May 26, 2015

Value is in agriculture: Supply risks are increasing while prices are anticipating an almost perfect crop

Commentary by Robert Balan, Chief Market Strategist and Alessandro Gelli, Commodity Analyst

“Most El Niños historically have had a global impact on food prices.”

Nick Klingaman, a climate researcher at the University of Reading, May 21st 2015

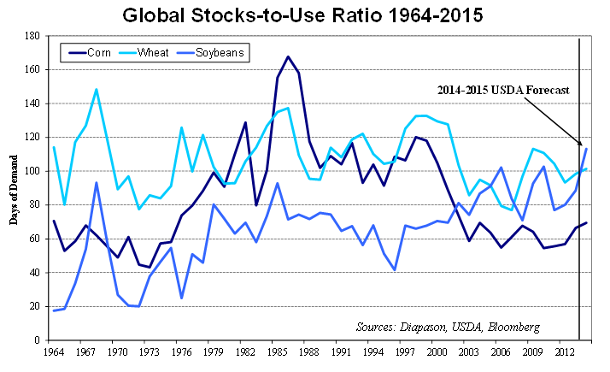

El Nino is back. Last week, UK’s official weather forecasters confirmed recent warnings from other weather agencies (e.g. Australia's Bureau of Meteorology, US National Oceanic and Atmospheric Administration). El Nino conditions have now begun across the tropical Pacific. The return of this weather phenomenon could have a major impact on prices of agricultural commodities. Prices in this sector have remained at depressed levels, contrasting with the recent good performance of other commodity sectors such as energy and base metals. Excellent crop conditions for the second year in a row and large inventories have contributed in bringing the DCI® Grains Index down by about 10% year-to-date.

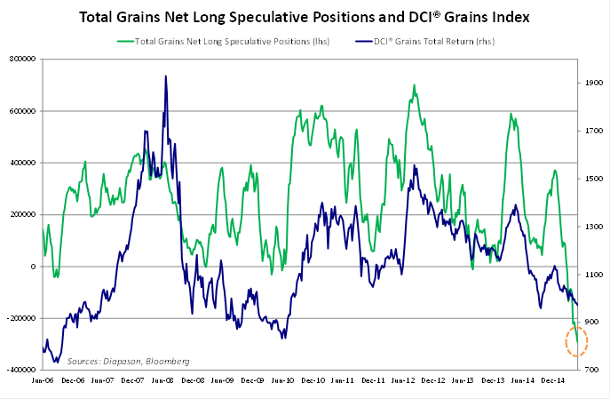

Soft commodities also suffered, and are still suffering, from ample supplies. The DCI® Soft Commodities Index is down by almost 11% since the beginning of the year. But speculative net long positions on agricultural commodities and especially those of grains are at or close to record low levels and are now signalling oversold conditions. A strong El Nino, which could pose major negative risks on the crop of some agricultural commodities, may therefore provide strong upside pressure on prices in the sector later in the year.

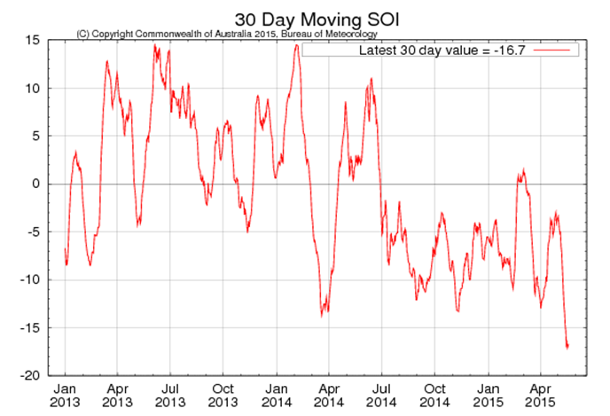

Signs indicating that El Nino is in an early stage are becoming more important and are clearer than last year when early conditions faded without producing an El Nino (see the first chart of the week). While the appearance of El Nino conditions now does not necessarily guarantee that a strong, full-fledged El Nino will eventually develop and bring floods or droughts, which will push agriculture prices higher, there will be an increased likelihood of supply disruptions. An El Nino event, indeed, has a reputation for being a powerful catalyst for extreme weather conditions. For now, there are still many uncertainties over the intensity of the forthcoming El Nino. More importantly, the market has yet to price-in the future impact of this weather phenomenon. Variations in the strength of an El Nino event can have different impacts on the prices of individual agriculture products.

El Nino should increase the likelihood of droughts in Australia and Southeast Asia but it may also increase rainfall in the Americas. Supply of some agricultural commodities could be positively affected by El Nino. Arabica coffee, soybean and corn could experience a stronger crop due to warmer weather and rainfall in North and South America. El Nino would indeed likely boost Arabica coffee production in Colombia and Brazil. These conditions could also benefit the soybean and corn crops in the US and in South America. However, too much rain in the US could also increase the likelihood of floods. Thus, while a mild El Nino could add some downside pressure on corn, soybean, and Arabica coffee prices, a strong El Nino and its consequent floods in the US could have a positive impact on soybean and corn prices.

The impact of El Nino is more clear-cut on other agricultural commodities. On sugar, El Nino could create drought conditions in India and Thailand, while causing excess rain in Brazil — both events could reduce the global sugar crop. These 3 countries account for about 54% of global sugar exports. Any supply disruptions in these countries could push sugar prices higher. Cocoa prices could also experience some upside pressure as El Nino typically brings in drier weather in West Africa. This region accounts for almost 80% of global cocoa exports. Among grains, wheat supplies are at risk with El Nino as it typically causes floods in China (17% of global production), while India and Australia (collectively 17% of global production) may experience droughts. Supply disruptions in these countries due to El Nino usually more than offsets better wheat yields due to El Nino in the US and Canada (13% of global production). The net impact of El Nino is therefore typically positive for wheat prices.

Rice supplies in Asia are also at risk as the 4 largest exporters (India, Thailand, Vietnam and Pakistan) could face drier weather because of El Nino. Already the Philippines, the world’s largest importer of rice, is seeking 250’000 metric tons of rice to increase its buffer stocks and last week officials also announced that the government could buy more rice if El Nino intensifies. Thus, it is really prices of wheat and some soft commodities which will benefit the most from El Nino. The appearance of El Nino could occur at the same time as other risks on the crops are increasing. Grain prices have fallen below the marginal cost of production, which stood at $10.25/bushel for soybeans, $4.02/bushel for corn, and $6.89/bushel for wheat. Prices this low have already reduced farmers’ incomes significantly. According to the USDA, US farm income should decline by 32% y/y in 2015 to $73.6 billion. As a consequence, farmers are likely to spend less on their crops. This should lead to a significant reduction in expenses for fertilisers and equipment, which may diminish yields. Deere, the provider of agriculture equipment, has forecasted a decline of 17% of net sales for 2015. There is also increasing the likelihood of farmers rotating to other crops, where it is possible to do so, if low prices persist. Low agricultural products’ prices therefore pose increasing risks on crops.

Low margins have already contributed to planting reductions in the eight major crops in the US (corn, soybeans, wheat, cotton, rice, sorghum, barley and oats) which may decline to 254.6 million acres, down 3.3 million from last spring, and the lowest since 2011. Some farmers had to breach lease contracts in order to reduce planting, leading to growing tensions between landlords and farmers — 40% of farmland is leased out in the Midwest Corn Belt and the grain-growing Plains. In Iowa, about 1% of the farmland leases could be breached this spring, reflecting growing financial difficulties for farmers. Indeed, breaking leases may lead to long legal battles and are typically a last resort for farmers in order to cut expenditures. Weak incomes have also forced some farmers to turn to banks for loans to pay rent. Total non real-estate farm loans rose by more than 50% y/y in Q4 2014 to $112 billion, increasing the vulnerability of farmers to a possible rate hike later this year. We already have stories of farmers being refused loans due to the continuing prospects of lower agriculture prices.

The combination of these supply risks and the increasing likelihood of an El Nino event is therefore an important threat to the supply of some agricultural commodities. These commodities are also presenting signs of oversold conditions (see charts of the week). The confirmation of such factors could trigger a short-covering rally, while at the same time downside risks appear limited as prices are below the cost of production. The agriculture sector therefore appears to provide an excellent value case.

|

Main drivers this week:

|

Commodities and Economic Highlights

Commentary by Alessandro Gelli

The decline in US oil rig count is losing momentum due to higher prices

Two weeks ago, Baker Hughes reported that the number of rigs in the Eagle Ford Shale in South Texas rose over the week by 3 to 108. This was the first weekly increase since December 2014. This also followed an increase in the number of rigs in the Permian basin in west Texas, the week before. Overall US rig count has also been declining less rapidly these past few weeks. This is suggesting that higher oil prices and lower costs may have increased the profitability of several oil projects in Texas.

WTI crude oil prices rose from $47 per barrel in mid-March to around $60 per barrel last week. This 27% upward move benefited US oil companies. They have also increasing hedges using the higher oil prices of more distant maturities. According to the CFTC two weeks ago, short positions held by producer/ merchant/ processor/ user rose to 473’024 contracts, the highest level since October 2011. This is implying that oil prices have risen to a level high enough for oil companies to hedge their expected production.

Higher oil prices also imply that some oil wells may be completed. Indeed, the collapse in oil prices has encouraged oil companies to postpone completion operations, which account for the bulk in well costs. This contributed to the rise in uncompleted wells in North Dakota to 880 from about 600 in mid-2014. The elevated number of wells waiting for completion is implying that crude oil production could rebound even though the number of rigs remains unchanged. The completion of wells consists essentially of the hydraulic fracturation, which could take only several weeks to perform. However, the availability of fracking crews may prevent a rapid increase in crude oil production from these wells.

Aluminium producing capacity under further pressure amid strong demand

Rio Tinto recently announced its intention to sell unwanted aluminium capacity as the metal’s margins remain under pressure with weak prices and falling premiums. This has already forced Alcoa to announce the closure of capacity in March 2015. It is now the turn of Rio Tinto to reduce its capacity.

The company already cut 25% of its aluminium producing capacity and about 33% of its alumina producing capacity since 2009. This situation reflects clearly the difficulties that mining companies are facing with current metal prices. This is likely to contribute to further cuts in production. Global production of primary aluminium in Q1 2015 reached 13.99 million tons, up 7% y/y. Production ex-China reached 6.44 million metric tons, up 2% y/y.

While producers are under pressure, demand continues to grow at a rapid pace. In Q1 2015, global demand for aluminium ex- China rose to 6.72 million metric tons, up 1% y/y, implying a deficit (ex-China) of 0.28 million metric tons. In China, demand for aluminium rose by 6% y/y in Q1 2015. Demand of aluminium from the transportation sector remains strong as automobile manufacturers are increasing the substitution of steel with aluminium.

Charts of the week: El Nino and Grains — global stock-to-use and speculative positions

The tropical Pacific is in the early stages of El Niño. El Niño–Southern Oscillation indicators have shown a steady trend towards El Niño levels since the start of the year. Sea surface temperatures in the tropical Pacific Ocean have exceeded El Niño thresholds for the past month, supported by warmer-than-average waters below the surface. Trade winds have remained consistently weaker than average since the start of the year, cloudiness has increased and the Southern Oscillation Index (SOI) has remained negative for several months. These indicators suggest the tropical Pacific Ocean and atmosphere have started to couple and reinforce each other, indicating El Niño is likely to persist in the coming months. Sustained positive values of the SOI above +7 may indicate La Niña, while sustained negative values below −7 may indicate El Niño. Values of between about +7 and −7 generally indicate neutral conditions.

|

|

|

|

For the full version of the Diapason Commodities and Markets Focus report, please contact info@diapason-cm.com