June 22, 2015

The Fed's continuing prudence seals the US Dollar's fate

Commentary by Robert Balan, Chief Market Strategist

“I want to emphasize that the importance of the timing of a first decision to raise rates is something that should not be overblown whether it is September or December or March, what matters is the entire path of rates, and as I have said the committee anticipates economic conditions that would call for a gradual evolution of the Fed funds rate towards normalization.”

Janet Yellen, Chair of the Federal Reserve, June 17th 2015

The Federal Reserve continues to display prudence in their conduct of monetary policy, sealing the fate of the US Dollar, which weakened significantly after the FOMC statement was released. The Fed's surprising, but appropriate, dovishness in response to less than stellar US growth performance in H1 2015 suggests that the US Dollar will further lose traction in the near-term; we expect the domestic currency to continue weakening for the rest of the year. Federal Reserve Chair Janet Yellen's lack of confidence in the economic outlook was in stark contrast to the contents of the FOMC statement and projections, which largely support at least one rate hike this year. Yellen's less-than-optimistic outlook during the Q&A session suggests to us that the bar for rate hikes is higher than what the market had supposed, and the Fed could once more move the goal posts further away despite what the official statements and SEP projections may have implied. And the trajectory of a tightening regime, when it does start, will be shallow.

The FOMC, curiously, chose to upgrade its assessment of economic activity, in line with the stronger pace of very recent data. The minutes described a moderate expansion of economic activity, versus having slowed in the April statement. The committee also said that job growth has picked up, so consequently, the underutilization of labour resources have diminished somewhat. However, there was slippage in the policy trajectory: the committee downgraded their outlook for growth and now look for a modestly higher unemployment rate in 2015. Therefore, even though the median expectation in the SEP dots is for two rate hikes in 2015, the updated set of projections suggests a slower and lower trajectory past a possible September rate hike. However, any rate hike this year is unlikely to take place, in our opinion, after Chair Yellen's reluctance to endorse an outlook that warrants the beginning of a rate hike cycle later this year. She said the committee desires “more decisive evidence” that economic momentum will be sufficiently strong enough to support further improvement in labour markets, before any rate hike takes place. All in all, a totally dovish assessment. That has sealed the US Dollar's fate.

One of the primary rationale for the US Dollar rapid rise from May last year was the mantra that the US was, at that time, the only developed economy with improving growth prospects. In Q3 2014, qoq growth was bumped upwards to 5%, the highest in 11 years, on the back of upward revisions of personal consumption and business investments, which are among the most stable and persistent components of US GDP. The unemployment rate was 5.6% and falling. These in turn reinforced the belief that the Fed will begin raising interest rates, consensus at that time putting the event in June 2015. The alternatives to the US Dollar on the other hand looked very unattractive. Europe’s economy was recovering but very slowly. Disinflation was epidemic in the area, and the spectre of deflation loomed large in the eyes of investors. QE, the ECB's chosen tool to prevent deflation from setting in, was thought to weaken the euro even further. Japan's economy still had not recovered from the negative, self-inflicted wound of a sales tax hike last year, spurring the Bank of Japan to increase its securities purchases, which likewise pointed to the prospect of a further weaker Yen. And the flat growth in China led many investors to ask whether China’s government will seek to engineer another weakening of the Renminbi’s dollar exchange rate to spur exports further. Collectively, these were good arguments for a stronger US Dollar.

All of that is water under the bridge now. The sharp US Dollar rise significantly tightened US financial conditions, which helped undercut the US economy, along with inclement weather in Q1 2014, leading the Fed to tone down their rhetoric for a policy rate hike during the March FOMC meeting. The US Dollar at that time reversed course immediately when the Fed revised its internal projections of future growth and inflation, and their expectations as to the pace of their expected tightening. The US economic situation today has recovered from the depths plumbed in early Q1 2015, but is still in such an uneven state that the Federal Reserve feels constrained to initiate raising policy rates from zero. On the other hand, the threat of deflation that has weighed down the Euro, along with the currencies of Norway, Sweden, Canada, among others, is largely gone. Central bank stimulus outside the US has finally helped generate sustainable economic growth. Inflation rates still remain below many central banks targets, but prices have stopped falling for all G10 countries, and disinflation is no longer a credible risk, except possibly in the US and in Switzerland. The currencies of both countries previously served as so called "safe havens". The most spectacular comeback was in the Eurozone. Euro area inflation continued to recover in May, rising to +0.3% y/y from -0.6% y/y in January; core inflation surprised to the upside increasing to +0.9% y/y in May, the strongest print since August 2014. Breakevens and bond yields in the developed countries have risen sharply since February, as evidence of stronger global growth in H2 2015 started to emerge — a synchronized global reflation is a distinct possibility during the second half of the year. Reflation is a theme that bodes well for a weaker US Dollar across the board, down the road. The Dollar performs best when US growth is outperforming the Rest of the World (RoW), and vice versa.

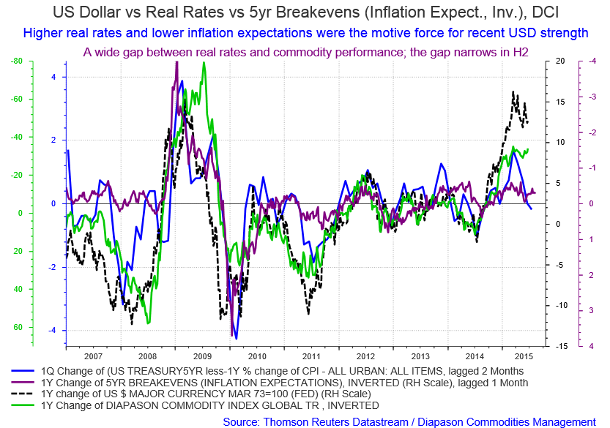

There are other elements that should contribute to further US Dollar weakness. Energy prices continue to rise, after global crude oil demand was sparked by a surge of gasoline consumption in Asia and the US. The trend looks sustainable for longer, and crude oil prices should increase further in H2 2015, even after having risen circa 40 percent from the January lows. This will increase inflationary pressures across the globe, at a time when bond yields are being kept in check by the continuing prudence of the Federal Reserve. A relatively faster pace in the increase of inflation compared to the pace in the rise of bond yields will lower real interest rates. The US Dollar is very sensitive to the direction of real rate trends — falling real rates weaken the US Dollar, and vice versa. On the other hand, the US Dollar's competitors, the Euro being the foremost, are making inroads as developed economies, ex-US, begin to benefit from easing policies which were implemented well behind the Federal Reserve's QE initiatives. Bond yields in these economies are now rising relatively faster than US yields, shifting the interest rate differential advantage to the US Dollar's competitors. These are classic determinants of the US Dollar's valuation, and they are now decisively turning against the US currency. With the Fed staying prudent with regards to monetary policy in the near-term, we expect the US Dollar to weaken further against the currencies of the other major economies up to the end of the year.

|

Main drivers this week:

|

Commodities and Economic Highlights

Commentary by Robert Balan, Chief Market Strategist

Is the gold rally for real?

The confluence of the Fed's dovish stance and the deteriorating situation in Greece pushed gold prices sharply higher on Thursday, reaching as high as $1209 (past the technical level of $1200) to settle at their highest level in nearly a month after the Federal Reserve signalled it will raise interest rates at a gradual pace, which weakened the U.S. Dollar. The gold rally also derived some support from mixed economic data last week, on the thought that weak economic data would deter the Fed from raising rates this year.

The real challenge for Gold: will it continue its ascent and go on to challenge the $1270 crucial level soon?

There is backwardation in place after the rally in gold prices during the past two weeks. The usual interpretations when this happens: (1) spot or physical buyers are dominant in the market; (2) current physical holders and/or producers of gold do not want to sell at this time (hoard) or waiting for higher levels to initiate selling (speculate); or (3) production levels are starting to decline.

Given our premise that a global reflation will likely take place in H2 2015, it would make sense for items (1) and (2) to be the dominant factors in the recent move to backwardation. Moreover, we have recently published that the current level of gold prices is proving difficult for many mining companies. Costs have increased rapidly these past years. Mining companies have been faced with higher power costs and rapidly rising wages. In 2014, the average all-in cost of gold mine production was $1,314 per ounce, above current prices. So item (3) may be part of the equation as well. The background for the recent move to backwardation is all of the above.

Taking all these developments into account, it should not be difficult to accept that gold's negative phase may be close to completion. The immediate concern however is that demand from China and India, the biggest retail consumers of gold, has fallen recently. We have attributed the fall in demand to the flat growth in those two countries in the previous months. Also, speculative positioning, despite the ongoing Greek saga and the risks it posed, posted the largest weekly decline in three months during the week preceding the FOMC meeting. Gross shorts were at their highest since late March. We interpreted this as a market focus at that time on a potential rate hike in September, and the concomitant rally in the US Dollar it will trigger. The FOMC policy decisions on Wednesday of course settled that issue, and we now see that most of the immediate obstacles have been cleared, leading to further rallies in gold prices.

Inclement weather raises concern on corn, soybean and wheat crops

Some concerns were recently raised regarding the persistent rainfall across major crop growing areas of the US which may negatively impact the development of corn and soybean crops. Inclement was also a factor in the winter wheat crop, as harvesting has been impeded by significant rains and flooding in the US Southern plains.

Temperatures have gone higher in the Midwest until mid-June, but persistent rain has prevented farmers from spraying pesticides. Many farmers expressed concerns that the delay in spraying will increase weed growth, and the wet conditions will increase the incidence of crop disease. The situation will likely come to a head in the next six weeks — considered by farmers as the most crucial growth period for the corn and soybean crop this year.

The growing situations for corn and soybeans crops were mixed: as of June 14, corn emergence across the U.S was at 97%, per reports from the USDA. It increased 6% from the week before, and was 2% ahead of the five-year average. The USDA also reported that the soybean crop was 87% planted, an 8% increase from the previous week -- but it was behind the five-year average by 3%. Farmers had difficulty completing the 2015 planting season due to the wet weather that persisted in the past month.

Meanwhile, the winter wheat harvest was reported at 11%, a 7% increase from last week. However, it is 9% behind the five-year average. Unusually heavy rains and flooding in the growing areas in the Southern Plain crop areas have delayed the harvest. The difficulty in the 2015 crops is translating into some price traction across the grain sector. It also helped that the US Dollar has continued its downtrend, after the Fed declined to provide guidelines which may suggest that the central bank will hike rates this year. We believe that the Fed is still constrained by the lack of solid evidence that the economy can take the transition to higher rates without curtailing the current recovery. The Fed's prudence should keep the US Dollar weaker during H2 2015, and that should translate into higher grain prices.

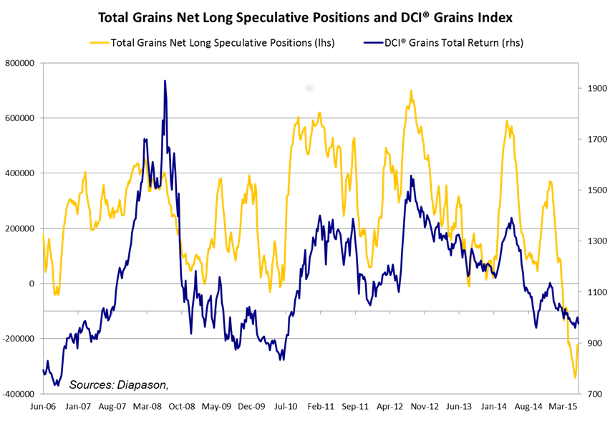

We believe that grain prices have a limited downside potential as they are significantly below the marginal cost of production, encouraging farmers to reduce spending. Moreover, crop disruptions are occurring at a time of extremely high levels of short positioning by large speculators in the grain sector. The most extreme positioning is on soybean futures, where net long speculative positions had been at a record negative level since at least 2006 when data started. The situation improved somewhat after prices showed signs of bottoming in the past three weeks, but the aggregate positioning in the grain sector remain close to record lows. Any supply concerns on grains could therefore trigger significant short-covering rallies, boosting the price of grains.

Charts of the week: USD vs real rates vs breakevens, total grains net long positions

|

|

|

|

For the full version of the Diapason Commodities and Markets Focus report, please contact info@diapason-cm.com