March 11, 2013

What should commodities expect from the new leadership in China?

Commentary by Senior Market Strategist Robert Balan

Details from China’s central budget and economic targets for 2013 released this week show a moderate increase in infrastructure outlays, in line with the market's base case scenario of a steady but modest pickup in commodity demand in H1 this year. While the new leadership has identified urbanization as a top priority for China in coming years, its planned budget shows some surprising discrepancies. The total spending on affordable housing is set to decline from 2012 highs as the government scales back somewhat, but certain transport projects, such as railways and roads, will see robust growth, which in some cases almost equals the intensity seen before the mandated slowdown two years ago. Major projects, including highways, airports and energy infrastructure, are set to grow faster than last year, consistent with a reacceleration of railway construction. Railway targets set out by the NDRC show an increase in new railway completed to 5,200km from last year’s 4,750km.

The main targets laid out this week are relatively conservative: GDP growth of 7.5%, and M2 growth of 13%, but with fiscal policy characterized as fairly "expansionary" and monetary policy as "neutral". Off the bat, these stimulus programs on infrastructure will not match the goals seen in 2009. However, the economic plan reported by the National Development and Reform Commission (NDRC) confirms that the government is budgeting for a moderate increase in central outlays, while selectively boosting and scaling back certain sectors. Spending on infrastructure has therefore become selective. Total spending on affordable housing, which includes investments and subsidies, is to be scaled back from the highs of 2012, and is consistent with the less ambitious goals for new social housing construction plans this year announced in late February. Nonetheless, the government sees 6.3mn units being started this year, compared with 7.8mn units in 2012, and 4.7mn units being completed in 2013 versus 6mn units in 2012. These are still impressive numbers, but are less than the frenetic pace seen in past years.

The impact on commodities will necessarily show up first in the ferrous metals. Already, spot Chinese 20mm steel rebar prices remain not far from the top seen in February. The February industrial production data released this weekend supports this: the production in investment goods strengthened further, likely reflecting the acceleration in investment growth within the month. By products, steel production rose to 14.2% from previous 13.5%, while cement production rose sharply to 10.8% from 5.4%. Meanwhile, auto production recovered further to 12.4% y/y from 5.3%. The market awaits Premier Li Keqiang’s press briefing on 17 March and gauges the direction for “the new urbanization”. Major reform initiatives will have to wait until the Third Plenum of the Central Committee to be held in autumn 2013. But we may be seeing a preview of a new wave of demand for industrial commodities for the rest of the year.

|

Main drivers this week

|

Commodities and Economic Highlights

Commentary by Robert Balan, Alessandro Gelli, Marion Megel and Alban De Rougé

Gasoline crack spreads surged due to ethanol rules

Refiners and blenders are torn between their consumers that cannot use gasoline with more than 10 percent of ethanol and the US government that requires blending 13.8 billion gallons of corn-derived ethanol, while only 13.4 billion gallons is expected to be required this year as gasoline demand should be significantly lower than what was expected in 2007 when the ethanol mandate was implemented. The sharp rise in the price of Renewable Identification Numbers (RINs), which can be used instead of actual ethanol to meet the mandate’s targets, suggests that the ethanol blend wall is close. Refineries and blenders are indeed forced to buy RINs in lieu of physical ethanol to meet the target as they cannot use ethanol into the gasoline because of the blend wall. Since January, RINs prices rose by around 550%, increasing significantly producing costs for refiners. Ethanol prices have also surged. Both high RINs and ethanol prices added support to gasoline crack spreads which rose by almost $3 last Friday to above $23, an extremely high level for the season.

The sharp rise in gasoline crack spreads occurred in the middle of the refining maintenance season, which reduces the refining sector’s flexibility to respond to such a surge. Nonetheless, further upside appears limited for gasoline crack spreads as ethanol producers are likely to boost activity, increasing ethanol supplies (and at the same time the amount of RINs). As we are approaching the end of the turnaround season, more refineries would be able to boost crude runs, adding downside pressure on crack spreads. Thus, we could see a correction in the coming weeks.

US net oil imports are likely to decline at a slower pace this year

In December 2012, US net oil imports of crude and petroleum products fell to 5.99 million b/d, down 1.42 million b/d y/y. This was triggered by the shale oil boom that reduced the need to import foreign crude oil. Furthermore, as US crude oil cannot be legally exported, the oil surplus has translated into stronger petroleum products exports. Indeed, the US became a net petroleum products exporter in 2011.

The shale oil boom contributed to the bulk of the sharp decline in net oil imports. Nonetheless, this was also caused by extremely weak US oil demand, which fell to 18.56 million b/d in 2012 down 0.62 million b/d from 2010 level, due to weak economic growth, high unemployment and increased vehicle efficiency. Cyclical factors have outweighed structural factors in the oil demand’s weakness. Thus, this would not be a surprise to see a rebound in US oil demand this year.

In the first 8 weeks of 2013, US oil demand rose 0.23 million b/d y/y, according to preliminary data. Furthermore, oil demand growth would have been stronger with normal temperatures. Distillate demand was indeed particularly weak during this period due to warmer than normal temperatures. While US oil demand growth could slow down due to high gasoline prices, it could nonetheless grow this year. With US oil production expected to grow at a smaller pace than last year and rising oil demand, US net oil imports could decline at a significantly slower pace this year.

LME Copper: Contango-driven stockpiling

LME copper inventories have strongly swollen over the past weeks to reach 458,775 tonnes on March 1st 2013, the highest level since October 2011 and a 43% surge from the start of the year. Many market participants have shown some apprehension over these inventory levels, although they do not appear extreme compared to the previous years.

Further stockpiling in LME-approved warehouses can be expected, as the current environment looks favourable to storage strategies, in particular the renewed contango on the LME forward curve, which tends to lower the storage costs. The process is simple: when futures exceed spot prices, a trader can simultaneously hold a long position on the spot market and a short position on the futures market. The price difference between the two contracts will cover partly or fully the storage costs up to the delivery date of the futures contract. Conversely, a backwardation tends to discourage the holding of inventories.

Unlike what one may initially believe, it is not the rise in inventories that tends to push the forward curve in contango territory. Most of the time (although not always), it is the other way round: the time spreads, driven mostly by markets’ sentiment over the metal’s fundamentals, tend to lead the changes in the exchange inventories.

Coffee and Sugar: depressed sentiment, oversold prices, a contrarian play?

Sugar and coffee prices have reached lows not seen in more than two years, as heavy surpluses weigh on the global markets. There are other common factors linking these two markets too. Total gross short positions are at historical highs as speculators bet on falling prices, self-perpetuating the bearish trend. Finally, Brazil, the dominant producer of both commodities, is expected to reap large crop this year, as weather has so far been friendly.

Raw sugar last week fell below 18 c/lb, the lowest level since August 2010, while Arabica coffee fell to the lowest level since June 2010 to below 140 c/lb. The bearish price action is justified, given that both markets are in a structural surplus, and that weather so far has been broadly favourable amongst the largest exporting nations.

Global stocks of coffee and sugar are rebuilding, as producers have been responding to the 2010-2011 high prices by expanding production. Around the world, coffee producers and cane and beet farmers have been either expanding area or applying more care and nutrients to their crops to take advantage of the high prices. And where weather has been kind, this has allowed a significant growth in total volumes of Arabica and sugar produced worldwide.

With the above mentioned weather looking benign, and the resulting production outlook in the main producer, Brazil, improving every day, the world supply prospects for both coffee and sugar continues to look heavy. Unsurprisingly, we are seeing speculative traders and managed money funds increasing their short positions on the NY ICE futures and options markets. In view of the above mentioned fundamentals, there is a strong chance that funds retain their short positions in this market.

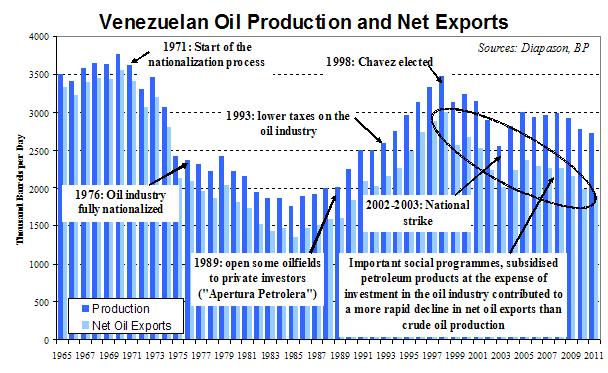

Chart of the week: The Venezuelan industry at a crossroad

|

El Commandate’s death has created a leadership vacuum in one of the most important oil producing country, leading to major uncertainties about the country’s future. During Chavez’s reign, the Venezuelan oil industry suffered from the lack of investment that contributed to a decline in crude oil production by 21.8 percent. Chavez’s policies did not only affect the oil production as investments were neglected and foreign companies had limited access to oil reserves but it also had an impact on the oil consumption. Important social programs and subsidized petroleum products financed by oil revenues at the expense of investment in the oil industry boosted oil demand and hence contributed to a rapid decline in net oil exports since 1998. The latter indeed fell by 1.11 million b/d, while crude oil production fell by 0.76 million b/d between 1998 and 2011. Gasoline prices at 2.3 US cents per liter are indeed boosting domestic consumption, which was hence insulated from rising international prices. The post-Chavez era remains uncertain. Elections are likely to be held in the coming months and the result is likely to determine the future path of the Venezuelan oil industry, which is in a critical state after more than 10 years of underinvestment. Even the election of a pro-business president such as Capriles is unlikely to have a major impact in the short term. Indeed, the new president would need to consolidate its position before making important reforms. Furthermore, it would then take at least 2-3 years to see Venezuelan crude oil production growing.

|

|

For the full version of the Diapason Capital Markets report, please contact info@diapason-cm.com