October 26, 2015

China could help the world avert economic stagnation and low, even negative, rates

Commentary by Robert Balan, Chief Market Strategist

"We are retaining our forecast that benchmark rates and the reserve requirement ratio will both be cut once more before the end of the year, with a further move in both early in 2016.”

Capital Economics, October 23, 2015

An important (and widely expected) policy announcement came from China, where its central bank, the People's Bank of China (PBoC), cut one-year deposit and lending rates by 25 basis points (bps) to 1.5% and 4.35%, respectively. The reserve requirement ratio (RRR) for major banks was also cut by 50 bps. The latest rate cut represents the sixth such reduction in policy rates since November of last year, underlining China's determination to escape a hard landing.

Today, China comprises the largest, single factor which impact global risk assets. We will be watching developments in the Chinese currency, track capital inflows/outflows and develop clues from the response of the Chinese equity markets. We believe that if China can continue to ease financial conditions (thereby lowering activity costs) and at the same time, keep the currency stable and equity market volatility low, we believe China would be positive for global risk assets and market sentiment. However, the inverse can also be true (but which we believe to be of lesser odds) – if further easing policy in China creates renewed pressure on the currency, increases in capital outflows and curtails FDI inflows, then market sentiment could quickly turn and China becomes a net negative for the global risk assets. We will monitor these elements carefully.

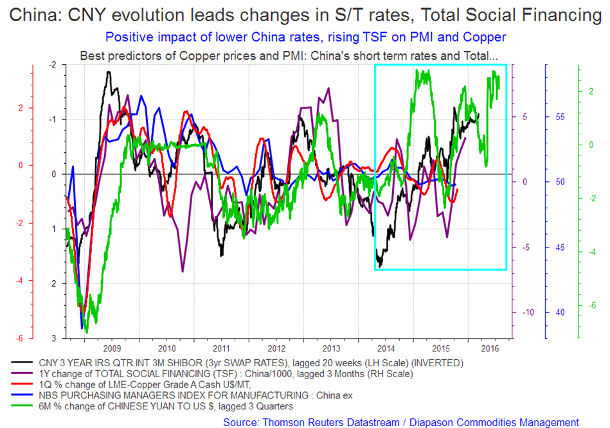

Unlike in developed economies where the currency tends to be a sideshow, China uses the currency as a major policy tool. In China, the evolution of the currency tends to lead changes in policy rates, and subsequently, market interest rates. The relationship takes added significance when one considers that short-term market rates lead the changes in the amount of Total Social Financing (TSF), the rubric for spending on government infrastructure and socio-economic projects. TSF, in turn, leads the evolution of manufacturing PMI; and PMI in turn is the best predictor in the changes in copper and base metals prices (see chart of the week below).

Most of the issues that concern and constrain China’s policy makers today stem from currency-related developments. Chinese policy makers were specifically interested in ending capital outflows in order to provide a stable platform for a further monetary stimulus. But stimulus in the form of lower rates, on the other hand, diminishes the value of the currency, which has a large bearing on FDI inflows and outflows. Hence, the PBoC has to cut rates very, very carefully so as not to trigger domestic currency outflows. One strategy of Chinese authorities to stimulate inward FDIs was by accelerating the timetable for the entry of the Chinese Yuan into the IMF's SDR basket.

This initiative however ran into problems due to the low participation of European and American banks in the financing of Chinese bond issues. The Chinese crafted a ran-around by having London banks spearhead the opening up of the Chinese capital account with the first Renminbi denominated sovereign bond sales outside of China and Hong Kong. Further momentum for the strategy was provided during Mr. Xi’s visit to London by dropping hints that China aims to fully open up its capital account and completely integrate with the global financial system by 2020. This outlook was further helped by the apparent successful transformation of the Chinese economy from infrastructure based to a consumer model. The latest sectorial data from the Q3 2015 report shows that financial services have expanded by 16.1% in Q3 versus the same quarter a year ago. Industrial growth on the other hand was just about a third of the data for financial services in comparison.

The apparently successful modal transformation brings the hope that China might actually come to the rescue of the world economy. To explore this possibility, one has to see if what ails the global economy is something that can be addressed by China’s transformation from a rural economy to an industrial one. The persistent issues of global deflation and falling (even negative) bond yields world-wide are the symptoms of an excess of savings over investments on a global scale. Global savings is accumulating further due to the collective impact of (1) slower population growth, reducing investment needs; (2) the rise of modern corporations in the IT sector that has reduced investment needs for business infrastructures, and (3) the rising ascendancy of capital over labour, with the deterioration of labour union rolls as proof. The increased supply in savings, which meant a reduced demand for business investments, has translated into persistent pressure on bond yields and market interest rates globally.

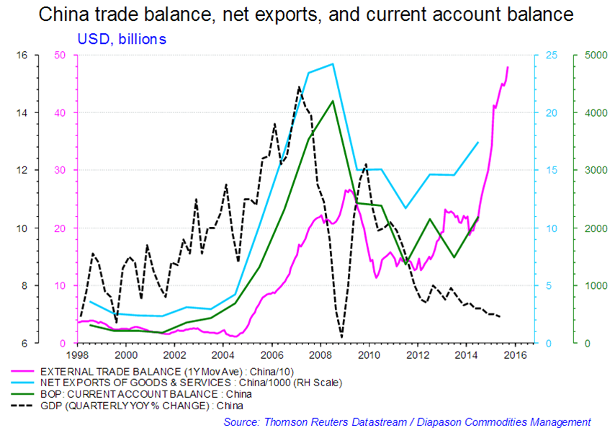

China has been in the forefront of this global savings glut. Impressive as the investment on infrastructure was, its savings counterpart is even more spectacular. The evidence of course is the trade balance, which has been tremendously positive for decades, and is still rising (see second chart of the week below). The absence of a social safety net in China and the requirement for substantial down payments for real estate are two of the primary reasons why the Chinese save so much. So if the Chinese can be persuaded to part with a large portion of their precious savings in a move to consumerism, then the world may be able to escape the stagnant, deflationary environment that currently plagues the global economy.

And there are signs that such a move may indeed be taking place. China has become the largest market for cars and mobile phones, for instance. There are other plans afoot which may hasten the diminution of savings. Government officials have already started talking about the need for a health-care system, which many developed countries take for granted. The Hokou residency system is also being revised, which will hasten the urbanization of China. Wages have practically doubled in a few years, providing the wherewithal for consuming. If the “unsaving” meme takes root in China, the rest of the world may just be “saved” from a fate of economic stagnation and low to negative interest rates in the near-future.

|

Main drivers this week:

|

Commodities and Economic Highlights

Commentary by Robert Balan, Chief Market Strategist

The ECB hints at further stimulus and will add further fuel to another rally in asset prices

There was clear change in investors’ sentiment in last two to three months. Market participants replaced somewhat guarded optimism over the global economy with concern for the next few quarters. And it was the Chinese slowdown which sparked the process, even as the sharp decline in emerging market currencies accelerated the downtrend in sentiment and asset prices. That led the central banks to reappraise the policy paths that were being mapped along the lines of moderate global growth over the next few quarters.

Now with the ECB acknowledging the potential need for additional stimulus, a new, more bearish outlook is being adapted by global policy makers. The ECB made strong hints that more stimulus will follow, sparking what we describe as a new risk-on phase for global asset prices. Market expectations are now weighted in favour of this expansion of the QE programme in December. If that is the case, the Fed and the ECB will then again begin to officially diverge at this time. This divergence in policy has profound effect on asset allocation preferences between the US and the Eurozone financial assets.

After the ECB meeting last week, Governing Council member Vitor Constancio went to the extraordinary length of explaining to the capital markets the likely fallout from an ECB expansion of QE at the time that the Fed is going into a regime of raising policy rates. According to Constancio, the impact will fall harder on the Eurozone economy rather than on the US economy. It is the usual flight of capital in search of higher yields. And that tends to strengthen the US Dollar. Capital flowing out of the Eurozone into North America also creates a feedback loop, which will tend to strengthen the American economy more than the domestic one – simply put, the ECB’s new QE program is more likely to stimulate the American economy rather than the Eurozone economy. This will have adverse impacts on the Fed’s policy outlooks as well. The Fed may be forced to tighten monetary policy further, while the ECB is likewise forced to ease further, exacerbating the divergence in policy paths.

At this point, all of these are speculations and the strong hints of stimulus from the ECB may still be quashed by better-than-expected Eurozone economic activity. The picture from this aspect is not clear. The Euro area economic upturn picked up a bit of momentum in the early Q4, but job creation remains at levels that had disappointed policymakers in the common market. This is the most significant data to watch, and absence of progress in this regard will raise expectations of further stimulus from the ECB. Another, less significant data set from the stimulus point of view, is the rate of inflation in the Eurozone. The outlook has not improved much, as a renewed fall in output prices in October suggests that inflation will likely remain in negative territory until year-end.

The Fed risks being flattened by another US Dollar surge as other central banks embark on easing mode

The Last week, we had asset prices rise significantly on prospects of ECB’s further easing and the triple-barrelled China easing move. That leaves the Federal Reserve in a bind, as increasing rates at this time will transport the US central bank to a point that it was in earlier in the year - when it had to grapple with the negative effects of a surging US Dollar.

As the global economy slows, and the Fed had kept up its hints of initial policy tightening, global capital flowed back into US Treasuries and the US Dollar, in search of a safe haven and the opportunity to capture widening interest rate differentials. Capital inflows into the US in this manner are both a boon and a bane. Capital inflows tend to stimulate the economy and lower interest rates which counteract the deleterious impact of a stronger US Dollar. The US currency tends to strengthen when US domestic policy rates are raised, at this time when other major central banks (e.g., ECB, BoJ) are contemplating to ease monetary policy further. But US yields also fall due to the increased demand for Treasuries.

The FOMC will meet this week, but the market put the odds of a policy rate hike at only 6 percent, statistically a non-event. Nonetheless, Fed officials continue to characterise every new FOMC meeting as “live,” and the vast majority still seems to favour hiking in 2015 based on speeches and the dot plot that has been featured at every meeting. However, market pricing have been diverging sharply from Fed communications and projections. The market is now pricing the first Fed rate hike only well into at least the middle of 2016.

In fact, market participants expect a dovish message from the October meeting, but it is likely that they may be disappointed. Based on the language changes to the October FOMC statement, there will be no substantial alterations in the official statement, but if there are, they should lean in the direction of allowing the Fed maximum flexibility in subsequent statements or actions. Our opinion is that the FOMC will remain cautiously optimistic for lift-off in December, as they have been hinting for several months now. There is a challenge for the Fed however in that while the global economy is no longer as dire as it looked back in September – thanks to several policy easings by the PBoC and the improvement in EU data over the past quarters – some US economic data has turned for the worse. And there are indications the data will get progressively worse.

That brings us back to a full circle to the situation existing earlier in the year. It is almost December, and the US central bank is nowhere near getting the ideal conditions that they are looking for so they can initiate a policy tightening to get out of zero. Nonetheless, the Fed seems determined to get out of the zero-bound and will do so as soon as they get cover for doing so. The US Dollar may rise somewhat if this happens, but we also happen to believe that the US Dollar valuation has already baked-in at least a 50 basis point hike, and if no further hikes are coming after the first, the US Dollar will probably decline as a consequence.

Charts of the week: China: Total Social Financing leads the evolution of manufacturing PMI; China’s trade balance is still rising

|

|

|

|