February 18, 2013

A mild short term correction over 3-4 weeks should be expected

Commentary by Senior Market Strategist Robert Balan

Investors continued to allocate funds to equity funds of all kinds, at a rate not seen in years. Indeed, the net inflows of $20.7 billion into conventional mutual funds recorded over the four week period ended January 30 is the largest such period of inflows seen not only since the financial crisis of 2008, but since the previous economic crisis that began with the dotcom bubble bursting in the spring of 2000, according to data released by Lipper-Thomson Reuters.

As of January 30, equity investors had invested a net total of $34.2 billion into both equity mutual funds and ETFs for the month – the best performance recorded since January 1996, long before Alan Greenspan issued his famous warning about the dotcom economy suffering from ‘irrational exuberance’.

Commodity markets and other asset classes have in turn responded to the positive market flows, signs of improvement in the global economy, and in particular to improvement in purchasing managers’ indices in China, the United States and the eurozone. The energy sector and base metals have benefited from the better newsflow from China -- in the past five weeks, crude oil was up 8.4%, gasoline 14.5%, and heating oil 7.0%. Within base metals, Copper was also higher (3.7%), but it was the minor base metals that really shone since the start of the year. Zinc was up 4.7%, tin 6.1%, and lead 3.2%. The rally is likely cyclical in nature – we expect global growth to rise until Q4 2013 – the commodity rally will likely ride alongside the reflation process.

However, the asset markets have reached a point where, in our opinion, a modest correction would take place soon. In a short period, speculators boosted net-long positions to high levels across commodity futures. And sentiment improved rapidly – too rapidly in our opinion. The market is now approaching overbought territories.

Most of the perceived reasons for such a correction are technical, but there is one issue that investors seem to be insufficiently pricing in – the impending sequester cuts and their potential drag on economic growth, which may be worth 0.5% of GDP immediately.

|

Main drivers this week

|

Commodities and Economic Highlights

Commentary by Robert Balan, Alessandro Gelli, Marion Megel and Alban De Rougé

Commodities should outperform equities during the correction

The next two weeks bring the sequester cuts into focus in the U.S., potentially leading to some market turbulence, which could lead to a moderate pullback in risk asset prices (equities and commodities). In Europe, the focus will be on the second LTRO repayment, as well as the elections in Italy (which could provide some rough time as well).

A market pullback will likely occur, in varying degrees depending on the asset class. We believe U.S. equities will be hit much more negatively (from 7% to 10%), while commodities (currently being buoyed by expectations of munificence soon after a March 1 takeover of a new Chinese government) will probably be hit less, from 5% to 7% depending on the pro-cyclicality of the sector. A market correction could be seen as early as next week, and it could end quickly in something like four to five weeks. The crucial date for a recovery is March 27, when the continuing bill resolutions are renewed, perhaps permanently.

Central banks tolerate higher inflation; will send commodity prices higher

As a new wave of innovation sweep global central banks, most major central banks (G7) appear willing to tolerate higher inflation in order to support growth -- thereby indirectly targeting nominal GDP. But the timing and the extent of the efforts are affecting markets in different ways. Central banks’ actions and rhetoric will continue to be a major driver of markets. Over the past few days, some major central banks have reminded market participants that they need higher inflation if they want to avoid very weak growth. While the objective of inflation and the tools to achieve it are broadly similar, the timing and the extent of the various efforts is affecting markets in different ways, requiring different tactical means to take advantage of the variability in central banks’ strategies.

The general effect of a higher tolerance threshold for inflation is further addition of monetary liquidity in the global financial system. Such ultra-loose monetary policy bodes very well for risk assets (equities and commodities). The main issue in this regard is which assets will thrive generally better under these varying regimes. Offhand, we say that hard assets (commodities), as the primary hedge against unexpected inflation will likely perform better than paper assets under most of the situations we can envisage in the new global central banks’ reaction function.

Aluminium: like a millstone around producers’ neck

Rio Tinto reported its biggest net loss ever in 2012, of $3bn, down from a net profit of $5.8bn a year ago, due to $14.4bn of impairments combined with a drop in commodity prices last year. It appears that the company’s aluminium division was mostly responsible for these gloom results and should remain burdensome this year for Rio and for most producers of the grey metal.

At current prices, about half of the world’s aluminium producers are operating at a theoretical loss. LME prices remain also 5% below the marginal cost of production, suggesting little incentives to ramp up production. Despite these apparent tight business conditions, the world’s production of aluminium did not narrow last year, maintaining the grey metal in surplus. Two main factors have driven this unexpected solid production in 2012: firstly, Chinese smelters, which represent 45% of the world’s output, benefited from governmental subsidies on power tariffs, which drastically improved their margins and allowed them to increase production by 11% in 2012. Secondly, in the rest of the world, producers enjoyed strong premiums paid by consumers to get delivery of the metal, given the physical tightness created by the financially driven inventory building. The World ex-China only reduced output by 2% despite the late-2011 announcements of heavy production cuts to rebalance the market.

Consequently and despite the expected pick up in China’s industrial demand, the aluminium market should remain in large surplus this year, as we see little drivers for real market changes. Although oversupply has peaked to our view, aluminium’s performance should continue to lag behind most other base metals, and producers should continue to report poor business conditions.

Heavy maintenance works at refineries should prevent the Brent-WTI spread from narrowing

The Brent-WTI spread widened sharply these past weeks and is now back to around $20 per barrel due to the reduction of the Seaway pipeline’s flow. The pipeline’s flow is not the only driver behind the wider spread. Refineries in the Midwest are expected to perform important maintenance works this year after delaying them during two years in order to benefit from high margins (thanks to the large WTI discount to Brent and as petroleum product prices in the Midwest remained connected to international prices).

Furthermore, oil production in Canada and in the Midwest continues to grow at a rapid pace. Canadian crude oil production rose by 280’000 b/d y/y in average in 2012. In North Dakota, crude oil output rose by 250’000 b/d y/y in average during the same period. Due to the problem at the Seaway pipeline and the lack of new pipelines that could move crude oil out of the Midwest, oil companies have increased shipment of crude oil by trucks and rail. More than half of the production in North Dakota is now being transported by trains. However, new rail oil terminals are not sufficient to keep up with growing crude oil supplies amid lower domestic refining activity. Thus, the Brent-WTI spread isn’t likely to return to $15 even if the Seaway pipeline’s flow is restored to 400’000 b/d.

Chart of the week: Commodity markets getting ahead of themselves

|

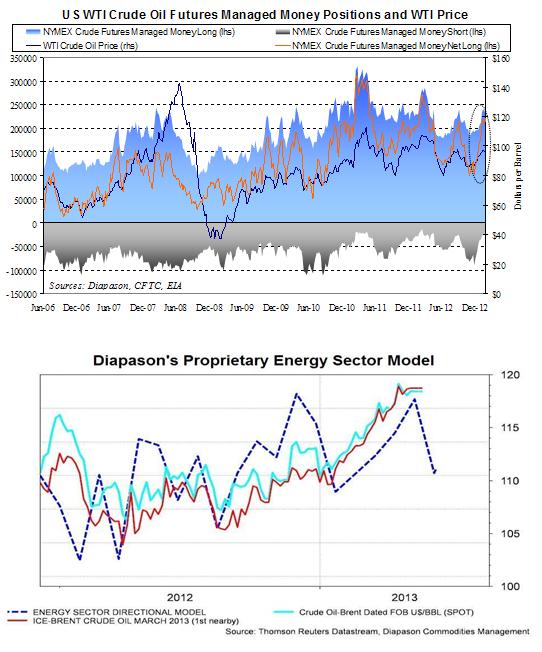

Commodity markets have performed well since the beginning of the year. In particular, the energy sector (see chart below) is up by 6.6% year-to-date, while the base metals sector is up by 3.7% year-to-date, driven by the acceleration of the Chinese economy. However, signs of an overbought market are appearing. Net-long money managed (speculators) positions rose sharply these past weeks for many commodity futures. Speculative positions on the NYMEX WTI futures also rose by 64% since the beginning of December 2012 and account for about 9% of the open interest, up from 5% in early December. This is not specific to the energy sector. Speculative positions in other commodity futures have also risen sharply. On the COMEX PGMs futures, they have now reached record highs. A contrarian analysis would suggest that a technical correction is more than likely. Nonetheless, the correction is expected to be limited and should last only 3-4 weeks. For example, as suggested by our model, ICE Brent price could fall to around $113-110. |

|

For the full version of the Diapason Capital Markets report, please contact info@diapason-cm.com