January 5, 2015

2015 commodity outlook: Supply and demand adjustments and supportive macro-economic conditions

Commentary by Robert Balan, Senior Market Strategist and Alessandro Gelli, Commodity Analyst

“Overall, this shows us that the nation's oil and gas companies have become more reluctant to drill for oil in the current price environment.[…] All of these factors force the conclusion that oil production worldwide is likely to decline going forward. This should result in the current oversupply of oil being eliminated or even potentially turning into a shortage. Through the economic law of supply and demand, this seems likely to result in rising oil prices as this story plays out.”

Power Hedge, Why low oil prices are not the new normal, Seeking Alpha, December 24th, 2014

2014 may be remembered as the worst year for commodities since the economic and financial crisis of 2008. But like previous significant moves in commodity prices over a prolonged period, the physical market is likely to make some adjustments. Producers are already cutting investment plans, while improving macro-economic conditions and low commodity prices should stimulate demand. These factors should contribute to the recovery in commodity prices this year.

Almost every day since the November’s OPEC meeting, oil producers have announced their intent to delay or to cancel projects and /or sharp cuts in expenses. This followed the mining companies, which had made similar decisions in 2012-2013 in response to lower metals prices and high costs. Commodity surplus is often the foundation of an upward move in commodity prices as demand typically reacts more rapidly than supply encouraged by lower prices amid lagging supplyadjustments. The current or expected large deficits for aluminium, zinc, nickel and lead are the result of the cut in capex by mining companies these previous years. It is now the turn of the oil industry. Moreover, demand for commodity may grow at a faster pace this year than last year supported by improving macro-economic conditions and lower commodity prices. We expect indeed that several macro-factors which contributed to the downward move in commodity prices in 2014 could become supportive for commodity prices this year. Stronger global growth, a weaker US Dollar and improving sentiment over China as the economy is likely to accelerate should provide the foundation of a recovery in commodity prices this year, like in 2009 when commodity prices rebounded by almost 30% following the 38% fall in 2008.

China: For two years now, China has been haunted by the spectre of a possible “hard landing”, with fears including a financial collapse and bad-debt crisis, crippling deflation and sharp drop in economic growth that could lead to political instability. The government’s deliberate efforts to balance reform with growth had indeed exerted a downward pressure on economic activity in the past year, but it is likely that the result will be a “soft landing”, a moderation rather than an outright contraction, with prices to remain stable. We believe this to be the case because we see signs that the government is willing to “mitigate the pain” of such reform via stimulus. Any proof of this? The on-budget fiscal deficit in China has been widening, and constant liquidity injection has become and will likely remain a conventional operation of the People's Bank of China, partly as a result of reduced currency intervention of late. With that as a given, we also see China having little risk of outright deflation, as policy makers are ready to respond quickly if growth or inflation slows significantly.

The fear has been a Japan-style deflation taking hold, as China’s consumer price index has slowed its gains from 3% in November 2013 to just 1.4% in November 2014, when compared with the year-earlier level. But weaker prices, externally at least, should be a help rather than be a hindrance, with lower commodity costs offering a boost for China’s consumers and its energy-intensive businesses. This may actually provide a positive surprise to growth which has not been incorporated in the general market's growth projections for 2015. We believe that China's 2015 GDP may hew closer to the projection of the World Bank (and ours as well) of 7.8% growth rate from an estimated 7.3% in 2014. The acceleration of the Chinese economy will benefit almost all commodities but especially the base metals sector, which is the most dependent on the China’s economic health.

Global Growth: Growth outside China is also likely to become more important in 2015. The IMF expects global growth to reach 3.8% in 2015, up from 3.3% in 2014. And this projection will also be likely revised higher due to a recent stronger trend in US growth, and a reappraisal higher of Eurozone growth in 2015. The US is indeed a major exception in the global growth slowdown during the late part of 2014. The American activity expansion seems increasingly well established, with estimated quarterly growth near 4% over the next two quarters. We firmly believe that global growth follows a sequence with a lag which begins with US activity impacting growth in Eurozone and Japan during the following one to two quarters, and thereafter the collective impact of the three major economies on Chinese and EM growth three to four quarters later. This could lead to a higher global growth for 2015 than what the IMF expects. This should have a positive impact on cyclical commodities such as energy, base metals and some agricultural products.

US Dollar: It is particularly in the US that commodity prices have been falling, which suggests to us that the recent weakness in commodity prices was caused at the core by the rise in the US Dollar, and was merely linked vicariously to global growth. Take any non-US Dollar denominated commodity Indices, these indices have declined significantly less than US-denominated indices. The US Dollar had its best year since 2005. The DXY, which measures the greenback against a basket of six rival currencies, was up by 12.8% in 2014 as the improved economic situation in the US is seen as encouraging the Fed to raise interest rates this year, while other central banks are expected to keep ultra-loose monetary policy.

However, the US Dollar may start weakening this year. While financial markets expect a hike in US interest rates in mid-2015, the US Fed may wait a little longer due to threat of US and global deflation and as the rest of the world is struggling to stabilize growth. Moreover, the ECB may initiate a sovereign QE in early Q1 2015, but modest in scale relative to expectations as Germany is not likely to permit a more aggressive strategy. Markets are likely to be disappointed with the small size of the ECB's initiative and European banks may choose to hold their bonds instead of selling. ECB balance sheet still may not reach 3 trillion euros and the euro could then rally sharply, adding downside pressure on the US Dollar. A weakening US Dollar is likely to be supportive for most commodities and especially the precious and agricultural sector, which always showed strong ties with the greenback.

Thus, while some of these elements had a negative impact on commodities in 2014 — especially the US Dollar, they are likely to gradually become more supportive for commodity prices throughout 2015. This should come on top of adjustments of supply and demand in response to lower prices, which are laying down the foundation to a recovery of commodity prices this year.

|

Commodity Outlook 2015:

|

Commodity Outlook

Oil outlook: Supply response amid stronger demand growth

Last year’s decline in oil prices was the most important since 2008, while the global growth has only slowed down and is not expected to move into a major recession, contrasting with 2008 and 2009 when the global economy faced its worst economic crisis since at least WWII. This is suggesting that the recent correction in oil prices is overdone. Moreover, adjustments from the supply and demand in response to lower oil prices are likely to contribute the most to the recovery of oil prices in 2015.

By keeping its production unchanged in an oversupplied market, OPEC thinks that lower oil prices could negatively affect higher cost producers in non-OPEC countries. Non-OPEC supply growth is indeed likely to slow down this year — from record level reached last year — as some oil companies are cutting capital expenditures and reducing drilling activity. According to Wood Mackenzie, two thirds of the international oil companies it covers required a barrel of Brent at more than $90 to break-even through 2015-16, based on pre-slump expectations for investment and distributions. These companies are hence now forced to cut expenditures or dividends/buybacks or sell assets. The most direct impact on supply growth is likely to come from the US as producers of US tight oil require elevated oil prices to break-even and can respond relatively rapidly to lower oil prices. According to Wood Mackenzie, 30% of US tight oil is uneconomic if prices are below $75 per barrel. The fact that tight oil supply is significantly more price elastic also implies a significant reduction in supply growth especially in the second part of 2015. Oil companies are indeed not as well-hedged for the second part of 2015 as they are for the first part of 2015. According to Wood Mackenzie, WTI prices at around $65 to $70 per barrel for most of 2015 could lead to a reduction of 0.6 million b/d in US tight oil supply growth by the end of 2015. In fact, several US oil companies have already reduced rig count and capex in response to lower oil prices in October and November 2014. In Texas, new drilling permits issued fell in November by 50% compared with the previous month. Furthermore, the number of US oil rig count fell by 7% between mid-October and at the end of the year to 1499, the lowest level since April 2014, reflecting a rapid reaction of the US oil industry.

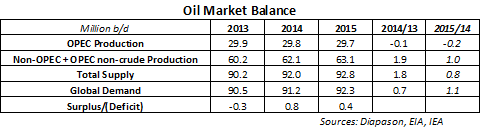

On the demand side, some factors are becoming more supportive for oil prices next year. The decline in oil prices occurred as oil demand growth slowed down significantly this year. In 2014, global oil demand growth is indeed estimated to reach 0.7 million b/d y/y, the weakest growth since 2009, and significantly lower than in these past 4 years, when global oil demand grew on average by 1.5 million b/d y/y. Weak Asian and European oil demand growth contributed to the significant slowdown in global oil demand growth. However, oil demand should accelerate next year and could grow by 1.1 million b/d y/y, driven by stronger demand growth in Asia, a lower decline in European oil demand and higher US demand growth. Current low oil prices are likely to act as a stimulus to the global economy. Moreover, low oil prices could encourage purchases of oil for Strategic Petroleum Reserves (SPR). The Chinese crude oil imports have been growing at a faster pace these past 4 months while Chinese oil demand typically decline during this time of the year and while oil prices were declining, suggesting purchases for SPR like in 2007 and in 2009, which occurred after major oil price corrections.

In sum, following weaker demand growth and stronger supply, the oil market moved in an important surplus in the last part of 2014. The surplus is likely to last until at least the second half of 2015 when slower supply growth and stronger demand could help balance the oil market. However, oil prices may react before the supply/demand balance adjusts. A political agreement between Iran and the P5+1 in April 2014 could trigger the last wave of sell-off in oil markets. The latter could then gradually recover until the year-end.

Copper outlook: a significantly lower surplus than initially expected for 2015 — AGAIN!

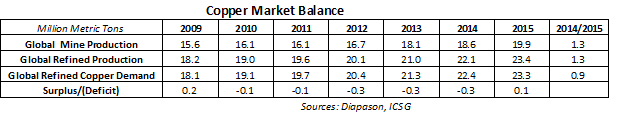

Copper may surprise to the upside in 2015 contrasting with 2014. Copper was the third worst performing base metal in 2014, down by about 13% despite the fact that the market surplus did not appear as initially expected. The copper market is likely to have remained in deficit in 2014 due to the slower than initially expected supply growth. World copper mined production is indeed likely to have grown by only 3% in 2014, down from 8% in 2013 due to operational failures, strikes in Chile, delays in ramp-up in production and start-up of new mines.

Despite the likely acceleration of the Chinese economy in 2015, the copper market is expected to move into a surplus as last year’s delayed supply should come on stream on top of an already planned expansion and new mines. Thus, global mined copper production is expected to grow by 7% y/y in 2015. Supply growth is also expected to remain strong in 2016 as 18 new mines and expansions are expected to come on stream in 2015-2016, which could result in 1.8 million metric tons of new mine supply, which represents 10% of global copper mined production in 2013. But like in 2014, the copper market could surprise. The surplus is indeed likely to be smaller than initially expected due to possible supply disruptions and strong demand. The decision of the Zambian government in mid-December to raise mining royalties has already triggered announcements of one mine closure in the country, which was Africa‘s largest copper producer in 2013. Furthermore, mining companies are worried about a new labour bill in Chile. The bill, which was sent to the Congress last week, aims to give more power to unions and workers‘ rights. This could lead to higher labour cost for mining companies and could encourage strikes, increasing the likelihood of supply disruptions.

Moreover, copper prices need to remain at an elevated level due to growing costs. Energy costs have declined following the decline in international oil prices. However, labour and water costs continue to rise. While the marginal cash cost of production is estimated at $4’900 per metric ton, the average incentive price to build a new copper mine is estimated at around $6’300 per metric ton, below current copper prices as new mines are smaller, more complex and with ore of lower quality. Thus, the elevated price structure required should prevent prices from falling significantly in 2015.

The acceleration of the Chinese economy that we expect could also have a positive impact on copper demand. Already demand for copper has been stronger than expected, growing at around 4.2% per year on average these past 4 years, despite the slowdown in the Chinese economic activity. In 2014, refined copper demand is likely to have grown by 5.3% y/y, driven by the tightness in the scrap market. In 2015, the scrap copper supply should recover, leading to weaker refined copper demand growth at 4% y/y. The copper surplus in 2015 could therefore only be 0.1 million metric tons lower than the 0.4 million metric tons surplus expected by the ICGS in October 2014 and the 0.2 million metric tons surplus forecasted by Wood Mackenzie in November 2014. The smaller than expected surplus could surprise the market and contribute to a rebound in copper prices as visible inventories have fallen to low levels. Indeed, copper inventories at major exchanges reached at the end of 2014 300’000 metric tons, down 68% from the record high made in mid-2013. Visible copper inventories are now back to November 2008 levels, implying that the large inventory build since 2009 has been erased. The copper market is hence significantly more vulnerable to supply disruptions, of which the risk of occurring has increased. Copper prices could especially do well in the first part of 2015 driven by the acceleration of the Chinese economy and supply concerns in Zambia and Chile amid low inventories. The start of new mining capacity should affect copper prices in the second half of 2015 as inventories are likely to gradually reflect the growing surplus, which is likely to be more important in 2016.

Chart of the week: The US Dollar was a major contributor to the commodity price weakness in 2014

|

The US Dollar was a major force behind the decline in commodity prices in 2014. This contributed to the significant underperformance of the DCI® in USD relative to the DCI® in Euro and in Yen. The weaker US Dollar we expect in 2015 could therefore contribute to higher prices for US-denominated commodities, leading to the outperformance of the DCI® in USD versus the DCI® denominated in other currencies. |

|

|

For the full version of the Diapason Capital Markets report, please contact info@diapason-cm.com

.png)