December 8, 2014

Improving situation with inflation expectations and the USD may help gold prices to rebound

Commentary by Robert Balan, Senior Market Strategist and Alessandro Gelli, Commodity Analyst

“Sentiment toward gold is at such a bearish extreme, it seems as if every market seer is saying it’s time to buy because nearly everyone else has been selling.”

Conrad de Aenlle, Bearish sentiment gives gold bugs glimmer of hope, November 26th, 2014

The gold price bear market may take pause as gold prices may rebound at this stage. The yellow metal may have bottomed in early November and could soon see higher levels. The gold price rally may be supported by short term and medium term factors such as the extreme negative sentiment on gold, an expected weakening of the US dollar and higher inflation expectations fuelled by pro-growth policies now implemented in Asia and which may even soon start in Europe as well.

Following a year-low made in early November at $1142 an ounce, gold prices rose by 4.7% until the end of the month, driven by the possibility that the Swiss popular initiative on the central bank’s gold holdings may pass. The initiative aimed to force the Swiss National Bank (SNB) to hold 20% of its reserves in gold compared with only 7%currently, to bring back gold holdings outside the country to Switzerland and to forbid the sale of gold. It would have contributed to a significant rise in demand for gold by the SNB. However, the Swiss voted no. The result added a negative impact on gold prices. Nonetheless, the interesting factor is that despite this event, and given the extreme negative sentiment on gold, prices did not made a new low. This suggests to us a more balanced market at these levels. The very weak sentiment on gold is reflected by the sharp decline in total ETF holdings of gold, which fell last week to 51.8 million ounces, down almost 40% from January 2013 levels. This is the lowest level since May 2009.

Some factors are suggesting more supportive fundamentals for gold. The outlook over gold demand in India improved significantly, following the removal of some gold imports’ restrictions by the Indian government at the end of the month. On top of a 10% import duty, India indeed used to impose that 20% of the imported gold be re-exported — typically as jewellery. This rule was implemented in order to reduce gold imports, which had a significant weight on India’s current account. However, the new government has gradually implemented more liberal policies. At the end of November, the Indian government decided to remove the second restriction on gold imports, hence encouraging imports of the yellow metal. This and the more important likelihood that the 10% import duty would be removed are likely to add support to the yellow metal prices.

Nonetheless, the main drivers behind the possible rebound in gold prices are likely to come from macro-economic conditions. Several central banks are implementing more concrete pro-growth policies, which could soon translate into higher inflation expectations and also more important concerns about the size of some central banks’ balance sheet. Indeed, the relatively successful US monetary policy is likely to encourage other central banks to imitate the US Fed policy and implement their own QE programs. The PBoC and the BoJ have already injected massive amounts of liquidity into the system. The ECB should soon follow. As markets anticipated these injections of liquidity, the decision to implement these QE programs was sufficient to contribute to a significant weakening of the related currencies against the US Dollar. But the latter could soon start to trend lower as ex-US pro-growth policies are gradually having a positive impact on growth outside the US, while the effective tighter monetary policy in the US is negatively affecting US economic activity. A narrower differential in growth between the US and the rest of the world may lead to some downside pressure on the greenback. In turn, this should add upside pressure on gold prices.

The important liquidity injections outside the US could also increase worries about further rise in the size of aggregate global central banks’ balance sheet. This comes on top of elevated and growing governments’ indebtedness, which has in the past tended to boost the allure of gold, the traditional safe-haven destination during times of global inflationary policies. Gold prices indeed rallied following Moody’s decision to downgrade Japan’s credit rating last week.

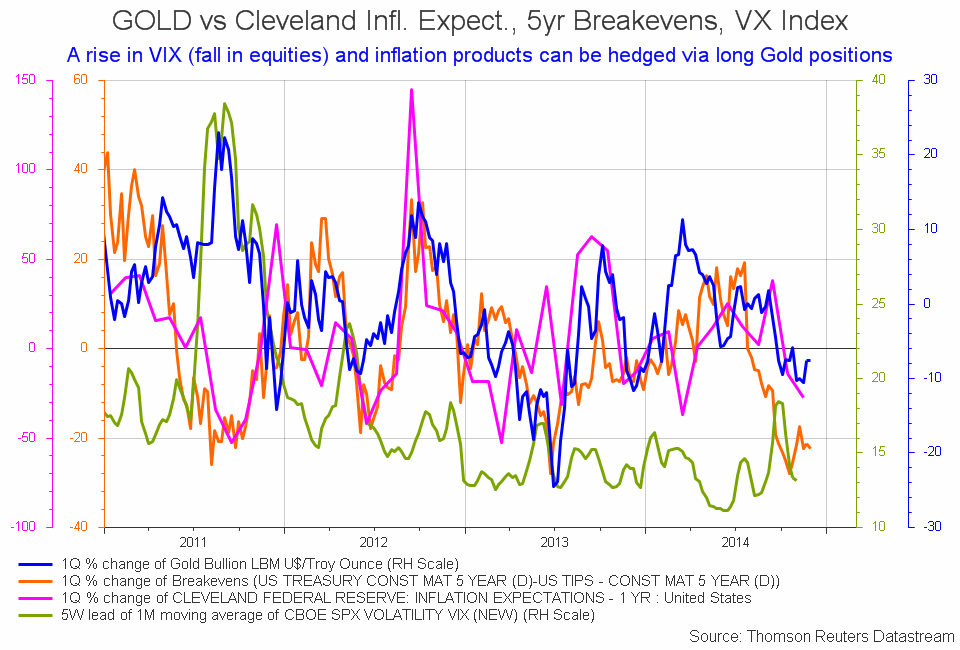

Moreover, in the US, there is a continued pickup in rental inflation, wage growth supporting services inflation, and less of a drag on inflation from the core goods sector. These factors raise the potential for a rise in core inflation in 2015. Gold should be seen as a good starting point in the search for an inflation hedge. If global growth does take hold, and we are correct in our assumption that core inflation and probably Headline CPI as well make a break higher next year, then gold may found support from higher inflation levels (see chart of the week).

|

Main drivers this week

|

Commodities and Economic Highlights

Commentary by Robert Balan and Alessandro Gelli

Brent-WTI spread is now less likely to widen

The Brent-WTI spread was little affected by the recent large move in outright oil prices. At the end of November, the Brent-WTI spread remained at around $4 per barrel, while Brent prices fell by more than $10 to around $70 per barrel, the lowest level since 2010. While the market panic had little impact on the spread, the decline in oil prices may prevent the spread from widening significantly in the coming months.

Indeed, the Brent-WTI spread was initially expected to widen due to strong production growth in the US, and limited capacity for the US to displace more crude imports, to export more crude oil to Canada, or to realise higher refining activity. But the recent decline in oil prices and the OPEC decision to keep its production unchanged, implying a large surplus in the oil market for the coming months, have increased the likelihood of a large slowdown in US crude oil production growth. Indeed, US tight oil producers need an elevated price to drill. Lower oil prices in October and November have already encouraged many companies to reduce activity. In November, according to Drilling Info Inc, US new well permits decreased to 4’520, down 37% m/m. The drop in new permits occurred across the top 3 US tight oil regions: the Permian, the Eagle Ford and the Bakken basins. The amount of new permits indicates what drilling rigs will be doing 60 to 90 days in the future. This is implying that the response to lower oil prices by US oil companies has already been faster than initially anticipated. The sharp decline in oil prices at the end of November is therefore likely to lead to a further drop in the number of new well permits.

This is implying weaker US oil production growth for 2015. New wells are indeed needed to mitigate the elevated rate of decline of existing wells. Slower production growth combined with a likely high US refining activity, as margins have not be affected by the recent decline in oil prices, should therefore contribute to a smaller than initially expected surplus in the US oil market. The Brent-WTI spread is hence less likely to widen next year.

Tin’s fundamentals continue to look better

Tin has been the second best performer, after nickel, among base metals these past 4 weeks. The trigger to this outperformance was the Indonesian government’s decision to restrict tin exports in order to boost prices, which are currently too low for some producers. Tin prices failed to gain some traction at the beginning of the year alongside nickel and other base metals, which benefited from the Indonesian ban on ore exports, as tin is usually refined before being exported and hence was not affected by the Indonesian ban. This contributed to the underperformance of tin prices compared to other base metals at the beginning of the year.

Low tin prices have then encouraged some Indonesian companies and the Indonesian government to limit tin exports in order to support prices. Indonesian tin exports started to fall to low levels in August and in September. But this was not enough to prevent the fall in tin prices in September and early October. Tin prices at the LME fell to around $19000 per metric tonne, the lowest level since July 2013. Alongside other base metals, tin prices then managed to rise driven by the improved outlook on the Chinese economy activity, triggered by more important targeted stimuli by the Chinese government and the rate cute by the PBoC at the end of November. But tin prices managed to outperform other base metals, with the exception of nickel, as Indonesia was expected to restrict further tin exports in 2015. At the end of November, the President of the Association of Indonesian Tin exporters predicted a decline in tin shipments for 2015 due to new export regulations and tighter mining concessions by the government. This should contribute to bring the tin market into a deficit next year from a balanced market this year.

According to the International Tin Researcg Institute, the global tin market should experience a deficit of 5’000 to 10’0000 metric tonnes in 2015 due to improved demand from the electronic sector. But the tin lobby may have underestimated the decline in supply from Indonesia. The rise in tin exports from Myanmar, which should reach 28’000 metric tonnes next year, up 8% y/y, should indeed be mitigated by lower Indonesian tin shipments. This should provide an important upside potential for tin prices. Moreover, tin prices are standing currently at a relatively low level. Indeed, at around $20’000 per metric tonne, about 15% of global tin mines are below breakeven. Furthermore, higher tin prices are needed to encourage investments in new mines. At current prices, only half of the projects are at breakeven levels due to elevated costs.

Wheat should outshine other grains

Wheat has been the best performer among the agriculture sector these past weeks. Wheat prices rose by more than 8% over the past 4 weeks, while the DCI® Agriculture Index rose by only 1% over the same period. Increasing worries about wheat crop conditions in Australia and in Russia and a weak crop in Argentina contributed to the outperformance of wheat within the agriculture sector. But trade restrictions imposed by the Russian government were the main factor behind the wheat’s prices performance. Moreover, animal feed demand remains strong, contributing to the outperformance of the low protein Chicago wheat against the Kansas wheat, which has higher protein content and is hence used for milling.

The major factor behind the outperformance of wheat within the agriculture sector was Russia’s intentions to restrict wheat exports. At the end of last month, Russia’s Veterinary and Phytosanitary Surveillance Service said it was introducing a series of new regulations after discovering unspecified problems. These regulations may lead to a decline in grain exports according to the Russian government, and hence increased worries of lower Russian wheat exports. Contrasting with 2010, when Russia imposed a ban on grain exports due to a major drought that hit the country, the Russian government cannot implement a similar decision without breaking WTO rules, as Russia joined the WTO in 2012.

The Russian government wishes to reduce wheat exports as it wants to keep its domestic market well-supplied and prevent prices from rising. The sharp decline of the rubble has indeed encouraged exports at the expense of the domestic market. Moreover, extremely cold and dry weather in Russia has increased concerns about the wheat crop conditions, while inventories are at a low level and demand is strong. SovEcon, the Russian agricultural market researcher, said last week that the Russian grain crop could fall to 86 million tonnes from the record 104 million harvested this summer. Russia may therefore implement further “disguised” wheat export restrictions. This should lead to further outperformance of wheat prices against other grains.

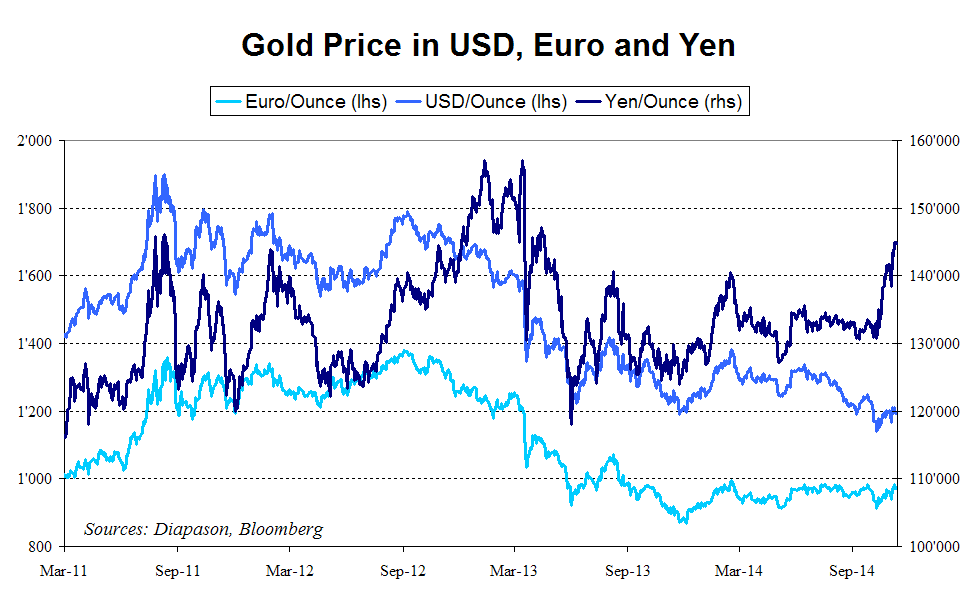

Chart of the week: Gold provides a good hedge against inflation / Gold in USD, Euro and Yen

|

The gold price evolution is well associated with the VIX Index (negative correlation) and inflation expectations (positive correlation). Since VIX is the risk gauge for equity prices, any prospective decline in equity prices or rise in inflation products may be hedged via long gold positions. Following a high made in mid-2011, gold prices in US Dollar term have fallen by almost 40% until early November 2014. But in Euro and Yen term, gold prices have declined by only 32% and 1% respectively during the same period. |

|

|

For the full version of the Diapason Capital Markets report, please contact info@diapason-cm.com