February 2, 2015

2015 commodity outlook: Base metals, waiting for the return of the risk-on environment and the acceleration of the Chinese economy

Commentary by Robert Balan, Senior Market Strategist and Alessandro Gelli, Commodity Analyst

"Our forecasts for the next five years show that across all of the base metals – aluminium, copper, lead, nickel and zinc – growth in demand will come predominately from China.”

Helen Matthews, head of base metals market research at Wood Mackenzie, October 18th, 2013

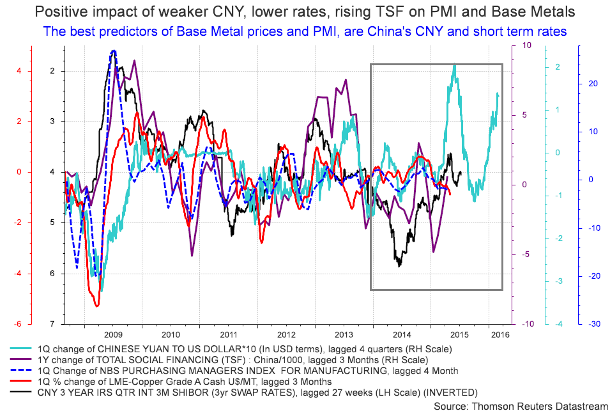

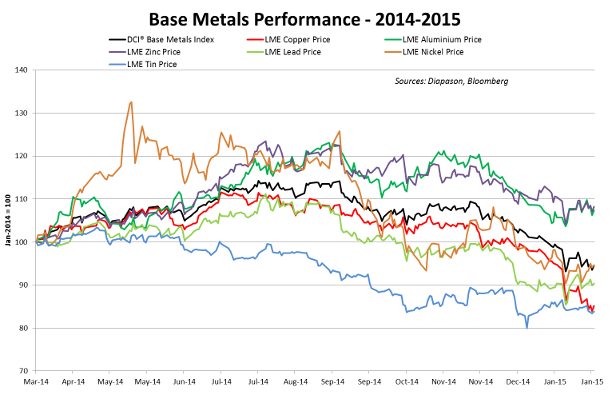

Base metals prices have recently been negatively affected by persisting concerns about the slower Chinese economic growth and disinflationary pressures caused by the large decline in energy prices. In fact, the downward move in base metals, which are cyclical commodities, coincided with the risk-off environment that was initiated in the middle of last year when, both, energy prices and cyclical equity sectors started to underperform defensive sectors amid a major rise in the US Dollar and the decline in inflation expectation.

The fall in oil prices has naturally had a negative impact on base metals prices as it lowers their cost of production. For example, power costs typically account for 40% of total costs to produce aluminium. The decline in oil prices had therefore an especially important impact on aluminium prices. However, aluminium and zinc remain the best performing base metals since the sector’s low of March 2014 (see charts of the week). Since then, both zinc and aluminium are up by about 8% while other base metals have fallen by between 6% and 17%. Stronger fundamentals contributed to this outperformance. Indeed, amid rapidly declining inventories, the zinc and the aluminium markets are in a structural deficit. Low prices these past 3-4 years have contributed to lower investments in new mines or smelting capacity, while demand growth is expected to continue to expand.

The transportation sector is using more and more aluminium and contributed to bringing the aluminium market into deficit, as suggested by the significant decline in aluminium inventories at major exchanges which have fallen by 26% since the end of April 2014 to 4.2 million metric tons, the lowest level since May 2009. However, although aluminium prices remain below the marginal cost of production estimated at $2300 per metric ton (before the 60% decline in oil prices), about 2.4 million metric tons of idle smelting capacity, accounting for 5% of global aluminium production last year, could restart in reaction to higher aluminium prices, capping the upside price potential in the short run as presented in the Commodities Insight Weekly of January 12th, 2015 “Aluminium could regain its position of leader within base metals with an oil price rebound”. The recovery in oil prices is therefore required to see a more sustained upward move in aluminium prices as it would also lift the breakeven price for producers.

Zinc inventories at the LME have started to decline earlier than aluminium, and since December 2012 have fallen by 49% to 631’000 metric tons the lowest level since December 2010. Zinc inventories could decline further in the coming years as some major zinc mines are expected to shutdown. This year alone, MMG’s Century mine in Australia, the world’s 3rd largest zinc mine with a capacity of 500’000 metric tons per year and Vedanta’s Lisheen mine in Ireland with a capacity of 167’000 metric tons (the world’s 7th largest zinc mine), are expected to close in the second half of 2015. This followed several major closures in the past two years. Thus, despite prices being above the marginal cost of production estimated at $1525 per metric ton, zinc mined supply growth is likely to lag demand growth, leading to a growing deficit in the coming 3 years.

Contrasting with other base metals, the copper market is expected to move into a surplus this year as last year’s delayed supply should come on-stream on top of already planned expansions and new mines. But like in 2014, the surplus is indeed likely to be smaller than initially expected due to possible supply disruptions and strong demand from China. Moreover, copper prices need to remain at an elevated level due to growing costs. Energy costs have declined. However, labour and water costs continue to rise. While the marginal cash cost of production is estimated at $4’900 per metric ton, the average incentive price to build a new copper mine is estimated at around $6’300 per metric ton.

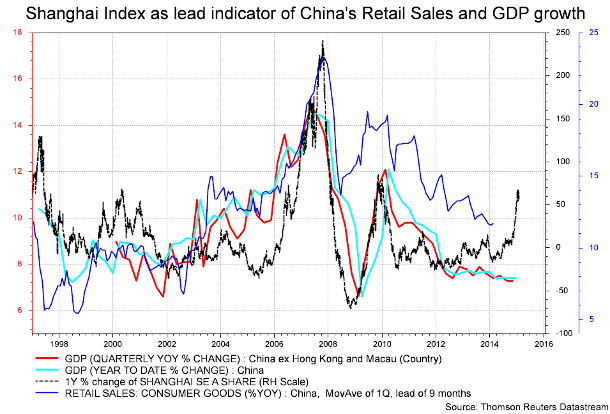

The strong demand growth expected not only in copper, zinc and aluminium but also in other base metals is likely to come from the acceleration of the Chinese economy. China, which accounts for more than 45% of global base metals consumption, has slipped from the limelight in the past months, as growth and activity remain flat. The government's desire to normalize from an infrastructure-led growth to one driven by consumption, but tempered by its desire to avoid major disruptions to employment, has produced a sideways trend to GDP in the past quarters. Whether or not this trend will continue for some time really depends on what policies will be adopted for the near-term. One thing we feel certain about: there will be no hard-landing for China. This was confirmed by the recent economic data, which were in line or only slightly weaker than expected. Industrial production growth rebounded and reached 7.9%, a 3-month high as the deceleration in fixed asset investment eased in Q4 and exports rebounded (exports growth rebounded to 9.7% y/y in December 2014). Overall, the better December data contributed to stronger Q4 GDP growth of 7.3% yoy, and full-year growth of 7.4% in 2014, close to the government’s target of 7.5%, and higher than market expectations of 7.3%.

Moreover, despite a continued deceleration in property investment, manufacturing and infrastructure investment held up in December. This could indicate a revival in economic activity following infrastructure project approvals in Q4 last year, and credit loosening by the PBoC towards the 2014 year-end. The decline in oil prices, and the resilient external demand particularly from the US, have also reduced downside risks of a weak growth for China in H1 2015. The factors above, plus the lack of visible improvement in the housing market up to present, should encourage a steadier pace of monetary easing and a neutral or looser fiscal stance. Loose monetary policy could positively affect the economic activity and hence could boost the real estate sector, which is a key sector for most base metals demand.

Chinese growth will likely hold up, even rise in 2015, as recent fiscal and monetary stimulative measures get further traction. Major policies which will deal with infrastructure investments may have to wait until March, however, when the government convenes to chart the desired course for the economy in the next five years. Until then, base metals may continue like the energy sector to be negatively affected by the risk-off environment. Further downward move in base metals prices would therefore offer interesting entry opportunities to benefit from the likely return in Q2 of the risk-on environment and more concrete signs of the acceleration of the Chinese economy. Base metals are indeed likely to anticipate the acceleration of the Chinese economic activity in the second half of 2015 and could follow any recovery in energy prices, and a weaker US Dollar.

|

Commodities and Economic Highlights:

|

Commodities and Economic Highlights

Commentary by Alessandro Gelli

Non-OPEC ex-USA oil producers also affected by low oil prices

US oil companies have made important cuts in expenditures in response to lower oil prices. Harold Hamm from Continental Resources, the largest oil producers in North Dakota, decided to cut expenditures by 41% for 2015 and expects other drilling companies to cut spending by 50% to 70%. But US oil companies are not the only ones affected by the significant decline in oil prices.

Oil companies operating in other non-OPEC countries are also facing significant pressure, forcing them to cut investment. According to Wood Mackenzie, investment in oil production in Norway could decline by 25% due to low prices. Moreover, even before the decline in oil prices, more than a dozen projects in the country were hit by cost cutting and development delays in the last 18 months, indicating already low profitability when oil prices stood around $100 per barrel. This is likely to have an impact on supply growth in the medium term.

A short term impact of lower investment can be the larger decline rate at existing oil fields in non-OPEC countries ex-USA. Indeed, oil companies typically invest in mature oilfields in order to extend its lifespan, which contributes to reduce the natural decline rates. According to the International Energy Agency (IEA) in 2007, the observed production-weighted average decline rate worldwide was estimated at 6.7% — this figure is likely to have increase with the growing share of tight oil. The IEA estimated that without field interventions the decline rate increases to 9%. At Davos, Patrick Bouyanné, Total’s CEO, said that “there is a natural decline of 5% a year from existing fields around the world. That means by 2030 more than half of the existing global oil production will disappear. There is an enormous amount of money that needs to be invested to get another 50 million barrels per day of new production.” Thus, current cut in expenditures could gradually start to affect mature oilfields especially in the North Sea and in Russia, which are likely to face a more important decline rate in the short run (could be useful to say why). This could contribute to tighten the supply/demand balance on top of the adjustments already in motion in the US. Furthermore, future investment in new oilfields required to offset the natural decline of oil fields may not be sufficient to meet future oil demand growth, increasing the likelihood of a major oil shortage in the future if oil prices remain at current levels.

The Brent-WTI spread widened on lower refining activity and close arbitrage

The Brent premium over WTI crude oil price narrowed below $1 per barrel, the lowest level since mid-July 2013. This was an important move as since mid-October 2014 the spread traded between $2.5 and $6 per barrel. The spread narrowed due to the start of the expanded Seaway pipeline from Cushing to Houston. The pipeline capacity increased last year by 450’000 b/d to 850’000 b/d. This massive rise hence contributed to reduce the glut on the US Midwest, adding upside pressure on WTI. At the same time, the rising availability of cheap Midwestern crude on the US Gulf Coast discouraged the use by refiners of more expensive crude oil of the same quality. This in turn added downside pressure on light sweet Atlantic crude oil, hence the narrow Brent-WTI spread. The spread also narrowed as refining activity reached elevated levels in the US at the end of 2014, encouraged by elevated margins.

The spread reached unsustainable levels, however, as it fell below $1 per barrel in mid–January 2015. The decline of the Brent premium encouraged US refiners on the East Coast and on the US Gulf Coast to purchase Atlantic crude oil at the expense of domestically produced crude oil. Demand for Midwestern crude oil also declined further as some refineries on the US Gulf Coast started to perform seasonal maintenance work. Crude runs in this region indeed fell by 786’000 b/d (or 9%) since the beginning of the year as refiners on the Gulf Coast start the maintenance season ahead of other regions. Therefore weaker than usual crude oil demand contributed to an important build in crude oil inventories. On the Gulf Coast, they rose by 4% since the beginning of the year to 202 million barrels, a record for this time of the year. In the Midwest, crude oil inventories increased by almost 10% to 120 million barrels, a new record high level. Inventories at Cushing, Oklahoma, the delivery point of NYMEX Light Sweet Crude Oil futures, also expanded by 105% since early October 2014.

This contributed to adding significant downside pressure on WTI prices especially relative to Brent. The more rapid than normal (for the season) build in crude oil inventories also reflected the global oil surplus. The refining maintenance season is likely to continue on the Gulf Coast and should start in other US regions by the end of February. This could contribute to a further rise in US crude oil inventories and could therefore add more downside pressure on oil prices. As crude oil inventories are already at an elevated level, concerns about storage capacity could soon start to arise. This should lead to the underperformance especially of front maturities as the contango would need to increase in order to encourage more expensive type of storage such as floating storage.

Charts of the week: China growth factors / Shanghai Stock Index and the Chinese GDP / Base Metals Performance

|

Chinese growth factors and the Shanghai Composite Stock Index are indicating stronger economic activity, which could have a positive impact on the demand for base metals. |

|

|

For the full version of the Diapason Capital Markets report, please contact info@diapason-cm.com