May 18, 2015

After multiple stimuli, Chinese growth may soon accelerate, providing further support to the base metals trend in H2 2015

Commentary by Robert Balan, Chief Market Strategist

“In public, though, the Chinese government maintains a “neutral” monetary-policy stance, as the leadership doesn’t want to appear to be resorting to the old playbook of opening the credit spigot to salvage the economy. In reality, some economists say, a new stimulus comparable to the $586 billion stimulus package launched in late 2008 is already in the making. Over the past six months, the central bank has cut interest rates three times and twice released the amount of rainy-day reserves set aside by commercial banks with the central bank. In addition, the PBOC has also provided more than $161 billion of funds to banks through a batch of tools.”

Lingling Wei, China Launches Stimulus Aimed at Local Debt Crisis, WSJ, May 13th 2015

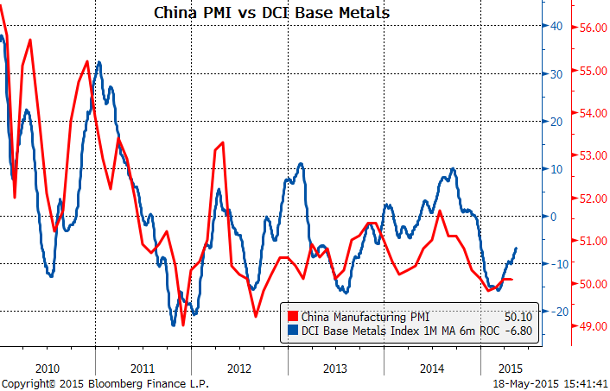

Base metals prices started well in the second quarter, following a stabilisation during the first quarter of this year. The DCI® Base Metals Index rose by about 10% in April. This upside move followed the good performance of the energy sector, the other cyclical commodity sector, as the DCI® Energy Index rose by 17% in April. It is interesting to note that almost all base metals experienced upward moves in prices, the best performers being lead and zinc (16.5% and 13.2% over the month, respectively). The broad rise in base metals prices, with the exception of tin, was triggered by the gradual return of risk-on appetite after global growth showed signs of picking up, amid persistent concerns about the supply situation for some metals. While these factors may not be sufficient for a sustained price, base metals prices may soon start benefiting as well from the likely acceleration of the Chinese economy later in the year.

China is the largest consumer of base metals, absorbing almost half of global demand for those raw materials. A Chinese economic recovery from here, largely unexpected by global investors, would be a game changer for base metals. While a hard landing in China is now being seen more and more unlikely, many market participants are still expecting a gloomier outcome for the country this year. This has prevented base metals from performing as well as the energy sector did during the past few weeks. However, this may soon change.

The Chinese government is proactively reacting to disappointing economic data by implementing what has been a series of pro-growth measures. While some of those moves have been short term fixes to the economy, many of the measures taken will likely have longer-lasting positive impacts on industrial activity. We expect those economic benefits to accrue during the second half of this year. Last week, the PBoC cut its benchmark lending rates by 25 basis points to 5.1%, its third reduction since November 2014. The PBoC also previously implemented a reduction in the reserve requirement ratio for banks and provided more funds to certain domestic banks in order to boost their liquidity. These and other pro-growth measures being contemplated should lay the foundation for stronger Chinese growth in the second half of the year.

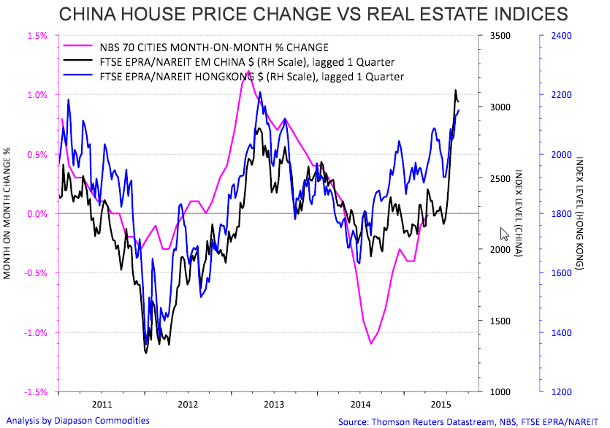

There are already some positive signs that these pro-growth policies are working. In April, Chinese property sales by volume rose by 16% y/y. Preliminary data suggest that the sales improvement can be further sustained this month -- real estate prices have stopped declining and could soon start rising (see the third chart of the week). Further stabilisation in these measures should trigger further increases in construction activity, which typically lags the improvements in home sales.

Furthermore, the Chinese stock market also suggests an imminent improvement in economic activity. The Shanghai Stock Exchange Composite Index is up by almost 40% since mid-February 2015. The index leads the Chinese GDP by about 6 to 9 months, implying added uplift to the Chinese economy by late Q2 to early Q3 of this year (see the first chart of the week). The incipient improvements in real estate sales and the lagged effects of the outsized Chinese stock market rally should enhance the so-called “wealth effect” — which should further boost the already rising consumer confidence index and finally prop up the erstwhile flat retail sales index. This in turn could enhance economic growth to levels that many market participants are currently not anticipating. The Chinese GDP could rise by 7.2% this year, with the peak in growth expected in Q4 2015 at 7.4%.

Improving global economic conditions, including those of China, should lead to stronger demand for base metals. Moreover, the bullish factors supportive of further base metal price improvements also include price pressure arising from constrained supply situations. For instance, Aluminium producers are currently cutting capacity due to the recent low prices. In March, Alcoa announced it would look at cutting or selling as much as 500’000 tons of annual smelting capacity, accounting for 14% of its total capacity. Since 2007, Alcoa reduced its smelting capacity by 1.3 million tons. Moreover, some major zinc mines are likely to close this year. MMG’s Century mine in Australia, the world’s 3rd largest zinc mine with a capacity of 500’000 metric tons per year, and Vedanta’s Lisheen mine in Ireland with a capacity of 167’000 metric tons (the world’s 7th largest zinc mine), are expected to close in the second half of 2015. This followed several major closures in the past two years. And the copper market is experiencing important supply disruptions, which could keep the market close to equilibrium this year, contrary to the surplus that was expected earlier in the year.

Thus, the combination of stronger demand from China amid supply constraints could lead to a tighter supply/demand balance for base metals. Zinc, aluminium, and to a lesser extent copper, are likely to benefit the most from this situation. Base metals should therefore perform well in the second half of the year alongside the energy sector.

|

Main drivers this week:

|

Commodities and Economic Highlights

Commentary by Alessandro Gelli

OPEC boost crude oil output to keep, not to gain, market share

While signs of adjustments of US crude oil supplies are becoming clearer, OPEC is boosting production. This is seen as an attempt to gain market share over expensive producers from non-OPEC countries. Saudi Arabia held its production above 10 million b/d. This contributed to bring OPEC crude oil production to 31.2 million b/d in April 2015, the highest level since September 2012, and up 1.4 million b/d y/y. Iran and Iraq also boosted production.

Some market participants have interpreted this as a deliberate action to gain market share. However, the rise in Iraqi and Iranian crude oil production has nothing to do with an attempt to gain market share. Iran is increasing output as much as possible but exports — and production — remains constrained by international sanctions. Iranian crude oil exports are unlikely to remain significantly above 1 million b/d for a sustained period unless the sanctions are removed. Iraq is still experiencing some infrastructure issues, preventing the country to export crude oil at full capacity. Recent improvements on the infrastructure and security situation have allowed the country to export more crude oil.

Finally, Saudi Arabia is increasing output in order to respond to stronger domestic demand. The start of new refining capacity is absorbing a greater amount of crude oil — greater crude oil production is not translated into higher crude oil exports. At the end of last year, the Kingdom added 400’000 b/d of refining capacity — Yanbu refinery — and should start the main gasoline unit by middle of the year. Moreover, direct crude burning should gradually rise on a seasonal basis, absorbing a greater amount of domestic crude oil production — the amount of crude oil used by the power sector typically peaks in July-August. Thus, the rise in crude output by Saudi Arabia has more to do with keeping its market share than gaining market share over other oil producers.

Short term risks for natural gas prices

US natural gas prices rose by more than 20% since its year’s low made at the end of last month. Prices reached a 3-year low in April due to mild temperatures, which negatively affected demand, and persisting rise in US natural gas production. Moreover, US natural gas inventories have been building at a faster than usual pace for the season since the beginning of April.

However, some elements have triggered the large rebound in natural gas prices. There are growing evidences that US oil production will decline in the coming months, dragging down US natural gas production with it. Associated natural gas production accounts for about 10% of US natural gas production. This is implying that the likely decline in US crude oil production should at some point negatively affect US natural gas production. Moreover, low natural gas prices have also encouraged the use of natural gas from the power sector. Furthermore, at the end of last month, short speculative positions on US natural gas futures had reached 353’204 contracts, the highest level since mid-2009 when the negative sentiment on natural gas futures reached extremely high levels. The concerns about natural gas production may have triggered a short-covering rally.

However, this rally may have been too strong too quickly. There are still some downside risks in the short run. US natural gas production growth is likely to remain strong during the coming weeks, leading to net injections into inventories that are greater than the usual for the season. It will only be in the second half of this year that natural gas will see more supportive fundamentals. The impact of lower oil drilling is likely to be felt by the natural gas market from mid-year onwards.

Demand could also improve. Low natural gas prices are encouraging power plants to use this fuel. Moreover, the closure of around 13GW (10%) of total US coal-fired output this year should lead to a significant gain in market share in the power market for natural gas.

Furthermore, the US should start exporting LNG from the Sabine Pass terminal by the end of this year, allowing the country to export its surplus. US natural gas prices have remained below European and Asian natural gas prices these past 6 years. By the end of the year, US natural gas prices could rise further. The forward curve is already showing higher natural gas prices with the December 2015 contract at $3.3 per million btu.

Charts of the week: Chinese growth, the Shanghai stock market, the Chinese real estate market and Base Metals

|

|

|

|

For the full version of the Diapason Commodities and Markets Focus report, please contact info@diapason-cm.com

%20final.png)