December 15, 2014

Market forces at work: producers have started to react to the sharply decreasing oil prices

Commentary by Alessandro Gelli, Commodity Analyst

“We will continue our efforts through dialogue with OPEC and non-OPEC producers to remove a surplus estimated at 2 million barrels per day. […]We may hold an emergency meeting before June.”

Youcef Yousfi, Algeria Oil Minister, December 10th, 2014

Oil prices have fallen to unsustainably low levels for some of the producers. Brent oil prices fell to around $62 per barrel, down 47% since the end of June 2014, reaching their lowest level since 2009. Naturally, consumers and producers are starting to react to this major price move. While consumers are starting to enjoy a lower oil price at the pump, producers are feeling more and more uneasy about the situation, leading to cut in expenditures. In turn, this should provide a support to oil prices.

Demand for oil is typically inelastic in the short run — you will probably not take a longer drive to go to work this week just because of lower oil prices, but you may plan to use your car instead of a plane during your next holiday. Oil production is also inelastic in the short run, but tight oil as we already explained is significantly more price elastic than conventional oil. Oil prices have already fallen way below the marginal cost of production — Canadian mining oil sands projects need a barrel at around $90-$100 to justify investment. And they are now closer to operational costs, forcing companies not only to reduce capex but also other expenses. In early December 2014, ConocoPhillips announced a capital budget cut of 20% - about $3 billion, the largest spending cut by a US oil and gas producer (in dollar terms). BP announced last week that it will cut thousands of jobs by the end of next year in a $1 billion restructuring programme. The British company is also considering a steeper reduction to its 2015 budget beyond the $1-$2 billion cut already announced in October. Several studies also concluded that many production sites in the North Sea were under severe pressure. Investment required to mitigate their strong decline rate is now unlikely to be made. Low oil prices could hence contribute to a stronger decline rate at some existing oil fields. According to Rystad Energy, about $150 billion of global oil and gas projects are likely to be put on hold next year in response to lower oil prices. This would be the most important decline in capex in the oil industry since 2008-2009, threatening crude oil supply growth, while global oil demand is expected to accelerate.

It was OPEC’s decision to keep its production unchanged in the last meeting which contributed to the significant downward move in oil prices, leaving the oil market in a major surplus. However, several members of the cartel are indicating that the current level of oil prices is unsustainable for them. Last week, the oil ministers from Algeria and Venezuela said that OPEC may hold an emergency meeting before June, reflecting their difficult situation. With Brent prices below $65 per barrel, all OPEC countries have seen oil prices move below the budget breakeven, increasing pressure to agree on a production-target cut next year. But the most rapid supply response is likely to come from the US in the form of a significant decline in supply growth.

Several US oil companies have already reduced rig count and capex in response to lower oil prices in October and November before the sharp downward move in oil prices at the end of November. US new drilling permits issued fell in November by 40% compared to the previous month. Permits issued should decline further in December. The number of oil rigs in the US fell by 29 to 1546, the lowest level since June 2014 and the largest weekly decline since December 2012. Low oil prices are also threatening small and highly indebted US oil companies, which already faced negative cash flow when oil prices stood at $100 per barrel, but always managed to raise funds. Current oil prices hence appear unsustainable for the oil market and are unlikely to remain at this low level as it is threatening the existence of these companies, which have contributed to the significant supply growth in the US these past few years. It is therefore not surprising to witness the biggest wave of insider buying by oil executives since 2012. The number of insider buying has increased by 64% y/y, and more than doubled from the average level during the first 10 months of 2014. At the beginning of November 2014, the CEO of Continental, the largest oil producer in the Bakken shale, decided also to remove all hedges for 2015 and 2016 in order to benefit from the oil price recovery he expects. The fact that tight oil supply is significantly more price elastic also implies a reduction in supply growth, especially in the second part of 2015. Oil companies are not as well-hedged for the second part of 2015 as they are for the first part of 2015.The rapid response from both OPEC and non-OPEC producers is clearly implying unsustainable price levels for the oil market.

The reaction from the supply side should be supportive for oil prices. The oil market indeed needs a higher oil price in order to balance itself in the future as expensive new projects are required to meet oil demand growth. This was well illustrated by the chief economist of the International Energy Agency, which said on December 5th: "I think an oil price, which will balance the markets in the next years to come, will be close to $100. […] We shouldn't be blinded with what's happening now. Looking at the geology, looking at the economics of the oil markets, one shouldn't be surprised if we see in a few years' time, again, a rebound of prices."

|

Main drivers this week

|

Commodities and Economic Highlights

Commentary by Robert Balan and Alessandro Gelli

The Chinese metal financial probe may affect copper and nickel trade in H1 2015

The base metals market was broadly hit following the financial probe at the Qingdao port in May-June 2014. Some metals could continue to be negatively affected by the metal financial probe, which started in June 2014. The financial probe contributed to the deterioration of confidence among market participants and hence contributed to reduction in imports of some base metals, adding downside pressure on their prices.

The financial probe at the world’s seventh largest port focuses on warehouse certificates’ duplication, which were made to use a metal cargo several times to raise financing. The investigation is not over, and has started to affect trade finance due to the unclear situation of several key market participants, leading to lower imports over several metals. Two metals have been especially hit by the financial probe: copper and nickel. Chinese copper imports indeed fell from 450’000 metric tons in April 2014 to 336’000 metric tons in August 2014. Copper imports have recently rebounded and reached 420’000 metric tons in November. However, between July and November 2014, Chinese copper imports are down by 10% y/y. Nickel was also severely affected by the Qingdao scandal. Chinese imports of refined nickel indeed collapsed to 4’500 metric tons in October 2014, down 75% from July 2014 level and to the lowest level since at least 2008, when the data started.

These two metals are likely to continue seeing weak imports from China in the first part of 2015. Some Chinese and foreign banks have indeed tightened credit conditions for metals imports, following the Qingdao probe. Thus, some term shipments for next year have been cut as importers are afraid they will not find financing. Term shipment is often used in commodity trading in order to secure supplies and lock-in a fixed premium. In the copper market, it accounted for about 80% of imports, according to Reuters. The reduction in term shipment could therefore have a negative impact on copper and nickel imports in the first part of next year, and imports are likely to decline y/y. The impact on the second half of 2015 is likely to be significantly less important due to low levels already reached in the second half of 2014 — it is therefore difficult to fall lower — and because of the likely acceleration of the Chinese economic activity, fuelled by new infrastructure projects, industrial demand is replacing financial demand. Nonetheless, the impact on nickel prices in the first part of 2015 is likely to be limited due to the Indonesian ban on ore imports, which has significantly tightened the nickel ore market. Low refined nickel inventories in China are also suggesting that imports aren’t likely to fall significantly further.

On the other hand, copper prices could suffer the most from the situation. Some companies are still trying to get rid of bonded copper stocks in Shanghai. This translated into weaker copper premiums, which recently fell to the lowest level since early 2013. But this could trigger a wave of purchases by the State Reserves Bureau, which already boosted its buying of refined copper and nickel this year. While the downside potential is limited on copper prices, they could however underperform other base metals, at least until the end of the first half of next year.

Chinese soybean imports could accelerate next year

This past week, soybean prices rose by around 3%, driven by strong Chinese imports and persisting logistical constraints in the US. Soybean prices are up by almost 15% since their low made at the end of September. But they remain down by 32% from the year’s high made in April. Soybean prices could recover further next year, driven by stronger Chinese demand.

In November, Chinese soybean imports rose by 47% m/m to 6.0 million metric tons, implying strong Chinese soybean consumption. However, this year Chinese imports of soybean in the second part of the year have been weak, up by only 0.7% y/y from the previous years (from July to November). This contrasts with the first part of the year when soybean imports rose by 30% y/y on average. Stronger domestic animal feed production has reduced the need to import soybean. While soybean production fell during the 2013-2014 season, production of corn, wheat and other animal feed have increased.

However, the production of corn is expected to decline next year, as well as soybean, while demand should grow to 85.9 million metric tons, up 7% y/y, the strongest growth since 2012, driven by low soybean prices. On the other hand, Chinese soybean production could decline by 3.3% y/y to 11.8 million metric tons, the lowest level since 1993. Chinese soybean imports are hence likely to increase to around 74.0 million metric tons, a new record high and up 5.2% y/y. The Chinese demand is crucial for the US grain market as it will absorb part of the US bumper soybean crop, which could reach 107.7 million metric tons next year, up 18% y/y and up by 30% from the 2012-2013 season. In its latest reports, the USDA revised higher US soybean exports to 48 million metric tons, 44% of expected US soybean production next season.

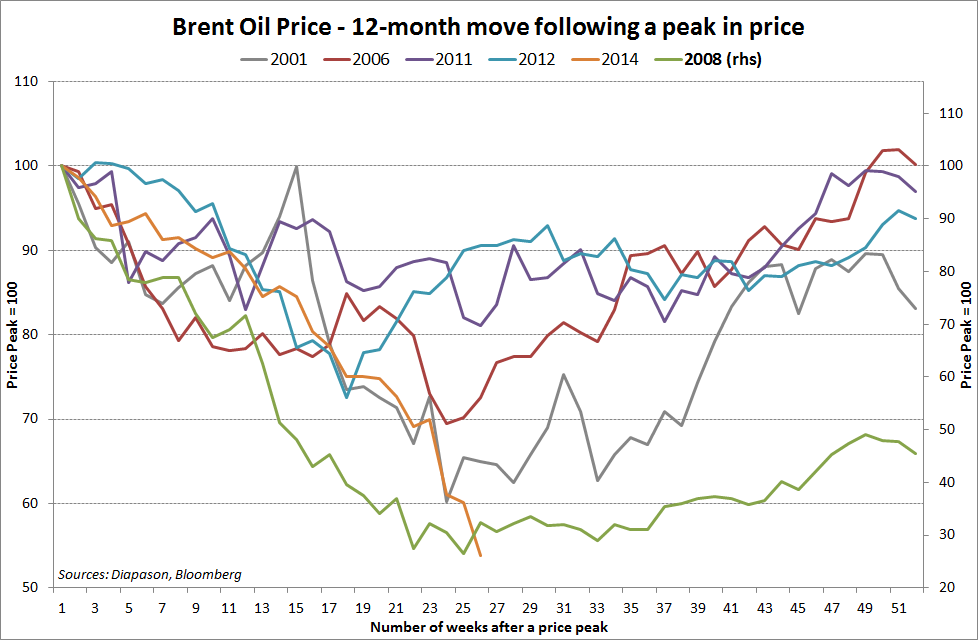

Chart of the week: Sharp 6-month decline in oil prices typically triggers a response from the physical market

|

The significant downward move in oil prices could surprise, considering that it was the largest decline in oil prices since 2008, but the global economy is unlikely to move into recession next year. In fact, global growth should accelerate. The IMF expects global growth to reach 3.9% in 2015, up from 3.7% in 2014, suggesting that the oil price decline is overdone. . The price move also triggered an important rise in the implied volatility, which reached 56 on Brent at the end of last week, the highest level since 2011, which was the second highest level after 2008. This also reflects the extreme negative sentiment on the oil market. However, past oil price falls are suggesting that the current decline in prices has matured. The drop, which started at the end of June 2014 has been running for the past 26 weeks, making it one of the longest oil correction since at least 15 years. However, oil prices have moved to unsustainably low levels and the decline in oil prices has been long enough to see a reaction from the producers which could stabilise the oil market like in previous important price falls these past 15 years. Last week, the number of oil rigs fell sharply, alongside an important decline in US drilling permits issued last month, while some oil companies are announcing important reductions in capex in response to lower oil prices. The number of tankers sailing to China also reached a record level last week, implying strong purchases of crude oil, probably for the Chinese Strategic Petroleum Reserves (SPR). The Chinese government typically buys crude oil for its SPR following a decline in oil price. |

|

|

For the full version of the Diapason Capital Markets report, please contact info@diapason-cm.com