February 25, 2013

The correction to be short-term in nature, driven by short-lived factors

Commentary by Senior Market Strategist Robert Balan

The markets were hammered not only by uncertainty over the fate of the sequestration cuts but also by a statements from outgoing Chinese Premier Wen Jiabao who urged local authorities to “decisively” curb real estate speculation as the country’s leading economic index climbed at a faster pace in January. Mr. Wen's instructions hit commodities hard, especially those sector which are most exposed to Chinese activity (e.g., base metals, energy). In addition, the markets were spooked further by revelations from the Fed's last meeting that several Federal Reserve policy makers were advocating that the central bank should be ready to vary the pace of its $85 billion in monthly bond purchases. We believe that the market read the wrong message from the Fed statements, but it contributed to an already panicky environment.

For us, there is very little chance that the Fed will reverse the policy easing that they have embarked just before the end of 2012. The combination of below-target US inflation (inflation has fallen below the Fed’s 2% target) and above-target unemployment makes the justification for Fed easing straightforward. Moreover, Mr. Ben Bernanke, a long-time student of the Great Depression, understands too well the danger of premature tightening, the proximate cause of the Recession of 1937. Vice Chair Yellen strongly defended the asset purchase program in a speech given a week and a half after the January meeting, and we expect a similar defense by Chairman Bernanke at next week’s semiannual monetary policy testimony in Congress. We still expect the Fed to continue with the $85 billion monthly purchases of Treasuries until the end of the year.

Big as the ongoing consolidations may appear, they are probably the last large ones before a significant rise in risk asset prices from Q2 2013 onwards to late in the year. For commodities, despite bigger than initially expected take-downs, the focus stays on China, and that remains positive in the longer-run. The latest results from the Conference Board Leading Economic Index for China increased 1.0% in January to 253.4, following a 0.4% increase in December and a 1.1% increase in November. This suggests a positive outlook for the next 6 months. The January acceleration in the LEI was driven primarily by consumer expectations and estimated real estate activity. Credit extension also contributed to the increase in the LEI.

The new mandates on house price crubs in major cities aside, the market has high hopes that the new Chinese government, which takes over on March 1, 2013, will again embark on public infrastructure spending in its first year of governance, as been the historic norm. Growth in China has stabilized, and even granting that future GDP targets will not be as robust or ambitious as in previous years, the new emphasis on social housing construction and public infrastructure offer hopes of relief for the base metals and energy sectors in the commodities space over the coming months.

|

Main drivers this week

|

Commodities and Economic Highlights

Commentary by Robert Balan, Alessandro Gelli, Marion Megel and Alban De Rougé

US GDP growth is stronger than most believe; US oil demand growth is also underestimated

Despite higher inflation indications, growth outlook for the US GDP remains weak in H1 2013. We are tracking 1.4% GDP growth for Q1 2013 with strong possibility of 1.6%, while the consensus forecast is 1.2%. For 2013, the consensus is 1.8%. This is lower than our expectation of 2.0% for the full year (+2.3% for H2 2013). Most market participants are underestimating the impact of restocking by US companies and are overestimating the impact of sequestration cuts in the US fiscal budget.

Furthermore, the US economy is moving into a more consumer based economy. US consumer spending has reached the highest percentage of US GDP at 71%, the highest ever recorded. US growth is now more dependent on consumer spending than ever. The so-called "wealth effect" is derived from the positive changes in the stock market and price houses and is still underestimate by most economists. Both wealth effects have turned slightly stronger this year, based largely on gains that have occurred last year — that increase in wealth effect has been an important driver of real consumer spending growth so far.

Because oil demand is inherently linked to economic growth, the International Energy Agency is also underestimating US oil demand growth at only +6’000 b/d y/y (in its January 2013 report). We expect US oil demand growth to benefit from the stronger US economic activity. In the first 7 weeks, preliminary data showed that US petroleum products demand was up by 1.1% y/y, or + 200’000 b/d y/y. While US oil demand growth should slow down to around 100’000 b/d y/y in 2013 and we believe the risk to this number is to the upside. A growth of US oil demand by 100’000 b/d y/y would nonetheless, be the largest annual increase since 2010 and will account for 9% of global oil demand growth forecasted at 1.1 million b/d y/y in 2013.

Commodity prices are overreacting to the Chinese tightening announcement

Crude oil prices have pulled back sharply in the past few days. Nonetheless, in our view, oil market fundamentals remain fairly balanced, with global demand growth holding steady while non-OPEC supply (ex-North America) remains stretched. OPEC output has also retreated from elevated levels seen last year, which has helped balance the markets’ requirements without contributing to a surplus at the spot markets. On the physical markets, immediate consumption requirements have moderated for now, due to refinery maintenance in Europe and Asia leading to a passive call on cargoes for prompt delivery.

It looks like commodity markets may be overreacting to the Chinese government’s announcement of new measures to cool property markets. The improvement in Chinese property is a function of the economic recovery now underway and goes in tandem with rising business confidence and better manufacturing growth. Base metals markets, in particular, reacted badly to the news. In the base metals, speculative buying had pushed prices higher than fundamentals justified, so the take down was much bigger than what has been so far in the energy markets. The Brent front month (April) will probably fall further from here (Friday, current price: $113.95) but further take downs may be limited to the $111.00-$110.00 area. A significant rally is expected after this correction, probably by mid-March.

World’s central banks rush on gold, amid currency wars threats

Last year, the world’s central banks purchased 534.6 net tonnes of gold, the highest volume in nearly fifty years, worth $28.7bn, bringing the world’s official gold holdings to 31,757 tonnes, the highest level since 2003.

With growing risks of currency wars, the precious metal has been widely used over the past months as an efficient hedge against monetary debasements, especially in transitional economies, which have been trying to diversify their FX reserves away from the dollar. Russia was the largest gold buyer, adding 75 tonnes throughout the year to its holdings, which now approach 1,000 tonnes. Latin American countries were also strong contributors to the world gold demand: Brazil in particular, whose officials have a lot complained about the dollar devaluation, added 34 tonnes to its reserves in 2012. Asian countries’ appetite was also robust, as the region ex-Japan purchased 143 net tonnes of the yellow metal, including 30 and 33.6 additional tonnes respectively in South Korea and in the Philippines.

In addition, the European countries signatories of the Central Bank Gold Agreement, which used to provide most of the gross sales in the past years, have basically stopped selling. Official European gold outflows amounted to only 5.5 tonnes last year, an almost negligible level in regards to the past volumes. Despite the ongoing sovereign debt crisis, countries have not attempted to alleviate their debts with gold (which would account for a very small part of public debts anyway); on the contrary, currency wars threats and the risks surrounding the Euro have encouraged gold hoarding, as evidenced by Germany’s recent decision to repatriate its foreign-based gold reserves and a Swiss popular initiative to do the same.

Shell’s reforms on Brent market should reduce the strong backwardation

Royal Dutch Shell changed the terms and conditions for BFOE (Brent, Forties, Oseberg and Ekofisk) in order to increase physical liquidity. From May 2013, Shell will apply a new quality premium to BFOE forward month contracts. The quality premium mechanism would allow for more crude grades and cargoes to be eligible to the underlying market price. This should lead to a narrower backwardation on ICE Brent futures time spreads and reduce the risk of market manipulation. Brent price was indeed heavily affected by supply disruptions in the North Sea, questioning its value as an international benchmark. Last week-end, production at the 220’000 b/d Buzzard oilfield was halted due to technical issues and the field failed to restart during the following days, leading to wider backwardation on ICE Brent futures. Shell wants indeed to prevent such event to affect global oil prices.

Like BP last week, other market participants could follow Shell’s move. On Monday, Platts proposed changes to the way it assesses the Brent oil market, which are slightly different from Shell’s new terms. Nonetheless, this confirms the willingness to increase the liquidity for the Brent market, adding downside pressure on the backwardation.

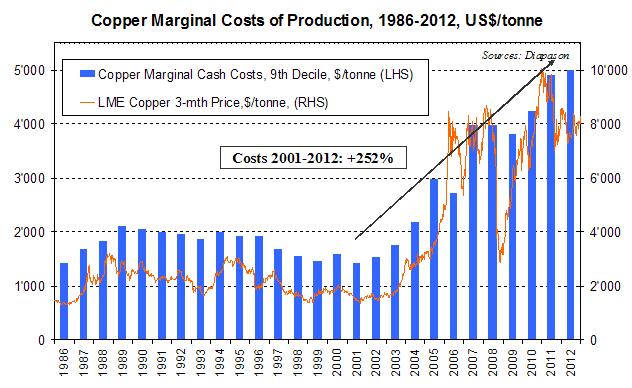

Chart of the week: Copper producers need high long-term copper prices

|

Although copper has been traded far above its average marginal cost of production over the past years, mining the red metal has become increasingly expensive. Last year, the marginal cost of production (last decile of the cost curve or the 10% top production costs) rose further to nearly $5,000/tonne, an slight increase of 2% from 2011 but up 17% from 2010. In 2009, the LME 3-mth prices were 78% above the marginal cost of production; in 2012 the ration fell to 60%. It seems that most of the cost inflation has come from new mines, which are currently much more expensive to operate than long-existing mines. In fact, mining today a mine launched in the past two years would be 20% more expensive than mining one launched between 2007 and 2010 and as much as 54% more expensive than a mine whose production started in 1996-2002. In addition, these are only operating costs, meaning that capital costs, general and administrative expenses, exploration expenditures and taxes must also be added to get a full picture of the industry’s total costs. This being considered, it seems that copper producers need a high long-term copper price, of approximately $7,500/tonne, to ramp up production and launch new projects.

|

|

For the full version of the Diapason Capital Markets report, please contact info@diapason-cm.com