January 12, 2015

2015 commodity outlook: Gold, a good opportunity to start 2015

Commentary by Robert Balan, Senior Market Strategist and Alessandro Gelli, Commodity Analyst

“Gold is unique in that it is an asset that bears no credit risk and therefore involves no counterparty and is no one else’s liability.”

Natalie Dempster, Head of Investment, North America for World Gold Council, October 2008

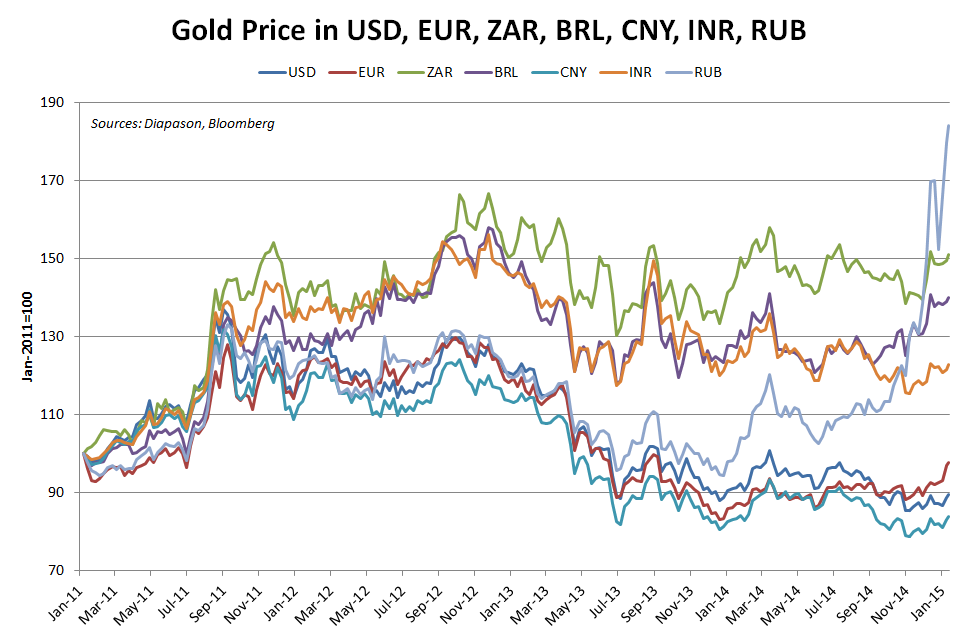

In 2014, gold finally stabilised, down by 1.5% over the year, following the major 28% decline in 2013. The slight decline in gold prices last year was the second worst annual performance since 2000. Contrasting with the past 2 years, gold prices could move higher to start the year, driven by what we expect to be a weaker US Dollar, political risks in Europe and loss of momentum of US growth. These factors may contribute to make gold a good pick to start the year within the commodity sector.

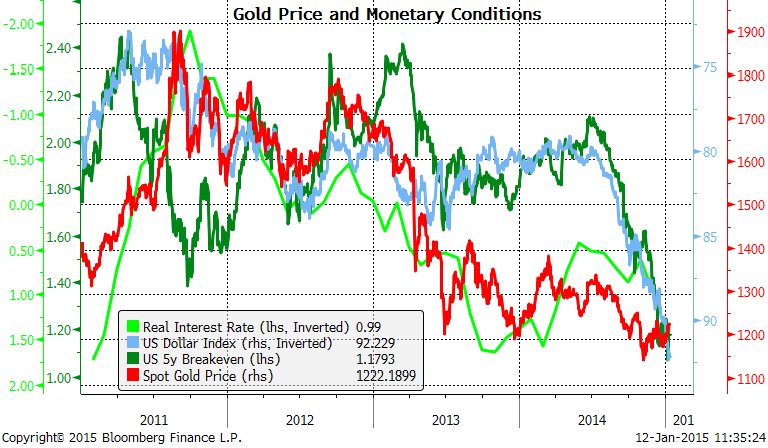

Over the past two years, stronger US economic growth, the strength in the US Dollar (from the second part of 2014), lower inflation expectation and higher real interest rates contributed to the decline in gold prices . However, US growth and the US Dollar may be in a position to pause. Moreover, growing political risks in Europe may also contribute to increase demand for gold as a safe-haven asset. Conditions are building for gold to experience a move upwards.

The US Dollar strengthened in recent weeks on market anticipation of higher US interest rates in 2015 and the anticipated QE program in the Eurozone. But as discussed in the last Commodities Insight Weekly, the Fed may wait for some time before raising interest rates. Moreover, the ECB's expected QE program this month involving the purchase of sovereign bonds, a proposal which has added negative pressure on the Euro, may disappoint as Eurozone banks remain lukewarm to the idea, and may likely chose to keep the sovereign bonds themselves. On top of that, Germany is implacably opposed to ECB purchases of sovereign bonds, and the legality of such an ECB move is still being subject to judicial review. Failure of the ECB to expand its balance sheet to 3 trillion euros via this program will help check the weakness of the euro, which will help stop the US Dollar's rally. A likely rebound of the yen on improving Japanese activity data may also contribute to a weaker US Dollar, and that will add upside support on gold prices.

Meanwhile, while gold prices are typically heavily influenced by the US Dollar, the main driver of gold prices in the last days of 2014 and the start of this year was growing political worries related to Greece. Indeed, the Greek parliament’s failure to elect a President at the end of December 2014 has forced the government to hold parliamentary elections by the end of January. The victory of the far left has triggered increased worries of the likelihood of a Greek default and the possibility of Greece leaving the Eurozone.

An often quoted factor for the past declines of gold has been rising real interest rates — higher real rates tend to strengthen the US Dollar and so, ipso facto, depresses gold prices. Real rates are of course products of the interaction between interest rates and inflation. As we stated before, we expect the Fed to wait for some time before raising rates, and moreover US interest rates did not really rise in 2014, so most of these mechanisms are not yet directly at work. US short term rates have been falling sharply since the start of the year, following the lead of long-term yields. We expect this lower trend to continue for both long-term and short-term rate over most of H1 2015, so we do not expect rising real rates to undercut gold prices during this period at least.

Another important factor that could contribute to higher gold prices is the likely deceleration of the US economy from the strong Q3 2014 GDP figure. We find the positive narrative directed towards the US economy and the US dollar exceedingly optimistic. One such reason for being not so positive on the US growth has been the recent rally of the US Dollar. Based on the Fed’s models, a large appreciation of the dollar is estimated to cut GDP growth by around 0.5% over the following year, which means 2015 growth has already been compromised. Therefore, the US economy isn’t likely to continue growing at the same elevated pace as in Q3 2014. Several factors could contribute to a weaker US growth, which in turn could benefit gold prices. Lower oil price is starting to have a negative impact on the energy industry, which had been one of the largest contributors to US job creations these past 5 years. Lower investments in the oil industry may lead to job cuts which will more than offset the positive impact of lower fuel prices on economic activity.

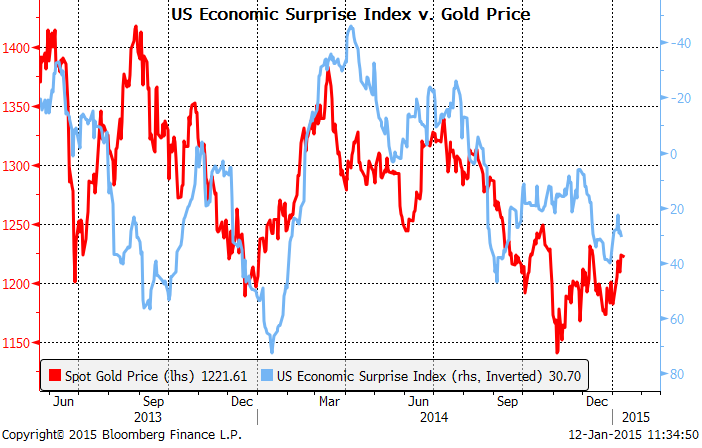

The declining unemployment rate has been a large factor in influencing the Fed's apparent desire to tighten monetary policy, so any back up in unemployment may influence the central bank from moving very soon or from tightening aggressively. If this happens, some forward-looking market indicators may immediately reflect the change in tone. One such market indicator is the Citi US Economic Surprise Index (US ESI). A decline in the US ESI is usually positive for gold due to the yellow metal's role as safe-haven (see charts of the week). Any such change in market sentiment is also reflected by the relatively strong positive link these past few months between gold prices and the VIX Index, and the negative correlation between gold and AUD/JPY, another key risk-on/ risk-off indicator. The recent rise of the VIX Index and the decline of the AUD/JPY are indicating significant risk-off behaviour of the market, which could lead to more upside pressure on gold prices down the road. The yellow metal’s price thus could move higher in the first part of the year.

|

Commodity Outlook 2015:

|

Commodity Outlook

Aluminium could regain its position of leader within base metals with an oil price rebound

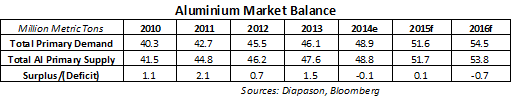

The oil price collapse has affected base metals prices. The DCI® Base Metals Index declined by around 10% in between the last week of November 2014 and the first week of January 2015, pulling down the performance of the sector further into negative territory for 2014; the sector fell by 5.9% last year. The end-of-the-year decline in the base metals sector was a broad move among all base metals and is the direct consequence of lower energy prices, which are reducing costs for mining companies.

The decline in oil prices had a varied impact on the different base metals. Aluminium underperformed the sector as the metal is the most energy-intensive base metals. Power typically accounts for almost 30% of total alumina cost and for 40% of total aluminium operating cash cost. This is why aluminium producers typically have access to cheap energy sources. The fall in oil prices — as a proxy for energy prices — hence contributed to reduce the breakeven price for aluminium producers. This is having an especially important impact on the aluminium sector due to the relatively large amount of idle producing capacity. According to Rusal, more than 6 million metric tons of aluminium smelting capacity out of China has been cut since 2007 and about 3.6 million metric tons couldn’t be restarted, leaving 2.4 million metric tons of idle smelting capacity. Lower power prices also contribute to reduce the cost of producing alumina, adding downside pressure on alumina prices. This is hence significantly reducing input costs for aluminium smelters.

Lower energy prices could lead to the restart of some idle smelting capacity and therefore help the aluminium market to move into a slight surplus next year. However, the recent decline in prices in the base metals sector, and especially aluminium, is implying that a rebound in oil prices could act as a strong support for base metals prices. Aluminium prices would especially benefit from a recovery in oil prices, suggesting a greater correlation between the two commodities.

Demand for aluminium is expected to remain strong, driven by the transportation sector. The latter is using a greater amount of aluminium at the expense of steel. US auto makers reported their strongest annual sales since 2006 due to weaker fuel prices at the end of the year and low interest rates amid a stronger economic activity. Car sales were especially important in December due to the decline in oil prices. This could spill over to the first part of 2015, contributing to strong aluminium demand growth. This is likely to occur while aluminium inventories at major exchanges fell by almost 25% since mid-2013 to the lowest level since 2009. This is implying a deficit in the aluminium market. Inventories remained nonetheless at an elevated level compared to pre-2009 levels. This may also contribute to limit the upside potential of aluminium. Thus, a rebound in oil prices is required to see the return of aluminium as a leading base metal in 2015. This could occur in the second half of 2015 when the oil market is expected to tighten. Aluminium prices could then be capped by the restart of idle smelting capacity.

Palladium: about to enter its fourth consecutive year of deficit

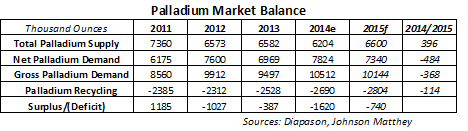

Palladium will enter its fourth consecutive years of deficit in 2015, supported by strong demand from the automobile sector and lagging supply.

The use of palladium for automotive catalytic converters accounts for about 70% of global palladium demand. Palladium demand growth is hence driven by vehicle sales and new environmental legislation in developing markets. Global light vehicle production is expected to increase by about 4% per year on average, driven by China. Moreover, more stringent emissions regulations are being implemented in developing countries, which are making mandatory the use of catalytic converters. Autocatalyst demand for palladium is likely to reach 7.6 million ounces, a new record high and up 4.5% y/y.

Production is highly concentrated in countries with high political risks. In 2014, 76% of mined palladium supply comes from Russia (42%) and South Africa (34%). In 2014, the 5-month strike in South Africa contributed to remove about 700‘000 ounces of palladium from the market, about 8% of global production of palladium in 2013. Palladium prices were also supported in 2014 by worries about possible sanctions against the Russian palladium industry.

In 2015, palladium supply could rebound as production in South Africa is recovering from the strike, while demand should decline due to lower investment demand for palladium. The launch of 2 South African palladium ETFs in 2014 triggered a strong rebound in investment demand from the previous year. However, these ETFs are not likely to draw the same amount of buying as in their inaugural year. Despite lower demand and the rebound of South African production, the palladium market is still expected to experience a major deficit in 2015.

The deficit could reach 740‘000 ounces in 2015, down from 1.6 million ounces in 2014. This would be the fourth consecutive year of deficit in the palladium market. This should add upside pressure on palladium prices. Moreover, on top of elevated supply risks in "politically sensitive" South Africa and Russia, mine closures could occur this year. Palladium is typically mined as a by-product of platinum in South Africa and as a by-product of nickel in Russia. Thus, platinum and nickel prices, which are below the marginal cost of production estimated at $1‘400 an ounce and $18‘450 per metric tons respectively, could lead to the closure of platinum and nickel mines, affecting at the same time palladium supply. Palladium prices could also gain some traction by the weaker US Dollar we expect for 2015 and the acceleration of the Chinese economy.

Charts of the week: Gold drivers may soon turn, providing support to the yellow metal

|

Political and credit risks, worries on growth, a weaker US Dollar and higher inflation expectations typically add upside pressure on gold prices. These factors are now gradually turning and could soon become more supportive for gold prices. |

|

|

For the full version of the Diapason Capital Markets report, please contact info@diapason-cm.com

.png)