May 20, 2013

The end of the growth scare

Commentary by Senior Market Strategist Robert Balan

“The market is always making mountains out of molehills and exaggerating ordinary vicissitudes into major setbacks”

Benjamin Graham, 1959

Global asset market prices have been strongly driven by upside surprises in hard economic data at the start of the month, with stock markets continuing to make new highs and commodity prices finally making a trough and stabilizing. Bond yields have also backed up everywhere, typified by the 10yr US treasury bond which rose from 1.61% trough on May 1st to a high of 1.98% last Wednesday. The bond yield back-up is significant in that sharp movements like this happen usually at the start of a new "risk-on" cycle.

The latest rally follows the more generalized asset price rally in H2 2012, which was primarily driven by the removal of the euro area tail risk and the short covering of related positions. Most investors remain downbeat about the global growth outlook, though, and have only reluctantly embraced the recent moves. Nonetheless, the recent shift towards less austere fiscal regime in the eurozone is a game-changer, and bodes very well for another "risk-on" episode. Moreover, this past week, economic data surprises have also started in China and in emerging markets.

The most recent data will likely alleviate concerns in the US, leading even some in the market to expect that the Fed would taper off the monthly $85 bn QE purchases soon –- something we do not expect. Nonetheless, we also expect US bond yields to rise (to circa 2.25% - 2.45%). We explain the dichotomy of the two views by pointing out that the market has a peculiar reaction function to apparent economic growth, which is distinctly different from the Fed's reaction function to that same apparent growth in terms of timeliness. Simply put, the Fed will wait for more evidence, but the bond market will not be as patient.

Elsewhere, central banks are on a cutting mode. It also helps that finally even the most recalcitrant central banks have shifted focus away from inflation and have shifted to the more pressing issue of lack of growth — central banks are cutting rates everywhere. Of course, there is something more in the cuts than reviving growth — it also has something to do about weakening the currencies, which in a circuitous way, is also about promoting (export) growth. In the past three weeks alone, no less that 8 central banks have cut rates. The more significant ones are Australia and New Zealand in that they have pointedly emphasized the rates were cut to keep the currencies from appreciating further. The impetus comes from the aggressive weakening of the Japanese yen, which had received sanction from the G7 recently. A new front has been opened in the currency wars — the story does not end here.

|

Main drivers this week

|

Commodities and Economic Highlights

Commentary by Robert Balan, Alessandro Gelli, Marion Megel and Alban De Rougé

The IEA is getting ahead of itself

Last week, the International Energy Agency (IEA) announced in its latest report that “North America has set off a supply shock that is sending ripples throughout the world”. The IEA expects North American oil supply to grow by 3.9 million b/d between 2012 and 2018, thanks to the development of tight oil. However, the agency failed to consider several factors that could mitigate the development of tight oil.

Indeed, the output of a tight oil well in North Dakota typically falls by around 70-80% after two years. Oil companies are hence forced to continuously drill new wells in order to compensate for the high decline rate, making tight oil output significantly more price-elastic than conventional oil fields. Furthermore, the impact of new technological advances is being offset by the fact that companies have first developed “sweet spots” and are now drilling in less prolific areas, forcing them to drill even more wells to mitigate the decline of existing wells.

Nonetheless, one of the most problematic issue is the complex geology, which is different in every locations, making long-term production growth forecast extremely difficult. Andrew Gould, Schlumberger’s former CEO and chairman said in March 2012 about shale gas (which remains valid for tight oil) that “the production mechanism itself is not understood, and the decline pattern even less so. Overall, we have insufficient data, and we do not have a reservoir modeling capability that can lend credibility to reserve or recovery numbers. […] Today’s approach to shale gas development is unsustainable, being more akin to the use of brute force. As a result is far from being optimal in terms of resource use, environmental footprint, production efficiency and cost”. Thus, the IEA’s strong forecast on the development of tight oil may be faced with disappointment.

Negative copper sentiment does not stand reality check

There has been a widening gap between the depressed negative sentiment on copper and the reality on the ground.

Copper prices have been quite resilient in the past two weeks, despite some persisting concerns regarding the global manufacturing and, more generally, the negative sentiment over China’s consumption of base metals. Copper skeptics are all over the place at the moment and are being supported in their views by the growing copper mine supply, the swollen LME inventories and the slightly lower than expected growth rates and industrial numbers in China.

One cannot fail to observe that the reality on the field is not that gloom. Physical traders are actually reporting some healthy demand in the US and in China, as the spring season is usually stronger for copper demand, especially in the construction sector. On the other hand, physical supply has become scarcer: in the US, a local shortage has been caused by the landslide at one Kennecott’s copper mine in Utah which represents 1.6% of world output and which should remain closed for 6-12 months. In the rest of the world, inventories were moved to LME warehouses for cash and carry arbitrages; and it currently seems that out of the 600,000 tonnes currently held at the LME, about 500,000 tonnes could be unavailable for consumption.

Consequently, physical premiums have surged. In Europe, the Rotterdam Grade A copper cathode premium has nearly doubled from its end of February 2013 lows, from $57/tonne to $108/tonne. In Asia, the same premium has more than tripled over the same period, from $40/tonne to $140/tonne. Also, in the US, the premium for copper high grade cathode has soared from $121/tonne at the end of April to $176/tonne. In addition, the tightness on the physical market has resulted in a scarcity of scrap supplies, which are usually traded at a 5-10% discount to refined metal prices, but, following the physical shortage, have recently moved to a premium.

Zinc fundamentals expected to tighten in the second half of the year

Zinc has poorly performed since the start of the month: while copper has posted returns of 9%, tin of about 5% and nickel of about 3%, the galvanizing metal only has advanced by 1%, being therefore the worst performer of the base metals complex month to date. Zinc continues to suffer from the weakness in the steel market, as about 60% of the world’s zinc is used to protect steel from corrosion (galvanized steel). In addition, the global refined zinc market is still expected to be in a surplus of approximately 100,000 tonnes this year; but this excess should only be about the third of that estimated for 2012.

In the coming months, zinc’s fundamental could tighten significantly. The demand side is indeed expected to improve as the construction (where most of the galvanized steel is used) and the automotive sectors have both good prospects in China and in the US.

The supply side should also be particularly supportive to zinc. Given the current low zinc prices, Chinese zinc producers have been under pressure, prompting China’s second-largest zinc smelter, Huludao Zinc, to suspend trading from May 8, 2013, after registering the third consecutive year of losses in 2012. This challenging market environment already forced smelters to curtail production last year, when output levels remained below the 5-year average in the whole third quarter of the year — a particularly depressed production level from China, which usually reports record output figures nearly month after month for almost all other base metals.

Although production improved in the first quarter of the year, we expect that the current tight margins will force producers to reduce output; and that the low production levels of 2012 will provide little buffer to consumers. As a result, we expect imports to increase significantly in the coming months, which should provide some support to zinc prices.

Stronger demand for cocoa could push prices higher

Cocoa was one of the top performing commodity in April, having rallied 18 percent since the lows of early March to a 5 month high of $2’415/mt. This trend defies the negative mood noted in other commodities, but also appears at odds with recent news and data published (weak consumption and larger mid crop prospects) which appear negative for cocoa prices. However, a closer look at the fundamentals point to a market that could easily fall back into deficit.

Dry weather during the July-September period last year affected the main crop in Ivory Coast. Since then, better weather and improved soil moisture has accelerated pod maturation and harvesting, resulting in arrivals now almost on a par with 2011-12. The focus is now on the mid crop (April-August), as the main Ivorian crop (October-March) is now practically over. The weather continues to improve for the development of the mid crop, thanks to abundant rainfall combined with good sunshine.

On the demand side, the Q1 2013 quarterly grindings volumes were recently released. Overall, a negative picture was painted, with the European grindings down 3.9 percent y/y to 339’377 t, and Asian grindings down 11 percent to 140’062 t. Only the North American grindings (albeit a smaller market) were up by a higher than expected 6 percent, to 125’887 t. However, the European grindings number was missing four of the 25 processors that normally report to the European Cocoa Association. This could account for up to 12'000 t of unreported grindings, which if included would have resulted in a more likely flat year on year change.

The weak grinding numbers in Q1 have prompted fears in the physical cocoa products markets that butter supplies will decline. Panic buying and increased butter demand are leading to stronger enquiries, which are pushing butter ratios back to two times the price of Liffe cocoa futures. Should this strength be maintained in the short term, this would support higher grindings volumes in Europe, Asia and North America for the next quarters.

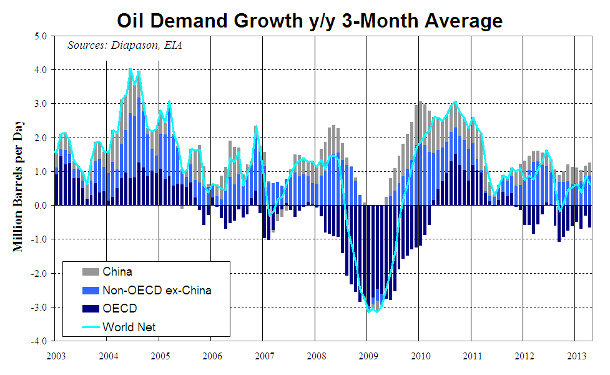

Chart of the week: China is not the only driver of global oil demand growth

|

The recent overperformance of the energy sector over the base metals, the other cyclical sector has one major explanation: China. In fact, it is its lower dependence on China that allowed the energy sector to outperform base metals which remained heavily link to the Chinese economy. Indeed, although China accounts for the bulk of most base metals’ demand growth, it usually only accounts for less than half of global oil demand growth. In 2012, Chinese oil demand indeed accounted for slightly more than a third of global oil demand growth. Again during the first four months of 2013, non-OECD ex-China continued to account for most of non-OECD demand growth. Like in mid-2012, concerns about the Chinese economy contributed to the underperformance of the metal sector over the oil sector.India, Russia. Brazil and the Middle East continue to see a rapid expansion of their oil demand. According to preliminary EIA data, their combined oil demand grew by 890’000 b/d y/y between January and April 2013, while Chinese oil demand growth reached 370’000 b/d y/y during the same period. Non-OECD ex-China countries are expected to continue to post strong growth until the end of the summer. The energy sector remains hence more insulated to weakness in the Chinese economy compared with the base metals. On the other hand, once the acceleration of the Chinese economy would be confirmed, energy is likely to lag base metals.

|

|

|

For the full version of the Diapason Capital Markets report, please contact info@diapason-cm.com