April 27, 2015

Adjustments from producers and consumers are starting to positively affect commodities prices with energy and base metals taking the lead

Commentary by Alessandro Gelli, Commodity Analyst

“The peak of US shale supply has arrived earlier than anticipated. […] The supply chain in the US has been decimated.”

Tony Hayward, Glencore Chairman and Genel Energy CEO, FT Commodities Global Summit, Lausanne, April 22nd, 2015

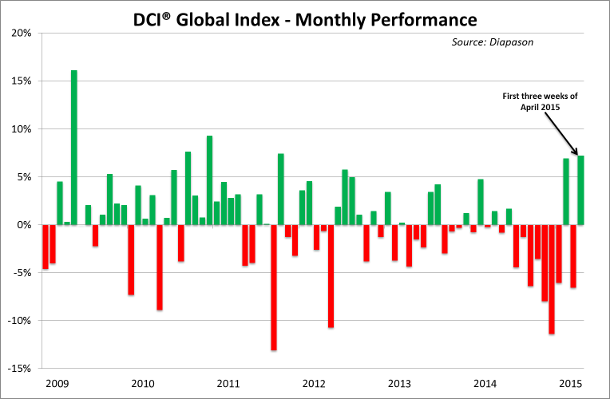

Adjustments by physical participants in the commodity markets have contributed in stopping the downward momentum in commodity prices. The DCI® Global Index even rose by more than 7% during the first three weeks of April. This monthly gain is the strongest m/m performance since October 2011 and was above February 2015’s 6.9% upward move (see the third chart of the week). This contrasts significantly with falling commodity prices between July 2014 and January 2015. The recent performance of commodity prices is therefore a clear sign of stabilisation. In April 2015, cyclical commodity sectors recovered, driven by the energy and base metals sectors — oil, lead, zinc and nickel prices made an especially good performance, up by 16%, 14%, 8%, and 6% respectively, month-to-date.

The reason for this stabilisation is the positive reaction of commodity producers and consumers to the low commodity’s price structure — commodity sectors have fallen by between 15% (base metals) and 44% (energy) since their highs of 2014. Commodity producers have also cut capex, leading to slower output growth. The adjustments mechanisms are even more rapid than usual in the oil market, thanks to the tight oil boom.

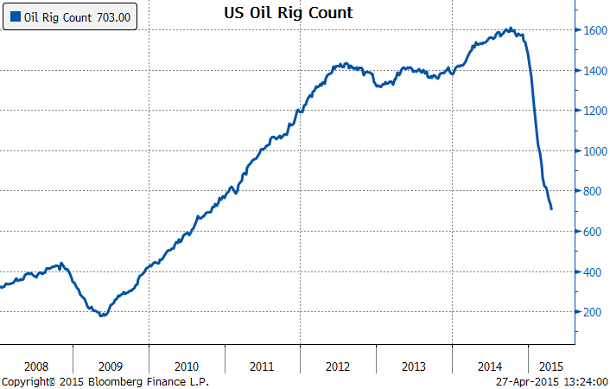

The elevated decline rate and the high cost of drilling wells should lead to a significant slow down in US crude oil production growth this year, while conventional crude oil supply would have taken maybe a year or two before adjusting to the new conditions. US crude oil production, which rose by about 1.4 million b/d y/y in 2014, is now only expected to rise by 0.5 million b/ d y/y this year due to the major reduction in capex as reflected by the rapid decline in US oil rigs count to a four-years low last week at 703, down 56% from October 2014’s peak (see the first chart of the week). Employments in the oil industry have also been cut. The massive decline in rig counts may have led to about 12’000 job losses in North Dakota in the past five months alone. The US government estimates that US crude oil production could start declining in the third quarter by 0.2 million b/d q/q, a significant change from previous years. The US is not an isolated case. Projects are also cancelled elsewhere. According to a senior executive at Saudi Aramco, the steep fall in oil prices may force the industry to cancel about $1 trillion of planned projects in the next couple of years. The stronger M&A activity such as Shell’s $70 billion purchase of BG Group in early April 2015 also indicates that the oil market is at or close to cycle’s trough.

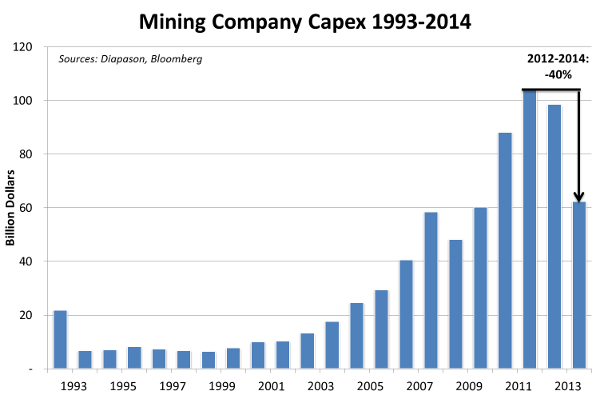

In the mining sector, adjustments from mining companies already started in 2013 when metals prices fell to low levels. Between the early 2011 and the end of 2013, the DCI® Base Metals Index fell by 35%. This prompted mining companies to reduce capex by 40% between 2012 and 2014 (see the second chart of the week). This is starting to have an impact on the supply/ demand balance. Some metals such as aluminium, zinc and nickel are expected to face a growing market deficit in the coming 2-3 years. Moreover, the recent downward in metals prices have encouraged miners to reduce further capacity. Some aluminium producers are cutting further their most expensive smelting capacities. In March, Alcoa, the world’s third aluminium producer, announced it would look at cutting or selling as much as 500’000 tons of annual smelting capacity, accounting for 14% of its total capacity. Since 2007, Alcoa reduced its smelting capacity by 1.3 million tons, which accounts for 2% of global smelting capacity in 2013.

Demand for commodities is also responding to low prices. US oil demand has recovered. According to the US EIA, US petroleum products implied demand was up by 4.3% y/y in Q1 2015, fuelled by low prices and the further rise in US jobs’ creation. Aluminium demand from the transportation sector continues to grow rapidly at the expense of steel. In February 2015, global zinc slab consumption also reached 1.1 million ton, up 8.5% y/y, while demand tends to decline seasonally because of the Chinese Lunar New Year. The combination of weaker supply growth and stronger demand is contributing to a narrower supply/demand balance. Aluminium and zinc are expected to be in a market deficit in the coming 2-3 years, while the oil market could move back into equilibrium by the end of the year due to the adjustments taking place, and all of these without any help from OPEC.

Commodities are therefore clearly benefiting from more supportive fundamentals. This is occurring on top of improving macro-economic conditions: the US Dollar has started to stabilise; growth in Europe is picking up; concerns over large emerging countries are gradually fading and the Chinese government is implementing pro-growth measures, which should contribute to stronger economic activity in the second half of the year. Commodity prices should then continue to perform especially well in this environment and especially in the second half of the year. While the asset class may experience a temporary setback in the coming weeks due to overbought conditions on some commodities, fundamentals are aligning for a significant improvement in commodities performance during H2 2015.

|

Commodities and Economic Highlights:

|

Commodities and Economic Highlights

Commentary by Alessandro Gelli

Refining maintenance season is set to peak in April; crack spreads may follow

Refineries are still in the maintenance season. Weaker petroleum products output amid slightly better demand fuelled by lower prices has contributed to keep crack spreads at elevated levels. It is interesting to note that despite significantly lower oil prices, refineries are doing relatively well as crude oil prices have fallen more than petroleum products prices. Crack spreads have increased since the beginning of the year more rapidly than what is usual for the season. Crack spreads typically rise during Q1 because of the refining maintenance season, which reduces the amount of operating capacity and reduces petroleum products production. This year, relatively strong US demand for petroleum products, the strike at some US refineries and major outages (planned and unplanned) at refineries in Venezuela have contributed to the strength in crack spreads.

According to JBC Energy, global offline refining capacity could peak in April at almost 6 million b/d (about 6.2% of global refining capacity), up from slightly under 4 million b/d in March. Refineries are likely to gradually restart activity thereafter. In May, global offline refining capacity is expected to fall to around 5 million b/d and to about 4.5 million b/d in June 2015. This is implying that crude demand is likely to gradually increase in the coming months. The combination of higher available refining capacity and elevated margins should boost crude runs and petroleum products production.

In turn, the stronger refining activity is likely to lead to lower crack spreads. Demand for petroleum products should rise but it will especially occur in the second half of the year. Gasoline demand is likely to be strong this summer during the driving season due to the improving economic conditions in the US and the lower unemployment rate. Global demand for diesel should accelerate alongside global economic growth in the second part of the year. Thus, petroleum products production may outpace demand in the coming weeks until the start of the summer driving season in mid-June. This could contribute to an important rise in petroleum products inventories in the coming weeks. Gasoline prices could especially be negatively affected by this rise as US gasoline inventories are already at record levels for the season. Thus, gasoline crack spreads are especially at risks in the coming weeks.

Zambia scales back mining royalties; mixed impact on copper miners

Last week, the new Zambian government approved a proposal to drop the January 2015 controversial rise in mining royalties to 20% and 8% for open-pit and underground mines respectively — from a 6% royalties for both operations before. The government has now set mining royalties for both open-pit and underground mines at 9%. The hike in royalties had previously triggered the halt of activity at Barrick’s Lumwana mine and prompted warnings of closures and thousands of job losses at other mines. Zambia is Africa’s second largest copper producer after the Democratic Republic of Congo, accounting for 4% of global copper production last year.

The decline in royalties reflects the growing pressure of mining companies over the Zambian government and may trigger a rebound in production in open-pit mines due to the possible restart of the Lumwana mine, and more investment at other existing copper open-pit mines. However, the impact may be limited as the royalties for open-pit mines still increased by 3% from last year level.

Furthermore, while royalties for open-pit mines have declined, they have increased for underground operations to 9% from 6% last year. This could put plans to invest in underground mines in jeopardy, which are a significantly more expensive than open-pit mines and account for the bulk of Zambian copper production. The Mufulira mine is the largest underground mine in Africa, employing 10’000 people and produces 300’000 tons of copper, accounting for almost 40% of the country’s copper production last year. Parts of the Nkana mine complex, one of the largest in Africa, are also underground operations. The rise in royalties for such operations could therefore negatively impact investment and the copper production outlook. The impact of the overall decline in royalties is therefore not entirely negative for copper prices.

Charts of the week: US Rig Count / Mining Company Capex / DCI Monthly Performance

|

|

|

|

For the full version of the Diapason Commidities and Markets Focus report, please contact info@diapason-cm.com