January 19, 2015

2015 commodity outlook: Weak fundamentals have contributed to current low agriculture prices; however, prices could find support from supply disruptions and the US Dollar weakness

Commentary by Robert Balan, Senior Market Strategist and Alessandro Gelli, Commodity Analyst

“Corn prices are at or below the cost of production following a record crop last year (in 2013) and yet another this year.”

Tim Scheer, a farmer at St. Paul, Neb., and chairman of the Nebraska Corn Board, January 16th, 2015

Following important price volatility last year, agricultural commodities could again experience some positive price movements this year despite ample supplies. While weak fundamentals have contributed to bring agricultural prices to low levels, sometimes below the marginal cost of production, the sector may benefit from possible supply disruptions and especially from the likely weakening of the US Dollar. Therefore the upside potential for agricultural products and especially for grains appears clearly more important than the downside potential.

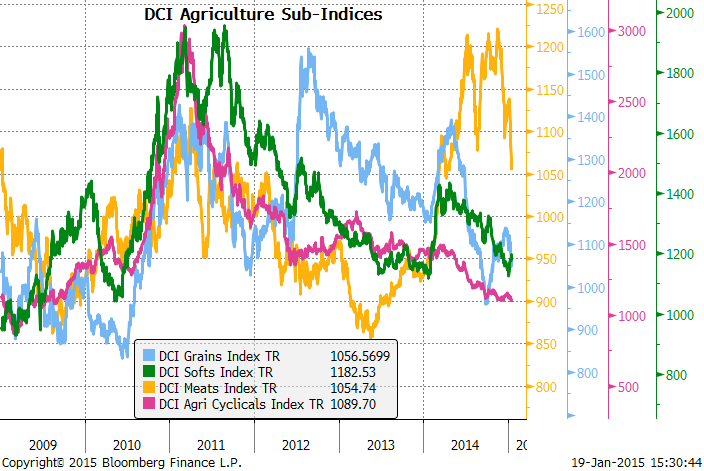

The start of this year contrasts with last year, when worries about the supply contributed to a rise in the price of agricultural products. The DCI® Agricultural Index rose by almost 18% between January and the end of April 2014, before falling by 21% until the end of September. Agricultural commodities prices then recovered close to early 2014 levels. The DCI® Agricultural Index was down 2% over the year but still was the best performing commodity sector. The drought in Brazil and growing fears of the occurrence of El Nino contributed to the move into higher prices of most agricultural products last year. However, the stronger US Dollar, the confirmation of large corn, soybean and wheat crops, amid reduced fears about El Nino then contributed to the downward move in grains prices, which resulted in bringing the DCI® Agricultural Index down (grains account for 53% of the index). Russian restrictions on grain exports contributed to a rally at the end of the year. However, grains prices then started to decline as grain users had already purchased most of their needs during the harvest, as prices were the lowest in years, while US farmers have sizeable amounts of grain to sell before the expected large harvests in South America.

This year, the market has priced-in high grain inventories. The market is also expecting a strong harvest due to good weather conditions. Global corn inventories stood at 6.8 billion bushels at the end of the 2013-14 season, the highest level since 2000-01, and could rise to 7.4 billion bushels as the corn market is likely to remain in a surplus for the second consecutive year. Global soybean inventories rose by 16% y/y during the 2014-13 season, and could rise further by 37% y/y to 3.3 billion bushels, a record high level driven by the likely record output in Brazil which would follow the recent record harvest in the US. Global wheat inventories are also likely to increase during the 2014-15 season to the highest level since 2009-10, due to the likely strong European wheat crop. Ample supplies relative to demand have contributed to the downward move in grain prices since the end of Q1 2014.

Put another way, the market has priced-in perfect supply conditions, hence the low price structure. Thus, any small deterioration in the expected weather conditions or further trade restrictions in Russia and Ukraine could be supportive for agricultural prices. Supply disruption risks indeed remain significant. For example, the market may underestimate the impact of the infested rapeseed crop in Europe. According to Oil World, the European rapeseed harvest could decline this year by 15% to a 3-year low due to insect damage. This has been caused by the 2013 ban on some pesticides forcing farmers to use older chemicals to which many insects had developed a resistance. Lower European rapeseed output would boost demand for other grains for feed, and by the biodiesel industry.

It is also notable that grain prices have gone below the total cost of production. The price of wheat remains well below the total marginal cost of production estimated at $8.0 per bushel. Corn prices are below the total marginal cost of production estimated at $4.3 per bushel. The total marginal cost of production for soybean estimated at $9.6 per bushel is also, albeit slightly, below current soybean prices. Thus, despite lower oil prices, which reduced costs, some grains prices are below the marginal cost of production. This could have an impact on the yields, as low or negative margins for farmers typically could discourage them to use fertiliser and seed technology. A combination of lower yields and supply disruptions may contribute to an unexpected tighter grain markets. Moreover, on top of the supply risks, the likely stabilisation of the US Dollar and its potential weakness may contribute to a good performance in the agriculture sector. Grain prices especially could be positively affected by the weaker US Dollar.

When it comes to agriculture prices, the element that determines pricing second only to the weather is the US Dollar. A strong US Dollar was instrumental in depressing US Dollar denominated grains prices up to early October last year, when grains prices went substantially below production costs. Since then the prices of grains have risen significantly due to various reasons, among them the expectation that the US Dollar rally may have been overdone in the light of the Fed's stance of holding off raising interest rates for a little longer. Expectation of higher interest rates in the US has been instrumental in supporting the US Dollar rally, together with expectations of a massive QE program to be initiated by the ECB to boost Eurozone output, and market expectations of further weakness in the Yen due to further stimulus from Japan. But both short- and long-term interest rates in the US have fallen instead of rising, the US unemployment rate may rebound and the massive QE expected from the ECB may prove to be smaller than the market expect. Furthermore, Japan may not have further need for stimulus now that they have cancelled another sales tax that was due this year. Clearly there is room for the US Dollar to weaken soon and in turn this should support agricultural prices.

The recent price correction in grains appears hence as an interesting entry opportunity to increase exposure in the sector, which is likely to benefit from elevated supply risks and a weaker US Dollar this year. Wheat is likely to outperform other grains due to growing worries on the Russian and Ukrainian wheat exports and risks of deterioration of weather conditions in the US, which could affect the US winter wheat crop.

|

Commodity Outlook 2015:

|

Commodity Outlook

Wheat: High supplies risk and a falling surplus

Wheat prices have been one of the best performing agricultural commodities in Q4 2014, due to worries on Russian wheat exports. Indeed, the significant fall of the rubble has encouraged Russian farmers to export corn and wheat at the expense of the domestic market. The Government is therefore likely to take measures to restrict exports. Reduced Russian grain exports could in turn contribute to a more balanced global market, adding upside pressure on grain prices.

The price of meat, fish and vegetables rose by about 20% last year, while the economy is expected to move into recession this year. Russian wheat prices have surged by more than 40% since July, mirroring the rubble’s collapse as the local market needs to compete with exporters for wheat supply. The surge in food prices could threaten the social stability, and Putin’s popularity. Thus, the Russian government has implemented measures to cap food inflation. While Russia officially said it won’t impose an export ban like it did in 2010, it has implemented mechanisms to restrict grain exports. According to trade sources, Russia's Veterinary and Phytosanitary Surveillance Service has restricted grain export certificates for some countries in December. At the end of November 2014, this agency also said it was planning to introduce some new regulations on grain exports.

The Russian government also announced that it plans to increase grain reserves to at least 5 million metric tons, in order to guarantee supplies for flour millers and animal feed producers as state reserves stood at only 1.3 million metric tons of grains at the end of November. The Russian stock-to-use ratio — including commercial inventories — also fell in the 2013-2014 season to 36 days, the lowest level since the 2007-2008 season. These Russian policies could have an important impact on the international grain market as Russia is the world’s fourth largest wheat exporter and the world’s fifth largest corn exporter. Lower Russian grain supplies on the global market could add upside pressure on grain prices. Moreover, Russia is not the only country to impose restrictions on wheat exports. Last week, the Ukrainian agriculture ministry asked traders to limit milling wheat exports at 200’000 metric tons per month in January and February, despite elevated stocks due to uncertainty about the next harvest in July. As Ukraine is the world’s sixth largest wheat exporters, this could increase concerns on wheat supplies and reflect elevated risks on supply. Wheat price especially is expected to benefit from this situation in the short run.

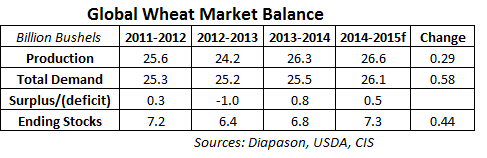

However, wheat prices remain under pressure by ample supplies. The global wheat market is indeed expected to remain in a surplus for the second consecutive year. This could contribute to the rise in global wheat inventories to the highest level since 2009-10. The stock-to-use ratio is likely to rise to 28%, the highest level since the 2011-12 season but still almost 7% below the 40-year average.

Low wheat prices should reduce production growth to 0.3 billion bushels in the 2014-15 season, down from +2.1 billion bushels y/y the previous season. Moreover, demand growth for wheat is expected to grow at a more rapid pace at 0.6 billion bushels y/y, up from +0.3 billion bushels y/y during the 2013-14 season. The wheat surplus is hence likely to be smaller than last season. Low prices could trigger stronger demand and discourage wheat planting during the 2015-16 season. This could contribute to a more balanced market and provide support for higher prices. Meanwhile, downside appears limited on wheat as the price remains well below the total marginal cost of production estimated at $8.0 per bushel (operating costs are estimated at $3.3 per bushel).

Corn: strong feed demand growth but ample supplies

The corn price rally that started at the end of September 2014 was triggered by the growing concerns on Russian wheat supplies, which affected the feed market overall, strong feed demand in the US and temporary logistics issues in the US. The corn market also had reached oversold conditions at the end of the third quarter.

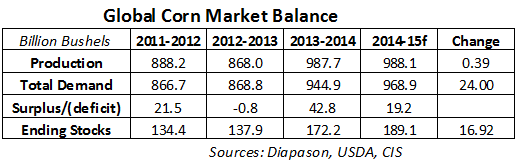

Like wheat and soybean, corn prices could benefit from worries on the supply as previously mentioned. But like other grains, the corn market is also well supplied. The corn market is about to enter into its second year of surplus. The corn surplus during the 2014-15 season is likely to be smaller than during the previous season due to stronger demand growth, as corn prices is now extremely competitive against other grains in the feed market. Nonetheless, inventories are high and could rise further. Global corn inventories stood at 172.2 billion bushels in the 2013-14 season, up 25% y/y to the highest level since 2000. Inventories are expected to grow to 189.1 billion bushels, a 10% rise y/y and close to record inventories reached in the 1986-87 season at 8.1 billion bushels. Naturally, the stock-to-use ratio is not as elevated due to the world population growth, which has been rising by 1.3% per year on average since 1986. The global corn stock-to-use ratio is expected to reach 20%, the highest level since the 2002-03 season. This is a higher level than in 2010-11 when the stock-to-use ratio fell to dangerously low level at 15%, but it is still well below the 40-year average of 25%.

Comfortable inventories and the expected large harvest in South America has contributed to current low corn prices. Like other grains, the market is pricing the perfect crop. Last year’s large harvest also increased the sentiment on the corn crop. However, market participants may have become too optimistic about the corn market. But supply risks remain important. The output from Brazilian second corn crop could be smaller than initially expected, due to the late planting of the summer soybean crop, which has increased the vulnerability of the second corn crop from insufficient rain and frost in the Parana region.

Moreover, the yield on corn could decline as prices are below the total marginal cost of production estimated at $4.3 per bushel. While farmers may continue to plant corn, the negative margins may discourage the use of fertilisers and seed technology. This could lead to lower corn yields and make the crop more vulnerable. The deterioration in the weather conditions may also contribute to even lower yields. Thus, a small change in weather conditions may trigger a downward revision in yields. Furthermore, corn could especially benefit from the weaker US Dollar we expect, as the US is by far the world’s largest corn exporters accounting for 40% of global corn trade.

Charts of the week: Grain prices could rebound due to a US Dollar’s reversal

|

The US Dollar has a major impact especially on the grains. Other agricultural products are not necessarily moving alongside grains and may not benefit as well as grains from the US Dollar weakness that we expect. |

|

|

For the full version of the Diapason Capital Markets report, please contact info@diapason-cm.com

.png)