November 3, 2014

Grain prices have likely made their year low but the recent rally may soon take a breath

Commentary by Robert Balan, Senior Market Strategist

“Rail logistics seem to be squeezing the soymeal market higher, along with limited soybeans available to soybean processors.”

CHS Hedging, October 30th, 2014

In October, grain prices have performed extremely well. In fact, The DCI® Grains Index grew by 14.1% over the month, driven by the soybean complex. Soybean meal was indeed the best performer as the December contract’s price rose by 30.1% over the month due to shortages in some regions in the US. This contrasted with the 31.0% fall in the DCI® Grains Index between May and September 2014 as crops expectations reached record levels. Corn and wheat prices followed the performance of soybean.

Several factors have contributed to this important rebound in grain prices. Wet weather in the US contributed to delay the harvest. Two weeks ago, 70% of the US soybean crop was harvested, compared with 76% for the 5-year average at this time of the year. The corn harvest was 46% complete compared to the 5-year average of 65%. Corn and soybean yields have also declined as the harvest moved from the Eastern Corn Belt into Iowa and Minnesota, where the crop condition is not as good as in the rest of the US. In reaction to the recent decline in prices, grain supply was further constrained as some farmers have preferred to store crops and wait for higher prices.

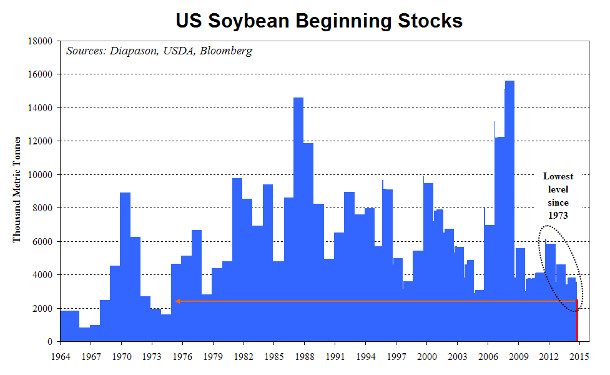

Moreover, one of the most important factors was a shortage of rail cars, which delayed shipment of soybean meal to livestock farms in the south-eastern part of the US. This forced these farmers to pay significantly higher prices for immediate supply, as they are competing with exporters. Domestic demand for animal feed (corn, soybean meal and feed wheat) is strong due to high margins for livestock farmers, as meat prices recently increased significantly — live cattle and chicken prices are up 27.4% and 32.8% year-to-date respectively. Foreign demand has also proven quite strong. US soybeans and soybean products export sales commitment were also stronger than anticipated, reflecting healthy demand. 6.2 million metric tonnes of US soymeal have been already booked for the 2014/15 crop year, the largest amount ever recorded for mid-October. This should result in a decline in US soybean inventories to 92 million bushels, the lowest since 1973 (see chart of the week).

Soybean meal shortages, provoked by constrained supply and strong domestic and foreign demand, also benefited corn and wheat prices, as these grains are also used as animal feed. Furthermore, as mentioned in the previous Diapason Commodities Insight Weekly, grain prices also benefited from delay planting in South America, the US and growing concerns over the Russian crop. The wheat crop conditions in Russia, the world’s fifth largest wheat exporter last year, have indeed worsened greatly as the lack of rain has damaged the early growth of winter wheat seeds in key growing regions. This could reduce the amount of Russian wheat available for export next year, encouraging wheat importers to secure shipments elsewhere. The rebound in grain prices was also triggered by a short covering rally. Brazilian corn production is also threatened by delayed soybean planting as it implies that the second crop — typically corn — may not be planted in time. Short speculative positions on soybean futures reached in October the highest level since at least 2006, while short speculative positions on corn and wheat futures also reached levels close to previous record high. Grain prices also benefited from the halt of the US Dollar rise.

Nonetheless, the recent grain price rally is not likely to continue at the current pace. Higher prices may encourage some farmers to release grains from storage, while the harvest could soon accelerate — and lead to the expected record grain crop — as dry weather is now expected to hit the US Midwest. Moreover, current logistical constraints are only “short term in nature” according to an industry source, while substitution has already taken place in some of the areas most affected by the shortage. Desperate US farmers had turned to foreign animal feed at the expense of expensive — or unavailable — US soybean products. Two cargoes of European feed wheat were reported to have reached US ports in October. This was extremely unusual, especially as record crops are expected. Expensive US soybean meal relative to South American products could also lead to lower US exports.

Thus, the temporary tightness in the grain market should gradually fade away. However, while grain prices are not likely to increase at the same pace as in October and could start to stabilise, they are unlikely to decline significantly either. Growing concerns about the second crop in Brazil, the Russian wheat crop and especially the quality of the massive US soybean crop could provide the needed medium term support to prevent a slide in grain prices. If confirmed, the lack of protein, caused by a wet spring and dry conditions when crop neared maturity, could affect the production of soymeal and tighten the animal feed market, whilst current soybean inventories are at the lowest level since 1973. The grain market is therefore likely to have made its year low at the end of September.

|

Main drivers this week

|

Commodities and Economic Highlights

Commentary by Robert Balan and Alessandro Gelli

Refining activity is growing, adding downside pressure on crack spreads

The refining maintenance season is about to end. The recent decline in oil prices occurred close to the peak of the refining maintenance season, when crude and petroleum products demand is seasonally weak. The restart of refining capacity should tighten the oil market, preventing oil prices from experiencing a downward move as large as the one experienced in October. Nonetheless, the restart of refining activity combined with the start of new refining capacity in the Middle East should add downside pressure on crack spreads.

According to the EIA, US crude runs reached 15.1 million b/d two weeks ago, down from 16.5 million b/d at the end of August. Healthy margins should contribute to a rebound in refining activity back to August levels. Moreover, US refiners are becoming more competitive on international markets following the widening of the Brent-WTI spread — which moved last week above $5 per barrel from $3.2 in mid-October. Russian refineries are also expected to increase activity in November. Last year, Russian crude runs rose by 400’000 b/d between October and December. New refining capacity in the Middle East should also contribute to stronger crude runs in the region. Saudi Arabia’s new 400’000 b/d Satorp refinery has started activity in August and is likely to run at full capacity. Stronger refining margins in Europe, especially for refineries heavily exposed to diesel, should also contribute to stronger crude runs.

While petroleum products demand should increase, seasonally, and because of the anticipated acceleration of the Chinese economy, the rise in refining activity is still likely to be more important than petroleum products demand growth, leading to a rise in petroleum products inventory. This should contribute to a decline in crack spreads, which are still at a high level for the season.

Signs of a tighter nickel market are becoming more evident

Nickel prices have declined by 21.4% since the beginning of September 2014, when it became clear that the Philippines would not impose a ban on ore exports any time soon. Weaker nickel demand in the second half of the year and strong nickel ore exports from the Philippines also contributed to the decline in prices. However, prices are unlikely to fall further significantly and should recover due to tighter fundamentals. Nickel prices have fallen below the cost of production. Furthermore, Chinese nickel inventories could be at a low level, making the country vulnerable to an acceleration in demand, which could occur as we expect the Chinese economic activity to increase in Q4 2014. This could occur while supply risks are increasing.

In August, global refined nickel demand fell 7.1% to 127’000 metric tonnes, the lowest level since April 2012. Stainless mill operators are also extremely pessimistic about the last weeks of 2014. Lower demand for nickel became more apparent while the amount and the quality of Philippines nickel ore exports are more important than initially expected. In September, Chinese imports of nickel from the Philippines slightly declined over the month but were still up by 27% y/y to 4.52 million metric tonnes. These factors contributed to the decline in nickel prices.

However, several factors are indicating that the price correction may be over. Indeed, nickel prices fell to around $15’500 per metric tonne, below the cost of production. According to JPMorgan, at this level of prices, 25% to 30% of global refined production is below cash cost, encouraging smelters to reduce activity. The breakeven price for the top 90th percentile producers is estimated at around $16’500 per metric tonne. Furthermore, Philippines nickel ore exports could start to decline due to the monsoon. The monsoon typically leads to the halt of mining activity in the main nickel region of Caraga between October/November and January/February. This should curb Chinese nickel ore imports from the Philippines until February.

The reduction in supply — from reduced smelting activity and lower exports from the Philippines — could occur while Chinese nickel inventories have reached a low level. The large decline in Chinese refined nickel exports in September is suggesting that Chinese nickel inventories have been depleted. Industry sources have confirmed that Chinese inventories of high-quality nickel ore have been almost completely depleted. Since June 2014, Chinese refined nickel exports have increased greatly to above 15’000 metric tonnes from an average of 3’300 metric tonnes between 2010 and 2013 following the financial probe on base metals inventories used as financial collateral in China. In fact, Chinese nickel inventories in bonded warehouses have moved since then to nickel inventories on the LME. This explains why the latter has increased at a more rapid pace since June 2014 to record levels — non-transparent inventories became transparent inventories.

The decline in nickel exports from China therefore implies low inventories. This has increased the upside potential of the metal price due to the likely acceleration of the Chinese economy which we expect to occur in Q4 2014. This could therefore lead to, first, the stabilisation in nickel prices, followed by a recovery in prices once these factors are being confirmed by data (Chinese economic recovery, lower ore exports from the Philippines, further decline in Chinese refined nickel exports or the stabilisation of nickel inventories at the LME).

The Brazilian coffee crop is still at risk

Arabica coffee prices fell by 15.0% since mid-October due to expected rainfall in the main coffee growing region in Brazil, and strong production growth in the rest of the world. Rains in Brazil were needed following important drought conditions, which negatively affected the development of coffee beans.

South-East Asian countries have benefited from a favourable climate, leading to higher yields. Coffee production in Indonesia, which is the world’s third largest producer of Robusta coffee, is expected to rise by 8% y/y. In Vietnam, coffee production has increased, allowing a rise in coffee exports from January to October of 37% y/y.

Moreover, coffee production in Central America is also increasing, following several years of weak crop due to the destructive leaf fungus roya. Costa Rica reported last week that it has managed to reduce the amount of coffee infected by the fungus to 2% in August 2014 from 16% in November 2012 thanks to measures taken by farmers. Production in other Latin American countries is increasing.

Nonetheless, the coffee market remains tight. In early October, inventories held by coffee growers in Vietnam stood at record low levels as elevated prices encouraged sales. Moreover, the Brazilian coffee crop for the 2014/15 season remains extremely vulnerable to the return of dry weather. This should prevent coffee prices from sliding significantly further.

Chart of the week: US soybean market vulnerable as inventories are at the lowest level since 1973

|

Delayed harvest, logistical constrains and strong demand have contributed to bring the US soybean stocks to the lowest level since 1973. While, the rally in soybean price should not last as the record crop is still being harvested, low inventories are making the soybean market vulnerable to any crop disruptions. |

|

|

For the full version of the Diapason Capital Markets report, please contact info@diapason-cm.com