June 29, 2015

The grain sector kick-starts a bull market on a trifecta of weather-related issues

Commentary by Robert Balan, Chief Market Strategist

"Soybean plants that are at the V2-V3 growth are vulnerable to extended flooding. If flooded for three days, farmers could experience a 20% yield loss. Bump that up to six days, and they’re looking at as much as 93% loss."

Laura Lindsey, Ohio State University Extension, soybean and small grain specialist

The grain sector late last week kick-started the agriculture sector towards a bull market due to three weather-related issues. Too much rain in the Midwest and the Southern Plains of the US in recent weeks, insufficient rainfall in Europe and in Canada, and the quick escalation of an El Nino event in the Pacific Ocean are combining to push wheat prices 15 percent last week towards 20 percent threshold which is generally considered as minimum for a bull market. The weather situation has become much worse, and prices much higher since we reported the issues with the inclement weather last week ("Inclement weather raises concern on corn, soybean and wheat crops", Commodities Insight Weekly, June 22, 2015).

During last week alone, wheat futures were sharply higher at 15 percent and corn rose 9.4 percent in Chicago, while milling wheat, the kind that is turned into flour, advanced 8.7 percent in Paris. These gains are the largest posted by these commodities since 2012. Soybeans gained 5 percent, its biggest increase since October. The upside momentum has been a very strong, bullish signal as buyers have not crowded into these agriculture trades like this since the October to December 2014 grains rally. President Jerry Gulke of the Gulke Group, a research and information analysis firm providing marketing strategies for agribusiness said the corn, soybean, and wheat crops were damaged beyond repair in certain parts of the Corn Belt.

Excessive rains in the US Midwest and Southern Plains have eroded grain quality. The impact of excessive moisture comes in two ways. First is flooding — for instance, Indiana has so far lost 5% of its corn crop to flooding. Several flood warnings have been raised throughout the corn belt, a storm blew through Iowa and Missouri dropping as much as 7 inches of rain, and rain is expected to continue into the current week and beyond. Second, rain does not directly threaten the corn plant, for example, but rains may dilute or wash away nitrogen fertilizers used to enhance the growth of crops. The excessive rainfall also interfered with the winter wheat harvest which was 9% behind the five-year average as of last week. The unusually heavy rains and flooding in the growing areas in the Southern Plain crop areas have delayed the winter wheat harvest.

Meanwhile, wheat fields in France and in Canada have been parched by high heat and very little moisture in recent weeks. According to France AgriMer who cited dry weather as the main reason, good to excellent growing ratings fell to 81 percent from 85 percent the prior week, and 87 percent the week before that. French weather is expected to remain hot and dry over the next few weeks in many parts of the country. Meteo-France said that maximum temperatures in the south and center regions may exceed 35 degrees Celsius (95 Fahrenheit) this coming week. France is Europe's biggest grower of grains. In Canada's primary grain growing area of Saskatchewan and Alberta, topsoils were dry, and crop development delayed, according to the provinces’ agriculture ministries.

The El Nino developing across the Pacific Ocean is meanwhile quickly developing into a much more troublesome state. Reports continue to come in from around the world which show that it is becoming more certain that this global weather disturbance event will be a severe one. Japan's Meteorological Agency (JMA) is the latest government entity which added to the warnings of both the Australian Bureau of Meteorology and the U.S. National Oceanic and Atmospheric Administration that this year's El Nino has grown stronger. Tamaki Yasuda of the JMA said there El Nino models show scenarios that this year's event will likely be stronger than the 1997-1998 El Nino, which is the strongest on record. An El Nino event affects a host of commodities, but insofar as grains is concerned, it will disproportionally affect the wheat crop in Australia. Bloomberg reported last week that the forthcoming El Nino risks cutting Australia’s wheat crop to the smallest in eight years, according to National Australia Bank Ltd.

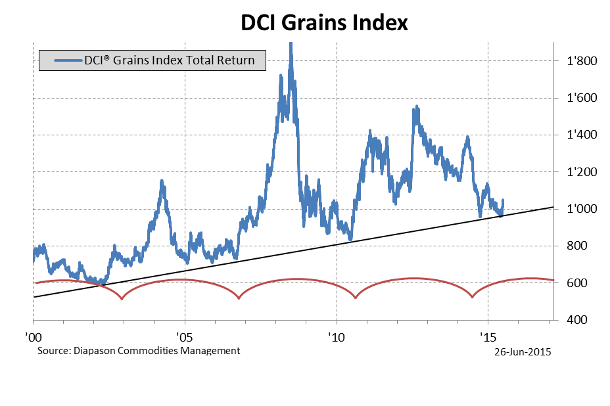

As we said last week, the difficulties in the 2015 global grain crops had, and will further, translate into price traction across the grain sector. The recent US Dollar weakness will also serve as tail-wind in addition to the weather-related issues. The grain sector usually responds to US currency weakness after a short lag (from two to four months). Moreover, there are fundamental issues going for the grain sector at this time. Grain prices had fallen significantly below the marginal cost of production, encouraging farmers to reduce spending. Moreover, extremely high levels of short positioning by large speculators had just started to be unwound, leaving the aggregate positioning in the grain sector remaining still close to record lows. This still leaves a significant room for price appreciation once the cost of these weather-related are fully appreciated, triggering significant short-covering rallies, boosting the price of grains even higher.

|

Main drivers this week:

|

Commodities and Economic Highlights

Commentary by Robert Balan, Chief Market Strategist

China drops the prudent meme, goes all-in on stimulus

The People's Bank of China (PBoC) cut both rates and RRR after stock market plunged last week, underlining its commitment not to let matters get out of hand. In what looked like an emergency move, the PBoC over the weekend announced 25bp benchmark rate cut and combined it with targeted RRR cuts, effective Monday, June 28. After Friday’s 7.4% plunge in the Shanghai Composite Index, the first combined rate and RR cuts since the onset of the Great Financial Crisis in 2008 underlines the Chinese government's concern of a stock market crash which could raise systemic financial risks.

The PBoC policy move is not exactly unexpected, but the scope of the combined easing caught many by surprise, including us. It looks to us that China is finally dropping the prudent meme and is finally determined to stabilize market sentiment and to lend support to property sales and generate economic growth in H2 2015. We do not expect this to be the last gesture from the PBoC, as do many observers. We expect a benchmark rate cut of 25bp in Q3 2015 (with another in Q4 if needed), together with the removal of the deposit rate ceiling, which has been agreed in principle for some time. The reserve ratio is still too high relative to developed economies' RRR levels; more regulatory slack is needed, so two 50-bp cuts may still be necessary, their timing depending on the evolution of liquidity conditions.

While some developed economies debate the role of monetary policy on asset prices, China as represented by the PBoC, holds a more positive view on the role of the expanded capability of commercial banks to lend margin to stock investors, hence the rapid reduction of RRR soon after the huge fall in Chinese equity markets. It is also a reason why we believe there will be more aggressive RRR cuts in the near-term. The equity market has been the only rosy spot in the Chinese financial landscape for some time, and so we believe the government may be loath to let it slide into irrelevance as well. When Chinese equity markets were on the rise just a few weeks ago, the PBoC appeared to want to strike a more balanced view, and had even moved to tighten liquidity conditions and regulatory oversight. But with the sharp fall in equity asset prices recently, policy moves to support market confidence is the only recourse left, in our opinion. We will see more of the same in the near-future.

The latest PBoC easing sends a clear signal that China’s monetary easing is still ongoing, and will proceed further well into H2 2015. The central may have indeed provided the wrong signal a few weeks back with the tightening of liquidity and equity market regulations, which contributed a significant degree to the current consolidation when investors became fearful of a halt in policy easing. The main policy thrust should now be channelling of low cost financing to the real economy, and that for us should remain the top priority for monetary policy in H2 2015. With the current, and projected near term easing moves later in the year, Chinese growth momentum should start picking up soon and growth could extend into middle of next year.

El Nino and commodity prices: what can we expect?

There is a high likelihood that El Nino will be back after a five-year absence — and it has potential to be as bad or even worse than the record 1997-1998 event. Incoming government weather agency reports are coming and showing that is becoming more certain that this global weather disturbance event will be a severe one. Tamaki Yasuda of the Japan Meteorological Agency said that their El Nino models show scenarios that this year's event will likely be stronger than the 1997-1998 El Nino, which is the strongest on record. Yasuda cited temperature readings in that region of the Pacific Ocean where the event takes place that are already higher than they were at a similar stage in 1997.

El Ninos can affect weather, harvests and trade patterns globally by reducing rainfall in Australia, causing very dry weather in Africa and in many parts of Asia, especially in the Indian sub-continent, and dumping heavy rains across South America. El Nino also fosters storms in certain parts of the world that can impede shipping and trade. El Nino events have a variable history of affecting commodity prices, positive and negative. The commodities that have been positively impacted the most during past El Ninos had been nickel, zinc, coffee, cocoa, cotton, rice, and soybeans.

Past El Nino events caused dryness in Western Africa (Ivory Coast and Ghana), which impacted cocoa trees which are old and are more susceptible to dry conditions. Most of the world’s cocoa is grown in the Ivory Coast and Ghana, so cocoa output is likely to suffer, pushing prices higher. Another commodity which could see higher prices is coffee and for exactly the same reasons. In past El Nino events, Eastern South America had experienced unusual dryness, which affected the Colombian coffee crop. Southeast Asia had also been hit in the past with extreme dryness, putting Vietnam's Robusta coffee crops, the biggest in the world, at risk. El Nino often brings the opposite effect to Southern Brazil, with heavy rains lowering the sugar levels in sugar plants. and often causing delays in harvesting from the world’s top sugar producer.

Base metals had also benefited in past El Nino events for varying reasons. Dry conditions in Southeast Asia adversely affects the hydroelectric poser and the transport needed by the copper and nickel industries in Indonesia and the Philippines. El Ninos in the past had led to flooding in Peru, hindering the country's zinc mining industry, pushing up zinc prices globally. That would add more pressure to prices, already being primed by forthcoming shutdown of two of the world’s zinc largest mines – the Century and Lisheen mines – by early 2016.

What is unappreciated is the potential of El Nino event this year to push crude oil prices higher. An El Nino event increases the storm potential in the Pacific Ocean which could disrupt oil, food and consumer shipments around the globe. Those items will also likely see inflated prices. Shipping routes from the Middle East to Asia are Transpacific, and are therefore vulnerable to storms generated by El Nino events. Moreover, exports from the US also travel largely via the Pacific. US distillate exports are on the rise to Central and South America, as well as Asia.

Charts of the week: Agriculture cyclical pattern; USD vs agriculture sector and grains

|

|

|

|

For the full version of the Diapason Commodities and Markets Focus report, please contact info@diapason-cm.com

.png)