March 4, 2013

The powerful elements to watch in 2013: Global manufacturing PMIs

Commentary by Senior Market Strategist Robert Balan

The world's biggest economies released their February manufacturing PMI reports last week, and so far the indications are that global manufacturing is headed towards better times. The PMI manufacturing score is uneven, but if we use the classic interpretation for PMIs, manufacturing on a global scope will continue to improve over the next six month period.

Manufacturing has lagged behind services during the recent global recovery. So it is of no surprise that global investors continue to underestimate the health of the global economy due to the perceived underperformance of global manufacturing. What is less spoken about is the impressive recovery of service PMIs. Historically, services recover ahead of manufacturing after a deep recession, leading the way by 2 to 4 months. We expect the case to be the same again this time. Judging from the recent upsurge in global manufacturing PMI, manufacturing output should pick up strongly in H2 2013. For one thing, manufacturing can glow slowly, but there is no risk of a "stall" -- as some economists have been speculating about the fate of the slow-moving manufacturing sector. Manufacturing activity (like economies) does not collapse if the sector grows slowly -- they just keep on growing slowly until better demand revitalizes output -- and then manufacturing grows faster.

China's official PMI released last Friday unexpectedly fell to 50.1 from 50.4 a month ago. China's unofficial HSBC PMI fell to 50.4 from 52.3 earlier. Both series fell slightly short of expectations. However, these reports are likely to have been impacted significantly by the Chinese New Year holiday. The data points to a stabilization of economic activities in the coming months, and hints of at least a modest recovery of growth. Still, at the very least, it's encouraging to see both China PMI numbers above 50, which means China's manufacturing industry continues to grow, with positive impact on commodity consumption and demand for the next several months. This contrasted with 2012 when the HSBC PMI was below 50 until last November. We continue to expect some new investment projects (when the new government takes office in March), robust consumption and stabilizing exports to sustain growth around its new potential around 8%-8.5%.

Manufacturing PMIs also rose in other large emerging countries. In India, it rose to 54.2 from 53.2 in January. In Brazil, the PMI fell to 52.5 from January’s 22-month high of 53.2; the Brazilian PMI has remained above the 50.0 market for five consecutive months, the longest in the past three years. Russian PMI was unchanged at 52.0. Indonesian PMI rose to 50.5 from 49.7. The strong US ISM reading on Friday at 54.2, up from 53.1 also suggest stronger manufacturing activity in the world's largest economy. These are positive signs for commodities consumption. Base metals and energy are likely to benefit the most from these improved economic conditions. Anecdotal evidence also starts to support expectations that the resurgent housing market in the US will soon underpin the prices of base metals, especially copper.

|

Main drivers this week

|

Commodities and Economic Highlights

Commentary by Robert Balan, Alessandro Gelli, Marion Megel and Alban De Rougé

The oversold gold market is close to a rebound

The recent gold price weakness stems from the good correlation between gold prices and the twists and turns in real interest rates and by implication, the changes in CPI inflation. The most negative impact on gold arise from a confluence of rising rates and falling headline CPI -- conditions which we have been having since early Q4 2012. It is therefore not a surprise that the impact on gold prices have been severe. Gold prices had so much headwind to overcome, and it failed to breakthrough.

Sentiment on gold has fallen to extremely low levels. Gold holdings of the SPDR ETF fell by 5% in the second part of February and recorded the largest daily decline since August 2011. These contributed to an oversold market. We expect relief from tactical factors: interest rates may indeed rise somewhat, but not as much as those that are abandoning gold have projected. The surprise could come from a stronger-than-expected CPI that could contribute to a rebound in gold prices.

Lead set to reverse from a surplus last year to a small deficit this year

The small world of metals analysts has been agitated over the past weeks by some debates regarding the balance of the lead market: will supply continue to outpace soaring demand this year? As far as we are concerned, we estimate that the market could reverse from an approximate 80,000-tonne surplus in 2012, to a small 40,000-tonne deficit this year, triggered by remarkable growths in China’s demand for automotives and for electric bikes, widely used in large cities as a cheaper substitute to cars and scooters.

The consensus is however not clear on that issue. According to a Bloomberg article from February 19 2013, “Supply will outpace demand this year as consumers trade in old e-bikes for new ones that use less lead”; in order words, China’s strong demand to replace old with new e-bikes would provide smelters with a lot of scrap to recycle, given that basically 99%-100% of lead scrap can be recovered.

We acknowledge that a pick up in recycled supply should be expected this year, but it seems that there will be even more demand. In fact, if all the e-bikes that were purchased in 2010 were to become scrap metal (which is already a strong assumption), it would result in a secondary supply rise of 130,000 tonnes; compared with a potential demand of 220,000 tonnes if demand for e-bikes were to increase by just 15% this year, which is a conservative assumption given the 35-45% annual growths reported in 2011 and 2012, and the 70% y/y rise posted in December 2012. In addition, these estimations exclude the potential demand from the Chinese automotive market, whose production of passenger cars hit a record high in January 2013. In a nutshell, China’s lead demand could grow by about 9% this year, contributing to a 5% rise in world demand; while primary and secondary supply should increase by just 4%.

The gasoline crack spread: too high, too fast

Gasoline crack spreads recently skyrocketed above $20 per barrel, an extremely high level for the season. There were multiple reasons behind this surge. Planned and unplanned refinery’s outages and stronger gasoline demand contribute to this. Furthermore, the gasoline’s strength was amplified by the transition towards the gasoline summer grade, which is more environmentally stringent, amid higher gasoline demand in the US (+200’000 b/d y/y in January 2013).

Nonetheless, as for all commodity spreads, the gasoline crack spread has the tendency to revert to its mean. Strong crack spreads indeed triggered an increase in refining activity in the US, while the latter tend to decline during this part of the year because of the refining maintenance season. Last week, US refinery utilization rate rose above last year level at five year-high for the season. As refineries are increasing activity, additional petroleum products supplies are likely to reach the market. Furthermore, high gasoline prices at the pump could also discourage demand. Lower demand and stronger supplies suggest that gasoline crack spreads are likely to decline to around $13-$15 in the coming days.

Nonetheless, gasoline fundamentals remained solid thanks to the closure of more than 1 million b/d of refining capacity in the Atlantic Basin since 2010, amid logistical constraints that prevent the gasoline surplus on the Gulf Coast to be transferred to the East Coast, which is the most important outlet for the gasoline market, accounting for about 15% of global gasoline demand. Thus, gasoline crack spread could then rebound and move back to the $20 levels during the summer when demand usually peaks.

Colombian coffee producers need higher prices

Thousands of Colombian coffee growers blocked roads and prevented beans from getting to port last week. The strike was made to demand more government aid after being hit by years of poor weather, crop disease and a strong currency. If the dispute is not resolved quickly, it could dash the country's hopes of increasing output to 10 million 60-kg bags this year, up from the 7.74 million in 2012, its lowest crop in three decades.

Colombia's coffee farmers have seen their livelihoods shrink in recent years as the cost of fertilizers and other imports needed to produce coffee has chipped away at earnings, already reduced by low bean prices and the country's strong currency. Colombia, a top producer worldwide after Brazil, Vietnam and Indonesia, reported disappointing output for the fourth consecutive year. Since 2009, growers also have suffered from the impact of torrential rains that flooded soil and knocked beans from the trees. That later brought on disease that wiped out crops.

In January 2013, Colombian farmers receive about $282 for a “load” of coffee (125 kg), including a government subsidy of $33, while the cost of production is estimated at around $366. As costs of production are not covered by international coffee prices, Colombian producers are likely to be forced to reduce output further this year, unless Arabica coffee prices rise.

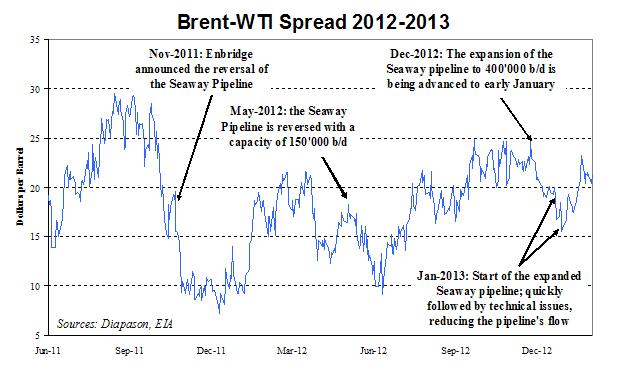

Chart of the week: The Brent-WTI spread should narrow by the end of the year

|

Enbridge and Enterprise Products Partners, the operators of the Seaway pipeline, announced last week that the Seaway pipeline will carry an average of 295’000 b/d between February and May 2013, up from 175’000 b/d. This had an important impact on the Brent-WTI spread. Since 2011, this pipeline had an important impact on the spread as it is the only pipeline that carry crude oil from Cushing to the US Gulf Coast. Because of the ongoing refining maintenance in the Midwest, the partial restoration of the Seaway pipeline’s flow isn’t likely to have a significant impact on the Brent-WTI spread. However, the spread could start narrowing by the end of March as refining activity starts to accelerate in the Midwest. The downside would nevertheless be limited due to strong (but declining) production growth in North Dakota and in Canada. While the spread could remain volatile during the summer and the autumn maintenance season, it could narrow significantly by the end of the year at around $10, thanks to the significant additions in pipeline capacity, that reduce the transportation costs between the Midwest and the Gulf Coast. TransCanada’s Gulf Coast pipeline project is expected to start in Q4 with a capacity of 700’000 b/d and the expansion of the Seaway pipeline to 850’000 b/d will come on stream by the middle of 2014. Furthermore, 18 other medium-sized pipelines are expected to come on stream this year. Most of those will run from the Midwest to Texas and are likely to contribute to the narrower Brent-WTI spread at the end of the year.

|

|

For the full version of the Diapason Capital Markets report, please contact info@diapason-cm.com