January 18, 2016

US Dollar outlook: a supportive environment for further strength in Q1 but could turn weaker during the rest of the year

Commentary by Robert Balan, Chief Market Strategist

"The Fed has already made it clear to the market that it prefers to err on the side of caution, so it is unlikely that four interest-rate hikes will happen next year—unless there is a strong rebound in commodity prices.” Vasileios Gkionakis, Unicredit currency strategist, December 22, 2015

The US Dollar has been, and still remains, strong against a slew of global currencies except for the Japanese Yen, the Swiss Franc and the Euro. Most notably, the US Dollar has been strongest on a trade-weighted basis, the most important measure of the US currency's impact on the global economy. Put differently, the US Dollar has seen its value appreciate the most against developing countries — the emerging market economies. Many investors ascribe the ascendancy of the US currency to the official monetary policy divergence between the US and the Rest of the World (RoW). Specifically, investors point to the Fed's policy stance of tightening monetary policy for the rest of the year, likely in four instalments, as the FOMC's Summary of Economic Projections (SEP) dot plots seem to indicate. This contrasts with the easier policy stance expected from the ECB and the Bank of Japan during the first half of 2016.

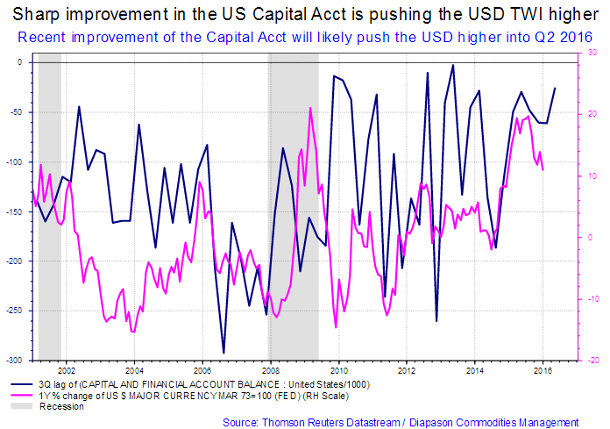

The Fed did raise policy rates a month ago by 25 basis points, but much of what has happened thereafter has been counterintuitive in that the policy-sensitive two-year Treasury yield has declined 30 bps from the post-hike high to the low seen last week. With last week's yield of 85 bps, the 2yr bond yield is now more than 15 bps lower than the closing yield of December 16, the day the Fed hiked rates. So it seems that the US Dollar strength is being driven by something else other than the much talked about interest rate differentials between the US Dollar and its major currency rivals. We suggest instead that the US Dollar's continuing strength is coming from the steady improvement of the US capital account balance. Changes in the US capital account normally shows up in the valuation changes of the US currency 2 to 3 quarters later. Capital accounts improve when external capital inflows increase or domestic capital outflows slow. The sharp improvement in the domestic capital account during the last three quarters of 2015 will therefore likely to result in a supportive environment for the US Dollar during Q1 (see the first chart of the week below).

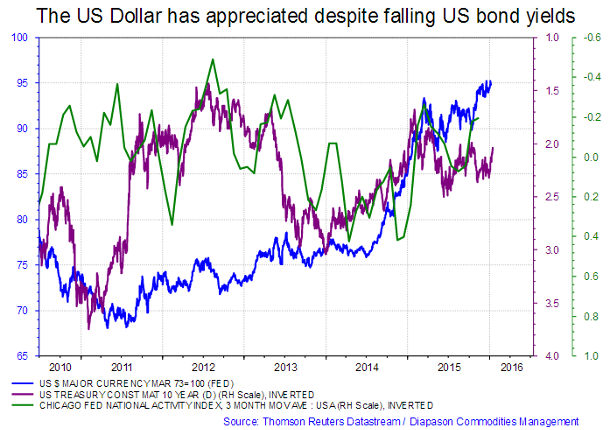

This poses another conundrum as this projected strengthening of the greenback may occur at a time when the US economy is slowing down during Q1 at least (see the second chart of the week below). The Atlanta Fed's GDP Nowcast has Q1 2016 growth at circa 0.7%, and a few banks have signalled US GDP growth early this year could even be lower than that. Barclays bank, for instance has reported last week that their most recent calculations show US GDP growth in Q1 could be as low as 0.3%. Even this may not weaken the US Dollar — US macroeconomic history since the Great Financial Crisis (GFC) of 2008 shows that during times of financial distress, global investors have sought safe haven in the US Dollar and the Japanese Yen. And there is a peculiar pattern in the safe haven flows triggered by economic dislocations — during these times, the Japanese Yen outperforms the US Dollar, as it is doing now. The explanation is quite simple and can be explained by idiosyncrasies of capital flows. Japanese and US-based investors collectively are the largest source of capital going into developing economies, almost 40% of that mobile global capital by some estimates. During times of global or US economic distress, US investors repatriate their capital back to the US. The Japanese investors do the same thing and pull capital back to Japan. The reason why Yen outperforms the US Dollar during these times is that the Rest of the World also brings safe-haven seeking capital to Japan, in much larger amounts relative to what goes into the US. By extension therefore, we believe that the US dollar will remain firm on a trade-weighted basis during H1, but the Japanese yen will likely be valued higher relatively to the US currency during this period.

Continuing strength of the US Dollar into late Q1 would have repercussions to a lot of assets and asset classes. The commodities asset class will remain under pressure if this projection happens, and so crude oil prices, which currently have the highest negative correlation to the Dollar among commodities, could remain on a downtrend until late March. The precious metals which have shown some life lately as a consequence of the lower US growth outlook, could come under pressure again and are at risk of making marginally new lows further out. Base metals may also come under pressure, but this may be mitigated by "better" outlook coming from China soon. The agriculture sectors should feel the sting of a stronger US Dollar as well, but prices in this sector may be pushed up by escalating effects of the El Nino phenomenon at the mid-Pacific Ocean, neutralizing the effect of a stronger Dollar. Another surge in US Dollar strength may contribute further to stresses in the Chinese economy and impact official policies. A stronger US Dollar will also pile further pressure on the Chinese CNY as a strong USD has been one of the proximate causes of domestic capital outflows looking for better alternatives to a weakening CNY. China does need a weaker currency, but a CNY collapse would be catastrophic (domestically and globally), so China's central bank may be again forced to defend the currency and further fritter away currency reserves. This may hinder an economic recovery in China, which we otherwise expect to confirm a trough in H2 2016. If these fears do not come to pass, it may be that base metals would be one of the best performers among the commodity sectors during H2 2106.

In summary, the US dollar may have a final rally over the next few weeks, but the narrative is starting to shift to a weaker US currency in H2 this year. Slower US growth, static, and even lower short and long bond yields, increasing likelihood that the FOMC may not have the wherewithal to carry out the planned four rate hikes during 2016, could undercut the US currency before too long. There is also something lurking in the background that could hurt the US currency later in the year. It has gone largely uncommented, or rarely acknowledged that core US CPI has climbed steadily higher in 2015 despite the fall in energy prices, and broader commodity prices. What matters most in the relative valuation of two currencies is their real interest rate differential. Higher inflation rate, all other things remaining the same, will provide a lower real interest rate, so if US core CPI increases sharply relative to the core inflation of other developed countries, then the dollar has to weaken. We therefore expect the foreign exchange narrative to change by H2 2016 — where a weaker US Dollar will help stabilize China and emerging markets, and finally provide a more conducive environment for the recovery of commodity prices.

|

Main drivers this week:

|

Commodities and Economic Highlights

Commentary by Sammer Khatlan, Oil Analyst

Emerging Markets: currencies, sovereign wealth funds and the US Dollar

Multiple headwinds will befall the emerging market space this year. The sharp depreciation of China’s yuan, plunging oil prices and a strengthening US dollar are the most significant threats to emerging market (EM hereafter) currencies as they retune following a period of QE that flooded the world with cheap money looking for returns.

EM currency performance last year was dismal to say the least: the Brazilian Real broke down 43%; the South African Rand dropped 25%; the Turkish Lira fell 20%; the South Korean Won was down 20%; and the Russian Ruble lost 15% of its value. The wider collapse of the commodity market slowed many economies whilst others were dragged into recession. Oil’s retreat to nearly 12-year lows has weighed heavily on EMs as many of their economies depend on resource production. Global trade has been negatively impacted, leading to a sharp fall in investment demand: for example, in West Asia, project awards have been subdued, down 3% YoY to $121billion (on a 12-month moving average basis). The revenues of global industrial players implies that the sluggishness has been present for close to nine quarters now – this has led to significant redemption pressure on several sovereign wealth funds. Allocations from these funds to EMs have reduced substantially, particularly in equities.

The difficulty with sovereign wealth funds is that many do not disclose their size, holdings or investment strategies, making it difficult to judge what risks they pose to the global financial system. Some funds are shrinking and/or are being tapped by governments under pressure from depressed commodity prices – this is forcing them to borrow or sell investments during a period of turbulent markets that could potentially exacerbate price movements, particularly against a background of liquidity concerns. The risk of default of these sovereign wealth funds has become increasingly severe, given that they are largely funded by commodity revenue and foreign-exchange reserves. The example of the Gulf nations is pertinent here.

EM countries are rushing to pay back dollar debts ahead of stronger US dollar which has created significant downward pressure on their own currencies. Severely low oil prices and the expectation of rising interest rates in the US has intensified speculation that the GCC currencies, particularly Saudi Arabia, would abandon the link with the dollar. Despite a budget deficit that has now risen to nearly 20% of GDP, Saudi has stated that it will maintain the peg. Kuwait, Qatar and the UAE are in a secure position with sufficient sovereign wealth fund assets and central bank reserves to maintain the current level of public spending for now. However Oman, Bahrain and Yemen, will potentially run out of foreign reserves in two years. Maintaining public expenditure will be a priority for the GCCs in order to preserve socio-economic order which will mean less revenue being transferred into the sovereign wealth funds. At the same time, pressures to draw down on these funds’ assets will rise. The point is that this current low price environment is not sustainable – some may be able to weather the storm longer than others (4-7 years, best case scenario according to the IMF) but revenues will need to come from somewhere. Apart from the UAE, none of the GCC states have diversified economies.

As the Fed tightened the supply of easy money and Chinese demand for metals and agriculture have decreased sharply, the conditions that were so crucial in the last decade for EMs and their currencies have vanished. More than three-quarters of assets are in funds from EMs, with many of the biggest in the Middle East and Asia. Sovereign wealth funds played a key role in EM investment that saw output and capacity expand in countries such as Brazil, Indonesia, India, Thailand and Peru. Anecdotally, it has been reported that around $100bn has been pulled from asset managers by the sovereign wealth funds in the six months to September 30th last year. Allocations to EMs will continue to fall so long as commodity prices trend lower.

It is no foregone conclusion that the US dollar will continue to rise this year. Of course interest rate policy will be key going forward – some commentators argue that December’s rate hike was merely symbolic, as the Fed needed to maintain its credibility and that the economy did not necessarily warrant a rise in rates. EMs unwinding process will be long and complex and the future movements of the dollar will be key to successfully navigating that course.

More job cuts and falling capital spending expected in 2016

The negative sentiment that has characterised the oil market for so long has continued in earnest at the start of the new year. As prices tumbled below the $30/barrel level in the only the second week of 2016, capital expenditure and jobs in the sector have been hit once again. The key headlines from last week included BP axing 4,000 jobs, Petrobras cutting billions of dollars of spending and Wood Mackenzie projecting that $380bn worth of oil and gas projects have been postponed or cancelled since 2014, including $170bn planned between 2016 and 2020.

BP’s latest round of cuts will be across its exploration and production business, including hundreds in its North Sea operations. The trade association Oil & Gas UK has reported that 65,000 jobs in 2015 were culled from this sector – direct, supply chain and indirect employment fell from 440,000 to 375,000. The North Sea is estimated to have some 20 billion barrels of oil and gas reserves however the region also happens to be one of the most expensive places to extract and pump crude in the world – the price collapse has rendered the majority of these fields unprofitable. As such offshore firms in the North Sea will remain under pressure and will continue to make more redundancies in 2016.

23% cuts in capex last year and around 20% this year mark the first time since the 1980s when oil budgets have been reduced for two consecutive years. In real terms, capital spending in oil has dropped from $673 billion in 2014, to an estimated $520 billion in 2015 to $444 billion in 2016. So far, the 2016 cuts will be most keenly felt in North America, at 27%, despite lower service costs and efficiencies that have resulted in a 20% decline in well costs. In the US, the latest monthly employment data indicates that the oil and gas sector cut another 8,000 jobs in December, bringing the total for the year to 130,000. In energy-rich Texas, exploration and production companies have shed 60,000 jobs, one-fifth of the state’s workforce. Indeed, oil companies in Texas have suffered huge revenue losses of up to 70% over the last year. Canada is home to another of the globe’s high-cost production areas: the tar sands patch in the Alberta province. The Canadian Association of Petroluem Producers has estimated that there have been approximately 100,000 job losses in the oil and gas sector by the end of 2015, including 40,000 direct jobs. As well as the low crude prices decimating the sector, policy uncertainties have also exacerbated the problem in Canada.

Conversely, the Middle Eastern Gulf is showing signs of resilience in the oil and gas labour market as GCC jobs are still holding, relative to the rest of the world according to recruitment consultant Hays. The obvious caveat here is that many of the projects were sanctioned some time ago whilst the Gulf nations benefit from the boon of tremendous foreign reserves to fund operations. Hiring has not been in the same “tens of thousands” range as five years ago but the green-lighting of developments such as the offshore islands projects by Abu Dhabi National Oil Company and the Kuwaiti’s Al Zour refinery and petrochemical project, is helping to stabilise the job market somewhat. Infrastructure projects have been pushed forward whilst key businesses such as Saudi Aramco have sought out western expats with specific unconventional experience. The Gulf rig counts, a proxy for activity, has underlined the resilience of the labour market: in December 2015, Saudi Arabia was up 6 units at 72 versus December 2014; Kuwait was up 3 at 36 rigs; Dubai was flat at 2; and Abu Dhabi was up 11 at 42 rigs. This, of course, has not been the case in Iraq, Iran or many of the Gulf’s other OPEC peers.

BP’s job cuts will affect employees and agency contractors in several key locations, including operations in Azerbaijan, Angola, Canada and the Gulf of Mexico. BP’s move, like so many other oil and gas companies, is not surprising – protecting its balance sheet is its primary concern right now. Oil and gas salaries have fallen 1.4% in the last year according to Hays, with the percentage of employees receiving bonuses, falling to 38% from 44% in 2014. Staffing levels and salaries are expected to fall further in 2016.

Our cautionary tale is pertinent at this juncture: the negative impact of capex cuts on future production will be significant. The North Sea requires massive investment to ensure that the structural decline of its mature fields does not accelerate. As further cuts to capex and opex are imposed, the absence of sustained activity (through extraction and/or maintenance) will curtail future production – this will be felt industry-wide and the pressure will be more intense on the offshore upstream sector. Even if oil prices rise early and fast this year, there will be a lag in any production rebound as the industry has mothballed a number of long-term projects. Canada for example has led the world in deferments with almost 40 projects scaled back since the beginning of 2015. This year is rife with challenges – cut backs to capital spending, staffing levels, EOR, infill drilling, maintenance and so on, will come back to haunt the oil markets in due course.

Charts of the week: Domestic capital account and impact on USD; USD may strengthen as US economy slows

|

|

|

|