May 6, 2013

A new rally in assets: what's going on; what happens next?

Commentary by Senior Market Strategist Robert Balan

"Inflation is the one form of taxation that can be imposed without legislation"

Milton Friedman

The S&P 500® index made new highs, European equities posted double digit gains and copper blasted higher by more than 5 percent on Friday in a perfect trifecta -- courtesy of the humongous gains in April payrolls (and February and March surprise upwards revisions), and a decline in initial claims to the lowest in five years. Friday also appears to have broken the trend in yield curve flattening for now as longer duration Treasuries rose in yield rather strongly -- the 10yr Treasury generic yield rose almost 12 basis point in the day. The US dollar initially rose, but gave back most of its gains at the close of the week, and shows sign of weakening further.

It also helped that last Thursday's ECB policy meeting met the market’s expectation of rate cuts, while signaling the potential for yet more expansionary policies, and discussed other initiatives to increase the flow of credit to nonfinancial enterprises -- hence the strong response from European equities and bond markets. In the case of China, the PMI numbers were soft, but total financing and new loan growth (forward looking factors) were the highest since at least 2002, providing a better outlook for export-import data in Q2 2013. And Japan was leveraging to the hilt the carte-blanche that was given by the recent G20 meeting.

So what's going on, and more succinctly, what happens next? This is what is going on: the global economy experienced a soft patch of activity in April, and inflation continues to soften in the US and the euro area, with disinflation also spreading to core countries such as Germany. These factors are giving major central banks good reasons to maintain (and in some cases add) monetary stimulus (please see "Here comes the central banks again to save the day; assets will rally", The Diapason Capital Markets Report, April 26, 2013).

An environment where soft inflation prevails is typically good for risk assets especially when growth is at or slightly above or below trend (as was the case in 2012 and in Q1 2013, and is expected to remain so for the rest of the year). CPI inflation was below trend last year, in the current period and is also expected to remain so for the duration of 2013.

This is what happens next: The rationale of course is that soft inflation and moderate (or slowing) output leaves plenty of room for expansionary monetary policy, which tends to push up all risk assets. The current environment is no different, in our view -- the central banks will undergo another reflation wave soon. Furthermore, the recovery period might well be longer than normal this time, given the lingering echoes of the financial crisis. This means that central banks remain ready to support growth, especially if signs of disinflation persist -- the signs that the global economy is emitting at this time.

|

Main drivers this week

|

Commodities and Economic Highlights

Commentary by Robert Balan, Alessandro Gelli, Marion Megel and Alban De Rougé

Concerns about cotton planting in the US could push prices higher

US cotton prices US cotton prices rebounded by more than 5 percent since April 24. Cotton prices at 87.5 cents per pound are still below the mid-March 2013 high of 92.8 cents per pound. Macro-economic concerns contributed to lower prices. However, they masked improving fundamentals. Indeed, concerns over planting delays are increasing, while China is expected to continue its stockpiling program this year. In 2011, the Chinese government started building reserves, purchasing domestic cotton above global prices to support farmers.

Furthermore, US cotton producers are facing rapidly rising costs. Total costs per acre are expected to grow this year by 2.6 percent y/y to $827 per acre. Total costs have increased by 17 percent since 2009. Several factors are pushing costs higher: the cost of chemicals, seeds, irrigation water, and new equipments. Higher costs per acre could be mitigated by a stronger yield. However, this year’s US cotton yield could disappoint like last year due to the lack of rain and irrigation water and the late planting.

Last week’s Crop Progress report showed that 14 percent of the cotton crop was planted compared to 20 percent on average and 25 percent last year. Furthermore, late planting occurred in large cotton producing States, such as Texas, which was the largest cotton producer in 2012 and in Arkansas and Mississippi, which were among the top 5 producers in the US last year. Moreover, recent reports suggest that US cotton acreage should decline this year, reducing cotton production expectations. Planting concerns and growing expectations of lower yield amid rising costs for producers could hence push cotton prices higher in the coming months.

The restart of South Sudanese crude oil exports will be welcomed by Asian refiners

International sugar South Sudan restarted oil production at the beginning of April thanks to an agreement with its northern neighbor Sudan. South Sudan halted its 350’000 b/d crude oil production in January 2012 due to a dispute over borders and pipeline fees with Sudan. Land-locked South Sudan has not choice but use the Sudanese pipeline in order to export its crude oil.

As the pipeline between South Sudan and Sudan has gradually been filled, South Sudanese crude oil exports could now restart and are expected to reach about 150’000-200’000 b/d in the coming days. The medium sweet grades that South Sudan will export should be welcomed by Asian refiners that are ending seasonal maintenance work. In China, the maintenance season should have peaked in April with about 900’000 b/d of refining capacity offline, accounting for 7.5% of Chinese refining capacity. Furthermore, the latter continues to be expanded. Petrochina recently completed its new 200’000 b/d Pengzhou refinery. During the second half of the year more than 500’000 b/d of additional refining capacity is expected to come online.

Other non-OECD Asian refiners are currently performing maintenance work that should end this month. Crude demand in these countries is expected to increase in June 2013 to 9.7 million b/d, up 300’000 b/d m/m. South Sudanese crude oil exports could hence be rapidly absorbed by Asian refineries and are hence not likely to prevent crack spreads to decline.

Rising sectarian violence threatens Iraqi and Libyan oil production growth

Growing political instability in Libya and Iraq could threaten oil production growth. The situation has particularly deteriorated in Iraq where clashes with security forces left more than 180 people dead since last week. This could mark the start of a series of sectarian violence like in 2005-07 but this time the US army is not there to mediate.

Political stability and security are important factors for international oil companies in their investment decision process. The US invasion of Iraq in 2003 was followed by a rebound in crude oil production in 2004 from 1.34 million b/d to 2.03 million b/d. But crude oil production fell in 2005 to 1.83 million b/d due to the insecurity that reduced investment in the oil infrastructure. It was only in 2007 that Iraqi crude oil production outpaced 2004 levels. Lower sectarian violence between 2008 and 2012 enabled the country to boost crude oil production by 660’000 b/d.

In April 2013, Iraqi crude oil production which reached 3.10 million b/d, up 160’000 b/d y/y compared with a growth of 300’000 b/d y/y in average in 2012, is still below the post-Saddam high made in September 2012 at 3.24 million b/d. Reduced Kurdish crude oil production (due to a dispute between Baghdad and the Kurdish Regional Government), infrastructure constraints and technical difficulties contributed to this decline. Adding growing insecurity and political instability to these issues would slow further oil output growth.

Nickel supply cuts to have limited impact on fundamentals and prices

Along with aluminium and tin, nickel has been traded below its marginal cost of production in the past weeks – 20 % below in fact. Nickel’s long underperformance and the growing uncertainties regarding future prices have recently prompted producers to announce production cuts: the world’s largest producer of the metal, Norilsk Nickel, indeed announced the suspension of two important mines (Lake Johnston in Australia and Tati in Botswana), which represent together 1% of global nickel output.

These curtailments are important but should not be sufficient to rebalance the market, which is expected to be in a 10,000-tonne surplus approximately this year. In fact, Norilsk’s (and other’s potentially) efforts should be counterbalanced by the rising nickel pig iron (NPI) in China. NPI is a cheaper substitute to refined nickel, produced and used in China in the making of stainless steel.

Last year, Chinese NPI producers aggressively expanded their capacity, and as China’s imports of nickel ores and concentrates from Indonesian surged in the first quarter of the year (by 50% y/y) we anticipate that the NPI running rates will be high this year. The Indonesian ore (unlike the Philippines’) is indeed particularly well adapted to the production of NPI, and it accounted for 80% of the total nickel ores imports in the first quarter this year.

Therefore, although the current depressed nickel prices should encore producers to reduce output, this should have a limited impact on fundamentals and on nickel prices, as this supply discipline should be counterbalance by a surge in NPI production.

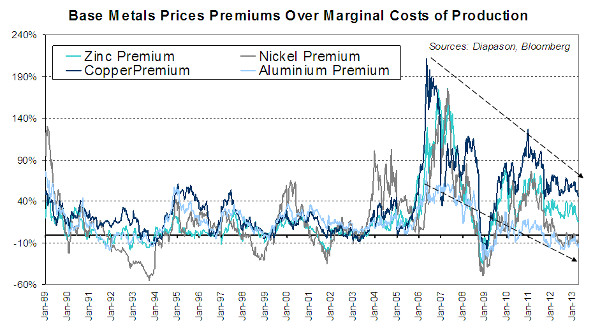

Chart of the week: Some metals offer buying opportunities as prices approach their costs-supports

|

The abrupt sell-off in the base metal markets in mid-April has dragged down most LME prices to multi-month lows, and closer to their global average marginal costs of production (the top end of cash production costs—80 or 90th percentile, depending on the metal). Marginal costs of production are usually good indicators of long term price supports for metal prices, as producers tend to adjust their production levels when marginal cash margins (the difference between prices and marginal cash costs) tighten. Some metals could soon represent strong buying opportunities as their prices have moved closer to their theoretical support levels, reducing therefore the downside risks. We indeed expect, as a direct consequence to these downward movements, that producers will respond to lower margins (and foremost, uncertainties about future margins) even more rapidly than in previous years, as most mining companies have embarked into lower-costs policies and shareholder wealth preservation strategies, heading by new CEOs with agendas to operate these changes as soon as possible. So far, only aluminium has tested its support level. In history, prices of zinc, nickel and copper have already fallen to much lower levels relative to their production costs; but these metals should however find some support on the costs-side, as the price premiums over marginal costs (margins) are back to ranges observed during the depressed period of the 1990’s for the commodity sector, when producers cut off capacity. Aluminium on the other hand, is currently testing its support, which has so far proved very strong. As the grey metal was already traded at nearly 15% below MC before the market sell-off, it resisted pretty well to the general downside and was left almost unchanged last week. The barrier of 15% below MC has been a strong support for aluminium prices in history (except during the market crash of January 2009) and has once again proved its strength last week after the grey metal strongly outperformed the rest of the LME complex. |

|

|

For the full version of the Diapason Capital Markets report, please contact info@diapason-cm.com