June 15, 2015

Oil: The swing variable is demand not production — could Saudi’s oil strategies boomerang?

Commentary by Robert Balan, Chief Market Strategist

“Demand is picking up. Good! Supply is slowing, right? That is a fact. You can see that I'm not stressed, I'm happy."

Ali al-Naimi, Saudi Arabian Minister of Petroleum, June 2nd 2015

In light of the universally expected decision of the Saudi-led OPEC (Organization of the Petroleum Exporting Countries) to maintain its 30 million barrel-a-day production level, the July 2015 Brent contract fell to an intraday low of $60.94. The cartel's quota on paper is 30m b/d, but the actual total production hovers around 31m b/d. By the end of the June 5 trading day, however, crude oil turned around and sustained a price run higher in the wake of sharp rise in long term rates across the developed world as global growth became more visible, with confirmatory decline of the US Dollar providing further support for a crude oil reversal, which was further confirmed by gasoline making a new high for the year.

This demonstration of market forces holds a lesson for market investors, and for the Saudi/OPEC alliance as well – with prospects of global growth becoming a strong reality, the swing data is going to be DEMAND not PRODUCTION for the rest of the year and beyond. We have been laying out the likely groundwork for a global recovery in H2 2015 by as early as month-end of February, after we saw the 10yr US breakevens rise by almost 40 bps from its 1.50% trough of January 14. Early this month, we received confirmation that global growth had moved from stabilization in the first and second quarters to firm prospects of actual growth by Q3. The information was provided by the reversal of the silver and gold ratio from a long, multi-year slide, and the rising ratio of equity cyclical over defensive sectors (see CIW, "Global growth is stabilising and will likely start to recover in Q3 2015" June 8, 2015). Both leading indicators have, in the past, done a good job of pinpointing the inflection points of actual global growth. Economic demand is therefore expected to continue to grow steadily, which means growth for oil demand as well. Even now, the demand fundamentals for crude oil and distillates may be understated – the world may be consuming more crude oil than it is producing.

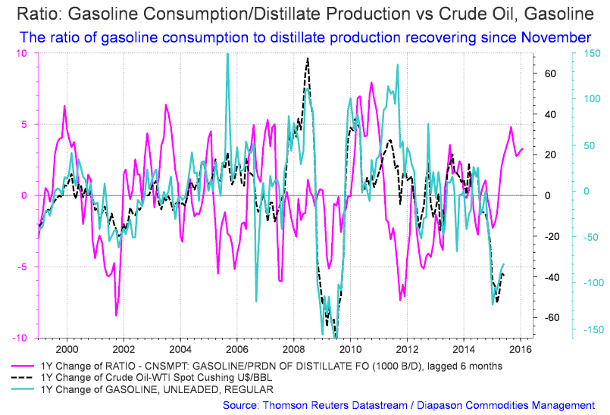

There are stark signs of improving demand, especially in East Asia, and so a firm global upturn in Q3 2015 should be a game-changer for energy prices. Last week, we saw gasoline buying from Pakistan (+20m b/d), China (+260m b/d), India (+80m b/d), US (+350m b/d), Saudi (+50m b/d) – these alone are over +750m b/d yoy. If we add LatAm and LDC Asia + Mideast – which will easily be another +200-250mb/d, there is close to +970.0m b/d gasoline demand. This favourably compares to the 912m b/d figure at the IEA website for 2013, the last published data for gasoline consumption. Indeed, distillate demand in the US is being primed by strong gasoline usage as the country approaches its traditional driving season. We see this in the chart of the ratio between total distillate consumption to total distillate production, which has been rising since November last year (see chart of the week No. 1). This development is confirmed by the highest gasoline sales since late 2007 as US gasoline demand hit 9.7k b/d (about 500K higher y/y).

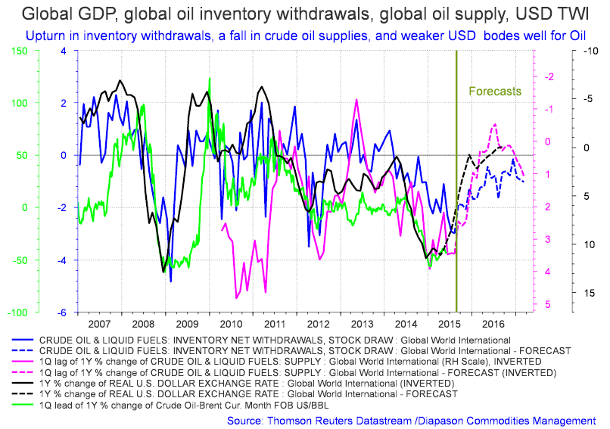

We are now seeing signs that the global crude oil market could shift into a deep deficit in Q4 2015 amid a strong drawdown in global stocks (see chart of the week No. 2). The consensus is that there is currently a global surplus of 2 million barrels a day, but given the current rate of global withdrawals, we expect that demand will outpace supply by as much as 1.2 - 1.6m b/d by Q4 2015. A projected deficit in Q4 will also be exacerbated by narrowing US inventories at a time that US crude oil production is also starting to decline after sharp drops in US oil rig counts in the past three quarters. Bloomberg reports that U.S. crude inventories probably shrank for a sixth week through June 4, decreasing by 6.8m b/d last week to 470m b/d, after surging to the highest in 85 years in the previous month. And in a report released last week, the US Energy Information Administration (EIA) that distillate liquid production in the major 9 shale projects in the US have peaked at "5,694,580 b/d and will have declined by 208,782 b/d in July". While these July numbers are 142,720 b/d above the production numbers seen in December, the EIA predicts that "production in December 2015 will be about 322,000 b/d below the December 2014 numbers". OPEC also released the May 2015 report last week which showed that the cartel's production increased by only 23,000 b/d from April, but April production has been revised upward by 110,000 b/d. The more salient data in the OPEC report was the fact that preliminary data indicates that global oil supply decreased by 0.27m b/d to average 94.06m b/d in May 2015 compared with the previous month. The OPEC data basically corroborates a very important detail – global supply of crude oil is diminishing quickly.

If this is indeed the case, then the Saudi/OPEC gambit of continued lower prices to weed out inefficient and marginal U.S. shale firms and higher-cost global projects, while maintaining market share, may not succeed, and indeed may boomerang. The Saudi/OPEC alliance can achieve both of these objectives only if prices remain low, and demand remains steady to slightly lower. But lower prices in the past three quarters are ironically already showing unintended benefits in the form of stronger than expected global growth in H2 2015. The lower crude oil prices have also presented China and India opportunities that cannot be missed. Contrary projected declines in demand, China has been aggressively hoarding oil in a fleet of super tankers, and this is keeping demand from Asia robust even when China's GDP growth has been muted. India has been pursuing the same strategy at a lesser scale. Much of the Chinese demand also comes from motorists, who are in the middle of a love affair with gas-guzzling SUVs. According to Bloomberg, in the first three months of the year, sales of SUVs soared 48% in China over last year. Hence, oil consumption in China has remained steady at around 10 million barrels a day over the past few months, despite slower economic growth of nearly 7% relative to 7.4% GDP growth late last year.

OPEC's presumption that low oil prices will decimate expensive U.S. unconventional production (and thus solve the oversupply issue) is therefore proving to be only partially successful, as shale oil producers have still managed to sustain high production rates in the seven core areas of unconventional production that account for 95% of U.S. oil production growth. This was despite a sharp drop in rig oil counts, which was achieved mainly by closing marginal production rigs, squeezing the needed revenues from more established wells. It may be that OPEC has acknowledged this fact and is prepared for a long struggle with its competitors. OPEC's long-term strategy draft report, published after the June 5 meeting, forecasts a two-year rise in non-OPEC oil production noting, "for non-OPEC fields already in production, even a severe low price environment will not result in production cuts, since high-cost producers will always seek to cover a part of their operating costs". But even this foresight may not come to pass, as demand has grown faster than the Saudis and everyone else had expected. With increased demand and higher prices for the rest of the year and beyond, the Saudis/OPEC have incurred huge opportunity losses with little gain to show for – in other words, the grand strategy has boomeranged. The Saudi/OPEC alliance may do have other grander objectives, like delaying a transition to cleaner fuels or calibrating crude oil prices so that the global economy is given a better chance to grow – it might even be that the Saudis see an opportunity to strike at the pockets of geopolitical enemies. Those are side benefits which add allure to such strategies.

But flooding the market with oil supplies and forcing prices to tank, and sustaining the pressure, speaks of more mercantile objects; the Saudis and OPEC do want to maintain or increase their market share, with or without those side benefits. Considering that they are only partially successful, and given their growing acceptance of the limitations of the strategy, it is not too much to expect that the Saudi-OPEC tandem will soon look for a graceful exit. There is also growing evidence that OPEC and Saudi Arabia's ability to retain the swing producer role and maintain their power to set global crude prices is coming to an end. Increasingly, crude oil prices have become very volatile, and the wide swings in prices do not support a thesis that Saudi Arabia or OPEC can set global oil prices for extended periods of time. High volatility does frequently impact the price discovery process with nonlinear effects, and this is true for crude oil to the same degree as high volatility has on paper asset prices (e.g. financial futures contracts). The reality is that the futures market has basically taken over that role and that might have been the case since 1999.

We also fail to understand or appreciate what Saudi/OPEC will gain from these strategies. Their market share gains can be kept only for as long as prices are depressed or are trading in a narrow range. We believe that once prices move past the $80 level, frack shale assets will be back on play, rigs will be re-commissioned and within several months the frackers will be back in business. Therefore, the end game may only be a partial or even a phyrric victory for the Saudis. It may also be the case that in the future, the shale frackers will be better organized, better capitalized and have better discipline after lessons from the OPEC blitz, and will be in a better position to weather further adverse initiatives from thereon. We suspect that if that indeed comes to pass, the line of least resistance will be on cooperation, and the oil fracking industry will eventually be part of a broad "coalition" to keep oil prices reasonably high to ensure profits are evenly distributed.

|

Main drivers this week:

|

Commodities and Economic Highlights

Commentary by Robert Balan, Chief Market Strategist

PGM fundamentals are improving; we expect platinum at $1,600 by year-end

PGM fundamentals are improving as the outlook for stronger global growth takes hold. What could be a factor as well are supply constraints plaguing the subsector. Johnson Matthey's (JM) newest assessment of the platinum and palladium markets concludes that both of those markets were in deficit in 2014 (at 1,112 koz and 1,633 koz, respectively) and will very likely remain in deficit for 2015 as well. JM's report said that the Platinum Group Metals (PGMs) deficits were driven by robust investment demand and a shortfall of supply due to the South African labour disputes last year. Palladium has been a market in deficit since 2007. The GFMS team estimates "the palladium market deficit last year at 1.58 million ounces, representing the most severe market imbalance for more than a decade".

Thomson Reuters recently released its GFMS Platinum & Palladium Survey (GFMS) 2015, where it corroborated that the platinum market was indeed in a deep deficit last year to the tune of 1.02 million ounces. The singular cause of the deficit cited was also the major strike-related production stoppages in South Africa last year. The 2014 deficit comes on the heels of surplus in 7 of the last 8 years; GMFS expects the deficit to continue during the rest of 2015 and into 2016. Above-ground stocks held by producers and the trade may make up for some of the shortfall this year. The World Platinum Investment Council (WPIC) said some 905 kilo-ounces have been drawn down in South Africa against a backdrop of global platinum supply down 8% to 7.2 million ounces. The rest of the world’s production had remained steady but South African supply fell sharply.

On the demand side there has been growth in the automotive sector, particularly in Europe where ever tougher emission regulations (Euro VI for trucks and buses and Euro 6 for passenger cars) are driving consumption from jewellery and industrial sectors such as industrial catalysts. The industrial use of platinum held broadly steady – chemical, petroleum, glass, electrical, medical and biomedical usages – were broadly level or up year to date. Automotive and jewellery (particularly in Asia) grew strongly, but financial investments declined by 3% compared to the same period last year. The earth of investment demand was described as the strongest barrier to further price rallies, despite the forecast of deficit this year. The other factor holding up a rise in prices, despite a reduction of above-ground inventory, is the availability of 2.8 million ounces supply coming out of ETFs if the market improves.

A lot of stock is being placed in an across-all-sectors rise in demand, but with such a large proportion coming from jewellery, slowing retail growth in China could undermine significant Asian growth in demand. Jewellery demand is broadly split between the US (35 kilo ounces), India (25 kilo ounces), Western Europe (5 kilo ounces) and the Rest of the World (RoW) (10 kilo ounces), with China itself contributing some 20 kilo ounces. A strengthening US dollar had depressed price rises in 2014 but the story may be different in H2 2015. A significantly weaker US currency would be a game-changer for the platinum and the other PGMs. The WPIC sees reasons for higher prices on the back of prospects of robust demand and a tightening supply market, a market which — it must be said — remains in deficit. We believe that platinum could move higher into the $1,600/ounce by year end.

Wheat prices are trapped in a range now, but that could change in a few weeks

Despite uncertainty regarding a potential El Nino event, wheat prices have remained stationary without a clear trend in the past 8 weeks, and prices may stay that way for 2 to 3 more weeks. But by early July, wheat prices may get the impetus to break out of the range to the upside. There are developments which could provide the trigger for a wheat breakout: (1) Russian taxes on "higher-value" wheat could restrict supply going forward, (2) Australia cut its wheat production outlook for the first time in five years, and (3) an El Nino event could have greater consequences for wheat supply than is being expected at present.

These positive aspects of the wheat market will take a while to develop, hence, prices will likely trade in a narrow range for a while, albeit with slightly higher bias. This means however, that we may have seen the bottom for wheat prices during the May 5 2015 low. Our price breakout expectations stem from our belief that these events will come together soon.

The negative side stems mainly from the still poor technical tone of wheat, and the possibility that the US Dollar rally will resume soon. Wheat prices have been unable to break above the $5.50 level which has been the resistance level since February. And the US Dollar DXY Index remains above 93.00 levels, which can be seen as a major support. There is a very distinct negative correlation between the grains, especially wheat, and the US currency. So wheat prices may trade sideways within a month, but the effects of a potential El Nino event should become clearer going into Q3 2015, when wheat prices could rise more consistently.

Charts of the week: Gasoline consumption/distillate production ratio, global GDP vs oil supplies

|

|

|

|

For the full version of the Diapason Commodities and Markets Focus report, please contact info@diapason-cm.com