January 26, 2015

2015 commodity outlook: when could oil prices anticipate a more balanced market?

Commentary by Alessandro Gelli, Commodity Analyst

“When the price drops below the all-in cost of production, and is expected to stay there, that discourages further exploration and investment. Indeed, in recent weeks, a number of oil companies have announced that they are scaling back investment. This is important, since new investment is needed to offset naturally occurring declines in production in existing fields.

[…] with current expectations for global economic growth, the demand for oil will continue to rise - and the world is likely to require some higher-cost oil to satisfy that demand. Barring major changes to technology or a large shock to the global outlook, today’s oil prices are unlikely to be high enough to balance supply and demand.”

Timothy Lane, Deputy Governor of the Bank of Canada, January 13th, 2015

The significant decline in oil prices has triggered a major response from the oil industry. Oil companies are announcing large reduction in expenditures in reaction to the low oil price structure. This is a normal market behaviour. In turn, this is likely to have an impact on global crude oil supply growth, especially in the second half of 2015. The supply/demand balance could even move back to equilibrium as soon as by the end of this year. However, oil prices may, as often, react before the actual equilibrium is reached. The oil market is not yet balanced and market participants are looking for a confirmation of supply and demand adjustments, which is needed for a recovery in oil prices.

The oil market is currently in a surplus estimated at 1.0-1.5 million b/d, which accounts for only 1.1% to 1.6% of global oil supply. The surplus could in fact rapidly disappear if a major supply disruption occurs, which is now more likely to occur in some OPEC countries. Indeed, the sharp decline in oil income in countries such as Venezuela or Nigeria could trigger more political and social instability. The decline of half Venezuela’s crude oil production (1.2 million b/d) would be sufficient to bring the entire oil market close to equilibrium.

But the most likely scenario in the short run is the adjustment of supply from non-OPEC countries. The 60% decline in oil prices has triggered a wave of large cuts in expenditures in the oil industry. Major announcements have been recently made. Schlumberger has announced it will slash 9’000 jobs, or 7% of its workforce. Baker Hughes also plans to axe 7’000 jobs. BHP announced a cut in shale drilling rigs by 40%. It is interesting to note how fast companies have reacted to the decline in oil prices because of the OPEC rhetoric, leaving adjustments to non-OPEC producers. Indeed, such massive cut in expenditures and layoffs occur typically with a more important delay due to the fact that oil companies typically hedge part of their production for the year and because conventional oil projects often take several years to be built. Another reflection of the rapid response by the US oil industry is the significant decline in the number of US oil rigs. Since mid-October 2014, these has fallen by 18% to the lowest level since January 2013. This was the most rapid 3-month decline since at least 1987, when this set of data started to be published.

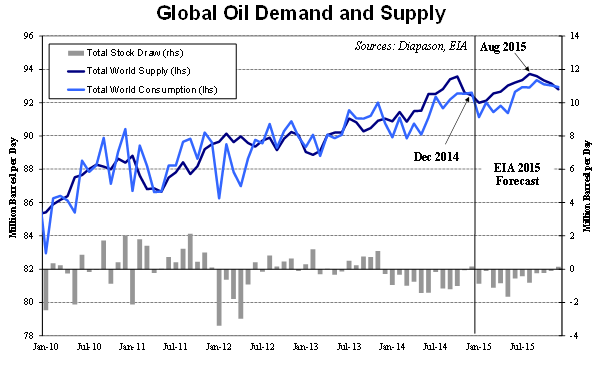

The impact of the rapid expenditures cut, layoffs and reduction in oil rig counts could start to have an impact on US crude oil production this year. Indeed, as detailed in the Commodities Insight Weekly of January 5th “Oil outlook: Supply response amid stronger demand growth”, US tight oil requires an elevated oil price to be exploited and is significantly more price elastic than conventional crude oil. Indeed, the initial large flow rates followed by very steep decline rates. Oil companies hence need to drill continuously in order to mitigate the decline at existing wells. In North Dakota, about 2’000 wells are required to be drilled this year only to offset the decline of producing wells. This is why the government of North Dakota estimates that 130 rigs are required just to maintain crude oil production flat. The number of rigs in North Dakota fell last week to 147, down from 189 in early October (-22%). The US Energy Information Administration (EIA) has estimated that these reactions from oil companies could contribute to a decline in US oil production in the second half of this year. The EIA estimates that the US oil production could peak in May 2015 at 9.5 million b/d and then decline by 200’000 b/d until December 2015. This should also have an impact on global oil supply as the EIA estimates that global oil production could start falling from August until the end of the year. Moreover, oil demand could grow at a faster pace. In 2015, global oil demand growth could reach 1.1 million b/d y/y, up from 0.7 million b/d y/y last year. This would also contribute to the reduction of the oil surplus in the second half of 2015.

Meanwhile, oil prices could still face short term downside pressure as inventories are likely to rise in the coming weeks, also encouraged by the significantly wider contango on Brent and WTI futures. Nonetheless, the downside potential appears limited at current levels. Oil prices are close to cash operating costs for some of the most expensive producers in Canada and in the US. About 1.1 million b/d in North America needs a barrel of Brent above $40 to break even on the cash operating cost. Lower oil prices than this level would hence greatly increase the risk of shut-ins. Moreover, the oil-to-gold ratio (using Brent) fell to the lowest level since the Asian crisis in 1998-99, below the low levels reached during the financial crisis in 2008, indicating risk-off behaviours from the market participants.

Growing evidence of the supply discipline and more concrete signs of stronger global economic activity are likely to trigger a recovery in oil prices before the equilibrium is reached due to the anticipative nature of the oil market. These signs are likely to become more important in Q2 2015. On the bright side, The Economist recently published a cover on oil, which from a contrarian perspective is usually a very encouraging sign, implying that the downtrend is now at a matured stage.

|

Commodities and Economic Highlights:

|

Commodities and Economic Highlights

Commentary by Alessandro Gelli

Saudi succession increases uncertainty in the oil market

The death of King Abdullah of Saudi Arabia has contributed to more important worries over the political situation in Saudi Arabia.

The oil market is naturally affected by the political uncertainty in Saudi Arabia as the country is (still) the world’s largest oil producer. The Kingdom, which produces about 10 million b/d of crude oil and 1.8 million b/d of natural gas liquids (NGLs) has also around 2.5 million b/d of spare producing capacity. This allows the country to adjust its production in case of a major supply disruption elsewhere. This is why Saudi Arabia is often called the central bank of the oil market. However, since September 2014, Saudi Arabia has decided to keep its output unchanged despite a growing oil surplus in order to defend its market share. This marked a major change in policy as in the past the Kingdom had adjusted its production in order to balance the oil market at the expense of its market share. For example, in 2012, Saudi Arabia cut its crude oil production below 9.0 million b/d as Libyan crude oil production rebounded following the end of the first civil war and Iraqi crude oil production increased significantly thanks to new export infrastructure.

The change in leadership in Saudi Arabia may affect the oil market in two ways. First, the new King may be unpleased with the new oil policy and may change it. Indeed, low oil prices are likely to contribute to a major government deficit this year and have a negative impact on the Saudi economy. The new King may want to restore the old interventionist policy, which would imply a cut in Saudi crude oil production in order to balance the market. The decision to change the oil policy again after that however remains unlikely as the crown prince typically works together with the King and the oil minister over the oil policy. The new King may hence have already agreed (or even pushed for) the new non-interventionist oil policy. There is nonetheless a more important possibility of change in oil policy with the change of leadership.

The second impact on the oil market comes from the growing uncertainty regarding the succession line. The legitimacy of King Salman is uncontested, as he is part of the “Sudairi Seven”, an important alliance of seven full brothers within the House of Saud. However, the legitimacy of the new Crown Prince, Muqrin, is contested by some princes in the royal family. This hence raises the question if the Allegiance Council, the body responsible for determining future succession to the throne of Saudi Arabia, will confirm Muqrin as Crown Prince now that King Abdullah is dead. Furthermore, more important contestations could arise from Muqrin’s opponents in the future if King Salman shows signs of poor health (which may occur rather sooner than later, as he is already 79 years old) as the question of Muqrin’s legitimacy would be heavily debated. These political uncertainties have hence contributed to add upside pressure on oil prices in the short term as any major changes in policy in Saudi Arabia could have an important impact on oil prices.

Upward revision of global grains inventories already priced in

Last week, grain prices experienced a downward move following the release of the International Grains Council report, which revised grains inventories higher for the 2014-15 season. This upward revision occurred while inventories are already at an elevated level and good weather conditions could contribute to a strong harvest this year again.

The International Grains Council (IGC) now expects global grains production (wheat and coarse grains) in the 2014-15 season to reach a record 2.0 billion metric tons, a 12 million metric tons upward revision from the previous report made in November 2014. The revision of global corn production to 992 million metric tons from 982 million metric tons for the 2014-15 season was the largest change in the report due to a reassessment of output in Argentina and upward revision of the European corn production, which more than offsetted the downward revision of the US corn crop. Moreover, despite the global demand estimated at a higher level, global ending stocks of grains are now expected to reach 432 million metric tons, up 30 million metric tons y/y (+8% y/y) and the most since the mid-1980s.

The IGC also revised global soybean production higher for the 2014-15 season to a record 312 million metric tons, up 10% y/y and up by 4 million metric tons in the last report. Indeed, despite weather conditions being not always favourable in Brazil and in Argentina, the soybean output in South America is likely to reach a new record high. Demand has also been revised higher to a record 300 million metric tons, up 7% y/y. But this was not sufficient to prevent the upward revision of forecasted global ending stocks at 42 million metric tons, up 35% y/y.

The report confirmed what was already well known. The grain market appears heavily oversupplied. This is however already reflected in prices, which have declined below or close to the marginal cost of production as the DCI® Grains Index fell by 25% since the end of April 2014. The limited price reaction following the IGC report’s release is also indicating that the market has already incorporated the likely large rise in global grain inventories in 2014-15. But, while the market is expecting a strong crop, any deterioration of the weather conditions or other factors that could lead to supply disruptions could hence have a positive impact on grain prices. The weaker US Dollar that we expect may also have a positive impact on grain prices.

Charts of the week: Global oil production / US oil rigs / Oil/gold ratio

|

The number of US oil rigs has declined by 15% since mid-October, reflecting the major cut in expenditures by oil companies in response to lower oil prices. This is likely to lead to lower US crude oil production growth in the second half of 2015. According to the EIA, the US crude oil production could decline by 200’000 b/d between May and December 2015, contributing in turn to lower global oil production. The oil market could return into equilibrium by December 2015. Since mid-October 2014, the US oil rigs count has fallen by 18% to the lowest level since January 2013, reflecting the rapid reaction of oil companies in the US to lower oil prices. The oil-to-gold ratio (using Brent) fell to the lowest level since the Asian crisis in 1998-99, below the low levels reached during the financial crisis in 2008, indicating risk-off behaviours from the market participants. |

|

|

For the full version of the Diapason Capital Markets report, please contact info@diapason-cm.com

.png)

.png)