January 25, 2016

Oil market balance: how close are we?

Commentary by Robert Balan, Chief Market Strategist

"Until we see meaningful production cuts from key producers, particularly the U.S., I’m not going to feel confident that oil prices have found their bottom.” Robbie Fraser, commodity analyst, Schneider Electric

Last week saw both crude benchmarks tumble below $30 per barrel, followed almost immediately by an end of week rally which saw WTI close at $32.19 per barrel and Brent settle at $32.18 a barrel on Friday. This capped one of the most volatile weeks in oil trading in many months. The dramatic reversal prompted a plethora of news articles and blogs speculating that the long-awaited balancing of the oil market had finally begun.

It is noteworthy that the uber-bear in oil prices, Goldman Sachs (GS), may be changing their tune. GS had previously postulated that oil prices could fall to as little as $20 per barrel, which many market participants had, at the time, found incredible. But with oil prices having broken the $30 level, a $20 barrel of oil did not look so improbable. In a recent note, GS seem to haev changed their view and has forecasted that the market will see $40 per barrel during the first half of 2016.

However, are we reading too much into the combination of short-covering, less-than-expected increase in EIA weekly inventory relative to what the American Petroleum Institute (API) published a day earlier, and a 5-unit fall in oil rig counts? Arguably, analysis of the short-term factors affecting oil prices do not support the hypothesis that oil prices have bottomed: the US dollar seems poised to go higher further in Q1 2016; sanction relief allows Iran to export its oil unfettered (at a time when the oil market is already flooded with supply); and global demand for 2016 is uncertain, with commentators expecting a slowdown in the first quarter. These considerations make us think twice before picking up a more positive view.

The oil market is still oversupplied: Since Saudi Arabia abandoned their role as OPEC swing producer in November 2014 and removed its backstop for oil prices in December 2015, crude supplies have continued to outstrip crude demand. The current and immediate future supply imbalance can be attributed primarily to output from five producers: Saudi Arabia – up over 0.5mb/d since January 2015); Iraq surprising oil markets with a production peak of over 4.4mb/d; US producers showing unexpected resilience and maintaining output over the 9.0mb/d levels despite lower oil prices and fewer oil rigs; Russia pumping at max capacity to hit over 10.7mb/d; and now Iran’s return which could be upwards of 1mb/d by the end of the year (assuming investment and technical constraints are overcome). If the market hopes to have balance soon, all or most of the above players have to collectively blink and reduce output. The market understands that there is very little chance of that happening soon, especially if the Saudis do not relent. So far, Riyadh has not provided any guidance on prospective 2016 output and export levels. In 2015, Saudi Arabia increased output at an average 600,000 barrels/day and exports an average of 500,000 barrels/day, according to IEA. The oil agency puts Saudi capacity at ~12 mb/d, implying that the Saudis could still add 1.5 mb/d to their exports, if they decide to ramp up production further.

The path for demand in 2016 is still uncertain: The IEA, in its December Oil Market report, estimated that global demand will increase 1.2 mb/d in 2016 to 95.8 mb/d, with China and Other Asia accounting for 65% of the increase (0.8 mb/d). Moreover, the lower oil prices in the past several quarters could enhance global economic growth and increase demand for gasoline and other petroleum products. Conversely, the tumult in financial markets and worries over global growth may impact economic recoveries and business sentiment. This can potentially diminish demand for crude.

The US Dollar may continue to rise during Q1 at least: The US Dollar TWI's appreciation has played a significant role in the decline in crude prices. Crude is priced in US Dollars, and as the greenback appreciated, it raised crude and petroleum product prices in local currency terms, pressuring demand even lower. The rising US Dollar also triggered capital flows from the rest of the world to the US, weakening EM economies and exacerbating downward pressure on global oil demand. The US Dollar's continuing strength is coming from the steady improvement of the US Capital Account Balance. The capital account balance reflects net change in ownership of national assets, and is one of the components of a country's Balance of Payments ledger, the other being the Current Account Balance. Non-resident (external) capital has been flowing into the US as foreigners purchase US assets like real estate, residential buildings and domestic companies. The recent strong decline in yields (and appreciation in price) of US Treasury and agency bonds also provide some empirical evidence, via the Treasury International Capital (TIC) flows, that non-resident capital has been moving into the US fixed income markets. Changes in the US capital account normally show up in the valuation changes of the US currency two to three quarters later. So the sharp improvement in the domestic capital account during the last three quarters of 2015 will therefore likely to result in further support of the US Dollar during H1 this year.

Second-order consequences are mostly negative: The most critical side of the equation is supply. Assuming that some sort of understanding can be reached by the major players, it would take very little to ‘spread the pain’ around to balance the market. Let's assume that demand stays at 95.8 mb/d (as per the IEA), Russian exports fall 460,000 barrels/day, US production down 500,000 barrels/day from the 2015's peak output, Iraq production reduced by 300,000 barrels/day from its 2015 peak level, and a wash for all other smaller countries – crude demand would exceed supply by ~160,000 barrels/day. This is even before accounting for a potential reduction in Iranian and Saudi production, which has to happen before this scenario can take place. The oil market, in other words, can be quickly (but perhaps not easily) balanced with some political will. The Saudis have always said that they are willing to cut output if the other players are willing to do so.

Summary: Failing any accommodation taking place in 2016, we view that the the Saudis will continue to use the oil weapon. The recent Saudi fiscal budget and rhetoric underlines the Kingdom's resolve to continue to fight. It is unlikely that Iran can return to the fold as aggressively as it would like so Saudi in our view will not be worried about Tehran in the short-term. Instead they will look beyond OPEC, as they and the cartel will hope that the pain being felt by producers in North America, Russia, China, Latin America et al, could become too intense and blink first. We feel that this is not the time yet to bet against Saudi Arabia.

|

Main drivers this week:

|

Commodities and Economic Highlights

Commentary by Robert Balan, Chief Market Strategist and Sammer Khatlan, Oil Analyst

Downgrades loom as pressure continues to mount on resource companies

Last week’s headline that Moody’s had placed 175 energy and mining firms on review will have come as no surprise. The potential (and reality) of credit downgrades has been a frequent theme in the energy sector, particularly amongst the US E&Ps; but this has been a global rout – no commodity has been safe.

Big names in the mining sector have already been under financial and operational distress. We have seen this manifest in share values, balance sheets, dividends, assets – all of which have come under severe strain and pressure. Arch Coal, the second-largest US coal miner, filed for Chapter 11 bankruptcy protection on the 11th January with a plan to cull $4.5 billion in debt. Last week, Barrick Gold, the world’s largest producer of the metal by output, warned that it expected to book up to $3 billion in impairment charges. Last month, Glencore’s credit rating was downgraded by Moody’s to one notch above junk status, citing weak mining market conditions over the next two years.

55 miners in total have been placed on review by Moody’s, including twelve companies from Europe, Middle East and Africa, eleven from the US, twelve from Canada, nine from Latin America and four from Australia. Alcoa, Rio Tinto, AngloGold Ashanti and Vale are among the big names as Moody’s recalibrates the ratings in its mining portfolio to align with the “fundamental shift in credit conditions of the global mining sector”. The ratings review will also incorporate companies that had been previously placed under scrutiny, such as Anglo American and BHP Billiton. This ongoing examination will include the conventional audit on asset bases, cost structures, cash burns and liquidity; however the review on management strategy for coping with the protracted market depression and the ability to execute on the same, will be significant as this is not a normal cyclical downturn. Rather, Moody’s have highlighted the fundamental change in the sector, pointing the finger at China, highlighting the country’s “outsized influence” on the commodity markets.

For many of the miners, the reassessment of cash flows and credit metrics will likely result in credit downgrades that will make borrowing more expensive for companies. Slashing capital spending, selling already-distressed assets and cutting dividends may not be enough to retain ratings, despite maintaining relative strength on the balance sheet. Declining prices has impacted companies across the sector but of course the severity varies markedly across the companies/issuers. Moody’s review will focus on those rated in the range from A1 to B3 but higher and lower rated companies will also be re-evaluated given the current market conditions: B is considered “speculative and… subject to high credit risk” on the long-term scale, whilst ratings from Ba1 to B3 are considered as ‘Not Prime’ on the short-term scale.

Standard & Poor’s, Moody’s peer, have dropped their price forecasts for minerals and oil, indicating that downgrades are also imminent from their side. For miners, S&P contend that the oversupply of steel will have a knock on effect on demand for all related commodities including iron ore, coking coal, zinc and manganese. Conventionally, higher rated companies tend to show more resilience to depressed commodity prices but it is likely that downgrades will happen across the board. The next month will be fraught with difficulty, anxiety and risk for the mining sector as the unprecedented pressure refuses to relent. Moody’s expects to conclude its rating review by the end of 1Q16 for both energy and mining companies – multi-notch downgrades are the worst possible scenario for issuers, closing-off access to affordable funding that may be needed to survive if the current price onslaught continues or worsens.

Is it time to buy copper on a new price dip?

Copper was off to a bad start in 2016, down 5%, adding to a 25% sell-off last year. Last year's fundamentals provided a lot of headwinds, but some better outlooks are emerging for copper in 2016, despite the bad start. However, copper rebounded from a 2016 low of $4,318 per ton in January, igniting speculations that copper may be on the mend. The sell-off in copper prices in January was driven mainly by the re-emergence of a risk-off environment, as investors again panicked over speculations of a hard landing in China. Although investors' worries have not completely dissipated, copper has been resilient after the initial sell-off. Copper, along with other base metals, seems to be going into a bottoming-out process. With Chinese activity having stabilized, it is time to reassess the situation for copper and the base metals.

There were other developments on the supply side, which could provide a more sustainable lift near-term. First, 10 large Chinese copper smelters of the China Smelters Purchase Team (CSPT) to tackle the steep decline in copper prices. In November, they forged an agreement to cut 350,000 tons of refined copper output in 2016; this corresponds to 4.4% of China’s total output. Second, the Nonferrous Metals Industry Association requested to the National Development and Reform Commission (NDRC) to buy surplus metal early in December. The State Reserve Bureau responded by considering buying as much as 150,000 tonnes of copper. Third, some miners, ex-China, have announced a number of supply cuts. Glencore announced the suspension of production in African mines for 18 months; that will remove about 400,000 tons of mine production. Freeport also announced production cuts, equivalent to 160,000 tons, including the closure of its Sierrita mine (40,000 tonnes per year) in Arizona. These supply cuts could tilt the balance for copper once the fear of a China hard landing has dissipated.

On the demand side, the downstream copper sector in China is showing some signs of stabilization. Automobile production was positive in November and continued to expand at a moderate pace in early 2016. China's car sales were solid, rising 18% in December from a year earlier. Power grid investment grew at a fast clip in 2015, up 11.3% from 2014, and is likely to strengthen further in the months ahead. Economic performance in North America, Europe, and Japan, comprising 31% of the copper market was starting to pick up. China, which consumes 45% of the global copper production, continues to disappoint as growth flat-lined. The US market has been lacklustre as well. US industrial production was down 0.4% month-on-month in December, and fell for the fifth straight month.

Global industrial production is yet to pick up however. In Europe, industrial production fell 0.7% month-on-month in November; it was the lowest rate since July 2014. In Japan, industrial production was down 0.9% month-on-month in November, and fell for the first time in three months. Chinese industrial production slowed to 5.9% year-on-year in December from 6.2% in November. The best hope for Chinese copper demand is if the domestic housing market continues to pick up. China home prices continued to rise in December, with average new home prices in 70 major cities up 7.7% year-on-year. However, investment growth in real estate projects rose only 1.3% year-on-year in the first eleven months of 2015, suggesting that developers are still unwilling to undertake more projects in the current environment.

However, given the outlook of a stronger US Dollar during at least Q1 this year, the appropriate strategy would be to look for buying opportunities going into Q2 if we have by that time seen a new price dip. That is also the time during which Chinese data may start reflecting the massive stimulus carried out during H2 2015. We therefore believe that the copper market is well positioned for a rally during H2 this year. This outlook is bolstered by the positioning of speculators in the copper market, who sold copper aggressively on the COMEX and the LME since late October, which overstretched the positioning on the short-side. The net short fund position in the Comex was driven to an all-time high of 42,025 contracts earlier this month. On the LME, money managers are now net short copper for the first time since August 2015. Good fundamental new, or favourable data in China should trigger a strong wave of short-covering which would fuel a significant price rise.

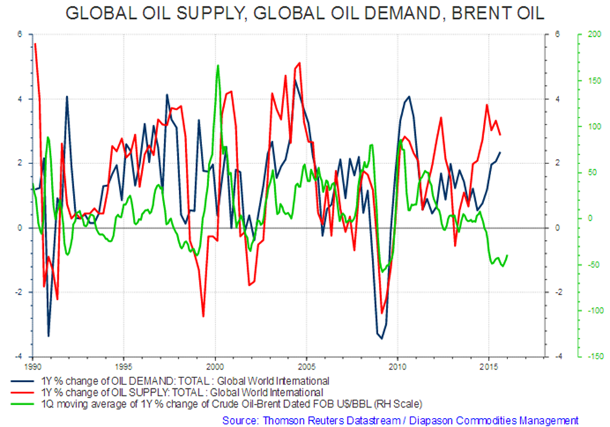

Chart of the week: Brent price vs global oil supply and demand

|

|