April 22, 2013

Panics offer buying opportunities

Commentary by Senior Market Strategist Robert Balan

"Bull markets are born on pessimism, grown on skepticism, mature on optimism and die on euphoria.”

John Templeton

The recent sell-off in some risk assets is sparking an evaluation of tactical allocation decisions, and for some investors, the strategic foundations of some investment decision taken at the start of the year. Worries regarding global growth and assorted miscues in the data may have created a mini "perfect storm". It appears to some investors that simmering under the surface are global growth worries, but which are propped up by monetary policy. Although US equities have suffered relatively a shallow correction, pockets of globally leveraged industries have not escaped the sell-off seen in other assets classes, such as commodities and EM equities.

Of course, this is not the first time that we have gone through this kind of episode. In each of the past three years, a growth scare has prompted an equity market correction -- in 2010, 2011 and 2012. This time, however, the risk of a public policy-related flare-up is much lower. As in the past three years, some investors have extrapolated their frustrations about the lack of decent growth in economic variables to extreme and unlikely outcomes -- but each time, the economy somehow manages to bounce back and confound the skeptics. Also, during the last three yearly episodes, the central banks have played decisive roles in making sure that the worst fears of skeptical investors are not realized.

The Fed remains committed to data-driven accommodation, and based on March U.S. economic activity reports as well as the fiscal drag, which will likely intensify by mid-year, large-scale asset purchase tapering is unlikely to begin soon. Aggressive QE from the Bank of Japan further reduces ‘risk-free’ supply to the benefit of the portfolio balance channel, which is a key driver of the strong performance of stocks with bond-like characteristics. The latest episode of asset price weakness and fluctuation in market sentiment will likely harden the central banks' resolve even more.

The international finance ministers and central bankers are also meeting in Washington to discuss signs of slowing in the world economy, and we are sure the monetary authorities will respond to this latest shock in the "expectations channel". So is ironic that the central banks' aggressively pro-cyclical stance had hurt the asset classes that stand to benefit the most from that progressive policy -- or at least that is how the media portrayed the recent sell-off.

However, as the experience of the last three years show, a sell-off which wipes out the weak long hands, has always been followed by a broad rally when stronger and well-capitalized institutions step in to buy bargains available in bucketfuls. Some base metal and even gold had their prices brought below production costs. Of course, price is not the same as value. But except for short periods of time, producers of any commodity, including gold, either will not or cannot sell the commodity for less than it costs to produce it. We believe this will be the case again this time around.

|

Main drivers this week

|

Commodities and Economic Highlights

Commentary by Robert Balan, Alessandro Gelli, Marion Megel and Alban De Rougé

Gold poised for a recovery following last week’s excessive sell-off

Among many explanations for the biggest drop in gold in more than 30 years: a fourth annual global growth scare as data disappoint from China to the U.S. and investors fold long-held bets that monetary stimulus will ultimately unleash inflation. Other reasons for the drop range from a view that the price reached so-called technical levels to concerns that Cyprus could start a rush by indebted nations to sell their supplies of the metal. And then there were blips in the macro data which added to the market skittishness. These blips may have pushed skittish investors over the edge. But was the magnitude of the sell-off justified?

In regards to the sole hypothetical sale of Cyrprus' gold official reserves, the sell-off was clearly excessive: the country's total gold reserves account for just 1.7% of the Comex daily gold trading volumes, and for just 3% of Cyprus’ total public debt. In other words, the marketing of these reserves would have a marginal actual impact on both the supply of gold and on Cyprus' financial strength; and the scenario is similar for the other PIIGS countries. Markets' capitulation on inflation risks has probably added to the price decrease, but still can not explain the degree and the abruptness of the price panics as this capitulation has been gradual. The main explanation to this sell off, on top of the reasons mentioned above, is the return of the risk-on environment, where gold tends to underperform industrial metals and the energy complex.

Markets are now looking for a support level; and by all measures, current gold prices are significantly below the so-called "all-in" costs, which our precious metal analyst estimated at circa $1,500/oz. Gold price could go lower than the production cost, but probably not for long. There is also no certainty that gold will substantially rise above its production cost, but it is more likely than not that the current depressed value of gold (circa $1400) which is below the "all-in" cost, will cause an upward adjustment before long. There are of course no guarantees but we believe that gold prices will not stay this depressed for very long.

Copper supply concerns are back

Although copper prices tumbled at the beginning of the week, it appears that the red metal could be at a turning point. We have been arguing over the past weeks that copper demand should soon pick up, especially in China where fundamentals are tightening. More recently, the supply-side has also become supportive as production constraints are back into the spotlight.

The upward trend in Chile’s copper production has masked the fact that the Chilean sector is still facing serious challenges due to its aging mines and soaring costs. At the Cesco conference in Santiago this month, the mood was pretty gloomy, as discussions focused on the nearly 50% cost rise the sector experienced in average last year, on escalating power tariffs, labour costs and desalination expenses. As most producers will renegotiate labour contracts this year, additional salary hikes are likely, particularly in this Chilean election year that could accentuate the political pressure on miners to grant pay rises. Furthermore, nearly all growth projects that were supposed to boost Chile’s production are now completed – and as producers have embarked into cost-saving strategies, there is currently little room for further important investments in the near future in the world’s top copper producer.

Simultaneously, production constraints have repapered in other parts of the globe. Earlier this month, a massive landslide hit Rio Tinto’s Bingham Canyon mine in Utah, US, which produced 1.4% of the world’s copper last year and 20% of Rio’s copper output. Operations should not restart before 6 to 12 months. The market reaction was quite muted, although this potential loss of 163,000 tonnes could be significant, in a market with no consensus regarding this year’s deficit or surplus. Although most analysts apply a “production disruption allowance” to their copper supply forecasts, it is likely that production will turn out to be, this year again, overestimated.

The market setback confirms aluminum's support at 15% below marginal costs

Amid last week’s downturn in base metal markets, aluminium was the best performer, despite exhibiting poor supply-demand fundamentals. In facts, from April 11th to April 18th, copper fell by 7%, tin by 10% and nickel by 4.5%; but aluminium rose by 1%.

It appears that the light metal has found a solid price support around $1,850-1,870/tonne, or at levels that stand 15% below the global average marginal cost of production, as we already mentioned in our March 25th publication. The recent markets’ fall strongly confirms this support: as aluminium prices were already not far from these levels before the general setback, they did not follow the same downward trajectory as the rest of the LME metals.

Historically, prices have generally quickly rebounded after having hit a price 15% below marginal costs – with the exception of January 2009. The downward risks for the grey metal are therefore limited and prices are expected to improve in the near future.

How will OPEC react to the decline in oil prices?

Following the decline of Brent below $100 per barrel, Venezuela and Iran, which are both heavily dependent on high oil prices to finance their budget, have called to an emergency OPEC meeting. While other members are likely to refuse to organize this meeting, Saudi Arabia is closely monitored as it posses the largest spare capacity and it always played an important role within OPEC and for the global oil market.

The Kingdom recently announced last week that it started pumping oil ahead of schedule on its new offshore Manifa oifield. Output is expected to reach 500’000 b/d by July 2013 and 900’000 b/d by the end of 2014. However, Saudi Arabia does not intend to increase its overall capacity with this new field but to replace the decline at existing fields, leaving overall producing capacity unchanged at around 12 million b/d. Regarding the recent oil price sell-off, a Saudi Arabia’s reaction could play an important role. However, Saudi Arabia doesn’t need to cut production to send a positive signals to the oil market. Indeed, it only needs to maintain output level flat as domestic crude oil demand is increasing and will peak in August thanks to direct crude burning by power plants. Higher domestic crude oil demand, while production remains stable, hence implies lower Saudi crude oil exports.

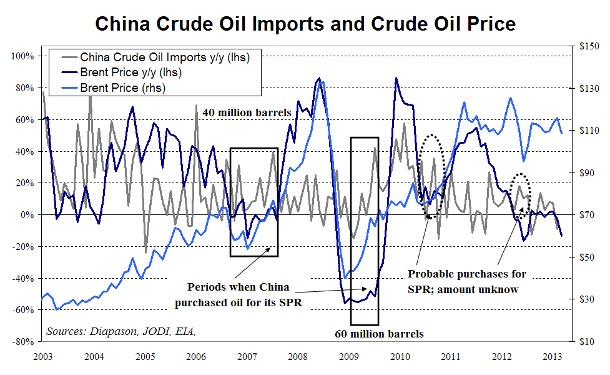

Chart of the week: The oil price sell-off could trigger higher Chinese oil imports

|

China started building its Strategic Petroleum Reserves (SPR) in 2006. In 2012, storage capacity of SPR was above 280 million barrels. Almost 100 million barrels will be added this year. This could contribute to higher crude oil imports especially after an important decline in oil prices. In fact, China has often used period of lower oil prices to purchase crude oil for its SPR. About 40 million barrels were bought between August 2006 and June 2007, a period when oil prices fell below $60 per barrel. Between October 2008 and April 2009, about 60 million barrels of crude oil were purchased by China for its SPR amid extremely low prices. Lower oil prices in mid-2010 and mid-2012 could also have led to stronger Chinese crude oil imports for SPR stockpiling. As new storage capacity for SPR are being built, the recent decline in oil prices offer an interesting opportunity for the Chinese government. Chinese crude oil imports could hence accelerate in the following months.

|

|

|

For the full version of the Diapason Capital Markets report, please contact info@diapason-cm.com