June 8, 2015

Global Growth is stabilising and will likely start to recover in Q3 2015

Commentary by Robert Balan, Chief Market Strategist

“Insurance is a wonderful thing, but if the cost of the premium is too high, you may be better off accepting the risk. Today, some of the defensive sectors . . . are expensive, meaning you may be paying a very large premium to get only short-term risk mitigation. In my opinion, this may not be worth it.”

Russ Koesterich, BlackRock Global Chief Investment Strategist, October 2013

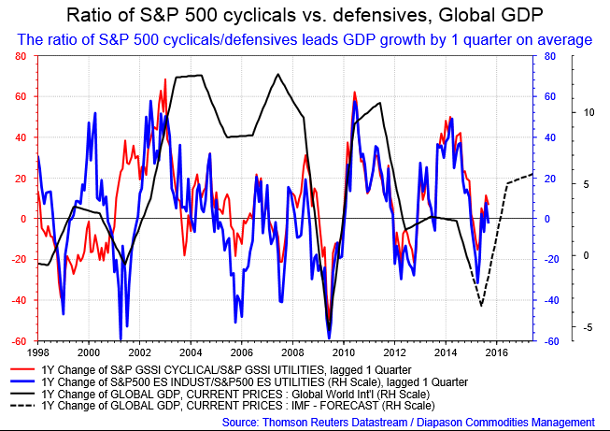

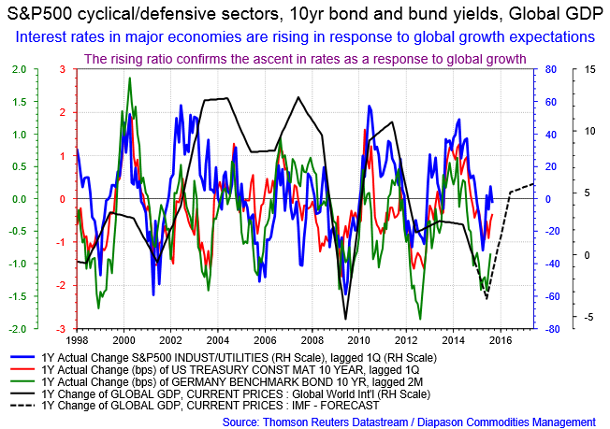

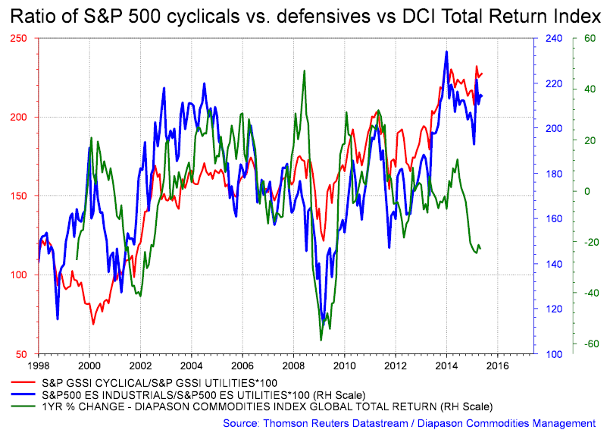

As early as Q1 2015, it has been our view that global GDP growth could start firming up in Q3 2015, and a recovery process could start and extend well into 2016. Although the usual coincident measures of global growth like industrial production and the manufacturing PMIs have not turned yet, some asset priced-based leading indicators are suggesting that global activity stabilization is taking place, and the next phase in global growth evolution could be a recovery. Asset prices, which are available on a daily basis, provide a real-time dimension in tracking global recovery, providing advance information on likely changes in industrial production and the global PMIs. One such tool to confirm and track that global growth is the ratio of cyclical equity sector and defensive equity sector (with the utility sector as a primary example). We call it the Cyclical/Defensive Ratio (Cyc/Def ratio). The upturn and the rise in the Cyc/Def ratio three months ago is likely signalling an upturn in global growth as from Q3 of this year (see No.1 Chart of the Week). Global growth is historically also preceded, or accompanied, by rising long-term rates, an uptick in inflation expectations or actual inflation. A rise in these variables should then confirm the advance information being provided by the Cyc/Def ratio, which slightly leads both interest rate and inflation developments, as actual global growth recovery gets underway.

The Cyc/Def ratio is currently rising with long term rates of major economies (US, Germany, rest of the eurozone, UK, etc.) — the US long bond yield and the German 10yr bund yield have risen sharply of late, as disinflation wanes in both countries. In the case of the US 10yr bond yield, we expect a move towards the 3.0% area, a target was derived by other methods. For the rate to move in that magnitude, global growth must indeed have to take place.

The other variable that accompanies global growth is rising inflation on a global basis, or at least in the major economies at the initial stages of the recovery. We chose the Implicit Price Deflator (IPD) of GDP to make our case that global growth is indeed set for a take-off in H2 2015. The quarter-on-quarter measure of IPD co-moves very well with the yearly changes in the Cyc/Def ratio — and the evolution of both the US and German IPD follow closely the contours of global GDP (see Chart of the Week No. 2). The sum total of these developments (rise in the Cyc/Def ratio, increasing long-term interest rates, and rise in inflation levels) indeed suggest that actual global growth is now taking place, although it may another quarter before it shows up in the coincident measures such as industrial production and the PMIs.

This should bode well for commodities, especially for the most cyclical sectors which perform well in a global upturn such as energy, base metals, and the cyclical components of the precious metals sector, such as silver and the Precious Metal group (platinum, palladium), and the cyclical components of the agriculture sector such as cotton, lumber, and rubber. Even now, the demand fundamentals for crude oil may be understated. There are initial signs of improving demand, especially in East Asia, and so a firm global upturn in Q3 2015 should be a game-changer for energy prices. The same can be said about base metals — the market remains unconvinced about a pick up in demand due to the lack of visibility of a near-term China recovery, a fear that becomes moot if global growth does take place in H2 2015. Global growth is usually accompanied by a weaker US Dollar, and under these conditions, the precious metals should also do well. But since the motive force is cyclical, we expect silver and the PGMs to outperform Gold during H2 2015.

|

Main drivers this week:

|

Commodities and Economic Highlights

Commentary by Robert Balan, Chief Market Strategist

The agriculture sector is set to benefit from a weaker US Dollar

The USDA estimated 95% of corn acres were planted across the U.S. as of May 30th, a 3% increase from the prior week and is even with the five-year average. The USDA also estimated the corn crop condition at 74% as “Excellent” or “Good,” unchanged from last week, but a 2% decrease from last year. Spring wheat emergence was reported 91% emerged, an 11% increase from last week and a 22% increase from the five-year average and the soybeans crop was reported 71% planted, a 10% increase from last week, and 1% ahead of the five-year average.

The initial conclusion after the report: this was another bumper grain crop, which would pull prices lower in the short-term. That thinking was apparently driven by developments in April, when prices declined briefly after USDA released crop condition estimates which were well above expectations. This time, a price decline did not happen, and instead, prices rose sharply in the case of wheat and corn shortly after the report. The sharp reversal to the upside was caused by a big decline in the US Dollar during the same time frame.

This underlines the strongest fundamental in the grain sector — the US Dollar’s trend changes can offset whatever crop fundamentals, in cases where those changes are not caused by large-scale weather disruptions like El Nino. We have been seeing a stronger correlation between changes in grain prices and changes in the value of the US currency of late, and we expect the correlation to get stronger going forward. We expect the Dollar weakness to extend through the rest of the year, hence the recovery in grain prices may have seen the lows at the end of May, with reasonable expectations of further price increases. In a recent report, we also analysed the likely impact of an El Nino event that is expected to get worse towards the year-end. Large-scale disruption plus a cyclical decline of the US Dollar may be the “perfect storm” which could move agriculture price much higher over the next 6 to 9 months.

Moreover, grains are showing signs of extreme market positioning; grains are now in deeply oversold territories. There are also other factors that limit the downside risk in grains: prices are now significantly below the marginal cost of production, which have encouraged farmers to reduce spending. This in turn puts yields at risk, while short positions are at very high levels. For instance, on soybean futures, net long speculative positions are at a record negative level since at least 2006 when data started. The oversold conditions coupled with historically high open interest could be telling us that there are speculative shorts in this market that will eventually need to cover risk positions. Nothing ignites a rally like speculative shorts, particularly in the volatile grain market.

Energy: the disconnect between oil prices, distillate inventory demand, and consumption

The week ending May 22nd, U.S. crude oil inventories decreased by 2.8 million barrels, gasoline inventories decreased by 3.3 million barrels, distillate inventories increased by 1.1 million barrels and total petroleum inventories increased by 2.2 million barrels. While the storage draws were supportive of prices, a massive surge in U.S. production had dampened sentiment briefly depressing oil prices, but other factors, mainly a recovery of the euro, pushed crude oil prices higher thereafter.

We believe that higher total petroleum inventories are a positive factor instead of negative due to a very distinct correlation between inventories and demand–consumption. Our approach which tries to explain the lead function of the distillate inventory data over consumption-demand is that distillate storage operators are very savvy, they understand the market, and stock up ahead of any potential spike in prices. Hence changes in the inventory data are consistently ahead of changes in actual demand and consumption by up to 6 months.

This situation therefore creates an empirical big disconnect between inventory and consumption-demand, and another disconnect between that matrix with crude oil prices. The first main issue is how quickly will demand-consumption catch up to the inventory build, and secondly, how quickly (and by what mechanism) will crude oil prices catch up with the adjustments that consumption-demand will make towards the lead of the distillate inventory build.

Most likely inventories will diminish, oil prices will continue to rise, then half-way through the lead-time inventory has over consumption-demand (sometime in August), consumption-demand will accelerate towards a peak, and inventories will speed up its momentum towards the downside. At this time we believe that crude oil prices could hit its maximum acceleration to the upside. However, the elements that should identify how high crude oil prices will go are still in a flux. Although we have identified the “time” element, more data is needed to solve the “space” variable, likely to be solved around August. There are some developments which hint that this is the case — for the first time in six months, the US oil market is flirting with backwardation, where the spot price is higher than one or three-month dated delivery — a sign of a tightening market and, potentially, a shortage. All of this will likely come to a head in August.

Charts of the week: Cyclical equity sector vs defensive equity sector ratios

|

|

|

|

For the full version of the Diapason Commodities and Markets Focus report, please contact info@diapason-cm.com