November 30, 2015

Will Saudi Arabia and OPEC relent on their slash-burn oil strategy on December 4?

Commentary by Robert Balan, Chief Market Strategist

"Saudi Arabia is a very reliable supplier. We cooperate with OPEC and non-OPEC countries to stabilize the market. We need billions of dollars to continue exploration and producing oil and to invest in spare capacity to stabilize the market.”

Saudi Oil Minister Ali Al-Naimi, November 19, 2015

The recent news flow out of Saudi Arabia seems to support an increasing likelihood of OPEC action on December 4 to put a floor on oil prices. There are also indications that behind closed doors the Saudis have indicated they would prefer to see an oil price in the range of $60 to $80. However, the entire market is betting against any sort of oil price supportive action from OPEC during the meeting. A report came out last week showing that out of 30 analysts surveyed by Bloomberg, every single one has the opinion that there will be no change to OPEC's strategy on December 4. To underline the bearish theme, hedge funds last week increased their short positions in oil by 70% from the middle of October. Therefore, if OPEC does reconsider their slash-and-burn strategy, the market is caught wrong-footed, and it could result in an explosive price reaction to the upside.

The Financial Times (FT) reported that the Saudis have also indicated privately that the price of oil fell much further than they had anticipated, and that they are ready for the oil rout to end. The FT also noted the Saudis' concern about how far investment cuts around the world have taken place, putting future oil supply in jeopardy. That could result in an oil spike in the future, which the Saudis want to avoid. Then there is also the announcement that Saudi Arabia and Russia had set up a special working group on oil and gas. That may not have a direct bearing on the December 4 issue of putting a floor on oil prices, but if the Saudis and the Russians are talking, they could also reach a detente about oil supplies. We have other reasons to believe that a Saudi change of heart is forthcoming. These are the likely reasons why they may give up the slash-and-burn strategy regarding oil supplies:

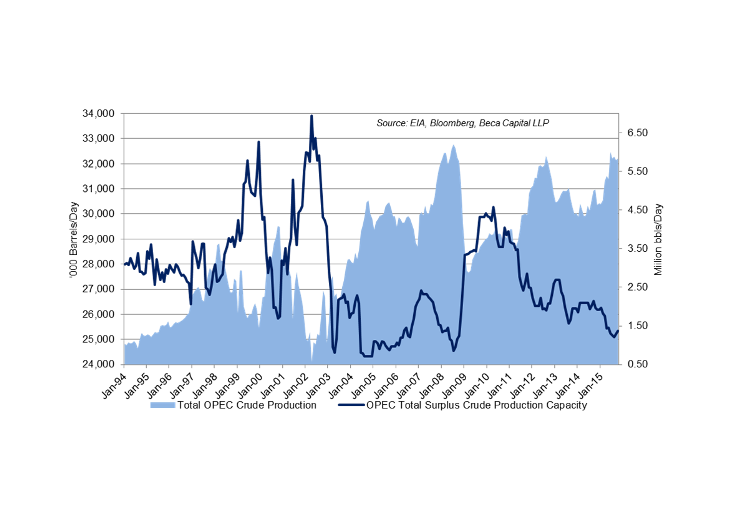

(1) If the reason for the Saudis/OPEC not to support prices during last year’s December meeting was to slow down American shale production, then they have already accomplished their mission. The US rig count which was 1,600 a year ago now stands at 564, according to Bakes Hughes. The US shale patch rate of drilling has slowed it to a trickle, and more importantly, the rig count is still dropping. US oil output peaked at 9.6 million barrels in April and is now down over 400,000 barrels per day since then. Furthermore, the most recent EIA Monthly Drilling Productivity Report (DPR) projects even further acceleration of production decline in months to come.

(2) Saudi Arabia may have not wanted (or expected) oil prices to come down this low and stay there that long. Saudi Arabia may have been willing to withstand lower oil prices for, say, two years, in order to teach the US shale oil patch some discipline. But it is very unlikely that Saudi Arabia thought the oil price would shoot down this low and stay there. After the December 2014 OPEC decision, Saudi officials were quoted of being willing to accept prices as low as $80 for two years. Kuwaiti oil officials were also quoted suggesting that $76 or $77 would be the bottom for oil prices. Both predictions were too optimistic. While the Saudi oil business will not have to deal with bankruptcy, like many in the US shale oil patch will be dealing with in the near future, Saudi Arabia lost circa $500 bln in potential revenues and are undoubtedly feeling the pain as well.

(3) “Stability” is now a catchword for Saudi oil officials. There has been a significant change in the language being used by the Saudis when discussing the oil market. Saudi Oil Minister Ali al-Naimi's catch word nowadays is “stability.” The most recent instance was last week in Bahrain. He said: "Saudi Arabia is a very reliable supplier. We cooperate with OPEC and non-OPEC countries to stabilize the market" This is radically different from his demeanour circa ten months ago when he was saying: "Whether it goes down to $20, $40, $50, $60, it is irrelevant."

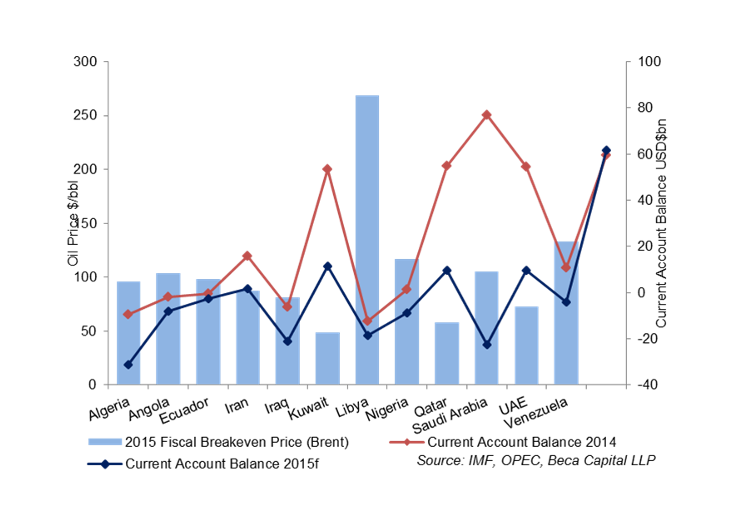

(4) Saudi Arabia faces a dangerous financial destabilization. Bank of America reported that the SA Riyal is under pressure by currency speculators. The 12-month riyal forward contracts – traders use this contract in betting on a collapse of the Riyal’s peg with the US Dollar – has spiked sharply to 535 from just 13 bps in June. This came after news reports of Saudi Arabia hitting the debt markets to supplement budgetary short falls. Saudi Arabia needs between $87 and $109 per barrel oil price to balance their fiscal budget. Saudi Arabia is now drawing down of their foreign reserves, which provide the support for the value of the Riyal. Saudi Arabia imports everything, so a strong Riyal is essential to their economy and their pride. The Saudis may need to decide whether teaching the US frackers a lesson in discipline is more important than making sure that their currency (and indeed their current King) remain viable. We believe that for the Saudis, enough is already enough.

(5) This may be the best argument of all – for Saudi Arabia, they do not really have to cut much. It has traditionally fallen upon Saudi Arabia to make the cut and balance the market, but after one year of really dire straits, Saudi Arabia should be able to get every OPEC nation to contribute to a production cut. And it does not take that much, as the actual daily oil supply and demand fundamentals are already very close to a balance. The largest bulk of the so-called oil glut formed at the end of 2014 and Q1 2015. Therefore, a large portion of the “glut” has already been stocked away in SPRs, although both EIA and IEA still maintain the same level of glut on paper. If OPEC just takes away one million barrels of oil off the market it will make a huge difference to both the price of oil and the amount of oil in inventory. OECD oil stocks are 200 million barrels higher than the five-year average. A million barrel per day cut by OPEC puts the oil market into a daily deficit of those one million barrels. It would take only 200 days to reduce inventory levels to normal.

OPEC produces a little more than 30 million barrels per day, with Saudi Arabia accounting for a third of that. If every OPEC country were to take a share of the million barrels per day cut proportionate to their share of OPEC's production it would mean that Saudi Arabia would need to cut only 300,000 barrels per day. The lesser OPEC member would have to cut far less. That is not much a cut for everyone, if it is shared. Given the pain that has already been endured, and given that even more intense pain (perhaps even national bankruptcy for lesser OPEC members like Venezuela) will be forthcoming if no deal is done, there are solid reasons to be optimistic of a deal comes December 4. The Saudis are proud people, but given that the fracking technology is a genie that has already escaped the bottle and will never be pushed back, we do not believe that Saudi Arabia and OPEC will remain in denial for much longer that their strategy of lower prices has failed. Saudi Arabia and the OPEC will have to reboot and tilt towards a tighter supply policy.

|

Main drivers this week:

|

Commodities and Economic Highlights

Commentary by Robert Balan, Chief Market Strategist

El Nino is providing positive factors for wheat prices in 2016

It is already possible to project some of the current El Nino's influence on world weather and subsequently on global agriculture prices. According to the US National Weather Service data, this month (November) the water temperature rise in the equatorial part of the Pacific Ocean where El Nino spawns has already exceeded 3.0 degrees over the historical average – the highest increment value for at least the past 60 years. The worst El Nino episode on record could well be the one that is on its way, and will soon be making significant effects on agriculture crops across the globe. We have written about El Nino's effect on cocoa, coffee and sugar in recent reports. Now, we take another look at how the weather event impacts wheat crops, especially in South East Asia, Australia, Ukraine, and in the US.

Firstly, wheat sowing in India has been delayed due to high temperatures and dryness fostered by the current El Nino. According to Reuters, Indian farmers have so far sown winter crops on only 24.22 million hectares, which is by 12.6% y/y below the usual acreage sown by this time of the year. Wheat-growing areas in India were also reduced by 26% compared to the previous year. Secondly, weak rainfall and high air temperature in Australia have negative impact on the winter wheat crop, and the domestic forecast for the entire winter cereals yield during the current year was reduced. This month, the USDA also reduced the wheat yield forecast for Australia by 1 million tons. But considering that historically, Australian agricultural producers are primarily affected by El Nino weather events, we believe that the USDA may subsequently reduce their yield forecasts for Australia.

During autumn, this year, US wheat exports came under strong pressure in the world market from Russia and Ukraine exporters, primarily due to the strong US dollar. But since last month, export activity at the Black Sea region has weakened much more than the regular seasonal weakness seen in most years. Ukraine officials have now warned of possible grain export restrictions because of the wheat sowing problems. Ukraine is very likely to reduce its wheat production next year. The U.S. current share of winter wheat crops that are in good or excellent conditions is equal to 53% (compared to 58% a year ago). However, this is not the best rate if reckoned in historical terms. Considering that the current El-Nino will have an impact on US wheat crops as well (although not as severe as it would be compared to India or Ukraine), we should expect further deterioration crop yields in the near future.

The global wheat market had been characterized by record stocks. Wheat and other commodities prices are generally under pressure due to excess supply. Concerns about the strong US Dollar, and slowdown world economy growth rates also have primary roles in the commodity price beat-down. But the El Nino event is changing some parts of that equation, as the 2016 crops may be at risk from adverse weather patterns, providing a positive spin for many agricultural products. As examples, there are problems with wheat production in Ukraine, and probably in Russia, India, Australia, and perhaps later in the U.S. as a consequence of El Nino. For us, this indicates a strong support to CBOT wheat futures for the first half of 2016.

Sugar prices are up 45% in 3 months and should rise further

The DCI® Total Return Index has been on a downtrend for most of the last 18 months. However, not all commodities prices have been depressed in the same way; many agriculture products have been bucking the downtrend, and among those strong outperformers, sugar leads. Sugar prices have risen 45% in the past three months alone. Other soft commodities, which have historically done well during episodes of El Nino (cocoa and coffee) have also benefited from expectations of potential damages to crops from Brazil to India. As sugar also just came out from a devastating 4-1/2 year bear market, demand rapidly recovered, and even ethanol demand is growing as well. Sugar cost was $36.08 at the peak of the cycle in February 2011, and was going for $10.13 at its low in August this year.

The question in investors’ mind now is whether or not the sugar recovery is sustainable, or just an artefact created by concerns over potential shortfalls due to the negative impacts from El Nino. According to the recent Commitment of Traders report, commercials are net short of sugar prices. Commercial interest are farmers, producers and refiners of this agricultural commodity – they are naturally short of the product because they are the natural hedgers of it. It is speculators and hedge funds that are now heavily long the market. Our thinking on this issue is that El Nino still has a long time to go before it peaks in late spring, so prices still have a lot to go on the upside before the upside momentum peaks, and the natural hedgers jump back into action.

Large hedge funds have been active buyers of sugar in recent weeks, as the outlook of El Nino turned for the worse. Sugar is also a non-correlated risk asset, which makes it an attractive investment vehicle to hedge funds which have exposures to a wide range of asset classes. The inflow of funds also added more volatility – weekly historical volatility rose from just 26% in the middle of September to over 40% last week. These are price characteristics that make it even more attractive to large, active speculators – especially since the threat of El Nino provides an upside trend that can be quantified and qualified by historical data which is readily available.

The CFTC's Commitment of Traders report shows that bullish bets on sugar by money managers hit a two-year high recently. The influx of large, new money coming to a relatively small market like sugar, which has a total value of around $18 billion, would tend to exacerbate the current price trend – and it did. So it can happen that futures price will actually move considerably above spot prices – and that did happen in the sugar market. Recently, futures prices were circa 12% above physical prices, which created a sort of disconnect and sharp adjustment. Arbitrages sprung into action, and closed the gap – the futures market fell from 15.53 on November 3 to lows of 13.93 cents per pound on November 9. The adjustment ended quickly – by November 13, March 2016 sugar futures on ICE rallied and subsequently closed at 15.04.

Sugar physical demand is also rising, so the sugar rally has fundamental underpinnings, and El Nino could really ignite the sugar market if the phenomenon turns out to be as bad as what many meteorologists are now saying. The best positive argument of all – the recent strength of the US Dollar had very little impact on the day to day sugar movements as investors focused on weather news and term structure (for tactical trades). Think about what impact if will have on sugar (and for all commodities) if the US Dollar peaks and declines soon as we expect.

Charts of the week: OPEC fiscal break-even oil prices; Can OPEC make up the impending supply shortfall

|

|

|

|