April 8, 2013

The World's monetary floodgates are swinging wide open - again

Commentary by Senior Market Strategist Robert Balan

The global central banks are or will be swinging the world’s monetary floodgates wide open -- again. The radical steps that new BOJ Governor Haruhiko Kuroda took towards aggressive easing means the world’s four biggest advanced-economy monetary authorities -- the BOJ, the Fed, the European Central Bank and the Bank of England -- have once again synchronized their policies to spur growth and return their economies to acceptable levels by unleashing a “typhoon of cash" globally.

Left unsaid is the slow but inevitable move from a sole focus of central banks on inflation to a broader mix of macro targets, which will have many similarities to nominal GDP targeting, which provides a cover to ease further. For one thing, central banks have been getting bolder, as conventional measures to reflate their economies have not delivered the expected results, leading central banks to employ these innovative approaches to extreme extent. We have reasons to believe that these innovations will pass on to the central banks of less-developed economies as well. It would be also be reasonable to suspect that there is significant effort put into collaboration and cooperation among the developed central banks. We may be seeing some form of "easing rotation" underway, which has allowed the most impressive display of firepower by a central bank so far -- the BoJ juggernaut earlier last week.

The BoJ Policy Board set out the objective of achieving the 2% price stability target “with a time horizon of about two years” through a series of measures called “quantitative and qualitative easing.” The measures to be taken also entailed (a) nearly doubling the monetary base by the end of 2014 (to 55% of GDP from 29% now), (b) increasing the monthly pace of JGB purchases to more than ¥7trn from the current ¥4trn, (c) in more sectors, from the current 3y sector, (d) increasing the purchases of ETFs and Japan real estate investment trusts (J-REITs), and (e) pledging the continuation of these measures as long as necessary to achieve and maintain the price stability target in a stable manner.

In Europe, it now appears as if Mr. Draghi is willing "to do whatever it takes" -- and believe him, it will be enough -- but there are some measures that he is not willing to undertake (like launching an asset purchase program sometime soon) so as not to lock horns (again) with the powerful German central bank. Our hope is that Mr. Draghi will resurrect the gung-ho spirit he has shown with the LTRO project -- otherwise, we expect eurozone to be flat for the entire year, and it will be seriously left behind in the growth derby. That is why we believe Mr. Draghi will join the select Trillion Dollars Club among central banks by H2 2013 (whether the BuBa likes it or not).

The fear in the markets has been the conventional reaction function of the Fed to impending higher growth, as signaled by rising GDP tracker data. There are no such fears now of an adverse reaction function from the Fed, after nonfarm payrolls fell to 88k in March, much much lower than anyone expected. We are almost sure that those numbers will be revised higher in subsequent months, but the impact has been felt and the damage to investors' confidence has been done. Bottom-line: we still expect the FOMC to keep buying assets at an $85bn per month pace throughout 2013.

|

Main drivers this week

|

Commodities and Economic Highlights

Commentary by Robert Balan, Alessandro Gelli, Marion Megel and Alban De Rougé

The Brazilian oil industry struggles to lift oil output

Brazilian crude oil production against disappointed in February 2013 by falling to 2.09 million b/d, down 8.5% y/y (or -0.17 million b/d y/y), due to heavy maintenance works at some offshore fields. Last year, crude oil production fell by around 50’000 b/d y/y, for the first time since 2004, due to important maintenance works at offshore fields, delayed starts of new fields and the halt of Chevron’s Frade oil field after an oil leak appeared. Brazil is expected to become an important player in the oil market thanks to its large oil discoveries these past few years. Proven oil reserves rose by more than 50% since 2002. However, recent output’s weakness has demonstrated that oil extraction can be challenging and uncertain.

Nonetheless, Brazilian oil output is expected to rebound in the coming months thanks to the start of several new fields. BG and Petrobras recently started to ramp up production at two new fields with a combined capacity of 200’000 b/d. They could reach their peak production by mi-d 2014. Several other fields are expected to start producing this year with peak production capacity above 0.5 million b/d. However, Brazilian crude oil production is expected to grow by a mere 100’000 b/d y/y this year, due to the important decline at existing fields and important maintenance works at some large fields with a combined capacity close to 300’000 b/d. Moreover, the net contribution to the global oil market is likely to be closer to zero, due to ongoing strong demand growth which is fuelled by the prolonged tax-break on new vehicle sales. In January 2013, Brazilian oil demand grew by more than 10% y/y (+210’000 b/d y/y). Although demand growth is likely to slow down after May when the ethanol content in gasoline will be raised from 20% to 25%, Brazilian oil demand could grow by around 100’000 b/d y/y this year.

Natural gas prices are set to fall

The US natural gas prices rose sharply during March and broke the $4.0 resistance level. Cold temperatures in the US have contributed to boost natural gas demand for space-heating, leading to a large drawdown in natural gas inventories. The number of heating degree-days that measure heating demand, rose by 30 percent in March from February, while they usually decline by around 25 percent m/m, reflecting extremely strong demand for space heating.

This contributed to the rise of net long speculative positions on natural gas futures to record high levels. Overbought conditions appeared amid growing decline in natural gas fundamentals. While natural gas production continues to increase in the Marcellus Shale, some companies are restarting production at current natural gas prices in other areas. Encana said in mid-February that it will resume natural gas drilling in the Haynesville shale due to a combination of low supply costs and higher natural gas prices.

On the demand side, while total US natural gas demand rose due to cold temperatures, this masked the decline in demand from the power sector as natural gas is becoming less competitive with coal. Indeed, since the beginning of the year, natural gas prices rose by around 20% while US coal prices fell by about 3% to $2.4 per million Btu. The current gas-to-coal switching contrasts with last year coal-to-gas switching that triggered the rally in natural gas prices. US natural gas prices are hence likely to decline in the coming days.

Thermal coal market at a breaking point

Although The coal market remained focused on the negotiation on coal prices between Xstrata and Tohoku Electric, the Japanese utility. The result is important for the market as it constitutes a benchmark for other long term contract’s negotiation during the year. The negotiation has stalled as the two parties cannot find a middle ground.

On one side, Tohoku Electric, which wishes coal price under around $92 per tonne, is under heavy pressure from the Japanese government to reduce electricity prices, which rose sharply since the halt of most nuclear power plants after the Fukushima’s catastrophe. The Japanese government also demonstrated its intention to breakdown the regional monopolies in order to increase competition and reduce electricity costs. On the other side, Xstrata, which wants coal price above $100, faced rising supply costs and the impact of the rising Australian dollars. While Xstrata could agreed for a coal price under $100 per tonne, upside pressure on coal prices could increase in the coming months.

Indeed, thermal coal demand keeps growing especially thanks to new coal-fired power plants in India and China, which both account for 85% of global coal demand growth. European thermal coal is also growing as natural gas is also less competitive. In 2012, European coal demand from the power sector rose by around 6% y/y, driven by Germany (+13% y/y). Furthermore, US coal exports could decline this year after having increased by 17% y/y in 2012 because of stronger domestic demand (gas-to-coal switching) and lower coal production. Supply disruptions also appeared in several countries due to strikes, while coal production remained disappointing in Mozambique and Mongolia and as Chinese regulators called for the closure of around 5’000 small mines in 2013 to rationalize production, amid rising costs. Coal output growth is hence likely to struggle to meet demand growth this year.

China’s copper imports to resume on favourable arbitrage

A few weeks ago, the combined effects of near-record high inventories and record production levels in China, added to an unfavourable arbitrage between Chinese and LME prices, prompted us to forecast that imports of refined copper could remain moderate in the medium term.

The situation has changed and now indicates that the Middle Kingdom could boost its purchases of overseas cathodes. The SHFE – LME arbitrage, including import duties, VAT and exchange rates, has rapidly climbed over the past weeks, meaning that importing copper could now be interesting (nearly profitable) again for Chinese traders. The resume of imports may have already started, as evidenced by the LME cancellations, which surged in the past month from 5% of total LME stocks as of early March to 16% this week.

In addition and as we had expected, inventories held in bonded warehouses have a bit declined (though some of the decline results from an inventory move towards LME facilities) and the industrial consumption appears much on the rise (as suggested by the recent construction statistics, and production of electric cables and automotives).

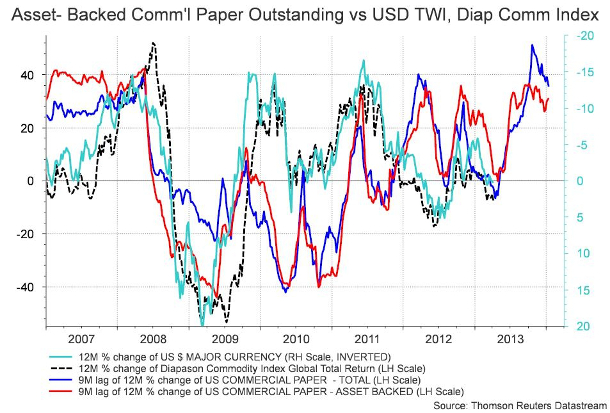

Chart of the week: Commodities will benefit from rapidly expanding liquidity

|

Risk-bearing capacity of financial intermediaries is tightly linked to the pricing of risky assets. At the margin, all financial intermediaries borrow to fund positions in risky assets such as foreign exchange and commodities. Short-term credit instruments such as commercial paper allow financial intermediaries to rapidly expand and contract balance sheets. Weekly reported figures of commercial paper outstanding can thus be expected to provide a high-frequency window on funding liquidity. To the extent that such credit aggregates reflect the risk appetite of financial intermediaries via the level of leverage of the balance sheets, there is a close relationship between the changes of their funding liquidity and the changes in asset prices. In the example provided this week, asset-backed commercial paper outstanding provide leads on the changes in commodity prices and foreign currencies well ahead of time -- in this case 9 months for the US Dollar (inverted) and Diapason Commodity Index.

|

|

For the full version of the Diapason Capital Markets report, please contact info@diapason-cm.com