November 23, 2015

The peak of the crude oil inventory is probably at hand and a price bottom may not be far behind

Commentary by Robert Balan, Chief Market Strategist

"The massive stockpile overhang is one more indicator, along with the ongoing slump in prices, that Saudi Arabia’s oil strategy isn’t working so far.”

Seth Kleinman, head of energy strategy at Citigroup Inc. in London.

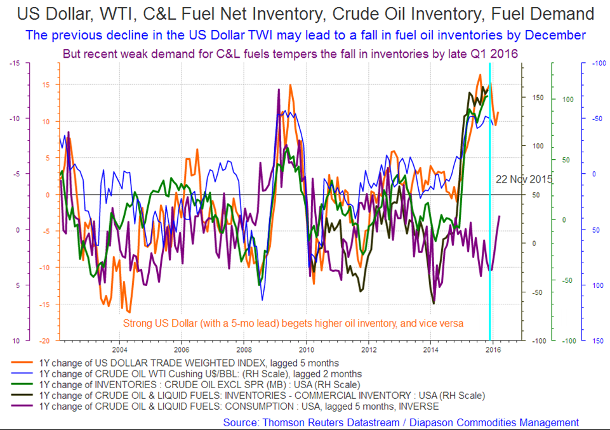

There is a distinct co-movement between the US Dollar and crude oil inventories, a relationship that runs through the price of crude oil, and is not difficult to prove empirically. The growth rate of oil inventories manifests at the maximum five months after a major change in the US currency: the stronger the US Dollar becomes, the stronger the growth is in oil inventories, and vice versa (see the first chart of the week below). In this relationship, the strength or the weakness of the US Dollar is the causality, as it leads to weaker or stronger oil prices respectively (as inverse function of the US Dollar trend), which is directly linked to stronger or weaker inventory builds after a short time lag. If the relationship still holds, then the previous decline of the US Dollar, which started five months ago, is signalling a likely significant decline in oil inventories before the December month is over. The US Dollar and oil prices are of course not the only movers of inventory builds. But on a grand macro scheme, the impact of the US Dollar, which is manifested in the price of crude oil, is the biggest single determinant of inventory build in the near-term.

We have written about this in past reports, but it is relevant to state it here again – the growth of oil production has very little to do with the build in crude oil inventory. Moreover, we also believe that inventories, by themselves, are not typically major price drivers. However, market sentiment and oil prices of late have been driven by perceptions of an oil glut, a phenomenon in which many media reports conflate oil production and inventories into a single humongous issue of supply glut, which is supposedly the cause for falling oil prices. In this erroneous context, inventories are perceived to accumulate when production stays high and demand remains low. Inventory builds, like the one we have seen over the past several quarters, are symptomatic of a market imbalance. That makes it important, but higher or lower inventories alone are not necessarily the primary oil or product price determinant. In this regard, output is more significant. Even without a significant inventory build/ draw, oversupply/ undersupply can significantly drive the nominal oil price. We have seen this happen in recent years. Significant oil sell-offs did happen since 2010 without inventory issues, and sharp decline in prices last year were not accompanied by significant inventory builds.

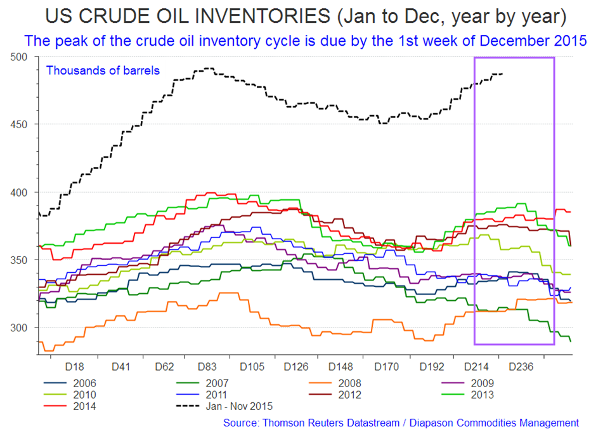

Nonetheless, any inventory overhang, like the one that exists today, has to be cleared before prices can normalize. The normalization process can sometimes be hastened or hindered by seasonality in oil inventory building – inventory tends to increase or decrease during certain months of the year, and those seasonality patterns can be persistent. These peculiarities are caused by the input needs of oil refineries. Refineries are the primary source of crude oil demand, which means that refinery input levels are the primary determinants of crude oil inventory draws and builds. The waxing and waning of inventory builds hew closely to refineries’ level of activity. For instance, oil inventories tend to build during spring time, reaching a peak in early summer. Summer months tend to see decline in inventories, but by early fall, inventories start accumulating again. This build peaks during December, usually before or by the middle of the month. That is the situation where we are now – we expect to see the current oil inventory cycle to peak by the first week of December (see second chart of the week below).

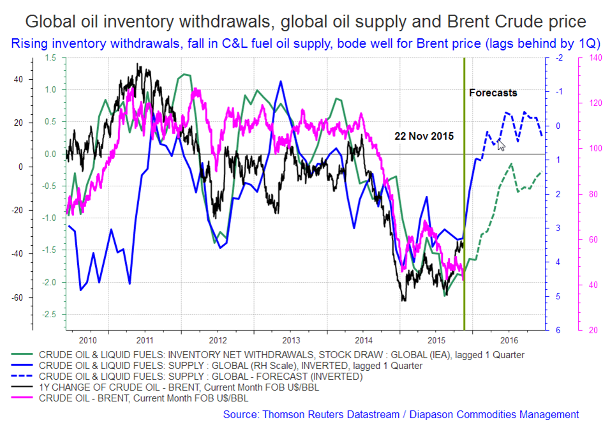

The same effect can be seen on US-centric data as well. Changes in the US crude oil and liquid fuel net withdrawals data usually precede changes in WTI oil prices by three months. That was essentially true until five months ago, when oil prices declined (due to the perception of growing inventory builds), even as C&L fuel net withdrawals were starting to soar. But we believe this is a short-term aberration, and that the correlation between increasing net withdrawals and rising prices would soon reassert.

As what we have been trying to show, high oil inventories are not the real cause of declining oil prices – it is oversupply or over-production which is the culprit, and the perpetrator of the glut has been Saudi Arabia. The conventional market wisdom is that Saudi Arabia wants to keep its market share, and is willing to allow prices to decline in order to take out marginal oil producers, many of them in the US shale oil patch. It initiated this strategy by not propping up oil prices late last year after global activity declined. The Saudis have usually taken steps to stabilize prices by cutting back on production, but did not do so this time around. Instead, OPEC (Saudi Arabia) increased their production, and aggressively underbid non-OPEC producers. The shale frackers responded to sharply falling oil prices by closing out marginally producing oil rigs and applied technology to improve productivity, which enabled them to continue producing at an even faster pace. Thus, the “oil glut” formed, and oil prices have been hammered further as a consequence.

However, Saudi Arabia cannot afford to keep the oil prices at the current low levels for a long time. The country faces severe financial instability, and even the IMF says the country "could be bankrupt by 2020" if current low oil prices persist. OPEC’s oil policies are also failing its non-Gulf members, some of which are facing dire economic hardship due to low oil prices, like Venezuela. The current OPEC oil policy not only promotes financial instability for less rich members, but also creates dangerous geopolitical friction with other oil-producing countries, such as Russia and Iran. Further destabilization of the entire Middle East region can not be ruled out, if low oil prices persist for longer. Saudi Arabia is now under pressure to let up or modify its slash-burn strategy, and rationalize towards tighter oil supplies – the sooner, the better. We believe there is a good chance that there would be hints of such outcome during the OPEC’s December 4 meeting. Crude oil prices could soon be in for a sharp relief rally at least.

|

Main drivers this week:

|

Commodities and Economic Highlights

Commentary by Robert Balan, Chief Market Strategist

El Nino concerns ignite a new up-trend market in Cocoa

Cocoa prices rallied to a new four-year high last week as drought in Indonesia and slowing deliveries in Ivory Coast, which come consequence of the current El Nino phenomenon, fuelled further concerns about supply. The International Cocoa Organization said that there could be a global deficit of about 160,000 metric tons of cocoa this season. El Nino is parching cocoa trees in Indonesia, the third-biggest grower, as well as impacting crops in West Africa. The output in top producer Ivory Coast will likely be smaller relative to the last growing season, as shown by cocoa deliveries to Ivory Coast ports which have slowed last week, significantly slower than the previous week. Ivory Coast cocoa port arrivals were about 50,000 tons in the week ended Nov. 15, compared to 61,000 tons a week earlier.

Cocoa prices, which have been rising since early October, were pushed even higher by the news. Cocoa for delivery in March rallied 1.3 percent to $3,420/ton on ICE Futures U.S. in New York, the highest level since March 2011. The price of cocoa has risen 17 percent in 2015, the biggest gainer in the DCI® Total Return Index. The previous peak was seen in July at $3,336/ton from the March low, due to strong demand from Asia. After a sideways move in Q3, cocoa prices rose sharply on the news that the current El Nino could possibly evolve into the most severe in history. Over the next few months, we believe that strong cocoa demand in combination with the negative impact of the El Nino phenomenon could push prices close to $3,800/ton at least by spring, when the current El Nino is expected to deal its maximum negative impact on cocoa crops. Every cocoa price consolidation this year has been a buying opportunity. China and Asia were consuming more chocolate than the year before as demand ratcheted higher each year. This has primed a bull market in cocoa. And for the rest of the year until spring 2016, we will likely see a combined strong-demand and constrained-supply situation – it could be the best of both worlds for cocoa investors.

The Asian demand for chocolate confectionery products has changed the industry in profound ways. This new market has been pushing cocoa prices since late 2011. In the process, the cocoa price uptrend has shown all the hallmarks of a demand-based up-trend market. It is important to differentiate the two prime movers of cocoa prices. On the one hand, supply-side rallies in the cocoa market are usually sharp, volatile and short-lived. Demand-based rallies, on the other hand, tend to be slow and steady with shallow pullbacks along the way. The Asia driven up-trend market has all those demand-based hallmarks. The Chinese have specially developed a liking for chocolate. As the bromide goes, if every man, woman and child in China eats a chocolate bar each every month, the one billion plus Chinese would indeed consume a very large mountain of chocolate every year – enough to keep an up-trend market in cocoa price running each year.

The largest producers of cocoa beans in the world are the West African nations of the Ivory Coast and Ghana. The two countries account for 60% of the world's production. The production in Ghana has dropped considerably in recent months due to dryness fostered by El Nino. Historically, the El Nino phenomenon has dealt price-positive impact for cocoa prices. We believe that the same thing will happen again this time around – El Nino-related weather issues could propel cocoa prices significantly higher in the months ahead.

The price of copper has fallen below the cost of production

The rout in the base metals continues and it looks like deleveraging is going on at a large scale as the US Dollar is expected to gain further. So those involved in the base metals market have been reducing their exposure to the bare minimum as base metal sector is expected to remain under pressure while the US currency stays firm. Copper as the lead metal in the sector is of prime interest because the supply side of the red metal has seen some constraints this year, limiting new supply on the market. However, most of the price pressures come from the US Dollar valuation and from the demand side of the equation as China goes through a metamorphosis and rebalancing of its economic and growth models, from investment to consumption. So the combination of US dollar strength and weaker and uncertain demand from China has undercut the supply-side's positive factors.

However, the market may be missing out on other elements that do contribute to the price discovery. Copper does not grow on trees – it has to be extracted from the earth, ground up, processed and refined – an expensive process from a cost perspective. The steps involved in transforming copper into a marketable form are indeed extensive and involve considerable time and resources. This brings the cost of production into a sharp focus. At what levels will copper prices fall below the cost of production? And how will producers of the resource respond when that inflection point is reached? With seven straight weeks of prices being hammered, the copper price has fallen to $4485/ton at the LME, a level last seen during the middle of 2009, when the global economy was just coming out of the Great Financial Recession of 2008.

Every asset has a price, and the asset also has a base cost. The price is what valuation the market will assign to the assets, but markets have the tendencies to overshoot in one direction or the other. But in the final analysis, the 'fair price' of the asset, given the existing dynamics in the market, has to be at or above the cost of production. Otherwise, producers acting as economic agents, will stop producing the asset. So at what price level of copper would producers go on strike? There are various estimates of the marginal cost of getting copper out of the ground, but the marginal cost of production varies widely because every copper mine producer has its own set of idiosyncracies, which impact their cost of production uniquely. But it is reasonable to assume that the current price of copper is now already below the historical, aggregate, long-term production cost of processing the industrial metal. A strike by the resource producers anytime cannot be ruled out.

Demand for the base metals sector has not really changed that much during the last seven weeks, but the price rout is happening nonetheless. What did change during the last seven weeks is the large fund flows into the US dollar – all dedicated towards front-running the Federal Reserve's raising policy rates in December. We have serious doubts that a rate hike in December will be followed by a long series of policy rate raises in 2016. That should undercut the support for the US Dollar, and removes the single biggest factor that had depressed the price of copper in the past six weeks – the strength of the US Dollar. When traders unwind these US Dollar fund flows and cover the substantial shorts in the base metals market, we should see better price structure for copper. We are uncertain how this eventually plays out – but what we are certain of is that copper prices south of $4500 could be setting up an ample short covering rally before 2015 ends.

Charts of the week: The stronger the USD the stronger the growth in oil inventories; Oil inventory cycle; Oil inventory withdrawals, supply and Brent prices

|

|

|

|

|

|