May 27, 2013

Fed’s reaction function: watch employment, not regional presidents

Commentary by Senior Market Strategist Robert Balan

“Importantly, in the 1930s, in the Great Depression, the Federal Reserve, despite its mandate, was quite passive and, as a result, financial crisis became very severe, lasted essentially from 1929 to 1933. "

Ben Bernanke, Chairman of the Board of Governors of the Federal Reserve System

Risk assets have been shaken last week by concerns that Fed tapering could take place in the near future following Fed Chairman Bernanke’s congressional appearance last Wednesday and the May FOMC minutes. Attributing the sell-off to what Mr. Bernanke may have said is totally erroneous. In fact the Fed Chairman sounded outright dovish in his prepared speech. It was the recent comments made by other hawkish Fed officials that led some investors to believe the FOMC was close to cutting the pace of purchases. However, rather than regional presidents, it the employment data that needs to be carefully monitored as it plays a key role in the Fed’s decision making process.

All of these remind us of something we learned in almost 40 years of watching the Fed and the FOMC: understanding the Fed's reaction function, and staying on top of the likely path of monetary policy means tracking the Fed Chairman -- now, Mr. Bernanke is it. Be wary of regional Federal Reserve presidents. The cacophony generated by regional Fed presidents results from attempts to generate headlines for the benefit of the folks back home, but usually does not amount to something much.

Throughout the US Quantitative Easing (QE) era, the market has shown a tendency to overreact to Fed speak, specially if the Fed speaker tries to balance the opposite nuances of an evolving policy. With that in mind, we looked at the likely triggers for the end of the extreme accommodation periods, following the three recessions preceding the last three business expansions (May 1983, February 1994, February-August 2004). Despite the popularity of inflation as policy trigger, the study shows that it was not inflation readings that made the difference. Rather than inflation, employment was the more crucial part of the dual mandate that triggered a policy shift. We reached this conclusion after plotting the nonfarm payrolls and the unemployment rate to see if we get the same effect -- and indeed we do. Policy changes occurred only when unemployment was falling sharply and accelerating to the downside

The 2003-04 period is particularly telling, given the introduction of statements following FOMC meetings, which had not existed in prior cycles. The description of the labor market evolved from ‘firing has stopped’ – a condition apparent in the current level of claims and the JOLTS survey data – ‘but hiring hasn’t begun’, to ‘hiring hasn’t begun, but other labor indicators are improving’, to ‘hiring has picked up’. Through the lens of these prior cycles, all the parsing of Fed speeches that we now do is perhaps unnecessary. It seems highly likely that the FOMC has in the past (and in the immediate future), concluded and will conclude the exit strategy right after the data at 8:30 on a Friday payrolls and unemployment day.

Despite the stronger-than-expected 1Q 2013 growth in the US that have increased speculations that tapering will start sooner than later, the Fed's leadership, Bernanke, Yellen and Dudley (BYD), have said they need a few more months of data before being able to assess the situation. This underscores the data dependency of the final decision. But even then, for us, this is simply an agnostic stand in the case of the leadership. BYD, among others, have also noted the fiscal drag that is still unfolding and past episodes where the better economic data was not sustained, and growth decelerated.

There is a lot merit to the BYD and the doves' argument that QE1 and QE2 were ended prematurely. Why so? After each of those QE episodes, the economy did not thereafter enter a self-sustaining course, and floundered again. The FOMC had to repeat the process. Bernanke's prepared remarks showed a clear (at least to us) desire not to three-peat the mistake of the premature ending of the first two QEs. The economy has lost momentum in recent months. Current conditions do not meet our perceived set of conditions which will move the BYD leadership to initiate a policy shift. The performance of the economy over the next 3-4 months is of supreme importance to the issue of whether or not a policy shift or even QE infinity tapering will take place. Until then the Fed we believe that the Fed is buying $85 bln a month of long-term assets and, even if its slows its purchases in September (highly debatable, and will be data-dependent), the Fed will be continuing to ease policy, perhaps at a slower pace, through the year-end, at least.

|

Main drivers this week

|

Commodities and Economic Highlights

Commentary by Robert Balan, Alessandro Gelli, Marion Megel and Alban De Rougé

Natural gas is losing market share to coal

In early 2012, low US natural gas prices relative to US thermal coal encouraged power plants in the US to switch to natural gas at the expense of coal. The share of natural gas as fuel used to generate electricity rose to 32.2% in April 2012, close to the share of coal which stood at 32.6%. This contrasted with previous years when coal share averaged 49.0% between 2000 and 2010, while natural gas’ share was 19.3%.

While coal’s decline is structural due to growing environmental regulations and thanks to the shale gas boom, coal demand could rebound this year due to high natural gas prices relative to coal prices. In March 2013, US coal consumption by the power sector rose by 24.1% y/y, while natural gas demand by the power sector fell by 8.4% y/y. The share of coal in the power sector is now back to 40% (v. 34.2% in March 2012), while the natural gas’ share fell to 26% (v. 29.9% in March 2012), reflecting impressive capacity by utilities to switch relatively rapidly of fuel in order to maximize returns.

This is also reflected in the growing correlation between coal and natural gas prices in the US. The correlation should remain important as the power sector becomes a more important component of natural gas demand during the summer. The share of the power sector over overall natural gas demand typically increases around 50% from less than 20% during the winter.

In Europe, coal demand is increasing at the expense of natural gas due to extremely low carbon prices (high carbon prices make coal less competitive with natural gas) and high natural gas prices that encouraged the importation of US coal. In March, French thermal coal burn reached a 14-year high. Natural gas prices need to become more competitive with coal prices in order to regain its market share.

The return of geopolitical risks

The geopolitical risk premium on oil prices could increase due to growing political uncertainty in the Middle East and North Africa. Oil prices are especially affected by the political situation in this region as it accounts for 40% of oil traded internationally. In fact, the risk premium could rise due to a significant escalation of a regional issue or due to the accumulation of several factors.

The Syrian civil war is becoming more international as some neighbours are increasing their involvement there, while the US and Russia can’t agree on a rapid solution, increasing the risks that the conflict could spill over to neighbouring countries. Sectarian tensions in Iraq are growing amid rising signs that the Kurdish Regional Government wishes to gain more autonomy. Uncertainty about the new leadership in Iran is increasing as the presidential elections in mid-June are approaching, while the country keeps developing nuclear capacity, increasing the risk of attack by Israel. In Libya, the weak government struggles to control former rebel groups amid growing social unrest that are threatening crude oil exports. These elements could contribute to increase the geopolitical risk premium on oil prices in the near future.

Zinc and nickel prices anticipating a crisis in the Chinese steel industry?

The world production of steel has been particularly strong over the past months: after having hit a record high in March 2013, it set its third highest volume ever last month. Most of this growth has been triggered by China (which posted in April 2013 its second biggest monthly production ever after the March 2013 record high), which continue to ramp up output as China’s average production has increased by another 3% in May 2013 according to CISA.

Two base metals are also closely related to the steel market: zinc and nickel, the former being used to protect steel from corrosion (galvanized steel) and the latter to make stainless steel. In recent history, there has consequently been a close correlation between China’s crude steel production and the zinc and nickel prices. In the past weeks however, a disconnection has emerged as base metals prices embarked into a declining trend while China’s production of steel has continued to soar: nickel prices have collapsed by 11% since the start of April 2013 while zinc prices have dropped 3%, despite the slow price recovery seen in the past days.

It seems that nickel and zinc prices could be anticipating a crisis in the steel market. Indeed, Chinese steel producers’ margins have strongly tightened in the past weeks as prices have severely fallen. It is therefore likely that China will begin scaling back production in the next months as supply of the ferrous metal appears really excessive and should therefore be largely sufficient to meet short term demand.

Zinc prospects remain however better than nickel’s, as zinc is also used in the automotive industry which has delivered solid figures since the start of the year. Also, nickel prices should remain hampered by the expected strong increase in nickel pig iron production.

Lead set to rank among the top performers of the base metals complex

Lead has outperformed the LME base metals complex since the stat of the month and last week in particular, as the metal is expected to exhibit tight fundamentals in the coming months. Since late last year, we have been supporting the view that lead could reverse from a surplus to a deficit this year, and could stand as one of the strongest base metals along with copper and tin.

This view was quite challenged in mid-April when lead prices suffered much more from the sell-off than copper and tin. In the past weeks however, lead has regained some strength as the latest statistics from China confirm the fantastic up-run in lead usage. The warm months are usually strong drivers for the transportation sector (and therefore for lead, used to manufacture lead-acid batteries); but beyond the sole seasonal pattern, China’s usage of the metal has been impressive so far this year: from January to April 2013, the production of lead-acid batteries increased 20% y/y. The production of electric bikes, which currently drives most of the battery demand, was up 20% also in Q1 2013.

Lead is however quite a volatile metal as the market enjoys less liquidity than copper; and further ups and downs are expected. However, as a clear line is being drawn on the LME between tight and loose markets, lead is likely to stand on copper and tin’s side, apart from the more depressed aluminium, nickel and zinc markets.

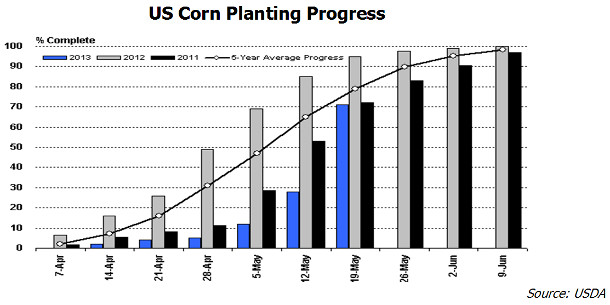

Chart of the week: a record corn planting progress yield loss

|

According to the last Crop Progress report published last week, the US Department of Agriculture reported a record weekly corn planting increase of 43 percent this week. US growers had planted 71 percent of their corn crop by Sunday, up from 28 percent the week before. Given that US farmers intend to plant 97,3 million acres of this year, the highest since the 1930s, the advance is likely to prove also a record in area terms, implying the equivalent of 41,8 million acres, or 16,9 million hectares. An area of that size is equivalent to planting the size of Florida in one week. More importantly, the previously concerning planting delays have largely been eliminated as average progress for this week is 79 percent. Soybean planting also saw an impressive week despite the extremely active corn planting, with 24 percent of the crop in the ground up from only 6 percent last week. While it is still well below the average of 42 percent, farmers will shift strongly to soybean planting, once the corn crop gets in, and there is little concern at this time regarding getting the crop planted given the wider planting window for soybeans. The third largest spring crop experienced also a significant improvement in planting activity. Indeed, spring wheat planting is now 67 percent complete, up solidly from 43 percent last week. However, 29 percent of the corn crop has still to be planted. And according to agronomic research, corn planted after May 20 could see a 10 percent loss in yield and when planting is delayed beyond May 31, yield could see a 20 percent decline. Moreover, this will create a situation where a large portion of the crop is going through pollination at the same time (in early August), elevating the risk of more widespread damage occurring if a major hot or dry spell hits the Corn Belt during that timeframe. |

|

|

For the full version of the Diapason Capital Markets report, please contact info@diapason-cm.com