August 24, 2015

The risk-off environment hammers commodities; the US Dollar as the primary culprit

Commentary by Robert Balan, Chief Market Strategist

"According to Ferbus (the Fed's economic model), a 10% increase in the exchange rate ripples through the economy gradually. In the first quarter after the shock, growth is shaved by a negligible 0.08% and the inflation rate by 0.1 percentage point. But the impact grows steadily for three years, as producers, exporters, importers and consumers adjust their habits. After two years, about 0.75% will have been lopped off GDP.”

Josh Zumbrun, "For the Fed, Dollar’s Strength Complicates Rate-Hike Calculus"

News flow and price action for the commodity sector has been completely negative for the past 6-8 weeks and the sector has now moved to full blown liquidation. Once again the financial world goes into a tailspin risk-off mode over China, falling crude oil and commodity prices, sparking concerns of another deflationary scare episode, which in turn is awakening fears that this could evolve into a global recession. Commodities and emerging markets seem to be the asset classes of choice to express those negative views, being the recipients of the resulting negative money flows. Commodities sank to the lowest level in 16 years on concern that China's economic slowdown will exacerbate gluts for everything from oil to metals.

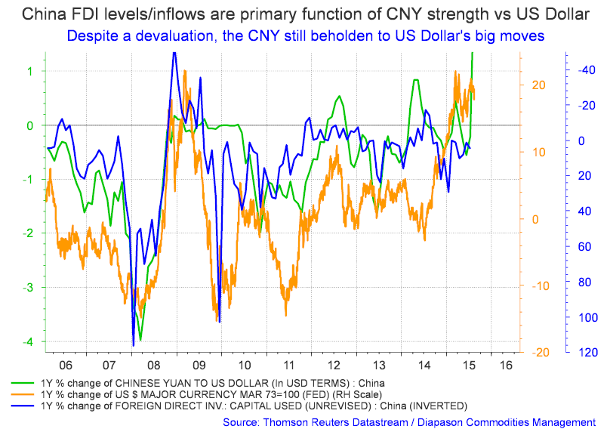

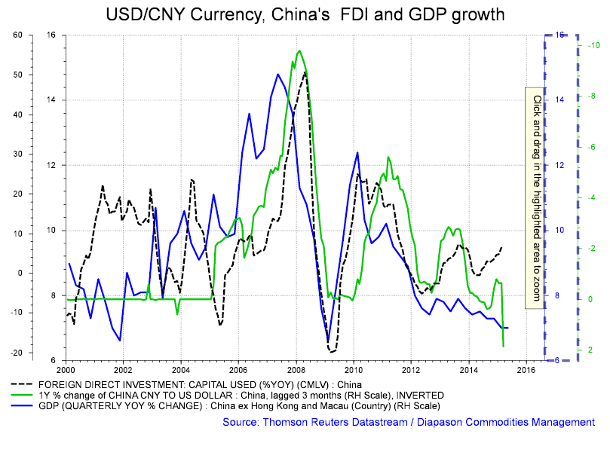

Media reports focus on China as the trigger for this risk-off episode, but actually most, if not all, of the financial world's travails at present can be traced to the US Dollar, which remained too strong for too long. Name any current financial calamity, and the US currency has its finger-print on it. The most recent case in point – the Yuan devaluation, which is seen as the key factor that crystalized the asset blood-letting at the moment. The Chinese held on to that unofficial peg of the CNY to the USD for far too long, hoping to hold on and/or attract FDIs and at the same time provide wherewithal for the economy to transition to consumerism by increasing its citizens' purchasing power (see chart of the week). It looked like a masterful move — kill two birds with one stone (see chart of the week). But the other parts of the Chinese economy devolved much quicker than the government anticipated, and moreover, the solution taken have to redress failing exports – CNY devaluation – has royally backfired. So here Chinese government stand on slippery ground, beset with a falling economy, a collapsing stock market and a property sector that is again at risk (see chart of the week).

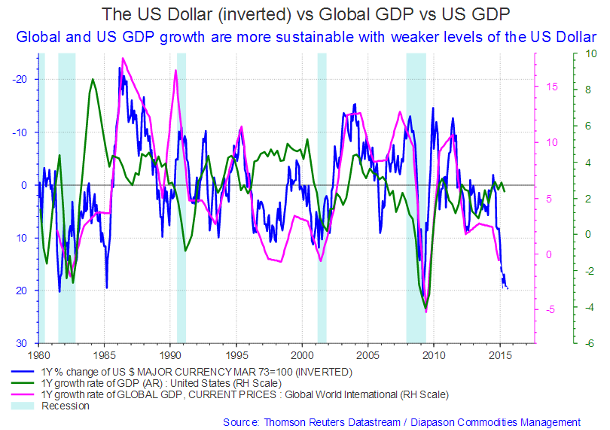

Of course, one may argue that the strong US Dollar can not be faulted for the misfiring Chinese grand strategy, but we are not ascribing blame here — we are looking at the ultimate cause of the current global woes — and it can be laid at the foot of a US Dollar that became too strong quickly, then stayed that way for too long. The strong US Dollar also hurt commodities, and lower commodity prices hurt fiscal and FX rates in high volume growth countries (e.g., EM and CHINA), and so a weaker global economy extends the full impact of the strong USD cycle even to export driven markets like Germany and Europe overall. In fact, the impact of a strong US Dollar is so pervasive that it affects the entire global economy — a stronger US Dollar begets weaker global GDP, and vice versa. The entire world, including the US economy which is negatively correlated to the US Dollar, will benefit from a weaker primary reserve currency (see chart of the week).

Fortunately, a weaker US currency is probably on the way. The US currency has been falling like a rock vs Euro, CHF and GBP since last week, when it became clear that the Fed is highly unlikely to raise policy rates next month on uncertain US growth and with the current manifestations of global financial stresses. Others scoff at this rationale, saying that the Fed only cares about domestic concerns. But be that as it may during normal conditions, it will be a very stupid Federal Reserve to initiate a rate hike which will further strengthen the US Dollar, which in retrospect is the ultimate cause of the current financial world's travails. We have been suggesting for some time that the US dollar had planted the seeds of its destruction with the sustained 5-quarter rise during most of 2014 and during H1 2015, on precisely the grounds that were discussed above. Moreover, it has to be said that a currency valuation is the ratio of two competitive currencies and that during the 5-quarter US Dollar rally being highlighted; all the elements were perfectly aligned for a USD bull market. But global conditions have changed for the better for some developed economies, ex-US, and US domestic conditions have evolved as well for the worse; moreover, the policy rate hike regime that the Fed has been trying to foist on a sceptical market does not now appear to be a slam dunk. Investors have taken note of all of these and have adjusted their evaluation of the likely evolution of the US currency in the near-future. And the verdict is a weaker US Dollar in the near-term at least.

If an overly strong US Dollar laid the foundations of the current global financial travails, then it follows that a weaker US currency will do a lot to redress the current stresses. We expect a more bearish outlook for the US currency once the DXY falls below the technical support of 92.00. That could within the next two day or so. Given such a confirmation, we would expect some form of respite for global assets (including commodities) within a week or two. Further declines below 90.00 on the DXY tells us that the US Dollar has way to go on the downside, and that would translate into a recovery of the global economy in general, and EM and commodity-based assets in particular, including EM currencies and assets, and resource producers. So watch US Dollar developments for key leads in the recovery of global assets from the current risk-off episode.

|

Main drivers this week:

|

Commodities and Economic Highlights

Commentary by Robert Balan, Chief Market Strategist

Coffee makes a defensive move higher

The decline in commodities continues against a wide swath of commodities. But there is a commodity that has defied the odds and is actually rising – Coffee. It is not a surprise that Coffee should be doing this – the "soft" sub-sector, to which Coffee belongs, is considered a "defensive" in the commodity universe, and Coffee is doing exactly that at present.

The significant characteristic of the Coffee price is that when it starts to move, it really trends. Spot Coffee has been trading slowly lower in a wedge-shaped structure since March this year. But on July 24, the bottom was apparently hit, and Coffee prices suddenly rocketed upwards and traded above the critical upper downtrend line of the wedge structure. This indicates a potential for a sustained move to the upside. We also happen to believe that the July bottom defines the trough for the bear phase which started in October last year. We consider the bear phase from October 2014 as a correction to the sharp bull phase from November 2013 to the October 2014 peak. So the rally from the July 24 trough may have the potential to match the previous move to the upside from November 2013 to October 2014. We will have a lot of opportunities to confirm later if this indeed is the case..

The behaviour of being able to do long trends is one characteristic that investors have to look for. An early buy, preferably on a dip (like the one that is occurring at present), may catch a sharp uptake that Coffee is known for. This is a trade where stops are readily identifiable and should be kept in place. If Coffee turns around and takes out the stop, the next bottom becomes a clear point of reference for another trade to the upside. Patience is required in waiting for the proper next optimum buying level to come by.

Past sustained breakouts in Coffee were not just technical developments. In most cases, Coffee prices were pushed higher by severe production issues that caused severe supply shortages relative to demand. A similar situation may be building again at this time. While the coffee market seems to have no immediate supply concerns today, the stock levels in most producing countries are declining sharply. There is only a moderate buffer in importing country warehouses, so any significant negative shock to coffee production may overwhelm what we consider to be insufficient cover. This could leave the market highly susceptible to a price surge. This is no speculation – we have seen such price surges in March 2014 and in early 2011, when production failed to meet expectations.

Simply put, the margin for error in the Coffee market may be getting thin, even dangerously thin. This situation helps make a bet on higher prices at this period a good proposition from technical and fundamental points of view. Insofar as "fundamentals" are concerned, the International Coffee Organization (ICO) had recently noted that coffee had entered a production deficit. Coffee exporting countries have been using existing stocks to support shipments. Total exports of Coffee in June this year were strong. June 2015 exports were off by 3.3% year over year (9.7M bags in total), but that month was still the second highest June month on record.

The IOC reported that depreciating currencies have been the primary driver of exports in Brazil and in Colombia. Production was lower in Brazil but exports have been taken from existing stocks. Colombia has enhanced export volumes for four straight years with the help of government "renovation" and other support programs. Vietnam and Indonesia, meanwhile, have reduced exports due to lower Coffee crop yields. These are encouraging developments for Coffee prices. Coffee demand remains very robust. World consumption has grown essentially linearly since at least 1990, and that should extend over the next few years as well.

The short-term and intermediate-term outlooks for gold

Short-term Outlook (3 to 6 weeks)

Gold is moving sharply off the bottom posted on July 24. We believe that Gold has more room to go higher. Technically speaking, gold has "completed" a downward (falling) wedge structure which started on August 30, 2013, but this thesis needs confirmation, which will be provided by an upside break of $1250 - $1275 (if it happens), depending on how fast gold prices will ascend. We expect that "test" to take place in 3 to 5 weeks. In this short length of time, gold "fundamentals" of supply-demand will be of little help in influencing the price evolution. The US Dollar trajectory, market sentiment, positioning, and technicals will be paramount during those 3 to 5 weeks.

The latest Commitment of Traders (COT) report is currently positive for gold bulls. Large speculators (e.g., hedge funds) have accumulated what we would describe as low net long positions. The large speculators (LS) are net long by only 32,442 contracts in total. This compares to the situation on January 27 when gold was at $1292, when the LS were net long by almost 190,000 contracts. The aggregate positions have been reduced roughly 80% over the past several months when prices traded lower, even sharply lower, during the great sell-off last month. Small speculators, which include retail investors, are net short on the other hand, and had been for the fourth straight week in a row. Some people would characterize this as typical: retail investors are said to be usually late to the game and get taken to the cleaners by the so-called smart money (the LS). Nonetheless, at this juncture, gold may still has room to move higher, as we do not believe that the LS are in a profit-taking frame of mind that soon.

Intermediate-term Outlook (until year-end)

The US Dollar index is still near its highs, but it is fading fast as the Fed becomes more constrained to raise rates due to low inflation pressure and the risk of further deterioration of international economic conditions, which will be exacerbated by higher rates and a stronger US Dollar. U.S. and international equity markets are also under pressure, even as the Chinese economy seems unable to make further headway – we just do not see the Fed adding to market stress with a rate hike at this juncture. Moreover, the Fed is the only central bank that is contemplating on raising policy rates, likely making the US Dollar strong again with a rate hike, which would have deleterious impact on the US economy. The situation may change early next year – but for us, a rate hike this year is likely not a done deal.

A US Dollar weakness combined with a weaker US stock market, and other assorted side issues (like further Yuan devaluation) could set Gold prices on fire further out. Yuan devaluation has historically driven Chinese investors to buying gold and precious metals as a hedge for the local currency and for safe haven purposes. Since we expect the Chinese central bank to engineer further Yuan devaluations on periodic basis (to forestall criticism from trading partners), Gold appreciation will be drawn out as well.

If other countries in Asia like India, Malaysia, Australia, Vietnam, etc. depreciate their currency in response to the Chinese devaluation, then that would be a continuing good catalyst for Gold. On technical terms, the target of the breakout from the falling wedge structure would be the origin of the wedge, which is at $1400. If other countries do go the devaluation route, there seems a good basis for expecting the $1400 level to be reached.

Charts of the week: China FDI; USD/ CNY, China FDI and Global GDP; USD vs. global GDP vs. US GDP

|

|

|

|