July 20, 2015

China Update: Numbers have been better than expected, but more accommodation is necessary

Commentary by Robert Balan, Chief Market Strategist

". . . the composition of (China's) growth continues to improve — in 2014 almost half of GDP growth came from the services sector, as industry and construction bore the brunt of the adjustment. In the first quarter of 2015 services remained robust. In most recent years, consumption has grown slightly faster than investment."

Recent Economic Developments In China, The World Bank, July 3, 2015

The market's focus on China is on its equity markets: have equities found a bottom, or the recovery is just a dead cat bounce? What is being missed is that the activity and growth numbers that came across even during the stock market crisis have been good indeed. Even the stock market debacle seems to be over – it ended on July 9 – that day, the Shanghai index closed 5.8% higher on the day, followed by strong rallies the following Friday and Monday. There was further drama after a 3.0% decline the following Tuesday, but gains over the three subsequent days finally ended the crisis. We have seen episodes like this before, so we can safely say that even if panic is over, there will be continued volatility in weeks to come. But for now, the government has successfully provided a "put" on the equity markets.

The previous stock market boom has been called the "phantom bull market", as the parabolic rally seemed inexplicable from a fundamental point of view. The equity markets soared even as the Chinese economy growth expectations were previously lowered, corporate profitability was being squeezed by high debt servicing, and banks, which dominate the Shanghai index, have seen a sharp rise in non-performing loans (NPLs). But perhaps it was unfair to label the stock market as "phantom", as improvements in the economy were indeed forthcoming after unprecedented easing and stimulus programs undertaken by the People's Bank of China over the previous three quarters. Stock markets are discounting mechanisms, and apparently, investors took the easing moves as signal for better times ahead and ploughed into the stock market in droves. In fact, the sharp sell-off was said to have initiated after a move by the central bank to temper the market advance by tightening margin regulations. That was unfortunately interpreted by the market as the end of the stimulus programs. Nonetheless, the strong and unprecedented steps taken by the Chinese government to forestall further panic has invited suggestions that more stimulus steps would be underway.

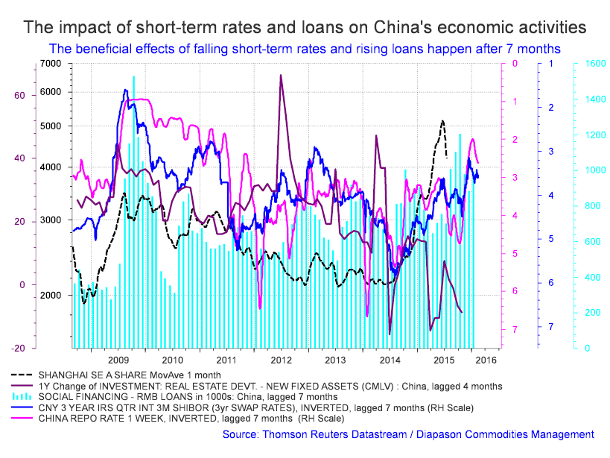

The stimuli programs since the middle of last year are indeed finally bearing fruit. China's Q2 GDP and June activity data all came in better than the market expected, suggesting that the economy has stabilized. The official Q2 GDP growth of 7.0% y/y and 7.0% q/q saar were above the 6.8% consensus market expectations. More significantly, fixed asset investment (FAI) growth was at 11.4% y/y (year-to-date), buoyed up by infrastructure investments which rebounded to 19.2% y/y (year-to-date). The rest of the data was positive as well: property investment was at 4.6% y/y (year-to-date) suggesting stabilization in this sector as well; the property sector has now grown two months in succession, igniting hopes of momentum going into year-end. Retail sales grew to 10.6% y/y from 10.1% in May: with better market sentiment likely from here, consumer spending should continue to grow.

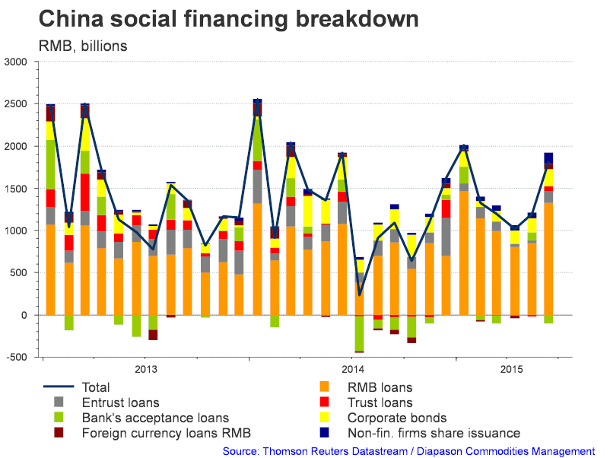

Could the sharp decline in equity prices pose downside risks to growth? Our take is that there should be no significant negative impact from the recent stock market correction. Unlike in the developed countries, China's domestic equity market has not yet become a major source of corporate financing. Latest data shows that equity finance provides less than 5% total social financing, as against more than 10% from the bond market and 75% from bank lending. There are fears that the so-called "wealth effect" has taken a severe knock, but the improved retail sales suggest that this may not be the case. We believe so as well because even after the severe sell-off, the equity markets are still up 70% even after a 30% write off – hardly a crash. Despite anecdotal stories of investors mortgaging their houses and apartments to play the stock market, typical Chinese households hold less than 20% of their financial wealth in stocks. The extremely high levels of household savings should help smooth out consumption trends.

The other bright spot was industrial production. IP growth rose to 6.8% y/y in June from 6.1% in May, above market expectations. The property sector had a mixed month. While property sales goes on with their upward trend, real estate investment growth declined to 4.6% y/y (year-to-date), from 5.1% in May. Also, while residential real estate investment was stable at 2.8% y/y (year-to-date), growth in commercial real estate investment fell to 10.2% y/y (year-to-date) from 12.2% in May. The brightest spot in the property sector was the increase in residential floor space sold, which improved to 18.2% from 16.4% in May (a 21-month high). This resulted in the sharp improvement in total floor space sold to 16.0%.

All of the above data have their origins in the easing and stimulus programs taken earlier in the year and in H2 2015. Further improvement is expected going into late H2 by stronger new loans and money growth seen in June. Last month's new loans and M2 growth data surprised to the upside as consequence of recent easing measures. June new loans were at CNY1271bln, above market expectations of CNY1100bln. Total social financing (TSF) increased in June, powered by new loans to the real economy. TSF came in at CNY1.89trln in June, up from CNY1.22trln in May; however, it was 3.9% y/y lower than the CNY1.97trln a year ago.

China’s June foreign trade rose, as exports rose for the first time since March and the contraction in imports narrowed; both data were above market expectations. In US Dollar terms, exports rose 2.8% y/y in June after falling 2.5% in May – not much but it provided signs of stabilization. The fall in imports slowed sharply to 6.1% y/y from 17.6% in May. The strengthening loan growth and trade data in the past two months should help support growth stabilization, and help improve market sentiment, although more easing by the PBoC is still needed. Providing low cost financing should remain a top priority for monetary policy in H2 2015. One more 25bp benchmark rate cut is expected in Q3, and the removal of the deposit rate ceiling follows thereafter; two more 50bp RRR cuts in H2 2015 are probably due, depending on liquidity conditions. The momentum in activity should be maintained well into year-end.

The improvement in activity was accompanied by some improvement in utilization of commodities. Raw product imports rose to 3.1Mt, representing 31.3% y/y gains. Crude oil imports in June rose to 7.2mb/d, (up 26.7% y/y) and were 1.7mb/d above May’s 5.5mb/d. The rebound in oil imports was due to higher utilization of refineries and continued stockpiling as prices remain attractive. Copper ores and concentrates imports remained flat (990Kt y/y), but up slightly (0.6%) m/m. Year to date, copper imports are up 10.8% y/y, relative to an increase of 17.7% for last year. Soybean imports rose m/m to 8.1Mt (26.6 y/y). For the first six months, imports stood at 35.2Mt, 0.95Mt higher year on year. On aggregate, commodity imports are at 6.6mb/d, up 423kb/d from last year. Exports also recovered m/m, to 3.06Mt, up 36.2% y/y. If growth in China keeps up in H2, as we expect it would, then the country’s imports of raw industrial materials should continue to increase, which could provide price support for base metals and other commodities.

|

Main drivers this week:

|

Commodities and Economic Highlights

Commentary by Robert Balan, Chief Market Strategist

China's gold holdings surprised analysts by its low level at 1,658.4 tons

The People's Bank of China (PBOC) last Friday updated its official gold reserves from 1,054 tons; the same figure reported since 2009, to 1,658.4 tons, a massive disappointment for investors looking for substantially higher numbers. The gold market fell sharply in the wake of that disappointingly small tonnage. Some analysts immediately flagged those numbers as "unreal", and indeed to us, the Chinese have more than 1,658 tons at hand. The disappointing Chinese gold data came out as the US Dollar was strengthening, which added further impetus to the selling. The market sentiment was well expressed by Mark O'Byrne, executive director of Dublin-based brokerage GoldCore Ltd, who said, "People were expecting that they have bought a lot more. That's why we haven't seen much of a movement so far today. The big question is whether they now continue buying."

While there are both bullish and bearish arguments for the disappointing Chinese gold holdings, we first have to assume that Chinese data is accurate. Since we have no way of refuting it, it should stand as correct. But the general sentiment is that the Chinese government could be holding plenty of "unofficial" accounts where gold is being accumulated but they are choosing not to disclose it until a future date where there are more strategic and favourable reasons for doing so. These are speculations and of no help to a rational analysis. The fact remains that based on IMF data, the Chinese still have a lot of gold to accumulate before they can catch up to the US and some European nations. For instance, China has to buy at least 2,000 tons to get abreast of Germany. And they would need to accumulate 7,000 tons to level up to the US. This is the platform for bullish arguments. The reasoning is that the Chinese still have plenty of gold buying to do, which will be an important support for physical gold purchases, regardless of what level of investors demand there may be in the near future.

The bearish argument reasons out that the Chinese should have increased their gold holdings by a much greater margin, given their desire to make the Renminbi part of the SDR basket. But since they did not (with the measly 1,658.4 ton holdings as evidence), then that means that they are not really inclined to accumulate gold at the same level as the gold bulls think they should. That means that the Chinese government will not be accumulating gold at a faster pace going forward. So that is not really a big positive for gold as they cannot be expected to support the gold price. The bears' position is of course stronger if the Chinese do only have 1,658.4 tons of gold. What if China has gold holdings on other accounts that they technically cannot be compelled to reveal? In other words, they are technically correct in declaring a mere 1,658.4 as holdings, but they do have gold accounts that they are not bound to reveal and still adhere to international disclosure standards. We believe this is the case.

Indeed, even among the most conservative China followers, there is unanimity that China had been surreptitiously increasing its gold holdings, and that the correct number should be at least double that of the Chinese Central Bank's latest announcement. The implication is of course that China is manipulating its own gold holdings figure without reporting the actual levels to the IMF until it chooses a specific moment to do so.

China's domestic gold production in the past six years is probably close to 2,500 tons. Since domestic gold miners are required by law to surrender their gold production to the government, many China observers say 2,500 tons should be the absolute minimum level of accumulation by the PBoC, to which we heartily agree.

US inflation increases at a brisk pace in June: will this move the Fed to hike rates?

CPI inflation is on a roll, on reports of another strong rise in June – food, energy and the core component all made positive contributions. Headline CPI rose 0.3% m/m, in line with consensus expectations. Core CPI rose 0.2% m/m, also according to expectations. So the gist of the recent CPI release is that the underlying pressures remain, and the trend stays pointed to the upside. We reiterate our earlier projection that core CPI will likely be rising for the rest of the year -- core and median CPI will likely be closer to 2.5% than 2% by December.

Services inflation was markedly higher in June and remains the primary driver behind the solid core CPI rise. Core services increased 0.3% m/m (from 0.2% in May), supported by a similar rise in shelter inflation (from 0.2% in May). Services inflation runs at 2.5% y/y, supported by shelter prices which were increasing at a strong 3.0% y/y. Within CPI shelter component, rent and OER rose a strong 0.4% - the last time that kind of increase in these two series was last seen in 2013 and 2006, respectively. Medical services inflation declined 0.2% m/m after three months of serial increases. Transportation costs rose 0.4% due to higher airfare prices. Energy prices were up 1.7% m/m, while food prices increased 0.3% m/m, after having been stable or falling in the past three months. Headline CPI rose 0.1% (0.0% in May) and core CPI 1.8% (1.7% in May), all on a y/y basis. The US has finally escaped deflation.

How will the Fed react to the CPI rising trajectory? By the time the FOMC meets in September, they may be confronted with a core CPI which will be around 2%, which is just a little off the perceived Fed's target of 2.2%. But by then it will be apparent that the core CPI uptrend still has ways to go. The interesting dynamic by September is this: inflation will likely be still below the Fed's target, and GDP growth may not be as robust at the Fed projections; moreover, we still have risks to the global economic system provided by Europe (Greece) and in China (collapsing equity markets). Will the Fed tighten in September nonetheless? Our answer would be normally No, they won't tighten in September. The top leaders in the FOMC have very dovish inclinations, so we would be surprised to see them hike rates unless inflation has met/surpassed their stated target, GDP growth is strong, and global risks have receded.

However, these rationales are clearly at risk after recent events. Fed officials have been hammering in their views that a rate hike this year is likely, even desirable. The Fed's talk has been described as a mere bluster, but I am not sure of that anymore. We should all pay attention to what Fed officials say, especially if it is the Chairman of the central bank. Ms.Janet Yellen and the other regional presidents have been saying the same thing several times already – that the FOMC could raise rates this year, but that is dependent on the incoming data. We have no idea whether or not the current issues in Europe and in China will still be risky in September when presumably they will have to make the decision to hike rates, but we are not even sure now that the Fed will consider these issues at that point. What we know is that Ms. Yellen has even told top government officials that given the right data, a rate hike will be consummated this year. So we believe that they would do it, considering that their inflation target will likely be at hand in September. Elevated core CPI will likely provide them the cover to do it by then.

China social financing breakdown; The impact of short rates and loans on China economic activity

|

|

|

|

For the full version of the Diapason Commodities and Markets Focus report, please contact info@diapason-cm.com