May 11, 2015

2015 looks promising as global growth is finally back

Commentary by Robert Balan, Senior Market Strategist

“World growth is projected to pick up modestly to 3.5 percent in 2015 and to 3.7 percent in 2016.”

IMF, Asia and Pacific’s outlook: still leading global growth, Regional Economic Outlook — Asia and Pacific, May 2015

2015 looks entirely different from the previous 4 years. Global growth is finally back. For the first time since 2010, the global economy may have a synchronised expansion as Europe, Japan and some large emerging countries may see a return of economic growth alongside the US. While US growth may have weakened in Q2, the outlook for growth is improving for the second half of the year. Furthermore, an acceleration of Chinese industrial activity is also more likely as the central government is committed to stimulate the economy with various measures such as the recent reduction in benchmark rates — the third cut in six months. This is naturally a positive environment for cyclical assets and especially commodities such as energy and base metals.

The IMF confirmed in its latest report that Asian economies will lead global growth this year, expanding by 5.6% as recoveries in India and Japan are expected to offset the slower growth in China. The latter is now more likely to experience an acceleration of the economic activity this year as the Chinese government is increasing its efforts to boost growth. This was reflected by the 0.25% cut in benchmark interest rates for deposit and lending to 5.1% last weekend. This followed other interest rate cuts, reductions in the reserve requirement ratio for the banks and injections of liquidity by the PBoC — rumours of a possible Chinese QE have even emerged. Moreover exports from developing Asian countries are likely to recover as they benefit from a weaker exchange rate. Lower fuel prices — oil prices fell by a larger amount than local exchange rates — should also act as economic stimuli for large oil importing countries. India, Indonesia, Malaysia and China are likely to benefit from the decline in oil prices. India is likely to be one of the fastest growing major economies in the world this year, expanding by 7.5% due to the combination of lower oil prices and recent policy reforms.

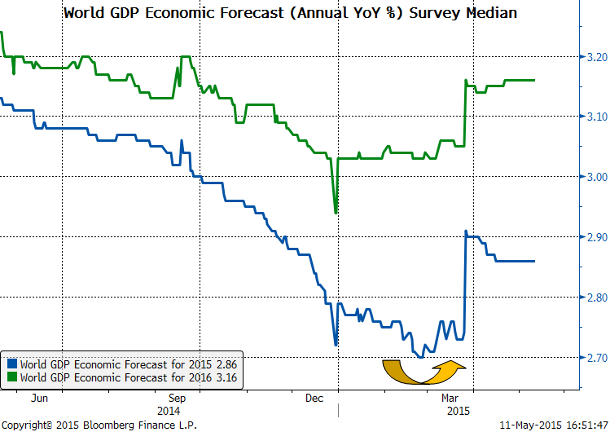

But developing countries are also expected to do well this year. According to the latest IMF’s report, “advanced economies are expected to strengthen, led by the United States, although the increase is seen as broad based, underpinned by accommodative monetary policies and lower oil prices.” While the economic activity in the US may slow down in Q2, it is likely to accelerate in the second half of the year, alongside other developed countries. The Japanese liquidity injection program should lift economic growth to 1.0% this year and to 1.2% in 2016, driven by stronger consumption and exports. In Europe, liquidity injections are already starting to have a positive impact on the economic activity. The Eurozone Market PMI has accelerated these past 5 months and reached 52.0 in April, slightly down from March 2015 (at 52.2), while it stood at 50.1 in November 2014. The IMF expects global growth to pick up this year from 3.4% last year to 3.5%. This would be the strongest global growth since 2011, when it stood at 4.2%, and it could reach 3.7% next year.

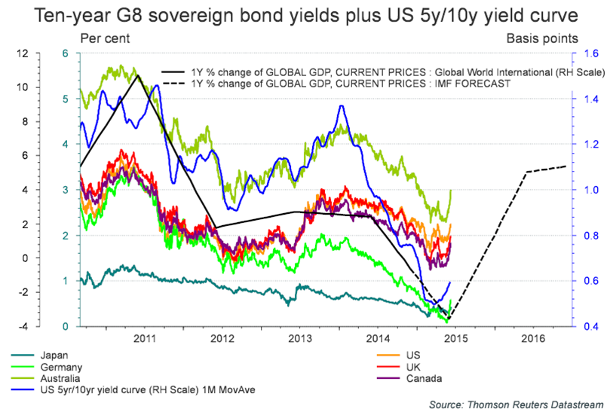

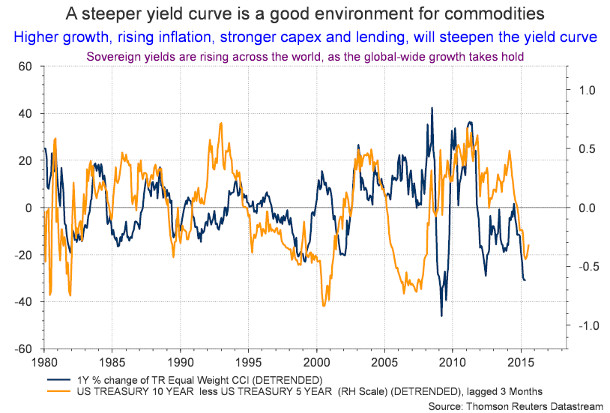

Moreover, the synchronized uplift in sovereign yields also sends the unmistakeable note that global growth is starting to recover (see the first chart of the week). US Treasury yields at the long end have been following a move higher in European sovereign yields, led by the German Bund. Last week, the 10y Bund moved close to 0.6%, while it stood at slightly less than 0.1% in mid-April due to the latest economic data, which showed that disinflationary pressure is gradually fading in Europe, and that the economic situation has improved. Reduced concerns over a Grexit also helped lift core European sovereign yields. But, it was mostly the long end that rose. Since the short-end is anchored close to zero, the rise in the 10s and 30s will essentially steepen the yield curve. The steeper yield curve is also suggesting higher economic growth and stronger inflation expectations. This is typically a good environment for hard assets. Commodities prices should therefore benefit from the environment of steeper yield curves (see the second chart of the week). Alongside stronger global growth, there is another explanation behind the rise in sovereign yields: inflation expectations are rising. Bond inflation expectation premia will therefore rise, so bond yields will increase.

The acceleration of the global economy, implied by recent economic data and the steeper yield curve across the globe, should positively contribute to stronger demand for cyclical commodities. Already US demand for petroleum products rose by 4.3% y/y in the first 4-month of the year, while Chinese crude oil imports reached a new record high level in April. This could occur while commodity producers are adjusting to the lower price structure present in most commodities and especially the cyclical commodities such as energy and base metals (see Diapason Commodities Insight Weekly, Adjustments from producers and consumers are starting to positively affect commodities prices with energy and base metals taking the lead, April 27th, 2015). The combination of slower or declining production growth and the recovery in commodity demand may contribute to a significantly tighter supply/demand balance for cyclical commodities, which remained at depressed levels. The DCI® Energy Index is still down by 42% since mid-June last year and the DCI® Base Metals Index is down by 10% since mid-September 2014. These sectors offer therefore interesting value as demand is accelerating amid supply adjustments to the low price structure.

|

Main drivers this week:

|

Commodities and Economic Highlights

Commentary by Alessandro Gelli

Disconnection between the physical and financial oil markets

The recent oil rally was triggered by growing expectations of supply adjustment, the increasingly significant geopolitical risks in the Middle East, and strong demand. However, there is a growing disconnection between the physical and the financial oil markets. Despite a tighter supply/demand balance, the physical oil market is still facing a surplus of crude oil. According to the EIA, the implied build in crude oil inventories should reach 1.7 million b/d in Q2 2015, a significant surplus. This would be above the surplus reached in Q1 2015 at 1.63 million b/d. This is implying that crude oil inventories could rise by about 155 million barrels during the current quarter, well above previous years rise in crude oil inventories for this season.

In April, the crude oil surplus may have been mitigated by the strong Chinese crude oil imports. These reached 7.4 million b/d, a new record high, up 17% m/m and 3.1% from the previous high in December 2014. However, the start of the spring refining maintenance season in China, typically between May and June, could lead to lower crude oil imports in the coming weeks.

On the other hand, crude oil production continues to grow. Weakening Chinese demand could occur whilst crude oil production from OPEC rises. According to JBC Energy, OPEC crude oil output rose to 30.9 million b/d in April 2015, up 125’000 b/d m/m, driven mainly by higher production in Saudi Arabia. Saudi crude oil production rose by 100’000 b/d m/m to 10.2 million b/d. Libyan crude oil production also increased and reached 600’000 b/d in April. This is implying that OPEC crude oil production is up by more than 1 million b/d y/y. OPEC crude oil production rose while US crude oil production continues to grow — albeit at a slower pace. This would in turn lead to a significant crude surplus compared to April, and poses a short term risk on oil prices.

Lower zinc output this year may more than offset weaker zinc demand

China, which accounts for 47% of global zinc demand, is showing signs of weaker zinc demand. Zinc inventories at the SHFE have been rising since the beginning of the year at a rapid pace. They are up by 155% since mid-January 2015 to 195’000 tonnes. Moreover, Chinese zinc imports fell by 60% in Q1 2015 to 82’000 tonnes, while exports rose to almost 40’000 tonnes, during the same period from around 400 tonnes last year. Premiums on zinc have reflected these weaknesses and have consequently fallen. Difficulties in the zinc market are mirroring the situation of the galvanised steel market, which is growing at a slower pace.

Nonetheless, despite weak demand, zinc prices have performed well these past few weeks. In April, the metal’s price rose by more than 12%, driven by ongoing concerns about supply. The zinc market should be supported this year by the closure of major mines. This year alone, MMG’s Century mine in Australia, the world’s 3rd largest zinc mine with a capacity of 500’000 metric tons per year and Vedanta’s Lisheen mine in Ireland with a capacity of 167’000 metric tons (the world’s 7th largest zinc mine), are expected to close in the second half of 2015. This follows several major closures in the past two years.

The temporary weakness in demand for zinc is therefore mitigated by the decline in zinc supply. The acceleration of the Chinese economy that Diapason expects for the second half of the year should trigger a recovery in zinc demand, while the supply situation is unlikely to change. This could lead to a major market deficit in the second half of the year, adding further upside pressure on zinc prices.

Charts of the week: Global growth, inflation expectations and sovereign yields rising together

|

|

|

|

For the full version of the Diapason Commodities and Markets Focus report, please contact info@diapason-cm.com