July 15, 2013

Commodities: Where have we been? Where are we going?

Commentary by Senior Market Strategist Robert Balan

« Change is the investor’s only certainty. »

T. Rowe Price

The past few weeks have been heady for commodity investors. Even as other asset classes wilted under the impact of the Fed’s announcement of it’s intention to taper QE Infinity’s monthly purchases of Treasury and mortgage paper, commodities basically held their ground. In doing so, commodities as an asset class outperformed across the board. One wonders whether this state of things will continue. Pursuing this line of thought, we believe that things should even get better for commodities, considering the following developments:

- The key takeaway from the market events in late June that have the most profound impact on commodities as an asset class is that central bank policy conditions have now fundamentally changed (as the tail risk of another collapse disappeared), and the change was for the better.

- Commodities are benefiting from geopolitical concerns and cyclical (growth) factors. Demand for energy and metals has been a lot better of late, and some supply constraints are starting to show up on selective commodities -- but the market is ignoring these factors and still focuses on China developments.

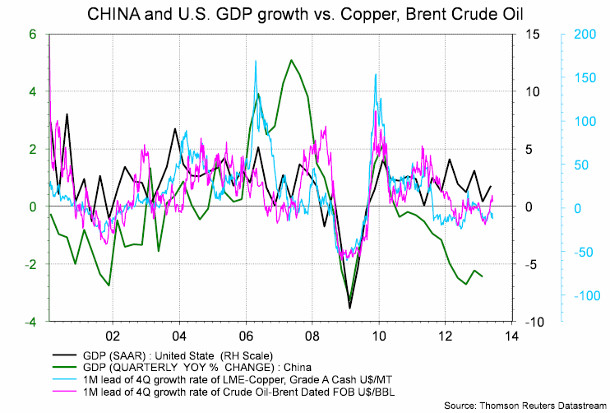

- Commodities prices of late have hewed to rate of change in US growth rather than China's -- there could be a positive surprise for commodity prices if market sentiment adjusts to the new supply-demand realities.

A repositioning is taking place between the bond market into equities and other riskier assets. This will keep the equity market rally going. Further uptrend in equities should underpin the price of all risk assets as well.

This repositioning is led by retail funds, which are also piling into prime money market funds. Retail investors typically link brokerage and money fund accounts so that the latter become, in effect, a “gateway” into and out of the stock market, so my personal reading into the situation says some of these funds will still find their way into stocks.

On the other hand, institutional positioning seems to be pulling away from credit-like wholesale deposits and commercial paper and transiting into equities. In the final analysis, the dichotomy in the focus between retail and institutionals probably stems from the desire to go for yields. These developments are important for the commodities space because once again, the correlation between equities and commodities is rising. Therefore factors that impact equities will henceforth be even more important for commodities.

The commodities rally is being led by crude oil and other energy components, boosted by geopolitical concerns and cyclical factors. The Egypt situation was instrumental in pushing crude oil out of its previous trading range. The movement of crude oil and copper is now also correlating better with US GDP developments rather than with China’s. This holds a significant potential, as the China story is increasingly being bogged down by the unpredictable and very opaque decision making process of the new government of Premier Li Kequiang. Promise of further growth in the US housing market holds special interest for copper prices.

Demand for energy and metals have been a lot better of late, and some supply constraints are starting to show selectively -- but the market is ignoring these factors due to its focus on China developments. However, commodities will likely continue to hew closer to the US growth story, which provides a better road map for the asset class. Growth factors in the US should be the key determinant of commodities in the next quarters to come.

|

Main drivers this week

|

Commodities and Economic Highlights

Commentary by Robert Balan, Alessandro Gelli, Marion Megel and Alban De Rougé

Upside risk increased on the Brent-WTI spread

The train derailment in Quebec last weekend has increased upside risk for the Brent-WTI spread. Indeed, the blast is likely to lead to a change in regulations over the transportation of crude oil by rail, increasing transportation costs.

The transportation of crude oil by rail is riskier than by pipeline. Moreover, rail tankers can transit through urban area. This accident increases the chance of more regulations on rail tankers in North America as the amount of crude oil transported by rail is getting more important and is expected to grow further. Petroleum transported by rail year-to-date was up by 47.9% y/y and now accounts for 5.9% of total US carloads. In July 2013, about 700'000 b/d of crude was transported by rail in the US, accounting for about 10% of US crude oil production. Rail shipment is even more important in the US Midwest as about 3 quarters of crude oil production in North Dakota, which reached almost 800’000 b/d in April 2013, is transported by rail. Crude oil by rail shipments are expected to grow to 1.1 million b/d at the end of 2014, according to Bentek Energy.

New regulations could take the form of a prohibition or limitation for rail tankers to transit through urban center, or/and the prohibition of the use of old rail tankers as new rail tankers are considered safer and the limitation in the amount of rail tanker per shipment.

All these new regulations would increase the cost of transporting crude oil by rail. Traders would hence need wider geographical spreads for implementing physical arbitrage by rail, especially in the Midwest where rail tankers account for a large share of the crude transportation is made by rail. The upside risk of Brent-WTI has therefore increased. This could also affect the profitability of some Canadian oil projects which are becoming more dependent on rail transportation as major pipelines projects (such as the Keystone XL pipeline which is still pending for the US government’s approval) are years away to be completed.

China’s zinc supply discipline loosening despite tight producers’ margins

After months of good supply discipline from Chinese producers, it seems that production is on the rise again in the country, although zinc smelters continue to report tight margins. In addition to the persisting low refined zinc prices, production costs are soaring in China, especially for electricity, water and gas. The two largest Chinese zinc smelters, Zhuzhou Smelter and Huludao, both reported heavy losses last year of respectively 619M RMB and 3.7bn RMB (prompting Huludao to suspend trading in May 2013). Margins are likely to remain very tight for these producers, especially since they do not enjoy strong public subsidies, contrary to aluminium producers.

Despite this, China’s refined zinc production was up nearly 10% y/y in the January to May 2013 period, from 1.95M tonnes to 2.14M tonnes, according to the Chinese Nonferrous Metals Industry Association. In particular, April and May 2013 saw production rising by 16% and 14% y/y respectively, i.e. growth rates not seen since H2 2010.

the latest production figures are negative for zinc’s prospects, it seems that the domestic usage of the metal is holding firm, given the solid construction and automotive sectors, where most of country’s zinc goes. Inventories also appear on a downward trend in China, confirming the solid consumption: stocks held in SHFE facilities stand now at their lowest level since October 2010.

Mining Capex controls to impact base metals on a medium to long term basis

In the past months, mining producers have radically changed their general rhetoric to enhance shareholder’s value creation instead of growing production. This new strategy (of cash flows over ounces) is set to be implemented by new CEOs that have been appointed at nearly all the sector’s major companies in the past months. A direct consequence is that mining capital expenditures (capex) have peaked and should decrease in the coming years.

This reduction in capex should start impacting supply-demand balances only in a two-to-three-year time. Indeed, there are two types of capex: the sustaining capex (aiming at maintaining existing operations, renewing machines, etc.) and the growth capex (aiming at developing a new project or expanding an existing one in order to increase production). As the sustaining capex are hardly reducible, producers should mostly focus on growth capex cuts, which should have a medium or long term impact mostly.

In addition, in the past years, 65% of the world’s top 40 mining companies’ capex have been allocated to iron ore, coal and gold – and it is likely that these three commodities will endure the strongest capex cuts too, especially given the price levels relative to the marginal costs of production (gold marginal cost: $1,350/oz; iron ore: $120/tonne). This means that base metals should be impacted to a lesser extent. Indeed, copper, the base metal that has received the most capital investments in the past year (15%), still enjoys strong margins as its marginal cost of production remains 45% below current prices.

The most important impact in the short-medium term for base metals is that shareholders will hardly accept cost overruns – and therefore that mining producers may not have the same capacity to plough in more money. This could be crippling especially for nickel projects using the HPAL technology, often associated with delays, setbacks and overruns. Also, zinc mining projects could also suffer from this new strategy, especially as many of them are located in Australia, where producers are taking the full brunt of shareholders’ pressure.

China wheat output dips for the first time in a decade

For the first time in a decade, China's wheat harvest is expected to fall this year, according to the US Department of Agriculture's Beijing bureau. China's wheat harvest, the world's biggest for a single country, should fall by 2.6 million tonnes to 118 million tonnes. Some private analysts have revised much lower their estimates to 108 million tonnes, which represents the weakest level in 8 years.

Indeed, industry sources suggest that there are quantity and quality issues with the 2013-14 Chinese winter wheat crop. Meteorologists point to wet conditions during the early part of the harvest, late May and beginning of June, as a reason for lower than expected wheat quality and potentially lower total wheat production.

Rain, while generally helpful to yields earlier in the season, can damage crops close to maturity by encouraging head blight and sprouting of kernels. According to the USDA report, some regions saw a large part of wheat failing to meet quality standards as required for state reserves due to a relatively high rate of unsound kernels: shrunk, germinated, or mould damaged.

Therefore, the USDA bureau lifted its forecast for Chinese wheat imports in the season 2013-14 to 4 million tonnes, a rise of 1 million tonnes year on year, although other analysts have lifted their estimate for purchases to 7 million tonnes. If this last forecast is realised, it will represent the highest amount since the season 1995-96.

Between the seasons 2005-06 and 2010-11, China has not been a consistent importer of wheat, but since the season 2011-12, its buying interest has picked up. As of June 27, China had total wheat purchase commitments from the US of 1.8 million tonnes. Since then, the USDA announced another 1.3 million tonnes of Chinese wheat purchases. China has also purchased 200,000 tonnes of French wheat in June and 300,000 tonnes from Australia.

Chart of the week: Cyclical commodities now driven by the US rather than China

|

Since the middle of 2012, commodities have been hewing closer to the US GDP story insofar as the rate of changes in prices are concerned (see chart above or below). And by the middle of last year, the switch over was complete -- since then, the rate of change in Crude oil and copper prices have followed the evolution of US GDP to a much closer degree than they do with the growth patterns in China. There are probably two reasons for this: the US housing market was by then showing a sustainable upwards trajectory (and with it, the implications for base metal usage in new houses to be built). The other reason probably is acceptance that there will be flat to lower growth in China, but there are also small odds of hard-landing, on the other hand. Moreover, the US promises to develop as the engine for global growth in the near-future -- hence, its growth prospects has become the de facto yardstick for gauging global growth prospects. We believe that this change in regime from China-centric focus to a US growth framework will become even more accentuated going into year-end and that growth factors in the US should be the key determinant of commodities in the next quarters to come. |

|

|

For the full version of the Diapason Capital Markets report, please contact info@diapason-cm.com