March 16, 2015

Low grain prices are discouraging spending, increasing supply risks

Commentary by Alessandro Gelli, Commodity Analyst

"Some grain farmers already see the burden as too big. They are taking an extreme step, one not widely seen since the 1980s: breaching lease contracts, reducing how much land they will sow this spring and risking years-long legal battles with landlords.”

Jo Winterbottom and P.J. Huffstutter, Rent walkouts point to strains in U.S. farm economy, Reuters, February 23rd, 2015

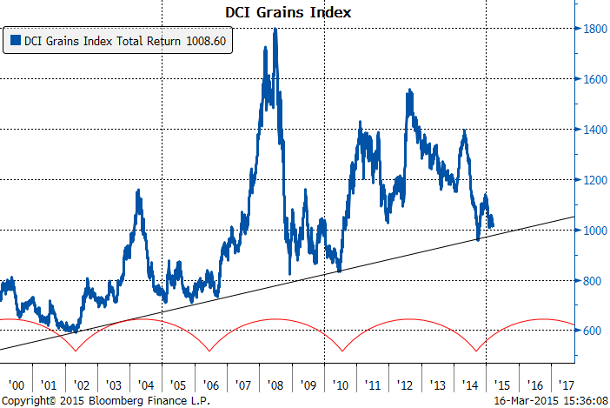

The price structure of agricultural commodities has fallen to low levels as the market discounted weak fundamentals. Last week, the DCI® Agriculture Index fell to the lowest level since 2010, as supply concerns, which pushed higher prices of agricultural commodities in February, faded. Moreover, following a pause last month, the US Dollar rally was reignited due to strong US economic data, suggesting an upcoming rise in the Fed’s benchmark rate. However, grain prices have fallen to low levels, approaching the lows made in 2008-2009, close to cost of production. This is encouraging farmers to reduce expenditures, which could in turn increase risks on yields. Moreover, investors should keep in mind that the agriculture sector may especially respond positively from any weaknesses in the US Dollar.

Grain prices have fallen below or closer to the average spending in the US. Average spending for soybean in the US Midwest is at $10.1 a bushel, while last week prices stood at around $9.8 a bushel. On the other hand, corn prices stood at around $3.8 per bushel, compared with an average spending to grow corn in the Midwest estimated at $4.6 per bushel, a difference of $0.8 per bushel. This could significantly reduce farmers’ incomes. According to the USDA, US farm income should decline by 32% y/y in 2015 to $73.6 billion. As a consequence, US farmers are likely to spend less for their crops. This should lead to a significant reduction in expenses in fertilisers and equipment, which may put yields at risk. Deere, the provider of agriculture equipment, has forecasted a decline of 17% of net sales for 2015. Low prices have therefore increased the risks on crops.

Moreover, low margins have already contributed to reduce planting for the eight major crops in the US (corn, soybeans, wheat, cotton, rice, sorghum, barley and oats) to decline to 254.6 million acres, down 3.3 million from last spring, and the lowest since 2011 (see Commodities Insight Weekly, US farmers are reducing overall planting, but soybean remains attractive, February 23rd, 2015). Some farmers had to breach lease contracts in order to reduce planting, leading to growing tensions between landlords and farmers — 40% of farmland is leased out in the Midwest Corn Belt and the grain-growing Plains. In Iowa, about 1% of the farmland leases could be breached this spring, reflecting growing financial difficulties for farmers. Indeed, breaking leases may lead to long legal battles and are typically the solution of last resort for famers in order to cut expenditures. Weak income has also forced some famers to turn to banks for loans to pay rent. Total non-real estate farm loans rose by more than 50% y/y in Q4 2014 to $112 billion, increasing the vulnerability of farmers to a possible rate hike this year.

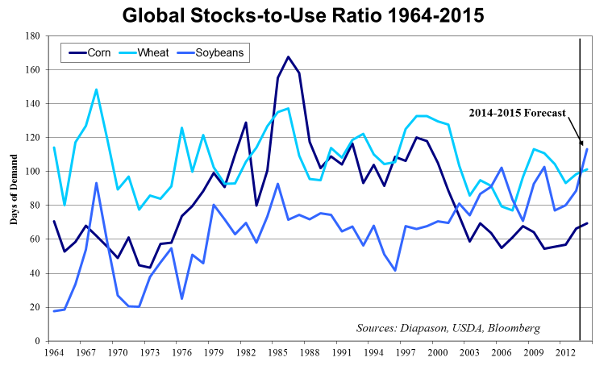

While inventories are close or at record high levels, this year’s crop could be significantly smaller than that of the previous year, as the crop is more vulnerable because of lower spending by farmers. This increases the likelihood of a deficit this season, while the surplus was already expected to be smaller than that of last year for most grains. A deficit could then contribute to reduce grain inventories, which have reached extremely high levels. According to the International Grains Council, global wheat and coarse grains inventories at the end of the 2014/15 season could rise to 431 million tons, up 29 million tons y/y and the highest level since the mid-1980s. The stocks-to-use ratio should reach 22% - the highest in 5 years. Global soybean inventories could rise by 18 million tons to a record 300 million tons.

Moreover, El Nino is back. The weather phenomenon has arrived later than initially anticipated and is currently too weak to harm crops. But it could become stronger and threaten yields as it increases the probability of drier conditions in Asia and in Africa particularly in August to October. While this could push the prices of sugar, cocoa and wheat, El Nino could bring better growing conditions in the US and in Latin America, increasing the crop outlook for soybean, corn and Arabica coffee.

Grain prices, which are looking more oversold, may have a limited downside potential as most negative factors have already been priced in (large harvest and inventories), while the market may have put less emphasis on supply risks. Some consumers have also increased purchases of US grains in order to benefit from the low prices environment despite the rise of the US Dollar. Grain prices have also proved to be resilient in face of the large upward move of the US Dollar in February. On top of that, agricultural commodities prices should benefit from the stabilisation of the US Dollar in the coming months (See Diapason Commodities Insight Weekly, The US Dollar rally losing steam; and signs of a transition towards a risk-on environment are slowly becoming more apparent, March 2nd, 2015).

|

Commodities and Economic Highlights:

|

Commodities and Economic Highlights

Commentary by Alessandro Gelli

Low oil prices are increasing political risks

The decline in oil prices had a major impact on the oil industry. Companies are cutting expenditures significantly. According to Chevron, lower oil prices triggered a 40% reduction to US upstream investment. The number of oil rigs in the US is also down by 43% since mid-October. This has contributed to reduce the supply outlook by a significant amount. The US government now expects US crude oil production to reach 9.3 million b/d in December 2015, down by 0.5 million b/d from its forecast made in October 2014. US crude oil production could rise slightly to 9.4 million b/d by May 2015, before falling in the second half of the year. US crude oil production is expected to grow by 0.7 million b/d y/y this year (the growth is concentrated in the first part of the year), compared with a 1.2 million b/d growth last year, reflecting the adjustments of the US oil industry.

The decline in oil prices has also affected companies outside the US. Ambitious projects are being delayed or cancelled. Two weeks ago, Statoil decided to delay again the final decision about whether to proceed or not with the Johan Castberg oil discovery inside the Arctic Circle.

Oil companies are not the only entities affected, governments of oil exporting countries are also severely affected by the decline in oil income. In particular, some large OPEC countries where the oil income accounts for the bulk of the government’s budget are facing growing difficulties to make payments. Last week, Reuters reported that Iraq was building up debts to the oil companies that are developing oil fields. Venezuelan government, which faced cash issues when oil prices stood above $ 100 per barrel, is having a hard time as 95% of its export revenues come from oil. The decline in oil prices could lead to a decline of $40 billion in export sales, while the central bank has less than $20 billion in reserves. The government is likely to run a deficit equivalent to 10% of GDP, amid inflation running at 60% and a likely contraction of the economy by as much as 7% this year. These factors have pushed higher the price of credit-default swaps on Venezuelan debt, which are now suggesting a 60% chance of default in the next year and a 90% probability in the next five years. This deterioration of the economic situation is also increasing the likelihood of more important social unrest — Maduro’s popularity fell to 22% in January 2015 a drop of nearly 29 percentage points since April 2013 when he won the presidency. In turn, this increases the risk of unplanned supply disruptions in this country which produces about 2.5 million b/d. At the end of 2002, strikes aimed against Chavez led to a decline of production by more than 2 million b/d during two months, before output gradually recovered.

The political situation is also at risk in Nigeria. Security issues have forced to postpone the presidential elections until 28 March instead of mid-February. Most of the violence has been concentrated in the northern part of the country. But the election of the opposition leader Muhammadu Buhari, a northerner and a retired general, may succeed in ending the violent Boko Haram insurgency but his elections may create more tensions in the oil-producing Niger Delta region. During the presidency of Goodluck Jonathan, the situation in the Niger Delta has eased significantly as he comes from the region. The non-re-election of the incumbent president may therefore increase the risks that Niger Delta militants take up arms again. Lower oil prices won’t help either — lower oil income redistribution may act as a trigger to a southern insurgency. The decline in oil prices has therefore increased risk of supply disruptions.

Aluminium producers are cutting capacity further amid weaker premiums

Aluminium prices have fallen below $1800 per tons, reducing the positive impact of lower energy prices on margins of aluminium producers. This is forcing some companies to reduce capacity further. Two weeks ago, Alcoa announced that it may cut an additional 0.5 million tons of production capacity on top of the 1.7 million tons reduction in capacity since 2007. This suggests that the aluminium industry is still trying to cut costs.

The recent decline in aluminium premium (the price paid on top of LME prices for immediate delivery of the metal) may trigger another wave of cost cutting as it affects aluminium producers’ margins. The fall in premium contrasts with the almost non-stop rise for the past 18 months. This was caused by long queues (up to 2 years) to get aluminium out of the LME warehouses — the queue at the LME Vlissingen warehouse in Holland stood at 586 days at the end of December 2014. The decline in premium is caused by the weakness in the Asian aluminium market. Indeed, while most aluminium producers were planning to reduce capacity, Chinese companies increased capacity, encouraged by government’s power subsidies.

According to the International Aluminium Institute, production of the metal outside of China reached 24.4 million tons in 2014, down 0.7% y/y and the third consecutive year of falling output as aluminium producers are responding to lower prices. On the other hand, Chinese aluminium production rose by 7.7% y/y to 24.4 million tons. The rise in Chinese aluminium output pushed higher its exports, flooding the Asian market. This has reduced the need for this region to purchase aluminium from more distant locations such as the Middle East. According to Reuters, Japanese stocks of aluminium at ports have recently reached 449’800 tons, a record high, while neighbouring countries have also elevated aluminium inventories. This contributes to lower premiums in Asia and in the rest of the world. Like with Alcoa, the decline in premium could lead to further cut in production capacity outside China, mitigating supply growth in China. But the major factor behind the likely tighter aluminium market is likely to be the strong demand growth. The use of aluminium in the automobile industry is rising rapidly, leading to expectations of a market deficit in 2016 and beyond.

Charts of the week: Agricultural prices fell to low levels / Global stocks-to-use

|

Agricultural prices fell to low levels, discouraging farmers’ spending. This is increasing supply risks. A weaker crop could lead to a lower global stocks-to-use ratio in the grains sector. |

|

|

For the full version of the Diapason Commodities and Markets Focus report, please contact info@diapason-cm.com