November 17, 2014

Targeted stimuli are likely to continue, boosting economic activity in China and demand for base metals

Commentary by Robert Balan, Senior Market Strategist and Alessandro Gelli, Commodity Analyst

“Investment projects approved by the NDRC will help to ease the problem of incomplete infrastructure in China's western regions”

Zhang Yansheng, secretary-general of the Academic Committee at the NDRC, November 11th, 2014

The base metals sector has been one of the best performing commodity sectors since June 2014, outperforming the DCI® Global Index by about 15% as base metals benefited from the pro-growth measures taken by the Chinese government. The anticipated acceleration in the Chinese economic activity should continue to provide further support to the sector.

Following the June-August 2014 decline in commodity prices, some sectors have started to turn around. At the end of September, agriculture prices reached a bottom and they have risen by almost 7% since then. The precious metals sector may have reached an intermediate bottom in early November, while the energy sector is still falling. The DCI® Base Metals Index has risen by 3.4% since its secondary mid-October bottom — as the year’s low was made in March. The index is up by 7.7% since March low. Since mid-October, the base metals sector’s performance was driven by aluminium and lead prices (+5.7% and +3.0% respectively), while nickel and zinc prices have lagged the rest of the base metals (+0.7% and +1.8% respectively). While each of the metals has specific fundamentals affecting its prices, the ultimate driver behind these metals performance is China. Economic data are currently implying a relatively slow growth — stronger than in the first part of the year but weaker than in previous years. Nonetheless, recent interventions by the Chinese authorities have contributed to improve the outlook on the economic situation, reinforcing our view that the economic activity should accelerate in Q4 2014.

Indeed, the PBoC has provided more liquidity to the banking system on a case-by-case basis. Small and medium-sized banks were first targeted, followed by the largest ones. The banking system needed liquidity due to previous government’s interventions against the shadow banking system, which led to tighter monetary conditions. Several injections of liquidity were made these past 3 months through newly-created lending facilities — Chinese types of quantitative easing programs. This had a positive impact on the banking system. Interest rates in China have declined and the Yuan has weakened.

The next step by the Chinese government was to increase spending. But in contrast to 2008, when a major $586 billion stimulus plan was implemented, the Chinese government this year chose to target specific sectors of the economy with programs of smaller sizes. Last week, China announced plans to invest $16.3 billion in infrastructure projects in Western China. This followed other announcements made during the previous weeks. Since mid-October, China's National Development and Reform Commission (NDRC) has indeed accelerated project approvals, including 16 rail lines and 5 airports evaluated at about $114 billion. We believe this will help cushion the slowdown in property and manufacturing investment in Q4 2014 and prevent further declines in investment going into 2015. The brighter spot was a pickup in infrastructure investment (utilities and roads), and signs of some near-term stabilisation in property investment in the October activity data.

Naturally, these plans should have a positive impact on base metal prices. The fact that base metals prices recovered at about the same time as the Chinese government started to announce new infrastructure spending plans is not a coincidence. And further upside is likely as the Chinese government may continue with its targeted measures in order to help the recovery of the Chinese economic activity. While the base metals demand prospects have improved, the supply side of the equation is also proving to be supportive for base metals prices. Indeed, following several years of underinvestment, some major old mines are expected to close next year without being replaced by sufficient new capacity to meet rising demand. MMG’s Century mine, Australia’s largest zinc open-pit mine, is expected to shut down mining activity in July 2015. In the aluminium market, smelting capacity has been halted due to low aluminium prices. About 2 million metric tonnes of smelting capacity in China has shutdown between late 2013 and the first half of 2014. Moreover, smelting capacity outside China is expected to decline by 1.5 million metric tonnes this year. Prices for some base metals have also fallen below the cost of production. With nickel prices at around $15’500 per metric tonne, 25% to 30% of global refined production is below cash cost, encouraging smelters to reduce activity. Moreover, the Indonesian ban on ore exports continues to affect ore trade in Asia. Base metal prices are therefore likely to continue to perform well into Q1-Q2 next year.

|

Main drivers this week

|

Commodities and Economic Highlights

Commentary by Robert Balan and Alessandro Gelli

OPEC meeting concerns mask supportive factors

Oil prices weakened again last week, following commentaries from OPEC members that the cartel will not agree to cut output during the next meeting in Vienna on November 27th. The oil market’s participants indeed estimate that a major surplus is likely to occur in the coming months, if OPEC does not reduce its crude oil production, due to persisting weak oil demand from Europe and Asia and ample supply. This could result in a major counter-seasonal increase in inventories. The IEA already reported, in its latest report, a counter-seasonal build in OECD oil inventories in September 2014.

Despite these concerns, the decline in oil prices to the lowest level in four years has already triggered adjustments in the physical markets. Demand is picking up due to low prices — and seasonality. The number of VLCCs sailing towards China remained at an elevated level at around 80, the highest level in 9 months. The price of VLCCs for the Arabian Gulf – Japan trip also increased at a more rapid pace than usual in October, implying stronger crude demand from Eastern Asia. On the supply side, several oil companies have already announced a reduction in drilling activity or capex in the US in reaction to the current low oil price environment. Moreover, Libyan crude oil production recently fell by 300’000 b/d to around 550’000 b/d due to protests and the capture of a major oil field by an armed group. Global refining activity is also gradually increasing as the refining maintenance season is about to end.

However, despite these more constructive factors, the oil market is likely to remain driven by news surrounding the November OPEC meeting until the end of the month. Oil price volatility could therefore remain important. Developments over the nuclear negotiation between Iran and the P5+1, which are expected to end on November 24th, could also have an impact on oil prices as an agreement could lead to the return of about 1 million b/d of Iranian crude oil next year. Moreover, a further cut in Libyan crude oil production and the perception that the latter will not rebound anytime soon may reduce the pressure on the remaining OPEC members to cut output.

Zinc’s prospects are improving

Zinc inventories at the LME fell by 9% since the beginning of September and reached 687’000 metric tonnes last week, the lowest level since early August 2014, reflecting tightening fundamentals. This contributed to the recent outperformance of zinc prices over those of other base metals. Demand growth should remain solid, driven by new infrastructure plans in China, while concerns over supply are increasing.

Last week, a strike started at Antamina’s largest copper mine in Peru. This may have an impact on global zinc supply as the mine also produces large amounts of zinc. Peru is a large producer of zinc, accounting for 10% of global zinc output. The strike is occurring amid expected stronger demand growth and the anticipated closure of some major old zinc mines next year. For instance, mining operations at MMG’s Century mine, Australia’s largest zinc open-pit mine are expected to end in July 2015 due to the exhaustion of economically recoverable ore reserves.

Zinc demand has increased at a faster pace in China as galvanized steel products output rose by 20.1% y/y in Q3 2014, compared with only +14.8 y/y and +13.7% y/y respectively in Q1 and Q2 2014. The zinc price spread between the SHFE and the LME has continued to rise and it reached last week the highest level since March 2014. This is also implying stronger Chinese demand for zinc and should result in higher Chinese zinc imports. Furthermore, we expect Chinese economic growth to accelerate in the coming months due to the targeted stimuli in the form of liquidity injections and also higher government spending in infrastructure projects. This should have a positive impact on zinc demand growth and add further upside pressure on prices. Zinc prices are hence supported by current tightness and the expectation that the zinc market will move into a larger deficit next year.

Sugar prices could move higher driven by concerns over the Brazil crop

Brazilian sugar production unexpectedly declined leading to a recovery in sugar prices. Brazil is the world’s largest sugar producer, accounting for 22% of global output last year. Hence, the condition of the Brazilian sugar crop has a major impact on international sugar prices. The rebound in sugar prices followed an almost 10% decline in prices made between early October and the beginning of this month.

Last week’s price recovery was triggered by the decline in sugar production in the main sugar-cane producing region, as the harvest was halted due to the lack of cane for mills to crush. The development of sugar cane has been hit earlier this year by a major drought. However, in September 2014, sugar prices fell to around 13.5 cents per pound, the lowest level since April 2009, and below the cost of production in Brazil, which is estimated at around 17 cents per pound. Some mills already closed for the year due to low margins. According to Unica, the sugar and ethanol industry association, refined sugar output reached 2.1 million metric tonnes in the last half of October, down from 2.4 million metric tonnes in the first part of the month and down by 17% y/y. About 15% of the mills in the region have already closed for the season, compared to a 5% closure during the same period last year. According to Unica’s estimates, halted mills have crushed on average 16% less cane than last year due to the severe drought conditions which hurt the crop this year.

Stronger ethanol production should also boost sugar demand. In the second half of October, the amount of sugar used to produce ethanol increased to 57% of total sugar use, up from 52% a year ago. Brazilian ethanol demand could rise as the government is expected to raise gasoline prices, making ethanol more competitive. The rebound in sugar prices was also triggered by a short covering rally as the amount of speculative short positions stood close to record levels. Net short speculative positions also reached elevated levels, close to previous record highs made in January 2014 and in June 2013. Sugar prices could move higher, driven by supply concerns and as price remain below the cost of production. Nonetheless, upside potential is limited as the sugar market is again expected to experience a surplus. According to the International Sugar Organisation, the sugar market should experience a surplus for the fifth consecutive year during the 2014/15 season.

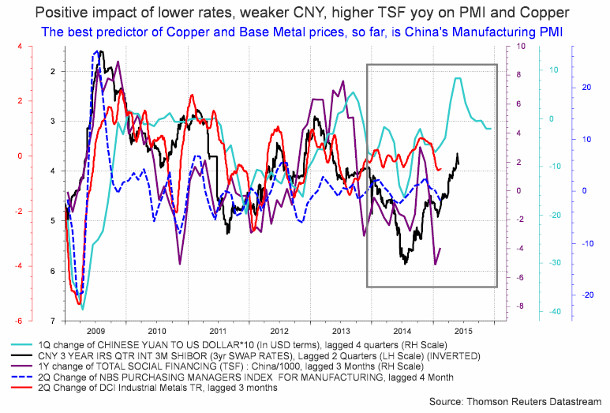

Chart of the week: China’s growth factors are moving higher

|

The health of the Chinese economy is probably the most important driver for base metal prices. China indeed accounts for the bulk in these metals trade and demand, as the country is still one of the fastest growing economies worldwide, with its GDP growth above 7%. In 2013, China accounted for 47% of global refined copper production and for 50% of global copper ores and concentrates imports. The same year, China absorbed 76% of global bauxite trade for its alumina smelters. China has also an important presence in other base metal markets. China indeed accounted for 50% and 41% of global nickel and lead demand respectively. Targeted stimuli have already contributed to a positive impact on China’s growth factors. Lower rates, a weaker yuan and the recovery in social financing are indeed indicating stronger economic growth ahead. This is therefore likely to have a positive impact on base metal prices. |

|

|

For the full version of the Diapason Capital Markets report, please contact info@diapason-cm.com