April 20, 2015

Eurozone recovery and its impact on commodities

Commentary by Robert Balan, Senior Market Strategist

“The eurozone economy is starting to turn the corner after years of recession and weak growth.”

Todd Buell and Paul Hannon, Eurozone data suggest ECB stimulus measures are already bearing fruit, WSJ, April 14th, 2015

The Eurozone is finally showing some signs of economic recovery. Following the steps of the US Fed, the ECB implemented a program of massive injections of liquidity and lower interest rates at the beginning of the year. These actions already started to have a positive effect on the economy, which in turn is likely to bring a supportive environment for commodities through two channels: the acceleration of the economic activity will boost European demand for commodities and will also contribute to a stronger Euro. The weakening USD/EUR rate could in turn have a positive impact on commodities prices.

The potential and impending weakness in US GDP growth compares adversely with the EUR outlook (please see the first chart of the week). Fundamental broad factors, which would reverse the Euro's downtrend, have been on a very robust uptrend for some time. In March 2015, car sales in the European Union rose by 10.6% y/y, driven by stronger sales in the Eurozone of +13.3% y/y, the strongest growth since 2010. This is implying that countries from the EU ex-Eurozone lagged countries in the Eurozone. Within the Eurozone, it was the peripheral economies which experienced the most clear recovery stories. Irish, Spanish and Portuguese car sales were up by more than 30% y/y in March 2015. Consumer confidence in Europe reached an 8-year high last month. New liquidity to the banks allowed them to make new loans. Credit standards to private enterprises are easing amid stronger corporate demand for credit. All these factors are reinforcing the likelihood of a sustained economic recovery in Europe.

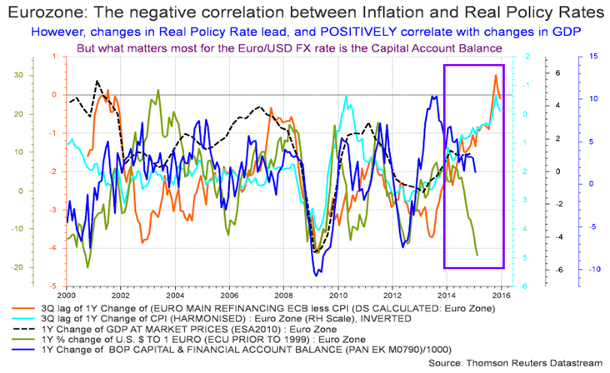

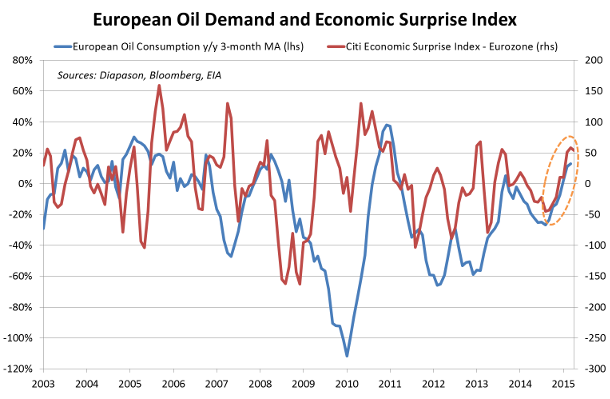

As in the US, the changes in real rates (policy rate, or the 10-year benchmark) are positively correlated with GDP growth in the common currency area after a lag. Note that the sharp decline in CPI inflation has been an important factor in bringing this about as well. The acceleration of the US economy last year also started to spill over to Europe. So for the next two quarters at least we expect growth in the Eurozone to continue to rise, perhaps even robustly. This could add to commodity demand as from Q2 this year. This would contrast with the previous 4 years. European oil demand for example has been declining by 300’000 b/d y/y on average per year between 2011 and 2014, mitigating the impact of non-OECD oil demand growth on global oil demand growth. This year, European oil demand is likely to decline by only 80’000 b/d y/y, the weakest decrease since 2010, thanks to the acceleration of the economy, implying that the region will no longer drag down — or only slightly — global oil demand growth. Preliminary data even showed a growth in European oil demand in Q1 2015 by 90’000 b/d y/y (please see the second chart of the week).

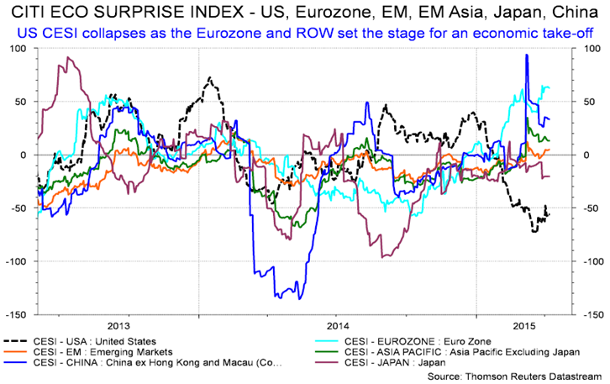

The sharp decline in the Euro also likely played a significant part in the Eurozone's expected change in fortune for the better. This of course contrasts with the negative outlook in the US during H1 2015, a situation where a strong US Dollar ironically played a significant part in degrading the US growth outlook (please see the third chart of the week). If we are to take the contrasting growth prospects as basis, then we should expect the EUR/USD exchange rate to turn around soon — its outsized recovery in the past several week tells us that the reversal has probably started. There is a wide gap between the expected growth recovery in the Eurozone and the level of the EUR/USD, which suggests to us that a significant EUR catch-up should take place over the rest of the year. That would weaken the US Dollar immensely.

Incipient growth in the Eurozone and prospects of a currency recovery also means that the area's Capital Account Balance should start improving after having deteriorated in the past five quarters. Capital inflows from European investments returning from abroad should strengthen the currency in a positive feedback loop, as growth, money supply, debt issuance and inflation factors continue to recover due to the impetus that cheap currency, low inflation and low rates have imparted on the economy in the past several quarters. Money is flowing-in back to Europe at a record pace. This year has seen the biggest inflows into European funds and assets ever recorded already. Naturally, this is increasing the pressure on the Euro to move higher.

A stronger Euro would have a positive impact for commodities. It could encourage European imports of commodities. But the most important impact is likely to be the growing downside pressure on the US Dollar. At some point, commodities should benefit from an environment of weaker US Dollar/Euro and the stronger European growth, which should positively contribute to demand for commodities.

|

Commodities and Economic Highlights:

|

Commodities and Economic Highlights

Commentary by Alessandro Gelli

Low tin prices may trigger lower production in Indonesia

Low commodity prices continue to encourage producers and consumers to adjust. Some mining companies are facing extremely low or even sometimes negative margins, forcing them to reconsider investment plans or even to reduce output. The case of the tin market is a good example of the reaction of miners to the low price environment.

Last week, the Indonesian Association of Tin Exporters announced that its members will not trade tin at prices below $17’000 a tonne, while tin prices at the LME fell to $14’5000 a tonne last week, a five year low. Indonesia is the world’s largest tin exporter but it has lost some market share as Myanmar has recently managed to increase output. Tin production in Myanmar reached 30’000 tonnes in 2014 and could grow further this year. Demand for tin has also slowed down alongside weakening global economic activity, as tin is mostly used in the electronics and chemical industries. Global tin demand is expected to rise in 2015 by 2.0% y/y, down from 3.5% y/y last year.

The declaration of Indonesian tin exporters is therefore suggesting a possible cut in production at some smelters. Last month, the association already announced that it will implement a monthly export quota of 4’500 tonnes to support prices, from about 6’000-6’5000 tonnes a month over the last year. The Association also says that 40% of members halted production and that the rest are producing at 50% or less of capacity. It may trigger a decline in Indonesian tin output to around 70’000-75’000 tonnes for 2015, down from 86’000 tonnes in 2014. This may result in a market deficit this year of about 5’000 tonnes, following an estimated surplus of 7’000 tonnes last year. In turn, this could contribute to stabilisation in tin prices.

Positive sentiment on commodities fell to extremely low levels

The positive sentiment on the commodity sector remains at an extremely low level. The DCI® Weighted Commodities Sentiment Index 3-month rolling average stood last week at 28.6, slightly up from the 24-year low reached at the beginning of February 2015 (at 26.5). In the oil sector, the positive sentiment has fallen to even lower levels than in 2009.

This was due to some views that the commodity super-cycle is coming to an end, and that the fundamental reason for the current decline in oil prices has been supply-driven — while it was demand-driven in 2008. Adjustments from the supply side traditionally take longer time than adjustments from demand, leading to the extremely low positive sentiment on the sector. But this may not be true anymore. The tight oil, which contributed to the major oil surplus, is significantly more price-elastic than conventional crude oil. US crude oil production is likely to grow by a significantly weaker amount this year due to the response of oil producers to the low oil price structure. The US Government estimates that US crude oil production could decline between May and December 2015 by about 150’000 b/d, a significant change from last year, when US crude oil production grew on average by about 100’000 b/d per month. In the coming months, investors may therefore be surprised to see these unusual rapid adjustments from the supply side.

The sentiment on commodities is also negative among commodity producers. There are a number of reasons behind this depressed sentiment: fears of hard landing in China and claims that the commodity super-cycle is over arose. These have prompted several investment banks to spread the idea that the end of the commodity secular bull cycle is a given certitude, while many structural imbalances remain. These theories quickly expanded to the media, contributing to the over-bearishness for the entire sector. On the other side of the debate, research houses such as McKinsey or Chatham House challenged these views but did not have an equivalent echo in the press.

Charts of the week: Eurozone economic activity moving higher

|

The Eurozone is showing signs of improving economic conditions. This is likely to have a positive impact on commodity prices through stronger demand and a weaker USD/EUR. |

|

|

For the full version of the Diapason Commodities and Markets Focus report, please contact info@diapason-cm.com