November 24, 2014

All eyes on the OPEC meeting

Commentary by Alessandro Gelli, Commodity Analyst

“Whatever the outcome of this uncertainty – prices staying the same, rising or falling – one thing is now a given: producers need relatively high prices to survive politically. While it is far from clear how the Arab uprisings may end, one result is already clear: the surviving Arab regimes and the new ones both need to keep their populations if not happy, then at least under control. This requires spending on a lavish scale to provide jobs, incomes and subsidies. The result has been that for many producing governments there has been an increase in the price at which the suppliers are willing and able to supply.”

Paul Stevens, Matthew Hulbert, Oil Prices: Energy Investment, Political Stability in the Exporting Countries and OPEC’s Dilemma, Chatham House, October 2012

The bi-annual OPEC meeting will be held this coming Thursday in Vienna. This may be the most followed OPEC meeting since the one held in November 2008, when the cartel announced a cut of 4.2 million b/d in reaction to the sharp decline in prices. Oil prices have indeed fallen to the lowest level in four years due to a change in supply/demand dynamics, a strong US dollar and a reduction in inflation expectations. However, oil prices have reached unsustainable levels for some oil producers. For example, several US oil companies have already announced a reduction in capex or in drilling activity in reaction to lower oil prices, and some large OPEC members have also called for a reduction in the OPEC production target in order to stabilise oil prices.

The parallel with 2008 may only be limited to the market’s focus on the meeting, as the situation is extremely different. Global growth is weak but has not collapsed like in 2008. The US is on its 6th year of growth, while the situation in Europe seems to have stabilised and is in fact better than what it was in 2011 and 2012. In emerging countries, economic growth has slowed down but this is expected to only be a temporary case. In China, the economic activity has increased at a slower pace these past 2 years but is now likely to rebound. As the Chinese government won its fights against inflation, rapidly rising real estate prices and the shadow banking system, pro-growth policy can now be implemented as reflected by last week’s surprise interest-rate cut. In fact, some measures have already been enacted by the Chinese government, leading to the outperformance of the base metals sector within the commodity complex since the beginning of the year.

The situation is therefore not as critical as in 2008. Nonetheless, the downward move in oil prices has been important, amplified by hot money flows out of commodities into equities. This is reflected by the sharp drop in net long speculative positions on oil futures, which declined by 71% between the end of June 2014 and mid-November 2014. The overbearish sentiment on the oil market is also reflected by the lack of market’s reaction over recent, more constructive fundamental factors. The number of VLCCs sailing to China stood these past 3 weeks at a 9-month high, implying strong demand; while crude oil production in Libya fell in early November by almost 40% to around 500’000 b/d, without having a serious effect on oil prices.

Moreover, the decline in oil prices has already started to affect producers. In the US, several oil companies have announced a reduction in drilling activity or lower capex in direct reaction to the lower oil price structure. Tight oil wells indeed require an elevated oil price to break even. WTI prices recently stood at $75 per barrel, the median cost in key tight oil plays, while the marginal cost of production is estimated at $90 per barrel. Next year, US tight oil production growth could therefore slow down due to the lower price structure. US crude oil production is expected to increase by 1.1 million b/d y/y this year (excluding Natural Gas Liquids) but by only 0.9 million b/d next year due to current divestments. Production growth from tight oil wells could change within a year as tight oil supply is significantly more price-elastic than conventional supply, due to the elevated initial flow rate, rapidly followed by a significant decline rate — up to 60% in the first year. Thus, significantly lower oil prices for a sustained period could be followed by a more rapid decline in production growth. The head of the US Energy Information Administration said last week that US tight oil production growth could stop after a year if prices slide to $60 per barrel. Moreover, two weeks ago, Continental – the largest oil producer in the Bakken play of North Dakota and Montana – has even removed its hedge on oil prices for 2015, 2016 and the remainder of 2014 as the company’s management is betting on a rebound in oil prices. Harold Hamm, Continental’s CEO, said on November 6th, 2014: "We view the recent downdraft in oil prices as unsustainable given the lack of fundamental change in supply and demand.” Lifting the hedges will allow Continental "to fully participate in what we anticipate will be an oil price recovery."

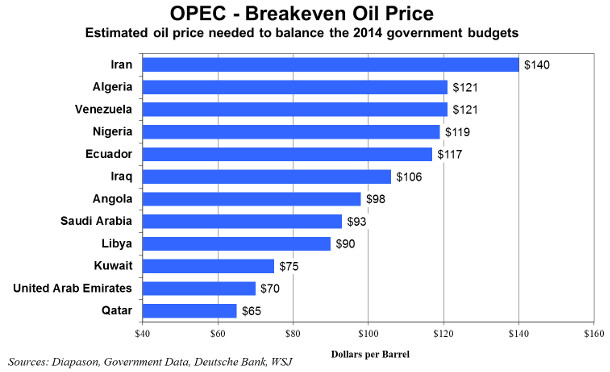

Other actors in the oil market may prevent oil prices from declining further. OPEC members are unlikely to let oil prices decline significantly further as they require an elevated price to balance their budget (see chart of the week). Oil prices are currently at unsustainable levels for most OPEC members, as reflected by intense pre-meeting negotiations by OPEC oil ministers. It is interesting to consider not only the level of oil price required for OPEC members to balance their budget but also to see the evolution of their budget breakeven oil prices. OPEC members have indeed broadly increased social and defence spending these past 6 years. In response to the Arab Spring, Saudi Arabia implemented a $130 billion social spending stimulus package in 2011, at the same time, it has increased its military spending. According to SIPRI, military expenditure in the Middle East rose by 37% between 2008 and 2013 to $150 billion as geopolitical tensions in the region increased significantly. This major increase in social and military expenses contributed to a rise in Saudi government expenditures to $247 billion in 2013, almost $30 billion above the initially expected expenditures, and up by 43.6% from 2008. Saudi Arabia therefore requires an oil barrel to be at around $90 to balance its budget, a sharp rise from 2008 when the Kingdom needed only a price of around $50 per barrel. This is another major difference to 2008. While these countries could face a budget deficit like every other country in the world, some OPEC members already faced cash-flow issues when oil prices stood above $100 per barrel and they may face difficulties raising enough money to finance their deficit. Autocratic countries like Venezuela heavily depend on oil income for their social programs, which are critical to maintain social peace. These regimes have hence little flexibility to significantly reduce expenditures.

They are therefore likely to be the principal supporters of a cut in OPEC production target in the next meeting. OPEC may cut 0.5 - 1.0 million b/d of its production target in order to restore price stability. This would translate into a reduction of about 1.0 to 1.5 million b/d of OPEC production as the cartel is now producing about 30.5 million b/d, 0.5 million b/d above the current production target. This is what we consider the most likely scenario as most OPEC members need a higher oil price to balance their budgets. A production cut of this amount would likely be enough to stabilise the oil market and should contribute to higher oil prices by the end of the year. This could bring the Brent price back to $100 per barrel in the first part of next year, as we expect global growth to accelerate. In fact, the oversold conditions and the likely reaction of US oil producers to low prices are implying that downside potential is clearly limited, offering an attractive risk/reward opportunity.

|

Main drivers this week

|

Commodities and Economic Highlights

Commentary by Robert Balan and Alessandro Gelli

Strong refining margins triggered by heavy maintenance work

Refining margins have reached elevated levels these past few weeks despite the fact that the refining maintenance season is about to end. The rise in crack spreads was caused by major unplanned outages. However, this should not last for long as these refineries are likely to soon restart activity, while other refineries are finishing seasonal maintenance work, leading to a major rebound in crude runs.

Two weeks ago, a power outage led to the halt of the Amuay and Cardon refineries at PDVSA’s main complex, the Paraguana Refining Center in Venezuela. This forced PDVSA to issue tenders for gasoline and diesel for short-notice delivery — implying extremely low inventories on-site. This contributed to rapidly tighten the petroleum products market in the Atlantic Basin. However, contrasting with 2012 when a fire hit the Venezuelan refining complex, damaging a refinery and forcing the country to rely on petroleum product imports during several months, the two refineries are expected to soon restart activity.

The tightening of the petroleum products market in the Atlantic Basin occurred while the Asian petroleum products market also tightened, as reflected by the crack margins for Dubai crude in Singapore, which reached the highest level in 15-month at $5 per barrel last week. This was caused by heavy refinery maintenance work in Asia, which peaked in October at about 1.1 million b/d, accounting for 3.2% of Asia’s total crude distillation unit capacity. Other refineries were also running at low rates due to previous weak margins. However, like in the Atlantic Basin, elevated margins are not likely to last. Global crude runs are likely to increase in the coming weeks as the refining maintenance season is almost over. According to the International Energy Agency, global crude runs are likely to increase to 78.7 million b/d by December 2014, up by 2.3 million b/d from October 2014. This should contribute to reduce tensions in the petroleum products market and lead to lower crack spreads.

Gold demand fell to a 5-year low but miners will soon start to reduce output

Since early July 2014, the price of precious metals declined, driven by the rise of the US dollar. This was however not the only factor that contributed to weaker gold and silver prices. Weak demand for gold also added downside pressure on precious metals prices. According to the World Gold Council, global gold demand fell in the third quarter to its lowest level since 2009, driven by weak Chinese demand. Chinese gold demand fell by 37% y/y to 182.7 metric tonnes despite lower prices. Jewellery consumption dwindled by 39% to 147.1 metric tonnes, while demand for bars and coins fell by 30% to 35.6 metric tonnes. Last year, strong Chinese gold demand was fuelled by low gold prices — which averaged $1300 an ounce in the second half of 2013. However, this year demand did not respond to lower prices.

Anti-corruption policies and price volatility reduced the interest for the yellow metal in China. In fact, weak Chinese gold demand allowed India to take back its positions as the world’s largest consumer of gold. Demand for gold also fell sharply in other large countries in Asia. Indonesia, Japan and Thailand experienced a double-digit decline in gold demand due to the unstable political climate (Indonesia, Thailand) and a new sales tax (Japan). Investment demand for gold also declined as outflows from exchange-traded funds continued during the third quarter. Since December 2012, total known ETF holdings of gold fell by 38% to 52.0 million troy ounce, the lowest level since early 2009. These factors contributed to the decline in global gold demand to 929 metric tonnes in Q3 2014, the lowest level since Q4 2009.

Nonetheless, low gold prices should soon lead to a reaction from gold producers. Indeed, higher-cost producers are now selling at a loss with prices below $1200 an ounce. This could trigger lower gold supply. Moreover, gold demand could recover as prices make the yellow metal more attractive. This should prevent gold prices from falling significantly further. Finally, we expect the US dollar to decline, which should provide enough support for an upward move in gold prices.

Weak fundamentals could keep cotton prices low

The price of cotton recently declined to the lowest level since 2009. Since the beginning of the year, the cotton price is down by 31%. Stronger expected supply amid lower demand has contributed to this downward move.

Cotton production in the US – the world’s largest exporter of cotton – is expected to increase by 27% during the 2014/15 season to 16.4 million US bales back to the 2010-2013 average. US cotton production is recovering whilst demand for cotton has declined sharply. Strong Chinese imports have indeed contributed to the elevated price structure of cotton these past few years. However, the Chinese government decided to stop stockpiling cotton. This contributed to a significant reduction in Chinese cotton imports.

In October, Chinese cotton imports fell by 42% y/y to their lowest level since 2009. In 2013/14, Chinese cotton imports already declined by 30.5% and they are expected to decline this season by 50.4% to 7.0 million bales, the lowest level since 2008/09. Instead of importing cotton, the Chinese government has extended subsidies to cotton farmers in the Xinjiang region. Thus, with the rise in US cotton output and weak Chinese imports, the cotton market is expected to face an important surplus this year, preventing cotton prices from recovering from current low levels.

Chart of the week: Most OPEC members need an oil price above $90 to breakeven

|

Most OPEC members have significantly increased social and military spending these past 6 years. Autocratic governments with limited cash reserves cannot easily cut expenditures as oil income is critical in maintaining social peace. These countries (top of the charts) are likely to be the most important supporters of a reduction in OPEC production target, which is required in order to stabilise the market. |

|

|

For the full version of the Diapason Capital Markets report, please contact info@diapason-cm.com