August 17, 2015

China wheels out more aggressive measures, weakens the US Dollar

Commentary by Robert Balan, Chief Market Strategist

"U.S. markets have priced in (a Fed) anticipated rate hike and caused U.S. monetary conditions to further tighten. Through the dollar peg this tightening has also been felt in China and can explain the slowdown in economic activity. Consequently, China had to loosen the dollar choke hold on its economy via a devaluation of its currency."

David Beckworth, "China's Devaluation: Impossible Trinity, Deflationary Shocks, and Optimal Currency Blocks" , August 11, 2015

China is still our primary concern in H2 2015. China's growth has been virtually flat for several quarters now, and has disappointed us in Q2 2015. We thought in late Q2 that policy easing and a wide variety of stimulus taken in H2 2014 and early 2015 would have impacted the Chinese economy in a very positive way by now. But apparently the slack in the economy was so much that further steps have to be taken. Nonetheless, the Chinese authorities seem to be more assertive in their response to the slow-down this time around, and have wheeled out more aggressive policy measures to stem further growth declines. We summarize the activities that have taken place lately:

China stimulus programs

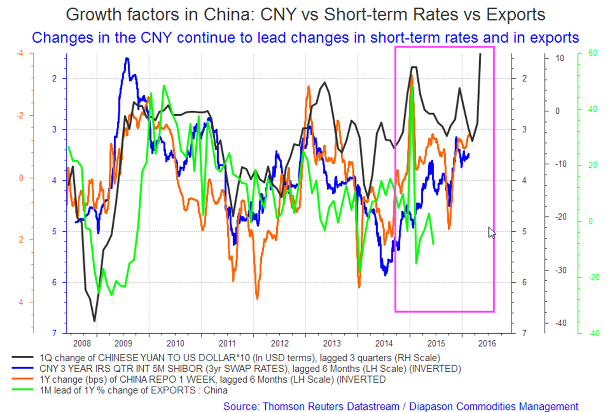

China is resorting to old growth drivers as the new ones fail to offset slowing investment and trade fast enough. Policy stimulus has failed to bolster aggregate demand and reduce excess capacity, so it is adding several tools to the existing arsenal. The latest is the devaluation of the CNY. China's external trade has slowed significantly -- exports of goods and services as a share of GDP fell to 22.6 percent last year from a high of 35.7 percent in 2006. The culprit has been the relatively strong CNY which had been pegged to the US Dollar. The devaluation could be effective if carried out in full-scale: Estimates show that a 10% devaluation could mean 10% growth in exports.

On the monetary policy side, the central bank has room to cut interest rates further. The PBoC has cut its benchmark lending rate to a record low after reducing interest rates four times since the start of November. They have room to move further, and we believe they will soon. The PBOC’s one-year deposit rate is at 2 percent and one-year lending rate is 4.85 percent, compared with near-zero benchmark rates in the U.S. and Europe. The PBoC could also pump liquidity into the money markets in order to push down interbank lending rates. The 7-day repo rate, the benchmark rate of interbank funds, has fallen to less than 2.5 percent from 3.5 percent in mid-June.

Moreover, The PBOC has significant room to lower required reserve ratios on banks to encourage lending. Even after a series of cuts, the RRR remains at 18.5 percent for major banks, among the world’s highest. Reducing the ratio by 10 percentage points would free up 13 trillion yuan ($2.1 trillion) of additional capacity for banks to lend.

On the fiscal policy side, the country’s $3.69 trillion of foreign-exchange reserves and relatively low national government debt levels mean it has the ammunition for fiscal stimulus. China is planning at least 1 trillion yuan ($161 billion) in long-term bonds, and potentially a multiple of that, to fund construction projects as the economy struggles. Most of the interest payments on the bonds will be subsidized by the central government. We believe that more projects of this type will be initiated in 2015.

China’s CNY devaluation

The latest blockbuster news out of China is that the monetary authorities have allowed the CNY to depreciate by about 5% (so far) which triggered warnings about an upcoming "currency war". Those warnings cannot be reconciled with monetarist theory and monetary history. China's devaluation does not stem from hostile intentions – rather, it is a desperate attempt to stabilize Chinese aggregate demand. If a country needs to ease monetary policy to support nominal spending then it follows logically that the local currency will have to depreciate as a consequence of lower policy rates and addition of currency volume in the general circulation. This is what has happened in China – the country has not started a “currency war”. The over-all rationale of China's currency devaluation is to stimulate aggregate demand, while lowering the value of the currency is aimed at increasing export volumes.

The CNY devaluation is qualitatively significant, but quantitatively, it is insufficient. A five-percent move in a currency is barely worth mentioning or even worrying about – it is almost within the daily standard deviation band of many EM currencies (to which the CNY belongs). The Swiss Franc strengthened by 20% against all currencies, in a single day, back in January, with no lasting repercussions. Also note that Switzerland’s imports amount to about 50% of its GDP. The impact of the CNY devaluation will be positive on China but more have to be done. Moreover, the better solution would have been to let the CNY float freely, and that should have been done a year ago.

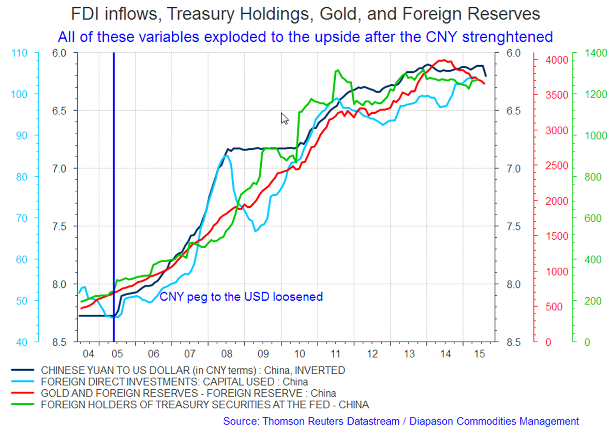

Devaluing the domestic currency has an especially powerful effect in China. The benefits are transmitted via lower short-term rates, which translate into higher levels of social financing, which redounds to higher GDP growth (see chart below). The overarching objective of China's manipulation of the CNY is Foreign Direct Investment (FDI). The Chinese need FDI inflows and want to keep those that they already have, and the best way to attract and keep FDI is a steadily appreciating currency. That’s why the Chinese systematically strengthened the CNY.

With the outlook of more devaluation to come, FDI inflows may be reduced while encouraging FDI outflows. This will reduce the level of the foreign exchange reserve needed (currently at 3.6 trillion US$); with this devaluation, there is a diminution of Chinese demand for US Dollar-denominated assets to add to its foreign reserves. This naturally weakens the US Dollar, and we have already seen a weakening response from the US currency.

Less need for US Dollars from China will change the flow of recycling excess capital from Asia to the US bond market. This means the US will get less help to finance its deficits from Asia, and the price paid for this is a continued rise in the cost of capital, which can already be seen in bond yield spreads. Add to this that the US Dollar strength is inversely correlated to the interest rate cycle (higher cost of capital makes US Dollar weaker; as the price of money goes up, the price of currency needs to adjust down in the case of a reserve currency). And indeed this will likely reduce the Treasury buying activity from China. This too will help weaken the US Dollar.

The market is misunderstanding the impact of the devaluation

The market misunderstood the impact of the CNY devaluation on commodities, looking at it as admission by the Chinese that the economy is really bad, thereby underlining the global deflationary impulse. But we already know all about the weakness of China’s economy! And easing financial conditions is pre-condition to a recovery, which the devaluation is all about.

Commodities or real tangible asset will become more attractive. China opening up, SNB not supporting floor, less recycling of Asian excess savings to the US – all of these will help see USD peaking out. Hence there are more attractive valuations for something like gold and silver (or better, long silver vs gold, which remains our favourite long trade). Chinese investors are already moving into gold, as they leave behind real estate, stock market and state banks deposits for the only currency NOT controlled by the Chinese central bank – Gold and other precious metals. With further weakness of the US Dollar, hard assets including commodities should merit a second look, especially at current low valuations across the board.

|

Main drivers this week:

|

Commodities and Economic Highlights

Commentary by Robert Balan, Chief Market Strategist

US Dollar weakens as Fed retains its options to defer rate hike

The US Dollar has been falling in the past two weeks, to its weakest level in a month against the euro, amid reduced expectations that the Federal Reserve will raise interest rates next month. The U.S. currency dropped from its highest level versus the Yen in more than two months.

Favourable sentiment for the US Dollar is fading as investors pushed down the odds on a September rate increase by the Fed. The Federal Reserve seems to be working to keep markets from becoming too certain over the possibility of a September rate hike. Over the past several weeks, a member of the FOMC has come forward to dampen market expectations whenever market-implied probability of a September rate hike has risen.

Case in point: following the employment report last week and the subsequent rise in market-implied probabilities, Vice Chairman Stanley Fischer gave an interview where he damped generally hawkish viewpoint on labour markets with a high level of concern over inflation and then said the Fed should not move before inflation, as well as employment, returns to more normal levels. Mr. Fischer said that “we are in a situation with very low inflation” and gave no benchmark against which an outsider could judge progress. This absence was especially notable, since core inflation trends in Q2, are already firming toward a year-end blow-off in our view. Year-on-year rates of inflation, however, still reflect last year’s energy and import price declines due to the base effect. It did not help that July commodity prices hit new lows for the year for some commodities.

The Fed may wait until next year to raise rates

The risk is that the criteria for raising rates could again shift the goalpost, as the FOMC did in March. Put differently, the Fed’s seeming desire to retain their options at this stage (very close to the September consensus hike date) may reflect lingering uncertainty within the FOMC over the state of the economy. If so, the FOMC could decide to postpone rate hikes beyond September for reasons that it had not yet explained to the market. The FOMC may have decided to postpone the start of policy easing until next year. This, indeed, is what we have been saying for some time. The poor quality of the US employment data, the relatively weak conditions in some EM regions, and the lack of overarching concern about inflation both globally and in the US, may be staying the hand of the FOMC. Why take the risk of reigniting global weakness when there is no imminent risk of galloping inflation? We do believe that this is what is going to play out in the monetary policy debate.

The US Dollar advantages are fading fast

The intrinsic fundamentals from US economic growth and activity that have supported the US Dollar from the middle of last year, started to falter by the middle of Q1 2015, and are now fading fast. US breakeven rates have risen, on prospects of higher inflation down the road, followed by long terms rates higher as the Federal Reserve faced the likelihood of delay in its long-signalled intention to raise policy rates and get out of the ZIRP. The long end rate curve also steepened as higher inflation expectation premium started to escalate within the bond’s term structure. All of these tend to undercut the US Dollar. The differences in interest rates and swap spreads have been trending against the US Dollar of late. Interest rates in the Eurozone have been rising, even as US long term rates are falling on reduced expectations of a September 2015 policy hike by the FOMC. The spread between Treasury 10-year notes is 148 basis points more than similar-maturity German bunds, the narrowest since early June, and well below a 2015 high of 190 basis points set on March 11. The gap with Japan’s 10-year bond yields was 175 basis points, the least since May 29. The spreads are still in favour of the US Dollar, but the greenback is falling just the same because the trend of the delta is now moving in the opposite direction. So what is important is the direction the rate spread is going to, and not just the absolute value in bps of the current spread.

The strong USD performance last year was primarily due to the collective weak situation of the US rivals at that time as well. But the rest of the world (RoW) has not stood still since that time, and moreover, some of the relative strengths of the US economy and activity in H2 2014 have either faded or have been supplanted by weakening activity data partly due to the Dollar’s strength itself. In the case of the EUR, many of the factors that weakened it versus the US currency have turned into the favour of the common currency. We expect the US Dollar weakness to continue perhaps until year-end, at least.

Gold haven appeal and low valuation attracts investors again

After Gold tallied its worst monthly performance in more than two years after falling to $1,072.30 on July 24, the lowest level since February 2010. But gold prices have recovered since then, and have risen significantly after China devalued the CNY, the local currency. Gold prices have also been supported by the fall of the US Dollar in the past two weeks. The Federal Reserve's retaining its option to defer its long-expected rate hike also helped the yellow metal.

China bought about 19 metric tons last month, releasing data in a drive for more transparency. "The People’s Bank of China said in a statement Friday that it increased bullion holdings to 53.93 million ounces, or about 1,677 tons, by the end of July. The update comes almost a month after the PBOC ended six years of mystery surrounding its hoard, revealing a 57 percent jump in assets since 2009 and overtaking Russia to become the country with the fifth-largest stash," Bloomberg reports.

Chinese physical demand, as proxied by gold withdrawals from the Shanghai Gold Exchange (SGE), continues at high levels for this time of year. The withdrawals for the week ended August 7 was 56 tons, which brings the 2015 total to a massive 1,520 tons, which is 135 tons higher than the previous record for Chinese gold demand at this time of year (posted in 2013).

Sentiment has also been helped by news of some of the big bullion banks taking deliveries of physical gold on their own account recently. There were also reported shortages of registered gold available for delivery in COMEX warehouses which were said to have been 'rescued' by a major reclassification of a big amount of gold from the Eligible to the Registered category by JPMorgan.

But the biggest impact in gold prices in the past few days has come from yuan-denominated buying in China – gold is up by 6% in yuan terms this week alone. It has to be understood that gold is unlike many commodities which are denominated in US dollar. Gold is also priced in non-US Dollar terms – gold prices have come down in US Dollar terms, but in terms of Russian Rubles, Euros, Yen, Australian Dollars, and Canadian Dollars, gold has been up in the past year. Gold priced in Rubles has risen by 52%, Euros by 1.78%, Yen by 3.11%, Aussie Dollars 7.48%, and Canadian Dollars 1.76%. Gold is up 2.0% in USD terms.

These are short-term developments but to sustain a long-term trend, something will have to change in the production side. This is the Achilles heel of gold – mine production is still rising (albeit slower now relative to last year) as miners look for revenues to pay down debt.

There are some signs of production declines from the U.S. Geological Society (USGS) data – as U.S. production has been dropping over the last decade with 2014 gold production hitting new lows.

The U.S. produces around 7% of total newly mined world gold supply. US production has continued to fall over the last 10 years. So the US production decline is relevant when calculating how total world gold production is going to shape up in coming years. If mined production starts to drop across the board, then investors can expect a bit of a physical gold squeeze, and subsequently higher gold prices.

Charts of the week: Growth factors in China; FDI, treasury holdings, gold and FR

|

|

|

|