March 25, 2013

Not quite goldilocks conditions, but expect a new bull phase anyway

Commentary by Senior Market Strategist Robert Balan

The recent run-up in asset prices reduced the leverage of MFIs; they may restore it, pushing up prices

Global growth did not "fall into a bottomless pit" in the ending days of 2012, and is starting to heal, although it could be a lot better. And this not-quite Goldilocks (but could have been worse) situation is reflected in the performance of the asset classes. Volatility is low, equities are outperforming and are very attractive relative to fixed income, and commodities are waiting for China's new government to groove into its new learning curve. The primary risk to the assets market, as we see it, is that equity markets have risen far too fast and that investor sentiment may have become a tad too optimistic too quickly. But we won't quibble over it - we expect further improvement in the underlying economic backdrop, primarily due to strong support from central banks, and that generosity is likely to persist for a while.

Many investors have become suspicious of periods of low volatility because, those tranquil periods have often proved to be the calm before a storm. But the 2002-07 ‘inter-crisis’ period showed that periods of low volatility can indeed last for some time, even for a very long time. Obviously, the conditions now of slow GDP, low-volume credit growth are different from the 2002-2007 era, which was marked by strong real US growth as the credit-driven economy powered high levels of investments and consumption. Nonetheless, we have at this time something just as good or even better: the highly pro-active policies of the systemically important central banks had stabilized the financial landscape and will continue to do so for a long time.

So the main risks of a global meltdown that has preoccupied and worried investors for some time seem unlikely to return to the menacing proportions which we have seen in 2008. And new ones of the same genre that will face investors seem unlikely to emerge for some considerable time to come. It makes more sense for investors to embrace the low-volatility environment than to prepare for another vicious turn of the cycle in the months to come.

It is just as well because our work on asset prices tells us that a new bull phase is about to be launched. The recent US Dollar strength is unsustainable from risk premium; the growth of repo and CPs in recent months suggests that a new sustained wave of repos and CPs growth is imminent, and comes after a long rally in the prices of risk assets. Since the behavior of financial intermediaries is pro-cyclical vis-a-vis their actual leverage, we foresee a rise in repo outstanding to fund the liquidity which will allow them to adjust their leverage higher to previous levels. The increased leverage will in turn drive asset prices higher, in a spiralling dynamic, similar to the bull run we saw in 2006-2007 (but probably in lesser scale).

|

Main drivers this week

|

Commodities and Economic Highlights

Commentary by Robert Balan, Alessandro Gelli, Marion Megel and Alban De Rougé

Emerging Market assets: is it time to reconsider the positive call?

It is clear to global investors that the case for EM assets is becoming more challenging. Developed equity markets have soared as improved sentiment in the US and Japan led a decoupling of developed equity markets from those of EM, where growth has generally disappointed, especially in the BRICs.

That has not been the recent case. As from July last year, after the tail risk driven risk-on/risk-off environment ended, additional easing from core central banks, became a clear positive for EM assets, as investors moved into higher yielding assets. The theme extended into Q1 2013, after hard-landing fears about China eased and major EM central banks further eased policies, and are still at it. Our assessment is that EM debt may be in jeopardy if US rates continue to rise (as we expect), but EM equities are another issue altogether. There is a case for EM stocks, - the overheated US and Japan equity markets will have to pause.

The shale oil boom is fading in North Dakota

Crude oil production in North Dakota fell over the month for the second time in three months, signalling that the shale oil boom in North Dakota is slowing down. In January 2013, crude oil production reached 738’000 b/d, down 32’000 b/d m/m and up by only 190’000 b/d y/y, the slowest annual growth since November 2011. The number of new wells was only 71, down from 127 reached in December 2012. This was hence lower than 90, the level that is needed in order to maintain production flat. The low amount of additional new wells contributed to the largest monthly decline in the history of the oil industry in North Dakota.

The snow storm that hit the region in January may have had an impact on drilling operations. Nonetheless, the working rigs count stood at 176, down 3 from December 2012 and the monthly decline in crude oil production was significantly higher than the drop during the snowstorm of March-April 2011. Another explanation that caused the reduction in incremental new wells is that it is becoming more difficult for oil companies to find economically viable wells in the region. This is also reflected by the slow leasing activity that comprised mostly of renewals, while few new leases have been purchased. Thus, crude oil production in North Dakota is likely to continue to slow down. Crude oil prices need to increase in the region in order to encourage drilling activity that is needed not only to increase production but to prevent production from falling.

North Dakota is a crucial case as it is the area where the shale oil boom started and could give us hints on the future development of other shale oil plays such as the Eagle Ford Play in Texas. The situation in North Dakota suggests that the path to energy independence for the US will not be as easy as forecasted by some analysts.

Zinc prospects improve on solid Chinese supply discipline

The base metals sector has been experiencing a strong downturn over the past month, which should be of a short-term nature and which should approach an inflection point soon. Amid the general drop, zinc has largely underperformed the LME complex, having dropped by more than 10% since February 15th, compared with a much more resistant tin (-4%) or copper (-6%).

Despite this gloom price returns, fundamental prospects for zinc have improved in the past months, as the market’s global surplus is set to narrow this year since China’s producers have adopted a solid supply discipline (quite surprisingly it is true, as the aluminium industry has largely failed in that matter). In facts, China’s zinc production declined in 2012 by 14%, on the first yearly retreat in three decades. From March to November 2012, production was continuously down on a year on year basis; and in September 2012, the annual drop reached 15%, the strongest since January 2009.

Good supply discipline should persist in the coming months, as suggested by the recent imports of zinc ores and concentrates, which are the zinc products that come out of the mine, with a low level of purity (concentrates are usually 30-50% pure zinc) and are ready to be refined up to a 99.9% purity. A high level of ore imports indicates that domestic refined production should be strong in the country, and vice versa. Last year, imports of zinc ores and concentrates have remained moderate, hovering in a range between 120,000 and 200,000 tonnes, compared with levels above 400,000 tonnes imported in 2010.

A rebound in white sugar premiums?

For the past two years , lowering raw sugar prices have grabbed most of the headlines, but the refined product—white sugar– has caught less attention. The white premium was indeed weak throughout the second half of 2012, weighed down by the weakening raw sugar prices and in turn, the bearish sugar market fundamentals. The premium fell to lows of $80-90/tonne during the final quarter, back to the bottoms observed in the prior two years.

Since then however, the white premium has recovered to $120.7/t, a near 50% rally. A look at the recent past has shown that the premium has tended to have a seasonal peak around July at higher levels of $160/t. During the May-June period indeed, refineries in the northern sugar producing countries (where refineries are typically attached to the mills) are usually done crushing, implying that they also start to shut down. As the current year should be characterised by much heavier world surpluses in both raw and white sugars compared to the previous two, it is unlikely that the premium will however spike to $200/t as it did in the past.

However, importers, most notably from the Middle East and North Africa, are still in the process of replenishing reserves and are taking advantage of the current low prices. Therefore, given the interest among importers, the white premium should stay at current levels at a minimum, and perhaps edge up to $160/t as we get close to mid-year, to encourage Brazil and toll refineries to produce more white sugar.

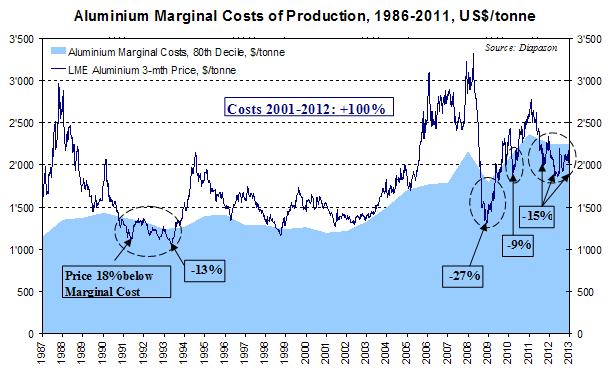

Chart of the week: Aluminium near a bottom

|

Last week, we wrote that aluminium should continue to underperform most base metals this year, as it did in the past decade. We argued that inventories remained a key risk for the market (especially as the contango has much lessened), and that production was not expected to decline any time soon (and this has been confirmed by the Chinese State’s recent decision to purchase and stockpile 300,000 tonnes of aluminium or 2% of the domestic production, in an attempt to support the labour-intensive industry). However, the fact that aluminium should lag behind most metals in terms of performance does not mean that prices are set to remain at current grim levels. Quite the contrary, we believe that aluminium may have reached or be about to reach a bottom, considering the extremely tight business conditions for aluminium smelters. Current prices are indeed about 14% below the average marginal cost of production, a level that has historically indicated an imminent rebound in prices. In the past, aluminium has been traded below the marginal cost of production in four different periods but has rarely dropped to more than 15% below the marginal cost (except for December 1991 when prices were 18% below it, and in March 2009, in the height of the financial crisis, when prices were 27% below it).

|

|

For the full version of the Diapason Capital Markets report, please contact info@diapason-cm.com