the degree of monetary stimulus before it began to withdraw it. The subsequent turmoil in asset prices clearly showed that the markets were blind-sided by the Fed's gambit as well. The collective message from our forward-looking tools and models, is that by the end of the year, the Fed may be again looking at reinvigorating the QE programs that it wants to prematurely unwind, an event many indications point to happening by September this year.

That is why we believe the US would do well in the slow-boiling currency race, with the dollar expected to fall against most currencies, and against the euro in particular, until year-end. The joker/wild card here is the ECB, which have also surprised many investors by appearing to commit itself to keeping rates at or below their current level for an extended period — Bundesbank objections notwithstanding. We still believe that the US currency will fall on a trade-weighted basis, but probably not to same extent as we thought earlier. Nonetheless, it should be enough to re-launch a wide range of commodities, especially those that are sensitive to future, near-term growth (e.g., energy, base metals) and to a weakening of the US Dollar in the short-term US (e.g., agriculture, precious metals).

Commodity prices may also be underpinned by a surprise jump in the CPI, as higher fuel and food prices earlier in the year started to seep into producers' cost base. Whether or not this uptick in inflation will figure into Mr. Bernanke's tapering calculus remains to be seen, but it does come at an awkward time for the Fed, which has basically ignored their inflation mandate when initially proposing to modify the current terms of the QE3 program. Inflation was not the only item that got short-shrifted — Europe, and its parlous state, also received scant consideration from the Fed. The message from Mr. Bernanke to the eurozone — you are now on your own.

It is clear that both the ECB and the Bank of England (now under new management) are keen to distance their policy stance from a potentially less accommodative Fed — with, in our view, good reason — the developed economies are not yet ready for tightening of any kind, including tapering. So many signals are flashing red (in our opinion) that a more stingy Fed could replicate the 1937-1938 US recession, which was caused by premature, simultaneous tightening of fiscal and monetary policies, after coming out of the Great Depression. Unfortunately, one can not undo the effects of a lapse in judgment in monetary issues. For instance, the sharp rise in yields and mortgage rates after Mr. Bernanke started mulling out aloud his desire to disengage have a real and deleterious impact on the US real estate market. The rapid ascent of mortgage rates in recent weeks has lead to a mini-collapse in US housing starts data in recent months. It will get worse, as mortgage rates have a large impact on the housing data.

The US economy will also take the jump up in yields seen in recent weeks squarely on the chin. Growth through this year and next will be weaker than many thought three months ago because policy will be tighter. We all know that this time will come, but some time periods are better than others when implementing strategic moves, like changes in monetary policy. Unfortunately, strategic sense does not always prevail. The big risk, as we said, is that the US economy slips back into recession -- which could well be the case next year, if the tapering process proves too aggressive and implemented too quickly.

|

Main drivers this week

|

Commodities and Economic Highlights

Commentary by Robert Balan, Alessandro Gelli, Marion Megel and Alban De Rougé

The gasoline outperformance should not last

Gasoline prices rose sharply these past few days, outperforming the oil sector. This was triggered by unplanned outages at several refineries on the East Coast. Indeed, the region is the US’ largest consuming region, accounting for 35.0% of US gasoline consumption and is in deficit of gasoline.

Moreover, the East Coast has a particularly important impact on the NYMEX RBOB (gasoline blending components) futures prices as the delivery point for the contract is located in the New York area, making the contract sensitive to local supply/demand factors. Thus, the upward revision by the EIA over gasoline consumption on the East Coast from October 2012 until March 2013 also helped to push gasoline crack spreads higher.

Another factor was the rise in Renewable Identification Number (RIN) credits’ price as refiners are forced to use a growing amount of ethanol to meet the ethanol mandate (imposed by the 2007 Renewable Fuel Standard), while they cannot blend more than 10% of ethanol into finished gasoline. Weak US gasoline demand make difficult to comply with the amount required by the ethanol mandate. They hence need to purchase RIN credits in lieu of using ethanol. Stronger demand for RIN credits pushed its price higher, which was pass to consumer at the pump.

However, the gasoline outperformance isn’t likely to last. Indeed, the US driving season, which should last until the end of August, is expected to be weak. Refining activity is high, implying strong gasoline production. The spike in US gasoline prices have encouraged European gasoline imports to the US East Coast. Finally, US gasoline inventories remained at a higher than normal level for the season, contrasting with last year.

Large inventories should balance supply disruptions, while RIN credit prices could decline, thanks to stronger ethanol production and high refining activity. Additionally, refining companies putting more pressure on the US government to modify the ethanol mandate, which would reduce RIN credits price.

Zinc will not be the “new copper”

Zinc long term prospects appear remarkable, as resource depletion should prompt many producers to shut down mines or to cut production during the 2013 to 2015 period. The global zinc mine production could decrease by more than 2% from 2013 to 2015, while global demand should keep rising, by 4% to 5% in the next two years due to ongoing urbanization wave in China, where only 51% of the population lives in cities vs. 82% in the US. Consequently, the supply-demand balance should be brought back to equilibrium (or even to a deficit) in the next two years.

These strong fundamentals have prompted many analysts and commentators to define zinc as the “new copper”, suggesting that zinc prices could experience a similar rally to that of copper between 2002 and 2011, i.e. a seven-fold surge.

We believe this assumption is excessive, although we acknowledge that zinc should be a top pick for base metals in the next two years. Indeed, there is a major difference between zinc and copper: China’s crust is full of zinc; not of copper. China indeed accounts for nearly 20% of the world’s known zinc reserves, but only for 4% of that of copper. Although zinc mining operations are not fully developed in China (and this could take years), this should prevent zinc from mirroring copper’s performance in the long term as China will not be short of zinc.

Nickel suffering from substitution with nickel pig iron

Nickel is currently under a lot of pressure, struggling due to a growing substitution with Chinese nickel pig iron production, whose marginal production cost remains 15% below that of refined nickel. There is no clear sign that the country’s NPI producers will durably restrain output. On the contrary, it seems that they are producing as much as possible given the current state of demand, anticipating that production could be crippled next year as Indonesia is expected to implement stricter exporting regulations on nickel ores (used in the making of NPI).

Not only stainless steel production recovery is particularly slow in China (monthly output remains below 160,000 tonnes, compared with levels comprised between 250,000 and 330,000 tonnes in late 2011-early 2012), but producers of stainless steel, which consume 70% of the world’s refined nickel, appear logically to prefer NPI to refined nickel at the moment. Therefore, LME inventories of refined nickel have soared and are currently at a record high of 188,652 tonnes, which represent 11% of last year’s global demand or 42 days of consumption.

Cattle prices supported by low inventories

According to the National Oceanic and Atmospheric Administration (NOAA), a large part of the western and more specifically of the Southwest of the United States is suffering from dryness, including top cattle producing states such as Texas, Oklahoma and Kansas. In average, 37% of these states are experiencing extreme or exceptional drought.

As a consequence, pasture in many states is lacking. The last report of the U.S. Department of Agriculture (USDA) shows that, in average, only 23% of the pasture in states mentioned above is in good or excellent condition whereas 42% is in very poor or poor condition.

This factor has led to a large liquidation of herds bringing domestic cattle inventories to a fifty year low. From a high of 130 million heads in the seventies, cattle inventories are forecasted to tumble to 90 million heads this year, representing a drop of 30 percent. From the start of April to the end of May 2013, cow slaughter rates were running 10% higher than a year before, led by a jump of 17% in beef cow liquidation.

Moreover, during the first half of the year, total commercial cow slaughter is projected to be 3% above the level reached during the first semester of 2012 and it could be the largest number slaughtered since nearly 3.5 million cows in 1996 according to the analyst Rachel Johnson from the USDA.

Therefore, tight supplies will be a large factor in supporting cattle prices, especially in the long-term. Indeed, after liquidation ends, it takes approximately 2 years to rebuild herds.

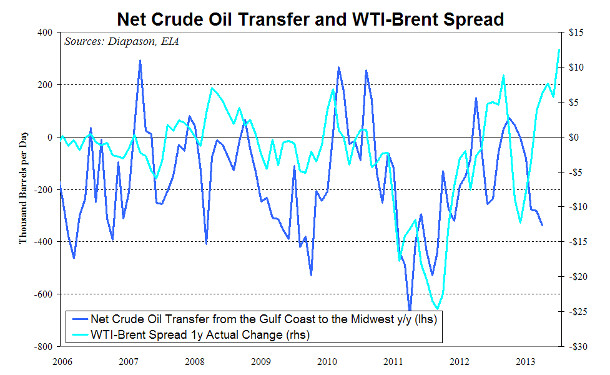

Chart of the week: The Brent-WTI spread should rebound

|

Last week, the Brent-WTI spread fell to less than $1 from around $8 at the beginning of June on the September maturities, the lowest levels since the end of 2010. The spread collapsed due to several factors, such as the floods in Alberta that reduced pipeline flows to the US, the restart of major refineries in the Midwest and the increased capacity of pipelines in Texas which are avoiding Cushing in Oklahoma, the delivery point of the WTI futures contract. Can the spread fell further? This is unlikely as the US Midwest and Cushing continue to produce (and receive from Canada) more crude oil than needed locally. Thus, in order to encourage the transportation of crude oil out of Cushing, WTI needs to remain at a discount with coastal crude oil such as Brent. The narrower spread may have already contributed to lower crude oil shipments to the US Gulf Coast from the Midwest as suggested by last week data, which showed a large decline in crude oil inventories on the Gulf Coast, amid rising crude oil imports and only slightly higher crude runs. Furthermore, the spread may have fallen too rapidly. WTI appears now overbought relative to Brent as reflected in the amount of net long speculative positions on the former, which reached the highest level since April 2011, while on Brent they rose but remained below previous highs. The recent rise in pipeline and rail tanker capacity has reduced transportation costs and therefore may have contributed to the narrower spread. Nonetheless, the recent rail tanker accident in Quebec increased the chances of new regulations over the transportation of petroleum by rail, which could lead to higher transportation costs. However, major pipelines linking Cushing and the US Gulf Coast are not completed yet. These pipelines will sharply reduced transportation costs between the two regions. TransCanada is now testing the new 700’000 Gulf Coast Pipeline (the southern leg of the Keystone XL pipeline, which is still pending for approval by the US government), which could come on stream only by the end of 2013. Finally, crude oil inventories in the Midwest are close to record high levels, while local crude oil production keeps increasing. While downside appears limited, upside risk has increased on the Brent-WTI spread. |

|

|

For the full version of the Diapason Capital Markets report, please contact info@diapason-cm.com