December 1, 2014

Extreme negative sentiment, panic, pain, and liquidation in commodity markets

Commentary by Alessandro Gelli, Commodity Analyst

“Lowering commodity prices continue to be the order of the day following a triple blow over the last few days as the Organisation of Petroleum Exporting Countries (OPEC) meeting, Swiss referendum and Chinese manufacturing PMI data all take their toll on investor sentiment.”

Shaun Murison, Commodities in trouble, Moneyweb, December 1st, 2014

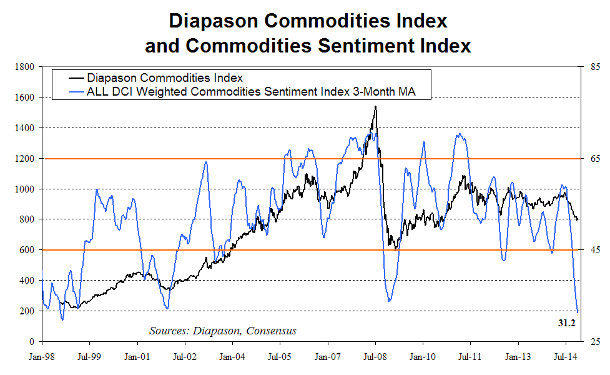

The sentiment on commodities reached one of the most extreme low levels at the end of November following a rare combination of negative factors: the OPEC decision not to cut production, the result of the Swiss referendum on gold, the end of the strike at a major mine in Peru, disappointing Chinese manufacturing PMI data and commodity funds liquidation. Those various elements generated a sense of panic in commodity markets. The sentiment on the commodity sector indeed declined to the lowest level since 1998 (see chart of the week), when the Russian financial crisis hit the sentiment on commodities — in December 1998, oil prices fell below $10 per barrel. The recent fall in the sentiment on commodities is comparable with the decline experienced during the 2001 and in the 2008 financial crises.

The sharp decline in the price and sentiment in the oil market was especially pronounced. The crude oil market indeed suffered from a major change in OPEC strategy. Within the cartel, Saudi Arabia wants to keep its market share at all costs, even if it means lower oil prices and especially the end of the oil price’s stability, a major shift compared with the previous 3 years. The recent drop in oil prices is having a negative impact on the oil industry and especially on US tight oil producers, which need an elevated price to break-even. Some companies have already announced a reduction in rig count and capex in response to lower oil prices in October and early November. The recent correction in oil prices should lead to further capex reduction. The sharp decline in prices and sentiment on crude oil also contributed to the deterioration of the sentiment on other commodities, however, commodity ex-energy prices have been more resilient. The DCI® ex-Energy Index fell by only 4% year-to-date compared with a decline of the DCI® Energy Index by 29% year-to-date.

The base metals sector experienced a mixed performance as copper prices fell sharply at the end of November, while prices of other base metals have proven more resilient. The copper industry has also been under pressure as reflected by the reduction in capex from mining companies as prices are too low to encourage the development of new mines. Capex in the copper industry is expected to decline in 2014 by 15% y/y and to fall further in the coming 2 years. The end of the strike in Antamina’s major copper mine in Peru and the weak NBS Manufacturing PMI, which fell to 50.3, the lowest level in 8 months, added downside pressure on copper prices at the end of last week and on Monday. These elements have contributed to the extreme negative sentiment on commodity markets due to the large weight of energy and base metals in global commodity indices. However, other commodity sectors have experienced a gradual tightening of their supply/demand balance, which was translated into a higher price structure and an improving sentiment.

In the gold market, the Swiss voting on whether the SNB should hold at least 20% of its reserves in gold, held last Sunday, first triggered higher gold prices throughout November. The rejection of the initiative then generated short term negative pressure on gold prices. However, prices did not make a new low, implying that prices have already incorporated recent negative news flow and may have bottomed in early November, when the sentiment on gold had reached a low level.

The agriculture sector and especially the grains subsector distinguished itself and played its role of defensive sector. Wheat prices for instance even increased by 8.4% during November due to growing concerns about the Russian wheat crop and strong animal feed demand. Following extreme low levels reached in early September, the sentiment on grains alongside prices gradually improved.

It is interesting to note that the sentiment on the commodity sector, as represented by the DCI® Weighted Commodities Sentiment Index (see chart of the week), fell to lower levels than in 2009 despite the fact that global growth is moderately positive and should improve next year driven by the acceleration of the Chinese economy, the stabilisation of Europe and a persisting strong growth in the US. This is contrasting sharply with 2008-2009 when the economic outlook was contracting sharply and highly uncertain following the collapse of Lehman Brothers.

Thus, the poor performance in commodity prices and especially the major correction in oil prices appear significantly overdone and is now providing an interesting risk-reward opportunity. Indeed, unless a major recession hits the global economy like in 2008-2009, the downside potential for commodities appears extremely limited and current levels unsustainable as the price of several key commodities have fallen below their cost of production. Marginal tight oil fields in the US require an oil price at around $80 per barrel, while the price to encourage new oil sand projects in Canada is closer to $100 per barrel. Prices for grains also fell below cash costs. US corn prices fell to $3.8 per bushel, below the $4.3 the marginal farmers require to break-even. Aluminium prices are also down to around $1’990 per metric tonne, while the marginal cash cost is estimated at $2’300 per metric tonne.

|

Main drivers this week

|

Commodities and Economic Highlights

Commentary by Robert Balan and Alessandro Gelli

Failed nuclear negotiations imply stable Iranian crude oil exports

Last Monday, before the OPEC meeting, which had a major impact on oil prices, Iran and the P5+1 failed to reach an agreement over the Iranian nuclear capacity. While the negotiations have made some advancement, a deal has not been reached. Iranian crude oil exports are therefore expected to remain at around 1 million b/d in the first part of next year.

Iran and the P5+1 did not manage to conclude a deal on the nuclear issue but agreed on the negotiation calendar for next year. A political deal is expected to be concluded by March 2015, while a broader agreement should be reached by July 2015. Only after this, Iran may be allowed to increase crude oil exports. But there are also many uncertainties ahead. Indeed, one of the issues Iran and the P5+1 did not agree on during the recent negotiations was the pace of the sanctions’ removal. Western countries want to keep these sanctions even after a deal is reached and to lift them only gradually in order to force Iran to implement the deal. On the other hand, Iran wishes the immediate removal of the sanctions following an agreement.

The pace of the sanctions’ removal is important for the oil market as it could set the pace for the increase in Iranian crude oil exports in the second half of next year. According to the Iranian government, the country could double its oil exports to 2 million b/d within 2 months after sanctions end. However, it may prove more difficult to restart production of idle fields as Iran lacks funding to preserve these fields’ capacity.

OPEC’s inaction should negatively impact US tight oil production growth

The decision to keep its production unchanged suggests that OPEC may want to fight for its market share even with the consequences of lower oil prices. The rapid rise in US tight oil, which should contribute to the rise in US crude oil production growth by 1.1 million b/d y/y this year, may have increased worries among OPEC members that they could lose market share and hence their role as market balancers, a role that has been a key factor in stabilising oil prices these past 6 years. By adjusting their output, the cartel, and especially Saudi Arabia, have contributed to keep oil price volatility low at around $110 per barrel. In June 2014, when oil prices were around $115 per barrel, Saudi oil minister made the following comments about the oil market: “everything is good; supply is good, demand is good, prices are good and the market is balanced”. So, what has changed since then?

Oil demand slowed down significantly, while supply disruptions fell. This occurred while US crude oil production growth increased greatly, following several years of already strong output growth. Between 2010 and 2013, US oil production (including natural gas liquids and biofuels) rose by 2.5 million b/d, equal to 8% of the current OPEC production target of 30.0 million b/d. Naturally, this increased concerns about the long term position of OPEC and its ability to influence international oil prices; OPEC accounted for 42.1% of global oil supply in 2013, compared with the US which accounted for 10.8%. Thus, a faction of OPEC, led by Saudi Arabia and likely followed by other Gulf monarchies, probably imposed its view that OPEC should not cut output to keep oil prices at an elevated level at the expense of market share. The cut in output would have represented a decline in oil revenues due to lower volume. These countries may have estimated that by keeping the production target unchanged, lower prices may have a limited impact on oil revenues but a negative impact on non-OPEC production growth, compared with the alternative of cutting output, This faction indeed probably thinks that lower oil prices could negatively affect US companies, which require elevated oil prices to break-even (according to Wood Mackenzie, 30% of US tight oil is uneconomic if prices are below $75 per barrel). Weaker US production growth would imply that OPEC would keep its market share. On the other hand, other OPEC members such as Venezuela and Iran, which require an elevated oil price to balance their budget, may have preferred a cut in the production target to stabilise oil prices and hence their income from oil.

In fact, several US oil companies have already reduced rig count and capex in response to lower oil prices in October and November. OPEC’s decision to keep its production-target unchanged and the subsequent decline in oil prices may encourage more US companies to reduce expenditures further for next year. According to Wood Mackenzie, WTI prices at around $65 to $70 per barrel for most of 2015 could lead to a reduction of 0.6 million b/d in US tight oil supply growth by the end of 2015. Thus, US oil companies and OPEC members with an elevated fiscal break-even price and little cash reserves are likely to suffer the most from the recent OPEC decision to keep its production target unchanged. This could trigger a lower supply growth next year.

The copper market is likely to move back in deficit earlier than expected

The industry consensus expected the copper market to experience an extended period of large surplus and low prices due to the recent important rise in capacity, amid concerns about China. However, a growing number of projects are now being delayed or scaled back, while demand continues to grow at a rapid pace. The copper market could therefore move back into a deficit in 2018, sooner than expected by the market.

Demand for copper has been stronger than expected, growing at around 4% per year, despite the slowdown in the Chinese economic activity. Demand from China is likely to remain important in the coming years, even though the country is aiming to become a consumer-driven economy instead of an export-driven economy. The urbanisation rate in China has reached 50% last year and is expected to reach 70% in 2030, still below the developed world average of 80%. China is hence likely to remain the largest contributor to global copper demand. In 2013, China accounted for 46.7% of global copper demand.

But even with the expected deficit for the coming 3 years, copper prices need to remain at an elevated level due to growing costs. Indeed, copper producers are facing lower ore quality in smaller new mines. The lack of power capacity has also contributed to increase costs in Chile, the world’s largest producer, accounting for 32% global production. This .has made the country one of the most expensive places to generate electricity, and that is leading to increasing miner’s costs. Water and labour costs are also expected to rise, while the average incentive price to build a new copper mine is estimated at around $6’400 per metric tonne, only 2.5% lower than current copper prices Thus, the elevated price structure required should prevent prices from falling significantly during the incoming surplus period.

Chart of the week: Sentiment on commodities fell to the lowest level since 1998

|

The DCI Weighted Commodities Sentiment Index fell last week to the lowest level since 1998, due to significant decline of the sentiment over most commodities. The extreme negative sentiment over commodity is implying that the recent correction in commodity prices and especially in oil prices is overdone. Prices could soon recover, helped by stronger than expected global growth and a weaker US Dollar. |

|

|

For the full version of the Diapason Capital Markets report, please contact info@diapason-cm.com