April 2, 2013

Repos, balance sheets and leverage - the commodities connection

Commentary by Senior Market Strategist Robert Balan

Broker-dealer balance sheet repo growth features significantly in forecasting commodity price changes

In a financial system where balance sheets are continuously marked to market, changes in asset prices show up immediately on the balance sheet of all constituents of the financial system. Financial intermediaries (especially broker-dealers), hereon MFIs, must therefore adjust actively their balance sheets to changes in net worth in such a way that leverage is high during booms and low during busts. That is, leverage is procyclical.

The rationale for our approach has been to interpret balance sheet expansions of financial intermediaries as indicating greater willingness to take on risky exposures. This risk appetite is reflected on the growth of securitized assets (repos and commercial papers); and last week, we explained that a new sustained wave of repos and CPs growth is imminent, and comes subsequent of a long rally in the prices of risk assets in a spiralling dynamic, similar to the mechanics of the bull run we saw in 2006-2007, but likely in lesser scale (please see our Commodities Insight Weekly from March 25, 2013).

This time, we shift the focus to the link between repos and commercial papers to commodities. Acting as market makers, broker-dealers facilitate the trades of active investors such as hedge funds and asset managers. As substantial inventory is required to meet the demand for such trades, and holding more inventory requires higher leverage, the leverage of broker-dealers may reflect the level of trading activity and the balance sheet status of the entire financial sector.

Following that line of thought, the risk-bearing capacity of brokers-dealers is therefore a strong determinant of risk premia in commodity derivatives. The overwhelming size of the OTC market relative to the exchange-traded and futures markets highlights the importance of broker-dealer capital for the functioning of commodity derivatives markets. As such, the premium that hedgers are required to pay for insurance against commodity price risk is likely to be affected by the effective risk aversion of broker-dealers. To the extent that hedgers’ demand for insurance is independent of broker-dealers’ risk constraints, the effective risk aversion of broker-dealers can be expected to impact the returns on commodity derivatives.

Erkko Etula went further in 2010, saying that that the effective risk aversion of broker-dealers determines risk premia in commodity derivatives because broker-dealers are, to a large extent, the marginal investor on the speculative side of the commodities markets, as financiers of ETC deals in commodity derivatives.

In summary, the risk appetite of broker-dealers shifts with balance sheet variations, and that risk appetite is reflected on the growth of securitized assets (repos and commercial papers). The level of securitized assets inventory translates into the depth of funding liquidity which will allow them to modify their leverage according to the size of their balance sheets. The leverage of broker/dealers in turn reflects the level and intensity of trading and lending activity which is linked to changes in asset prices, and intimately tied to how hard the sector searches for borrowers, impacting real economic growth.

|

Main drivers this week

|

Commodities and Economic Highlights

Commentary by Robert Balan, Alessandro Gelli, Marion Megel and Alban De Rougé

The US recovery is real

Despite ECRI's claims, the US will likely surprise on the upside and we should now worry about a recession this year. The big four economic indicators (private sector employment growth, retail sales, manufacturing, real disposable income) show a stable US economy growing at with minimal inflation. despite fiscal uncertainties, rising gasoline prices and new taxes.

The surprise so far is that manufacturing is still running above the 2.6% long-term average. Recent purchasing managers data, and durable goods orders suggest that manufacturing could continue to power ahead. Also, the consumer pullback expected by some economists early in the year simply did not materialize because the US consumer has found another ATM – their rising house valuations. Rising equity prices also added to the wealth effect, and when that wherewithal is harnessed to a pent-up desire to shop after more than three years of austerity, the effect could be powerful. We hope it will stay that way.

The restart of South Sudanese crude oil exports should remain marginal in the short run

The announcement of the restart of South Sudanese crude oil exports contributed to the recent weakness of the Brent prices. Indeed, the amount that could return to the market is not negligible. In January 2012 before exports were halted, South Sudan produced 350'000 b/d of medium sweet crude oil and exported most of it. Because of the low amount sulphur and as it yields an important amount of distillate, Sudanese crude oil is especially appreciated by refiners in Asia.

South Sudanese crude oil exports were halted due to a dispute over pipeline fees with Sudan, which possesses the only pipeline that links South Sudan to international markets. Tensions between the two countries which fought for years against each others remained high last year, preventing the restart of oil exports. Nonetheless, the two countries are heavily dependent on oil income. Sudan, which lost a large portion of its oil income when South Sudan became independent in July 2011, needs the pipeline fees, while oil income accounts for more than 90 percent of South Sudanese government budget. The high dependence on oil income forced the two countries to cooperate as land-locked South Sudan has little alternative to move the oil to the international markets.

The South Sudanese government said that crude oil production will restart at the end of March. However, it could take several weeks for the oil to reach international markets as the export pipeline needs to be filled and oil companies need to make some test before reaching full production. Thus, South Sudanese crude oil production will gradually ramp up and it could take a year before it reaches January 2012 levels. The impact on the oil market will hence be limited on the short run.

Platinum production still at risk in South Africa on precarious power supply

Although the strikes at coal mines in South Africa have ended last week, the potential risks on the country’s electricity supply have not much lessened. From March 5 to March 25 2013, coal and power generation were halted at two of the most important coal-power stations – Amot and Malta – which provide 16% of country’s installed capacity. Last week, the coal mining company Exxaro Resources and unions reached an agreement, just in time, as the country’s coal inventory levels had dropped to critical levels and as the national electricity provider, Eskom, had earlier reported that its reserve capacity was just 1%, close to the level that preceded the blackouts in early 2008.

The security of electricity supply in South Africa does not seem to have much improved from the late-2007 crisis, when national demand for power exceeded Eskom’s capacity, leading to a series of power outages and price hikes in the country. In 2008, Anglo Platinum, the world’s top platinum producer, saw its energy costs surging 8% and its production dropping 7%.

Since then, power tariffs for miners have risen by an average of 25% annually and are expected to rise by another 16% in 2013. If the 2008 scenario were to be repeated, supplementary cost pressures could occur and could add to the recent surge in labour costs (following the H2 2012 violent strikes). A higher-than-expected energy price rise could be the last straw and encourage platinum producers to announce further production cuts and disinvestments. The consequences on production could be much more important than in 2008.

Is fundamental dynamics of cotton changing?

Between the high of 2011 to the end of 2012, cotton prices fell by 65%, resulting from poor fundamentals. According to the USDA, production increased by 21% to 27M tonnes between 2009 and 2011 as prices quadrupled during that period. At the same time, consumption was slashed by 13% due to the economic recession; and consequently, ending stocks reached a record of 15Mt in 2011, or 67% of consumption, with as much as 43% of inventories stored in China.

However, a changing in the dynamics of cotton could occur in the season 2013-14, after three seasons oh heavy surpluses. According to the ICAC, the global cotton harvest will probably tumble more than expected this season, by about 13% y/y to 22.6Mt, as farmers make more money by planting grains. In the US, farmers already shrank their cotton acres last year; and the Beltwide Cotton conference reported that they may plant 10.36 million acres in 2013, down 16% y/y, one of the smallest crops in two decades.

Moreover, the recovery in world GDP will assist cotton consumption. In the US, cotton usage should rebound due to little domestic and international competition from man-made fibres. China has started a year ago to boost domestic reserves, in order to support Chinese farmers and to ensure the mills have enough buffer to counter a potential repeat of any future world shortage. China’s capacity to get rid of the 10Mt of cotton reserves will be key in determining the extent of the cotton price rise.

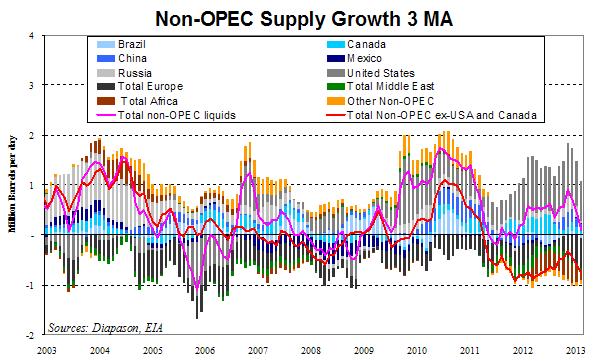

Chart of the week: Stronger refining activity should offset higher non-OPEC oil output

|

Non-OPEC supply growth fell significantly these past months. The main reason behind the slow down has been a reduction of output growth in Canada and in the US, which were the main drivers of non-OPEC supply growth last year. Indeed, non-OPEC supply ex-USA and Canada fell last year by 0.65 million b/d y/y, due to the halt of South Sudanese crude oil production, supply disruptions in the North Sea and a decline in Brazilian oil output. This was nonetheless mitigated by the tight oil boom in the US and stronger output in Canada. Their combined growth was 1.20 million b/d y/y in 2012. However, since November 2012, oil supply growth in the US and Canada has been slowing down and fell to 0.88 million b/d y/y in February 2013, the weakest level since November 2011. Furthermore, supply growth has also recently declined mainly in the North Sea and in Russia contributing to a decline in non-OPEC ex-USA and Canada supply growth from –0.31 million b/d in November 2012 to –0.77 million b/d y/y in February 2013. Thus, non-OPEC supply growth fell from 0.90 million b/d y/y to 0.11 million b/d y/y during the same period. The impact on oil prices was marginal due to the refining maintenance season, which was more important than usual. US crude runs were expected to fall by 1.4 million b/d in the first quarter, while they tend to decline by around 0.8 million b/d, following several years of weak cut in crude runs during the refining maintenance season due to the large WTI discount to Brent that contributed to high margins in the US Midwest. Nonetheless, recent developments in the North Sea and South Sudan should contribute to a rebound of non-OPEC ex-USA and Canada oil supply in the coming months. Furthermore, the incoming start of the 110’000 b/d Kearl field in Canada could mitigate slower output growth in North Dakota. Nonetheless, stronger oil supply is likely to be absorbed by rising crude runs that are likely to reach high levels due to strong refining margins. In the US, the amount of crude distillation unit (CDU) being halted for maintenance works is expected to reach 0.3 million b/d during Q2 2013, while it usually stood at around 0.5 million b/d, implying strong refining activity in the coming weeks.

|

|

For the full version of the Diapason Capital Markets report, please contact info@diapason-cm.com