April 13, 2015

Signs of fading disinflationary pressure: US breakevens showing the way higher

Commentary by Robert Balan, Senior Market Strategist

“The Fed backing away from its harsh stance frees inflation expectations to rise a little bit more”

Jim Vogel, Head of interest-rate strategy at FTN Financial, March 19th, 2015

Around the globe, developed areas and developing nations from China to Brazil and Greece are all feeling the adverse effects of excessive debt and the overall softening economic activity. This decline, in turn, is being felt via lower prices for both raw materials and traded goods — that is, disinflation. This environment is typically negative for commodity prices. But it may not last long. Inflation is set to come back sooner rather than later.

The decline in commodity prices, which fell by more than 30% from the heights of June 2014, is naturally fuelling disinflation as it reduces raw materials’ cost for factories. But there are other factors related to disinflation, which are negatively affecting commodity prices. Falling inflation effects loop back further into commodity prices by increasing real rates which in turn strengthens the US Dollar and which, in a second-round effect, depresses commodity prices even further. Furthermore, the fall in the consumer price index (CPI) also result into lower demand for hard assets as a hedge against inflation. Finally, falling prices for oil and other key industrial commodities has been followed by a sharp drop in capital expenditures by commodity producers, which in turn depressed related economic activity and employment in those sectors.

The effects of sharp cutbacks in capex and of slower employment in the energy sector, in turn, negatively impacted the prices of other cyclical commodity sectors like base metals. It is worthwhile to note however that not all commodity sectors were impacted to the same degree — Gold, which is normally considered as a good hedge against inflation, has outperformed within the commodity asset class, despite the stronger US Dollar and the disinflationary conditions. But this environment should not last. Already there are signs of fading disinflation; CPI inflation will rise as from Q2 to the end of the year, in our opinion.

US inflation now seems increasingly influenced by global forces. The historical sources of inflation in the US, namely wage growth and employment costs, have been tame and should not be the prime movers of inflation this time around. That role will likely be taken over by commodity prices this year. A rise in inflation in the US will therefore be predicated on the rise in commodity prices, which we expect to see as from Q2 this year. The down trend in oil, a combination of higher supply and less demand from emerging economies, has been a disinflationary force of late. But demand is starting to stabilize, and should pick up during H2 this year, while supply growth is weakening. This could lead to the return of a balanced oil market as early as the second half of this year, supporting a rise in oil prices. A recovery in energy prices should boost US CPI inflation in 2015 as well. We also expect US Core CPI inflation, which has been rising lately, to continue ascending for the rest of the year. US CPI inflation is a pace-setter in the developed economies, so expect the rest of the globe to follow suit.

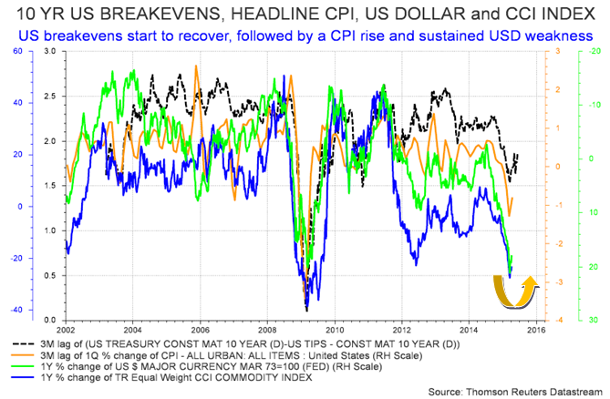

The lead US breakevens have on inflation is providing a clear signal that CPI Headline Inflation is on the way up (see chart of the week). Breakevens had recently fallen to the lowest levels since 2009, but have been rebounding over the past three months. This rise in inflation expectations has followed the Fed’s indications that it isn’t in a rush to raise interest rates. The implication is that the Fed wants to see stronger and sustainable economic growth before implementing a tighter monetary policy. This decision — or non-decision — to wait for better data is in fact bringing back worries of growth-led inflation on the assumption that the Fed will be behind the inflation curve again this time around.

When inflation rises in the US, it also lays the ground work for a weaker US Dollar as real rates fall. In turn, this has a loop-back impact on commodities through the lower US Dollar and finally through the stronger demand for inflation-hedges. The turnaround in CPI — from disinflation to modest inflation at least — would provide a more favorable and supportive environment for commodities.

|

Commodities and Economic Highlights:

|

Commodities and Economic Highlights

Commentary by Alessandro Gelli

Neglected geopolitical risks on the rise

The nuclear deal between Iran and the P5+1 countries is far from resolving all the complex issues of the Middle East. In fact, the geopolitical risks are clearly on the rise. Some major oil exporting countries are also facing growing domestic social discontent.

Saudi Arabia is under siege. Iranian proxies in Yemen and Iraq have started to take the upper hand on a domestic level and could soon start to threaten the Saudi dynasty. No wonder Saudi Arabia launched the “Operation Decisive Storm” —air attacks for now— against the Houthi rebels in Yemen, which many analysts believe that it has more to do with the power game in Saudi than in Yemen. The situation in the northern part of Iraq is also destabilizing for the region as recent gains against Daes were made directly with the help of the Iranian military forces, confirming the growing influence of Tehran over Baghdad as the US left a major vacuum when they left Iraq. The situation in North Africa is also far from stable. In Libya, persisting fights between rebel groups, which are unlikely to stop anytime soon, have started to affect oil flows, leading to rising volatility of crude oil exports. Libyan crude oil production indeed fell to 341’000 b/d in February 2015, down from 900’000 b/d in October 2014.

Further south, the political situation is also becoming unstable. The recent election of General Mohammadu Buhari in Nigeria is increasing political risks in the region. Indeed, the election of the northerner candidate may help against the Boko Haram insurrection, but the population in the south, and especially in the Niger Delta – the main oil producing region, is worried about the election of this northerner. Militant groups once again take actions against the oil infrastructure – the main source of income for the federal government. Militants in the Niger Delta were the main reason behind the decline in Nigerian crude oil production from 2.1 million b/d to 1.7 million b/d between the end of 2010 and mid-2013.

Finally, Venezuela is facing growing social discontent due to high inflation, goods shortages and political repression. This country, which produces 2.3 million b/d of crude oil, may face further social unrest. In turn, this could threaten the political stability and could cause unplanned supply disruptions like in 2002-2003 when social protest led to a halt in crude oil production of 2 million b/d for several weeks.

Limited corn price reactions following the release of the last USDA grain report

Last week, the USDA released its latest report on the US grain market. The report confirmed the fact that the US grain market is well supplied. However, the price reaction from corn futures was extremely limited, confirming limited downside potential, while supply risks are increasing.

In the corn market, the USDA only revised feed and residual usage slightly lower by 50 million bushels to 5.25 billion bushels. This a slight revision, which has contributed to a similar rise in expected ending stocks at 1.83 billion bushels for the 2014-2015 season, a significant rise from the 1.2 billion bushels of ending stocks of the 2013-2014 season. Nonetheless, US corn prices did not react significantly — down by only 0.3% during the session when the report was released on April 9th, 2015. This is due to the fact that most of the negative news have already been priced in. Corn prices are down by 26% since May 2014, and at around $3.8 per bushel, are below the average spending by farmers in the Midwest estimated at $4.6 per bushel.

This has already prompted US farmers to reduce planting intentions for the 2015-2016 season to 89.2 million acres, 1.4 million below last year and the lowest since the 2009-2010 season. Among grains, corn and wheat experienced the largest decline in US planting intentions, reflecting the poor economics of corn. The decline in planting is therefore likely to reduce US corn production by 4.1% y/y to 13.64 billion bushels (with an expected yield of 166.0 bushels/acres, down from 171 bushels/acres in the 2014-2015 season). This would imply a slight deficit as demand is estimated to grow by 0.8% y/y to 13.75 billion bushels. The 110 million bushels deficit should easily be filled by corn inventories. This should bring corn inventories down to 1.74 billion bushels, which would still be the second highest level since the 2009-2010 season. The decline in corn production and inventories is expected despite the fact that excellent crop conditions are expected.

A deterioration of the conditions could therefore lead to a more important drawdown in corn inventories and could support prices. About 22% of corn areas in the US are currently affected by a drought. If this persists, the corn market may experience a greater deficit than initially expected.

Chart of the week: Inflation expectations could rise further

|

Disinflation is gradually fading. US breakevens are suggesting that inflation may soon come back. |

|

|

For the full version of the Diapason Commodities and Markets Focus report, please contact info@diapason-cm.com