July 27, 2015

Mine production set to slow soon, offering relief for gold prices which are under pressure

Commentary by Robert Balan, Chief Market Strategist

"" We have put fundamentals aside in our gold outlook for 2015," Panizzuti said. "Geopolitics, the perception of risk and even emotional risk from investors are the main drivers this year.""

Frederic Panizzuti, CEO of MKS, February 9, 2015

Seldom has the media been more bearish on gold's prospects, especially after the publication of China’s official gold holdings, which disappointed a lot of investors. The ugly sentiment presented well-financed and well-organized traders an opportunity to “hunt for the stops” and engineered a massive dump of more than $500 million worth of bullion in New York in four seconds with selling occurring almost simultaneously on Chinese markets in early Asian trading Monday. The gold price fell from circa $1130 to circa $1080, a five-year low. Selling then abated, which triggered a sharp rebound to $1110. The price has faded since then, representing new sales from panicked investors who were unable to get out during the initial fall. This process will likely continue for a few more days, but the panic has subsided. Subsequently, prices tend to rise and try to get back to the level where selling occurred. This is par for the course for this “stops-hunting exercise” which was prevalent in the 1970s and 1980s era in gold and currency trading. This is the kind of short-term movement that baffle and try the patience of investors who have scant familiarity with gold’s fundamentals (supply-demand, macro-economics, geo-economic imperatives) and who may be using normal balance sheet methods in distilling gold valuations (the all-in-sustaining-costs concept of investment banks, for instance). Hence, it is important to get the abiding sense, and what reasonable expectations to have, in gold investing. In so doing, we may also even get to know what likely future prospects there are for the yellow metal.

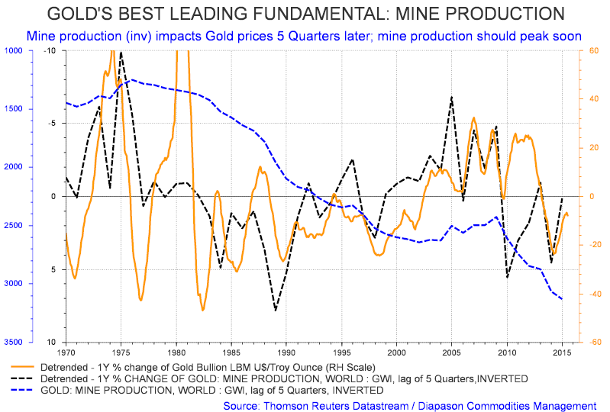

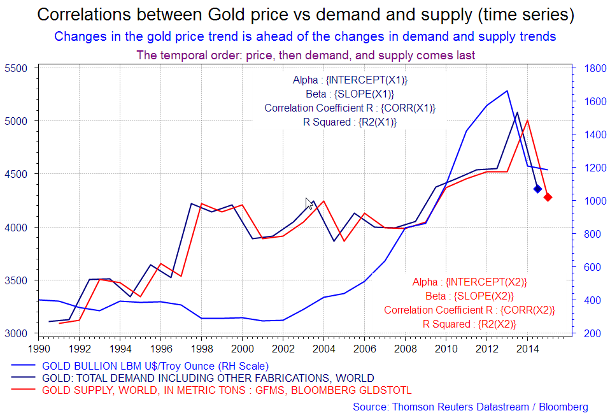

This is the current state of gold’s price-demand-supply fundamentals: (1) gold demand, consumption, and supply data have all been falling in the past quarters following the peak in gold price in late 2013, and (2) mine production is still rising. There is a peculiar sequence in gold’s price-demand-production dynamics, one that is also seen in some commodities (in crude oil for instance) : the prime mover of gold price is exogenous (coming from elsewhere), then changes in the price positively impact the changes in demand (total and physical, including jewellery use), and changes in the supply.

Changes in price also positively impact the pace of mine production, although there is a long-acting feed-back loop between production and price, which seem to offer interesting avenues to gold price forecasting. Moreover, changes in the gold price, to the upside, tend to push the all-in-sustaining-cost (AISC) structure higher as well, as new reserve discoveries become desirable as means to lever the equity valuation of the miner. The AISC can go higher or lower, depending on the ambitions of the miner’s CEO. In this specific situation, the AISC concept has limited relevance.

The peculiarity is that all of the above variables are positively correlated with the price of gold –- when the price of gold falls, demand (total, physical, jewellery) falls, supply declines as well, and eventually, mine production slows down. It is clear that expectation of lower prices further out has been the key driver in deterring purchases among physical buyers, and the same expectation is fostering a similar mentality in retail demand as well. This looks like a blatant violation of the so-called "law of demand" in economics which says that there is a negative relationship or correlation between the quantity demanded of a good and its price. Said another way, the law suggest that when gold prices fall, the demand for it should go up, not down (other pertinent things, e.g, income, remaining the same).

This is maybe why gold violates the "law of demand" : there is strong evidence that demand for a gold is relatively elastic, that is, changes in price have a relatively large effect on the quantity of a gold demanded. And the elasticity is positive -- gold is a Veblen goods. As such, the higher the price of gold goes, the higher the demand (and the rest of the "fundamentals") rises as well. Of course, the dynamics of Veblen goods are just as valid when the price of gold goes to the downside – its demand-supply variables also cascade lower in tandem.

The lag between the changes in price and the changes in these variables can be very long, from 3 quarters to as long as 10 quarters. That has been true for the pace in current mine production – production at high rate is still going on as the miners need revenues to service their debt, regardless of the current low price of gold. However, we now see signs that the pace of production is slowing down. Simply put, it’s the direction of the changes in gold price that essentially determine the direction of the response of many of the considered "fundamentals" inherent in the gold trade. The movements are all positive and seriously lag.

The World Gold Council identifies that there are 183,000 tons of gold above ground. The total world mined production is a little above 3,000 tons per year. Most of the gold that have been mined still exist. Practically no gold is ever actually used up, in the consumption sense. All of the gold that have been produced exist in various forms and are tallied as assets in some form or the other by someone. This makes gold a stock rather than a flow commodity (flow commodity example : oil or corn). Therefore, gold demand is not literally "consumption" driven – most of it is simply driven by investment preference.

If this were true, the major price setting mechanism for gold should be the demand for existing stocks ("world supply"). The demand variable is very volatile relative to the variation in mine production, especially after the market started to financialize gold (and other commodities). Therefore, demand has to be the key variable in gold price forecasting -- except that neither demand for existing stocks (physical or total), nor world supply, provide that much edge in forecasting future gold prices. The best correlative fit for both vs price in regression work is coincidental – neither variable can provide any leading indication of future prices.

Mine production is the only "fundamental" variable that has a valid gold price forecasting property. Mine production adds only about 1 percent to the total world supply each year. That amount is equal to less than 1 week turn-over in the world’s gold markets. Therefore, there should only be a limited impact from yields in mine production to the over-all price of gold – except that that does not hold true. It is the delta of the year-over-year gold production which had driven the major changes in gold price trends since at least the 1970s (see Chart of the Week). Changes in mine production lead the negative changes in gold prices by as long as 5 quarters. The negative impact of the rising delta of mine production over the gold price peaks 10 quarters after the positive change rate in mine production. Simply put, the delta of the current mine production vs. periods in the past impact future gold prices for some years to come and is the most important variable investors should track. What is significant at this point is that mine production's year-over-year change rate has already turned lower. We expect mine production to actually slow soon, and should offer relief for gold prices which are under pressure.

Due to the mid-summer break, our next Commodities Insight Weekly will be published on 17th of August

|

Main drivers this week:

|

Commodities and Economic Highlights

Commentary by Robert Balan, Chief Market Strategist

The Russian government is buying gold, and so are Chinese citizens

The Russian central bank's recently released gold reserve data showed further increase of 800,000 ounces in official gold reserves in June. Russia added the equivalent of circa 25 ton of gold, which cost $900 million dollars at current market prices. What this shows is that institutional investors like central banks become even more interested in adding to their gold reserves despite (or probably because of) the drop in the gold price. Central banks do not make decisions on reserve allocations in the same logic that average investor or hedge fund utilize in making trade decisions. Central banks have strategic imperatives and that is the sole prime mover for making investment decisions such as buying gold under current circumstances. In our outlook, there are only two strategic reasons which would favour steady gold accumulation as part of international reserves, as follows: (1) bonds of developed economies are starting to become less attractive, and (2) anticipation of a weaker US Dollar in the near-horizon.

Except for opportunistic "safe-haven" flows and/or short-term price appreciation, most investors would agree that the current interest rate environment is not good environment anymore for fixed income investments. Expectations of long-term inflation rates have gone above most of the developed markets bond rates, so holding bonds to maturity will likely lead to a guaranteed lose on investments. Central bank reserves are too large to play short-term capital appreciation games, so the horizon for these investments is measured in years, if not decades. Higher inflation further out would therefore make fixed income unattractive, so for a central bank, it makes sense to look for alternatives. Gold is usually seen as an alternative "reserve currency" to the US Dollar. That is the primary reason why gold tends to move inversely relative to the US Dollar.

The Russians of course are familiar with gold's role as a reserve currency. Since they are buying more gold, then they are either preparing for a weaker US Dollar down the road, or they expect that the US currency will play a smaller part on the global economy in the near-future. In a world where the US Dollar role plays a smaller role, the best "currency" to own will be gold. 800,000 ounces, or circa 25 tons, is a very large transaction in the physical gold market. In terms of global outlook, that is around 1.06% of gold mine supply of around 3000 tons a year. On an annualized basis, Russia bought the equivalent of around 12% of total newly mined gold supply. That seems a strong vote of confidence on the longer-term outlook for the yellow metal.

Meanwhile, it is relevant to ask what the low gold price is doing to Chinese investor demand. Chinese investors went strongly for gold in 2013 when Shanghai Gold Exchange (SGE) withdrawals reached a massive record of 2,181 tons. However, gold prices have been largely on a downwards path ever since. Now we are seeing a similar pick up in Chinese retail demand as shown by SGE withdrawals, which hit well over 60 tons for the week ended July 10th. This is at a time when gold seasonal demand is expected to decline.

In any event, SGE withdrawals for the week ended July 17th is the fifth highest weekly total ever. We would like to highlight how significant those numbers are -- the high demand level is happening during what normally is a very weak time of the year for Chinese demand. SGE withdrawals for the year to date, is a massive 1,366 tons, nearly 80% of global new mined production over the same period. The new world's newly mined gold supply is around 62 tons. So in the past two weeks Chinese SGE withdrawals is actually more than the world's mined supply during the same period. We expect gold to start rebuilding a base soon, from where a recovery process will be launched.

The rally in grains is not over yet

After the U.S. Department of Agriculture released its June 30 grain report, prices exploded higher. The USDA said that inventories and acreage planted were below market expectations. Considering that the grains were just above the lows made for the year at that time, the June 30 rallies were spectacular. Recently, prices have weakened, but we believe that grain prices are presenting trades that have limited risk relative to the potential appreciation.

The soybean market is still tight, and remains in backwardation. Open interest, the number of open long and short positions, on CBOT soybean futures, all fell during the recent rally. This means that short positions were bought back as prices increased. Open interest on CBOT corn futures also moved lower during the recent rally. This means that short-positions were covered as prices increased. However, open interest started to rise once again. Weather is the most significant news now regarding corn's future price. Corn remains in contango, where future prices are higher than nearby prices. Open interest on wheat futures moved lower during the recent rally. Shorts eliminated their positions as prices increased. However, with the recent decline in prices, open interest started to rise once again. Wheat also consolidates. Weather is the all-important input when looking for wheat's future price. However, unlike in corn and beans, which only depend on weather in the U.S., wheat is highly sensitive to weather in other growing regions in the world.

Grain prices have in the past two weeks, spent some time correcting lower. But after the sharp rally in the three major grain markets, we believe it was a healthy consolidation. The bull trend is still intact for the three grains. And once again, there is a significant risk posed by weather issues during the balance of the growing season and the fall harvest. We refer to El Nino. The odds of El Nino impacting crops this year are significant, and we must consider the challenges that it will pose for this year's crops. El Nino tends to create weather extremes of flooding, droughts, extreme heat and cold. The market is still expecting another year of bumper crops so if that is not the case by July 30, get ready for another upside price explosion.

Therefore the current sell off in the grains market could be an opportunity to re-engage grain trades. The best outlook is still in soybeans and in corn. Wheat still has relatively weaker fundamentals relative to the other two grains, so we suggest sidestepping it for a while. The best outlook is slowly evolving in favour of soybeans. But corn will not be far behind.

Charts of the week: Gold mine production; gold price vs. demand

|

|

|

|

For the full version of the Diapason Commodities and Markets Focus report, please contact info@diapason-cm.com