February 9, 2015

Demand for safe-haven assets remains firm amid negative yields, a positive environment for gold

Commentary by Robert Balan, Senior Market Strategist

"Normally, gold has an inverse relationship with the dollar, the currency in which it is priced. […] But that relationship can be reversed in times of stress.”

Biman Mukherji, Gold, Dollar Buck Trend to Shine Together, WSJ, February 4th, 2015

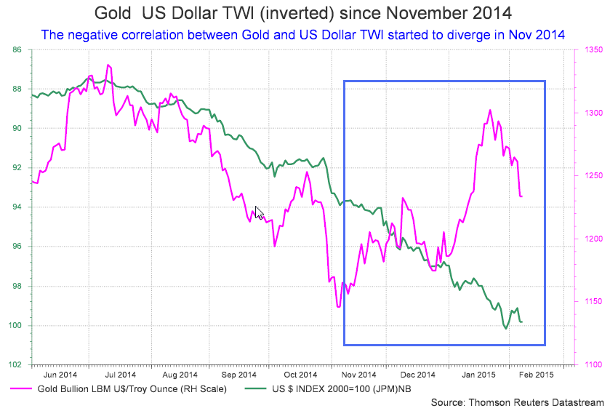

Within the commodity sector, gold and silver have been the best performers, up by about 5% and 8% respectively year-to-date. In fact, the rise and the outperformance of precious metals over other commodities already started in early November 2014, alongside a stronger US Dollar. This unusual positive correlation between precious metals and the US Dollar is the consequence of the risk-off environment. This is also suggested by the relative pricing of other assets. Gold is likely to perform especially well in this risk-off environment as other typical safe-haven assets have now negative yields. The continuation of the risk-off environment on the short term should still be supportive for gold.

The classic negative relationship between gold and the US Dollar has undergone a change since November 2014. Gold and the US currency have showed a positive correlation rather than the normal strong negative relationship since that time. So the question arises: will the negative correlation between gold prices and the US Dollar continue to diverge for long? Most of the time there is a negative relationship between the price of gold and the US Dollar. Is this another period which would see a prolonged positive correlation?

The answer is not straightforward because the US Dollar is not the only significant determinant of gold price movements. In fact we suspect that one of the reasons for their directional convergence in the past weeks was due to the safe-haven properties of both gold and the US Dollar in the light of potential dislocations emanating from the Eurozone/Greece debt situation, fading global growth prospects, emerging markets risks and more important disinflation pressures following the decline in energy prices. These factors have contributed to a risk-off environment when not only Gold and the US Dollar but also defensive equity and commodity sectors tend to outperform the more cyclical sectors. Precious metals and agriculture sectors outperformed the energy and base metals sectors. The DCI® Precious Metals Index rose by 8% since early November, while the DCI® Base Metals Index fell by 10% during the same period. Developed countries equities have also outperformed emerging markets equities since mid-October 2014. Since then, the MSCI Select OECD Index rose by almost 8%, while the MSCI EM Index increased by less than 1%, reflecting the risk-off environment. The 20-day moving average of the VIX Index also reached 19.2 last week, the highest level since July 2012 when the European debt crisis was still a major concern for financial markets.

Moreover, worldwide monetary easing have been relatively important these past few months. These almost synchronised actions are a reaction function to this risk-off environment. During these past 3 months, several central banks in both developed and emerging economies have either cut in interest rates or/and announced major plans to boost liquidity (ECB, PBoC, Royal Bank of Australia, Bank of Canada, Reserve Bank of India, Swiss National Bank, DanmarksNationalBank). These factors explain why both gold and the US Dollar rose together these past few months.

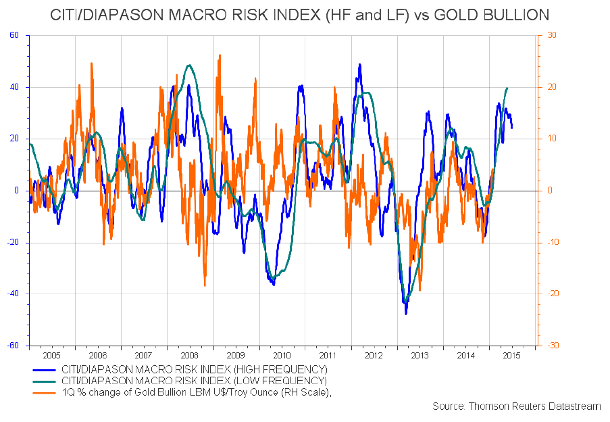

By definition, market conditions like the one prevailing now does not last very long, so we suspect that the positive correlation between gold and the US dollar may just last for weeks. That is how investors often associate gold with the notion of a safe haven. We define safe-haven assets to be assets that people would like to invest in when uncertainty and fear increases. These assets are said to preserve their values in times of turmoil or declines in aggregate growth. The negative-beta asset hypothesis (“gold goes up when everything else going down”) is closely related to the safe-haven hypothesis. We define negative-beta assets to be those whose returns are negatively correlated with macroeconomic performance.

Demand for gold as a safe-haven asset has also benefited from negative yields on other safe-have assets — resulting from the recent cuts in interest rates by central banks. Lower yields typically help gold – mechanically, declining yields tend to push up the price of gold as it lowers the cost of carry. This negative correlation becomes even more compelling when government bond yields become negative, as is now the case for the 10yr yield in Switzerland and in the short-dated government bonds of many countries in Europe. Even Nestlé's corporate bonds started to trade with negative yields last week, indicating strong demand for safe-haven assets. This means that investors are effectively paying governments (or large Swiss companies like Nestlé) for the privilege of holding their securities. This condition is incrementally favourable for gold – a zero yield is better than a negative yield. Moreover, there is no counterparty risk in holding physical gold.

The risk-off environment could last several more weeks as uncertainties related to Greece are likely to remain high, and signs of improved global economic conditions could take some time to appear. Furthermore, the Lunar new year holiday, which should start next week, is de facto contributing to the seasonal slowdown in the Chinese economy, preventing the data for January and February from providing an insightful reflection of the economic activity. Finally, the Citi/Diapason Macro Risk index (please see charts of the week) is signalling a potential short term uptick in macro risk. This period of uncertainty could fuel further demand for safe-haven assets. In turn, gold price could also be supported by the fact that some other safe-haven assets have now negative yields. Rising gold prices are, however, also indicating that we could be at a terminal stage of the risk-off environment that started mid-last year.

|

Commodities and Economic Highlights:

|

Commodities and Economic Highlights

Commentary by Alessandro Gelli

No fundamental justifications for the recent oil rally

Between Friday January 30th and Tuesday February 3rd 2015, oil prices rose by almost 20%. The following day (Wednesday February 4th) oil prices fell by about 9%. The volatility of oil prices hence rose significantly. The CBOE Crude oil volatility index has indeed reached 62.7 last week, up from less than 20 in August 2014. This is the highest level since March 2009.

The upward move in oil prices was first triggered by the release of the Baker Hughes’ rig count report on Friday, which showed a significant decline in US oil rigs count. They indeed dropped by 94 over the week, the largest weekly decline since at least 1987, when the data started. The number of US oil rig fell to 1223, the lowest level since January 2012. This had a positive impact on oil prices as it increased the likelihood of weaker US production growth this year.

Nonetheless, the rebound in oil prices was premature. The oil market is still facing important downside pressure. US oil production is still likely to grow on a month-on-month basis until May 2015 according to the last STEO report from the US government. The global oil market is also expected to remain in a 1.0-1.5 million b/d surplus until at least the start of the second half of the year. Furthermore, the refining maintenance season has just recently started in the US. These factors contributed to the significant rise in crude oil inventories in the US these past weeks. US crude oil inventories have been increasing at a faster than normal pace and have reached 413 million barrels, a record high level and up 15.4% y/y. And inventories are likely to increase even further as the oil surplus is not going to disappear any time soon, and the refining maintenance season will reduce crude demand.

However, the contango on oil futures and especially on Brent futures has recently narrowed to very low levels to make floating storage profitable. The contango is hence needed to widen to accommodate the oil surplus. This is likely to translate into the underperformance of the front maturities against more distant ones.

Wheat outperformance could continue on stronger demand and lower Russian exports

Wheat prices have recently recovered and outperformed other agricultural commodities. Following a 25% decline in prices between mid-December and the beginning of last week to $5.0 per bushel, US wheat prices rose by almost 7%, driven by a combination of stronger demand and poor conditions of the winter wheat crop in Russia.

Demand for wheat appears strong following several announcements these past few days. Japan recently bought 112’920 metric tons of US and Canadian milling wheat. Egypt’s state grain buyer purchased 300’000 metric tons of French and Romanian wheat in tender on February 3rd. Furthermore in the Middle East, Saudi Arabia and Iraq bought 690’000 and 50’000 metric tons of wheat, respectively. The timing of the purchases indicates that low wheat prices have encouraged demand. Further purchases could occur at the current price level.

These announcements occurred while the conditions of the winter wheat crop in Russia have deteriorated. According to the Russian Agriculture Ministry, the crops are in bad condition on 21% of planted area (3.5 million hectares). If the weather remains dry, these crops may die. This could then lead to downward revision of the Russian winter wheat harvest for the 2015-16 season. Wheat prices were also supported by the implementation of further export restrictions in Russia. The government imposed a new tax on wheat export, for the period of February to June 2015. This was implemented in order to keep the domestic market well supplied as the collapse of the rubble is encouraging exports at the expense of local demand. The tax added about Euro 35 per metric ton on the price of wheat, according to Archer Daniels Midland, the grain trader. The price of European milling wheat futures stood at around Euro 187 per metric ton last week. The tax is likely to lead to lower Russian wheat exports in the coming weeks. In turn, the lower Russian wheat exports could have a positive impact on the wheat performance especially within the grains sector. Corn and soybean remain under important downside pressure due to the expected major crops in South America. Consequently, wheat could continue to outperform corn and soybean in the coming weeks.

Charts of the week: Gold and the US TWI / Macro risk and Gold

|

Since November 2014, gold has been moving together with the US Dollar due to the strong demand for safe-haven assets. Further macro uncertainties could fuel higher demand for safe-haven assets such as gold. |

|

|

For the full version of the Diapason Capital Markets report, please contact info@diapason-cm.com