March 23, 2015

Will the Fed's surprising prudence lead to a US dollar reversal?

Commentary by Robert Balan, Senior Market Strategist

"The rise in the dollar means, effectively, that monetary policy has already been tightened. From an economy-wide perspective, an appreciation of the currency acts just like an actual rise in rates: it reduces the over-all level of demand and causes a slowdown in GDP growth. Now that this has happened, it’s no surprise that the Fed would reconsider its next move.”

John Cassidy, A Strong Dollar forces the Fed to rethink its next move, The New Yorker, March 18th, 2015

Finally, we are seeing the beginning of the end of dollar's amazing run-up of the past 5 quarters. What the Federal Reserve's FOMC minutes told the world last week was of course the key factor that stopped the dollar on its tracks, but the broad factors that would reverse the greenback's uptrend have been building up for some time.

As expected, the Fed removed the word "patience" from the official policy language which it has been using for some time now to describe its approach to timing America's first interest-rate increase in nearly a decade. That omission has been universally expected and the Fed had as well widely telegraphed its desire to get out of the constraints imposed by such language. But unexpectedly, the Fed also revised its internal projections of future growth and expectations as to the pace of its expected tightening. In effect, the Fed's revised policy statement suggests a later implementation of a policy change and a significantly shallower trajectory of the new expected path of policy tightening. Said another way, policy rates in the US cannot rise that much, that soon, and so the basis for the recent sharp appreciation of the US dollar has been an illusion. So it is necessary to rethink investors' stance on the dollar, and adjust the US dollar's valuation to the new reality. We are seeing such a re-evaluation. The Dollar's losses last week of about 1.5% will likely increase further as investors still in denial accept the greenback's de-rating. Once sentiment has turned around, the underlying fundamentals that should lead to further USD weaknesses should kick-in.

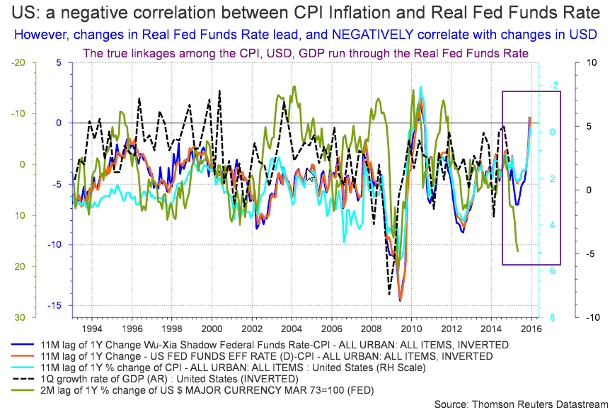

Among the most significant prime movers of the US Dollar are real interest rates, and it does not matter much if we take the real Fed Funds Rate, or the real 10-year benchmark rate as reference. But what is important in this relationship is that changes in the real rates lead the changes of the US Dollar by some time, and the relationship of the changes between the two are negative. Simply put, when the year-on-year change in real rates turn higher, the year-on-year changes in the US Dollar go lower after a lag (please see the first chart of the week). There is another correlation that is pertinent here: the relationship between changes in real rates and changes in GDP growth is positive, although with a significant lag as well. Note that the sharp decline in CPI inflation has been an important factor in bringing this about. Inflation is negatively correlated with real rates by definition, and the rate of inflation is likewise negatively correlated with GDP growth. So it is easy to infer from these linkages that a strong Dollar negatively impacts GDP growth, and vice versa. Indeed that is illustrated by the USD chart below which shows that recent episode of USD strength will likely depress US GDP growth over the next two quarters.

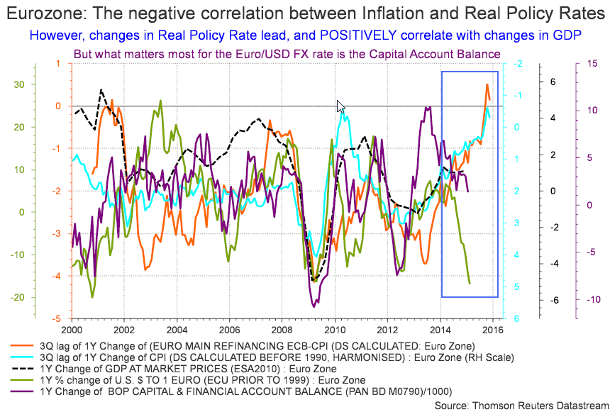

This potential (and impending) weakness in US GDP growth compares unfavourably with the Eurozone chart, which shows that fundamental broad factors which would reverse the euro's downtrend have been on a very robust uptrend for some time (please see the second chart of the week). As in the US, the changes in real rates (policy rate, or the 10-year benchmark) are also positively related with GDP growth in the common currency area. Note that the sharp decline in CPI inflation has been an important factor in bringing this about as well. So for the next two quarters at least, we expect growth in the Eurozone to continue to rise, perhaps even robustly. The sharp decline in the euro likely played a significant part in the Eurozone's expected change in fortune for the better. This of course contrasts with the negative outlook in the US during the same period, a situation where the strong US Dollar ironically played some part in degrading the US growth outlook.

If we are to take the contrasting growth prospects as a basis, then we should expect the EUR/USD exchange rate to turn around soon — it's outsized recovery late last week tells us that the reversal has probably started. There is a wide gap between the expected growth recovery in the Eurozone and the level of the EUR/USD, which suggests to us that a significant EUR catch-up should take place over the rest of the year. Acceptable growth in the Eurozone and prospects of a currency recovery also means that the area's Capital Account Balance should start improving after having deteriorated in the past five quarters. This is significant in evaluating the EUR recovery outlook as the Capital Account Balance is the single, most significant determinant of the EUR's future valuation. Said another way, capital inflows from European investments returning from abroad should strengthen the currency in a positive feedback loop, as growth and inflation factors continue to recover from the impetus that cheap currency, low inflation and low rates have imparted on the economy in the past several quarters.

The likely appreciation of the EUR mirrored by the depreciation of the US Dollar could then lead to a more favourable environment for commodities. The major US Dollar rally since July last year was an important factor behind the weakness in commodity prices. A change in perception and the beginning of a reversal in trend of the US Dollar could therefore have a positive impact on this sector.

|

Commodities and Economic Highlights:

|

Commodities and Economic Highlights

Commentary by Alessandro Gelli

After China, India is starting to build strategic reserves to take advantage of low oil prices

Low oil prices have encouraged China to boost crude oil purchases for its strategic petroleum reserves (SPR). Chinese crude oil imports have therefore grew sharply these past few months. Between August 2014 and February 2015, Chinese crude oil imports grew by 0.6 million b/d y/y on average, stronger than the 0.4 million b/d y/y rise on average in the January to July 2014 period and significantly higher than the 0.3 million b/d annual growth in 2013. The recent strong imports also occurred despite the lack of new refining capacity.

The new regulations allowing teapot refineries (small refineries operated by independent refining companies) to use crude oil instead of fuel oil may have contributed to the rise in crude oil imports. However, the main driver behind the stronger Chinese crude oil imports is the purchases of crude oil for Strategic Petroleum Reserves. According to Citi, Chinese SPR capacity should rise by about 100 million barrels this year to about 250 million barrels, giving the Chinese government more flexibility to purchase crude oil at a lower price in order to fill its SPR.

Another important oil-importing country is expected to purchase crude oil for its SPR. It is India. The government may import 8 million barrels of Iraqi crude oil to fill its first SPR. Like China, the Indian government wants to take advantage of cheap prices and the availability of Iraqi crude oil, which suits well Indian refineries on the eastern coast. India completed last month its first underground SPE in Andhra Pradesh with a capacity to hold 9.8 million barrels. Two other facilities located in the southern Karnataka state are being built and should be completed by October with a capacity of 29.3 million barrels. While the quantities are small relative to China, these new SPR sites are an additional support for global crude oil demand. Both India and China are likely to purchase crude oil for their SPR as long as they see oil prices as low until storage capacity is fully utilised.

Copper prices supported by supply disruptions in Indonesia

Copper inventories continue to increase at a rapid pace. Total exchange stocks of copper have doubled in only 3 months to 605’000 tons. Copper inventories at the SHFE reached last week 239’000 tons, up by 225% from the September 2014’s low and close to the previous record high made in March 2013 at 248’000 tons. The rise in inventories is confirming the expected surplus in the copper market. However, copper prices have remained stable throughout the month between $5650 and $5950 a metric ton. This is due to the fact that the market has already priced in the expected surplus. Copper prices have fallen by 25% between June 2014 and the end of January 2015 to around $5’400 a metric ton, the lowest level since mid-2009.

Moreover, copper prices again benefited from supply disruptions, which could in turn lead to a lower surplus this year. In February, supply disruptions in Chile and in Australia already contributed to reduce the expectations of a surplus, which was estimated at first at only 120’000 metric tons for 2015. Last Thursday, Freeport-McMoran had to halt operations at its Grasberg mine in Indonesia, the world’s second largest copper mine, as more than 50 workers blocked an access road to the site for a fourth consecutive day. Strikes are not uncommon at this mine located in the mountainous region of Papua. Exports were already disrupted last year due to a dispute between Freeport-McMoran and the Indonesian government over export duties.

While this strike could have a positive impact on copper prices in the short run, the copper market is still likely to experience a surplus. The latter may be likely weaker than initially anticipated despite rising inventories and the start of new copper mines this year. MMG is expected to complete its new Las Bambas mine in Peru in the first quarter of 2015 and expects first production of concentrate in the first quarter of 2016. At the end of last year, First Quantum Minerals began operations at its new Sentinel copper mine in Zambia with a capacity of 270’000 to 300’000 tons. Production there is expected to gradually ramp up. Grupo Mexico’s subsidiary, Southern Copper Corporation is expected to complete the expansion of its Mexican Buenavista de Cobre (+300’000 metric tons) copper mine and the Toquepala copper mines (+100’000 metric tons) in Peru. These expansions amid higher copper inventories, suggesting weak demand, are likely to prevent copper prices from rising significantly this year. Copper could underperform other base metals, especially zinc and aluminium, which are on the other hand expected to face a growing deficit.

Charts of the week: Real interest rates are pointing to a lower US Dollar

|

Real interest rates are major movers of the greenback. They are now indicating that the US Dollar may move lower. In Europe, real interest rates are also pointing to an appreciation of the Euro against the US Dollar. |

|

|

For the full version of the Diapason Commodities and Markets Focus report, please contact info@diapason-cm.com