November 10, 2014

The Brent-WTI spread could move back to $10 next year

Commentary by Alessandro Gelli, Commodity Analyst

“I expect the Brent-WTI spread to re-widen as we exit 2014 with a start up of new pipeline capacity in the Cushing storage hub.”

Michael Jennings, HollyFrontier’s CEO, November 5th, 2014

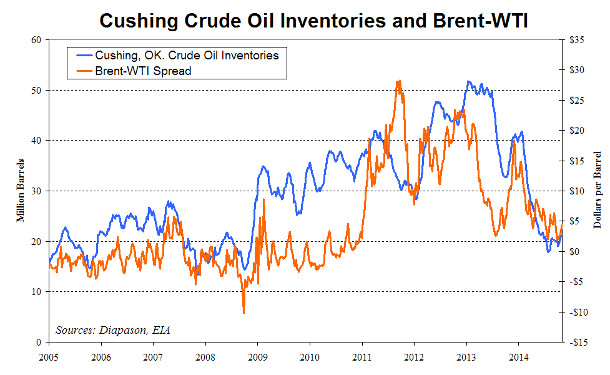

The price spread between Brent and WTI crude oil has recently widened and reached last week $6.0 per barrel up from $3.2 in mid-October. Weak refining activity in the US Midwest and the start of the new Pony Express pipeline have contributed to the wider spread. Next year, other factors could contribute to a further widening of the spread, contrasting with this year when the spread narrowed to the smallest level since July 2013.

The restart of refineries in November could contribute to a slightly narrower Brent-WTI spread until the end of the year and the beginning of Q1 2015. The spread could temporary move back to $3 per barrel. However, this should not last for long and may offer an interesting opportunity to bet on the spread reversal. Indeed, even if US oil production growth slows down due to current weak US prices, the rise in oil production should be larger than the capacity for the US to absorb it. This is contrasting with this year when incremental oil production was absorbed by the US market or exported, leading to a decline in US crude oil inventories. At Cushing, Oklahoma, a key transit hub and the delivery point of NYMEX Light Sweet Crude oil futures, inventories fell to less than 20 million barrels in July 2014, close to the operational minimum level. This added significant upside pressure on WTI prices relative to Brent prices.

In 2014, US crude oil production is estimated to increase by 1.1 million b/d y/y — +1.5 million b/d y/y if we include Natural Gas Liquids. Despite this significant rise, US and some Canadian refineries managed to absorb the incremental production. Between January and October 2014, US crude runs rose by 570’000 b/d y/y to record levels thanks to new refining capacity — built to use domestically produced light sweet crude oil — and elevated margins. US crude oil imports also averaged 7.4 million b/d between January and October 2014, down 425’000 b/d y/y as refineries are using a growing amount of domestic crude oil at the expense of foreign crude oil — with the exception of Canadian crude oil. US refineries especially in the East Coast have finally started to replace large amounts of imported crude oil with domestic crude oil, thanks to new infrastructure — mostly rail terminals, which allowed the transportation of crude oil at a competitive price. Between January and October 2014, US crude oil imports on the US East Coast fell by 250’000 b/d — or –23.8% y/y compared with a decline in crude oil imports on the US Gulf Coast of 8.4% y/y. US crude oil exports also increased by about 200’000 b/d y/y between January and August 2014 (450’000 b/d if we include Natural Gas Liquids).

Thus, the rise in oil production was absorbed this year by stronger refineries activity, higher exports and lower imports, contributing to the narrower Brent-WTI spread. These factors have therefore contributed to tighten the US crude market and led to the decline in US crude oil inventories. Between January and October 2014, US crude oil inventories fell by 0.8% y/y, contrasting with the previous two years when it increased by 3.6% on average during the same period.

The tightness in the US, and especially in the Midwest, contrasted with the oversupplied Atlantic Basin as West African cargoes could not find buyers during the summer due to the restart of Libyan crude oil exports amid weakening oil demand in Europe and in Asia. This added significant downside pressure on the Brent-WTI spread. Thus, it was interesting to see that despite the tight oil boom, the US experienced a tighter supply/demand balance than the rest of the world.

However, the situation is unlikely to repeat next year. Indeed, this year US refinery utilisation rates have reached elevated levels, leaving little flexibility for refiners to increase crude runs significantly further. Moreover, most of the light sweet crude oil imports have been replaced by domestic crude oil. US refineries still need to import heavy/medium crude oil in order to operate. Thus, US crude oil imports are unlikely to decline as much as they have this year. Finally, US crude oil was mostly exported to refineries on the Eastern coast of Canada due to the free trade agreement that circumvent the US ban on crude oil exports. These refineries can also import only a limited amount of US crude oil. Thus, US crude oil exports are not likely to increase significantly next year; and despite the recent Republican takeover of the Senate, the ban on crude oil exports is not likely to be removed next year. Without a major rise in refining activity and crude oil exports, the US market may not be able to absorb next year’s incremental crude oil production, even if the latter could grow at a slower pace at 0.9 million b/d y/y — as current weaker oil prices may discourage drilling activity in the most expensive tight oil plays. The US market is therefore likely to face an important surplus, leading to a build in crude oil inventories. Moreover, new pipeline capacity in the US Midwest could lead to an especially important build in crude oil inventories at Cushing. This should then contribute to a wider Brent-WTI spread, which is likely to move back to the $10 area in the spring of 2015 during the refining maintenance season.

|

Main drivers this week

|

Commodities and Economic Highlights

Commentary by Robert Balan and Alessandro Gelli

The US natural gas market is vulnerable to the upcoming cold wave

US natural gas prices recently increased to $4.5 per million BTU - the highest level since June 2014 – on expected cold weather. The US natural gas market is currently vulnerable to such forecasts due to the historical low level of inventories for this time of the year, ahead of the start of the withdrawal season.

Last winter’s polar vortex has contributed to a significant decline in US natural gas inventories. In early April 2014, the end of the 2013/14 withdrawal season — when the market is in a deficit and inventories are declining seasonally — US natural gas inventories were down by about 50% y/y and down by 54% from the 5-year average. Higher natural gas production and weaker demand for natural gas prices have contributed since then to a more rapid than usual build in inventories. At the end of October 2014, US natural gas inventories were only down by 8% from the previous year and the 5-year average. The rapid build in natural gas inventories contributed to the decline in US natural gas prices to around $3.6 per million BTU at the end of October 2014, the lowest level since November 2013.

However, despite the large net injection into inventories, US natural gas inventory remained below the past 6 years’ level, while the injection season is about to end. The US natural gas market is therefore more vulnerable to a rapid rise in demand or/and slower supply growth. In fact, the US natural gas market may be about to experience both. US natural gas production is indeed expected to slow down, not because of previous lower natural gas prices but because of the major decline in oil prices. Indeed, about 8% of US natural gas production is extracted alongside oil (associated natural gas). Slower drilling activity for oil wells or natural gas liquids — which prices are closer to oil prices than to dry natural gas prices — could therefore lead to slower associated natural gas supply growth. Moreover, a major cold wave is expected to hit next week most part of the US, which could boost demand for space-heating and hence natural gas. The confirmation of slower production growth and colder temperatures could therefore lead to further upside pressure on US natural gas prices.

Aluminium should remain a leading performer among base metals

During these past three months, Aluminium prices outperformed the base metals sector as they moved closer to their early September high of $2’100 per metric tonne, while the DCI® Base Metals Index remains down by almost 5% since then. The outperformance of aluminium was due to the relatively strong demand, concerns about bauxite supplies, a significant decline in inventories and the fact that prices are too low to encourage idle smelters to restart activity.

Prospect for aluminium demand has increased, supported by improving vehicle sales data in the US and in China. In October, US auto sales rose by 5.8% y/y, a slower growth than during Q2 and Q3 2014 when it averaged 6.9% y/y and 7.9% y/y respectively. This was nonetheless significantly stronger than the growth experienced in Q1 2014 at 0.9% y/y. Chinese passenger vehicle sales also continued to grow at a rapid pace and were up by 6.4% y/y in September 2014.

Signs of stronger demand are occurring while concerns about bauxite supply are increasing. Bauxite is used to produce alumina, which is required to produce aluminium. The propagation of Ebola in West Africa has indeed increased the risk of supply disruptions of bauxite from Guinea, which is the world’s fifth largest bauxite producer, accounting for 7.1% of global bauxite production in 2013. A reduction in bauxite supply would have a larger than normal impact on the market due to the Indonesian ban on ore exports implemented at the beginning of the year which has reduced greatly bauxite supply on the international markets, as Indonesia is the world’s second largest bauxite producer after Australia.

Moreover, aluminium inventories at major exchanges fell at the end of October to 4.7 million metric tonnes, the lowest level since November 2011. Since the beginning of May 2014, aluminium inventories fell by 18.8%. Stronger demand from the automobile market, growing concerns over bauxite supply and the significant drawdown in aluminium inventories have contributed to bring back the aluminium market into backwardation.

Short term weakness on the cocoa market should not last

Cocoa futures prices fell by 15% since the end of September when worries about Ebola peaked. The risk of Ebola affecting Ghana and Ivory Coast, accounting together for almost 60% of global cocoa production, has contributed to the rise in cocoa prices during the summer until late September. The upward move in Cocoa prices in the first part of the year was, on the other hand, triggered by expectations of a deficit this year and next year, whereas the cocoa market was already in deficit last year.

However, the risk of Ebola hitting Ghana and Ivory Coast has gradually faded, while the cocoa crop from these two countries are likely to be larger than initially expected. Moreover, demand for cocoa has showed signs of weakness, in contrast to the first part of the year. The main crop is about to start with improved outlook on the crop following favourable weather. Production in Ivory Coast should reach a record high this year. Cocoa deliveries from the region are similar to last year, while Ebola has not reached the two main producing countries. This has greatly reduced concerns about supply disruptions, while inventories are at a relatively low level. According to the International Cocoa Organization, global cocoa inventories fell to 1.6 million metric tonnes last year, the lowest level since 2010, and should decline by 4.6% y/y this year due to the expected deficit.

Cocoa grindings from Europe and Asia also weakened during the third quarter, by 1% and 6% respectively, compared with last year, as margins for cocoa processors have declined sharply. The decline in Asia would have been greater without the start of two new grinding facilities. The prices of cocoa butter and powder have not increased as much as cocoa beans price due to elevated stocks of finished products. On the other hand, grindings in North America increased by 6% y/y, driven by stronger retail demand unaffected by the hike in prices.

The ICCO still expects the cocoa market to experience a deficit of about 100’000 metric tonnes as demand is expected to outpace supply for the third year in a row, leading to a major decline in inventories. Downside pressure on cocoa prices should not last. The tighter market expected for next year amid relatively low inventories should provide support for higher prices. Renewed concerns about the West African crop — on Ebola for instance — could lead to a surge in prices.

Chart of the week: The rebound in Cushing crude oil inventories should lead to a wider Brent-WTI spread

|

Inventories at Cushing are having an important impact on the Brent-WTI spread. Crude oil inventories at Cushing fell to around 20 million barrels in July 2014 down from more than 40 million barrels at the beginning of the year. The refining maintenance season has contributed to a slight rebound in inventories, but this may not be sufficient to lead to a significantly wider spread, as refineries are now restarting. However, the rise in US crude oil production next year is unlikely to be absorbed by US and Canadian refineries, leading to a major crude oil surplus. New pipeline capacity is likely to bring part of this surplus to Cushing, adding significant upside pressure on the Brent-WTI spread.

|

|

|

For the full version of the Diapason Capital Markets report, please contact info@diapason-cm.com