May 13, 2013

The "Austerity" meme seems to be finally running out of steam

Commentary by Senior Market Strategist Robert Balan

“Politicians don’t move the economy, the economy moves the politicians”

Richard Russell

This weekend's G7 meeting saw European policy makers expressing a willingness to find and consider ways to shore up and revive the eurozone's economy, under prodding from the US to take action. Eurozone finance ministers and central bankers sent signals that they will scale back "austerity", are looking to unfreeze bank lending and provide more aid to businesses in the periphery.

It does look like the "austerity" meme is finally running out of steam everywhere. At this point the economic argument for "austerity" (slashing government spending even in the face of a weak economy) has collapsed. Inflicting pain via austerity may have reached its political limit, especially in the eurozone, which is confronted with a deepening recession (which is now impacting even mighty Germany) and a record unemployment that has exceeded 12% (27% in Spain). Even before this weekend, the writing was on the wall: France and Spain have received more time to meet European Union budget-deficit goals. That means less pressure to take tax and spending steps to plug fiscal shortfalls caused by economic weakness. Italy was debating doing a reverse of sales tax increases, and Spain is looking to introduce ways to support the creation of new industries.

In the US, some erstwhile defenders of austerity are changing their tune. Mr. Bill Gross, has come out in favor of fiscal spending, deficit or otherwise. In his own words: "The UK and almost all of Europe have erred in terms of believing that austerity, fiscal austerity in the short term, is the way to produce real growth. It is not, you’ve got to spend money.” The International Monetary Fund has also argued that Germany, the US and the UK are tightening their belts too fast.

Truly, this new development is potentially a game-changer, and if the proper follow-through is taken by policy makers, the investment environment will change profoundly, as the last source of tail-risk will disappear. What is significant at this time is that financial authorities have become keen about rallying lending at banks. This is especially of more import in the eurozone, where 80% of corporate financing comes from banks, as against only 20% in the US. Even the ECB is getting into the act, and is now considering buying asset-back securities as an option to help lending to smaller businesses.

The offshoot of the death of the "austerity" meme: stability in the eurozone, and less fiscal consolidation in the US. We believe that the uptrend market in risk assets should carry on in the second half of the year.

|

Main drivers this week

|

Commodities and Economic Highlights

Commentary by Robert Balan, Alessandro Gelli, Marion Megel and Alban De Rougé

Improved FSU and EU wheat crops will put pressure on prices

From a global prospective, the world is highly likely to return to a wheat surplus in the 2013-14 season thanks to a rebound in production in Europe and in the Black Sea countries (Russia, Ukraine and Kazakhstan). The US Department of Agriculture's Kiev bureau forecast that the Ukraine wheat harvest will hit 23 million tonnes this year, up from 16 million tonnes last year, and making it the third highest out of the last 20 years.

At present, most wheat crops around the world look in healthy shape. Only the US are experiencing issues. Drought conditions through the autumn last year along with a delay to spring have raised concerns for wheat production. One of the consequences of the delayed spring and the implied lack of growing degree days is that wheat heading has been very slow to progress across the US. According to the last USDA Crop Progress report, 20% of the winter wheat is headed, versus 64% last year and 39% on average. Moreover, only 32% of the wheat is in a good or excellent condition. It is far behind the level of last year when 63% was in these conditions and it represents the worst rating since 1996.

However, these issues will be largely compensated by the offer form the Black Sea countries. The aggressive competition of exports (or lack of it) from the FSU has been a dominant feature in setting the price of wheat in recent years. Black Sea wheat exports, on which buyers from the Middle East and North Africa are increasingly relying, are pegged at 35 million tonnes, a rise of 40% year on year and represents a market share of 23%. The resurgence of wheat supplies in the FSU later this year will lead to increased competition in the seaborne market, thus putting significant pressure on international wheat prices.

Gasoline prices to lag the oil sector due to weak fundamentals

Gasoline prices have been particularly volatile these past few months. Contradictory ethanol rules provoked a spike in gasoline crack spreads during March. The following month, US gasoline price underperformed the oil sector due to higher refining activity and weak demand. Indeed, higher margins encouraged US refiners and ethanol producers to increase gasoline supply. However, unplanned outages at 3 large refineries on the Gulf Coast in mid-April contributed to reduce gasoline supply, pushing gasoline crack spreads higher during the second half of April.

This proven to be temporary due to rebound in refining activity in the US, stronger ethanol production and weak implied gasoline demand estimated by the US EIA that added downside pressure on gasoline prices. US gasoline demand is an important factor to follow for the gasoline market as it accounts for about 40 percent of global gasoline consumption. Furthermore, the outlook for the US gasoline demand during the summer driving season remains weak.

The EIA now expects US gasoline demand between June and August 2013 to average 9.00 million b/d, slightly up from last year (+7’000 b/d y/y) and down by 570’000 b/d from the peak made in the summer of 2007. The small increase in gasoline consumption would be the first annual increase since 2010. Nonetheless, US gasoline demand remained weak, while US gasoline crack spreads hover at a relative high level. Thus, gasoline crack spreads are expected to decline.

Moreover, distillate prices are likely to outperform gasoline due to mainly to specific weaknesses in the gasoline market and because distillate demand could benefit from the probable acceleration of the Chinese economy, the stabilization of Europe and the rebound of the industrial activity in the US. Finally, distillate prices should benefit from the seasonality of the gasoline-heating oil spread that tends to decline at the end of May until October-November. While the gasoline-heating oil spread could remain volatile in the coming days, heating oil prices are likely to outperform gasoline during the summer.

Saudi Arabia increased crude oil production in April but not exports

According to some industry sources, Saudi Arabia increased in April 2013 its crude oil production to around 9.3 million b/d, up about 180’000 b/d m/m. This is still down from last year level of 10.1 million b/d when Saudi Arabia increased production to respond to lower Iranian and South Sudanese crude oil production and stronger domestic demand.

Despite the increase in Saudi crude oil output, crude oil exports from Saudi Arabia are reported to stayed flat m/m due to rising domestic demand. Indeed, some reports suggest that direct crude oil burning rose over the month by about the same amount than the rise in crude oil production. Indeed, between 2009 and 2012, direct crude burning increased in averaged by 165’000 b/d m/m in April. In May, direct crude burning tends to increase by about the same amount. Thus, Saudi Arabia could increase further production this month, without providing more supply to the global oil market.

Unchanged crude oil exports imply that Saudi Arabia did not feel threatened by lower crude oil prices, either because the government’s budget was in large surplus these past years and hence the Kingdom can face a period of lower oil income, either because it expected oil prices to recover.

Copper premiums are rising as the global physical market is tightening

The copper physical premiums — the amount that physical consumers pay on top of the LME prices to secure their purchase and insure priority on deliveries — have strongly increased in the past weeks. In Europe, the Rotterdam Grade A copper cathode premium has nearly doubled from its end-of February 2013 lows, from $57/tonne to $106/tonne. In Asia, the premium for similar material has surged from $40/tonne in the beginning of March 2013 to $130/tonne; and in the US, the premium for Copper High Grade cathode has soared from $121/tonne at the end of April 2013 to $176/tonne this week.

The rise in copper premiums confirms our view that the physical market has been tightening. Indeed, while industrial demand is picking up due to seasonal patterns, the refined supply has become scarcer, despite the expected increase in mine production this year. In the US, the massive landslide at Rio Tinto’s Bingham copper mine (1.6% of world output), which should keep the mine shut down for 6 to 12 months, has caused some shortages in the country, pushing premiums upwards.

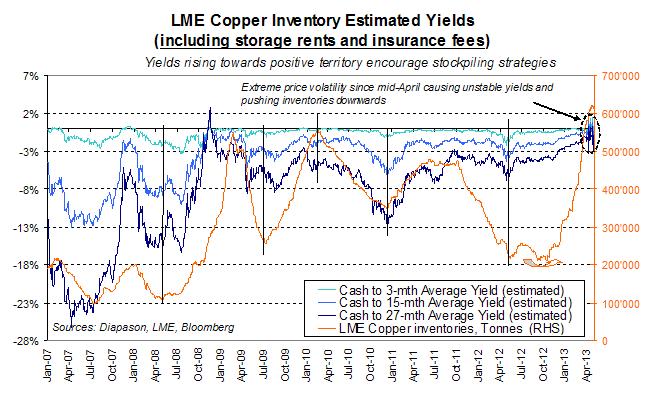

Elsewhere, it seems that premiums have risen mostly because of the heavy stockpiling at the LME, where refined copper has been locked up in long-term deals (cash and carry arbitrages) and became quite unavailable for consumers. The latter have thus in turn offered higher premiums to secure their physical purchase. In particular, Chinese material was moved from domestic to LME warehouses in the past weeks, causing some tightness in the Asian market. However, the extreme price volatility of the past weeks has resulted in LME time spreads moving erratically from contango to backwardation and vice versa, in a blink of an eye; meaning that storing copper on the LME could turn out to be not as profitable as it used to. Inventories — and so possible premiums — are therefore expected to decline in the coming weeks (see chart of the week).

Chart of the week: Copper financially-driven stockpiling strategies could slow down in the coming months

|

Over the past weeks, copper sceptics have found strong support in surging LME inventories, which have doubled since the start of the year to reach their highest level since 2003. This, combined with the consensus that copper production will rise significantly this year, has convinced many that the red metal is on track to report its first surplus in six years. We believe however that the annual surplus will not materialize before 2014 and that the strong LME stockpiling has been financially-driven and not the result of a supply increase. This has been evidenced by the stockpiling of copper in three major locations (Antwerp, New Orleans, Johor), which account now for +70% of the global LME inventories. Financially-driven stockpiling strategies are mostly the consequence of the forward curve being in contango, as the spread between the futures and the spot contract can reduce or cover the storage costs. The low interest rates and the affordable warehouses’ renting costs have also favoured such cash and carry arbitrages. However, these stockpiling strategies are only profitable as long as the spreads remain in contango. In the past three weeks, the copper spot and futures prices have experienced an extreme volatility, which resulted in the time spreads moving erratically from contango to backwardation, and vice versa, in a blink of an eye, delivering therefore unstable yields for stockpilers and discouraging inventory arbitrages. As a result, the LME inventories have narrowed since April 23rd for the first since late last year. In addition, as this heavy stockpiling tightened the physical market (premiums rose in the US, Asia and Europe and queues were formed in front of LME warehouses), it is possible that the spreads will return to a backwardation in the near future, which should decrease incentives for inventory demand. |

|

|

For the full version of the Diapason Capital Markets report, please contact info@diapason-cm.com