October 27, 2014

Will the hawks at the Fed lay low following the recent market volatility?

Commentary by Robert Balan, Senior Market Strategist

“Policy makers should be careful in changing course based solely on their economic forecasts, which have proven in the past to be too rosy.”

James Bullard, St. Louis Fed President, August 2013

Market volatility is back. In October, financial markets have experienced a significant downside move. In our view, the recent market turmoil was due to investors' belief that monetary policy is not accommodative enough for the level of expected growth. However, the market’s reaction, growing concerns among Fed governors about inflation expectations and a strong US Dollar could delay the anticipated implementation of a more restrictive monetary policy.

The Fed has indeed signalled the possibility of implementing tighter monetary policy next year. The Fed’s tapering, which is almost over, is already considered as an important change in stance from its previous ultra-loose monetary policy. The Fed governors may argue that ending the policy accommodation provided by QE3 should not be considered as a restrictive monetary policy, but that's not how the market perceives it. The latter acted accordingly; while the Fed's policy statements remained dovish, the tightening process has been ongoing even before the tapering had started. The Fed may think their "forward guidance" of "lower rates for longer" is working, but investors, especially in the bond market, are not fooled by this. The markets were focusing not on what the FOMC was saying, but on what it was doing.

The Fed’s desire to get out of the QE business has been building for a while. And it was cultivated further by the improvement in some crucial US growth metrics. The improvement in the US economy and the rapid fall in US unemployment have encouraged the Fed to reduce monetary accommodation. Fed governors’ public statements are also implying the intention to end the quantitative easing program and switch back to interest rate as a familiar policy tool again. This resulted in the market debating over the timing of the first raise in the policy rate. But what is less discussed is that there has already been a consistent policy tightening since May last year.

The Fed removed policy accommodation at a constant rate of $10 billion at every meeting since January 2014. What is remarkable is that they proceeded to remove liquidity accommodation despite persistent below-target inflation and the rapid increase in the US Dollar. However, Fed heavyweights Stanley Fischer and William Dudley recently said that the sharp fall in inflation expectations and the recent strong rise in the US Dollar may affect the timing of the Fed's policy adjustment. The Fed’s concerns about the surge in the US currency, echoed by other central banks, most forcefully by the Bank of Japan, stopped the rise of the US dollar at the beginning of October 2014.

Further volatility in financial markets, persisting concerns by Fed governors on inflation expectations and the strong US Dollar could mark the return of a more cautious Fed. This in turn could represent a major turnaround as the Fed is covertly the most hawkish central bank at present. If the Fed does relent on their tightening mode, then we expect further injection of "animal spirits" in the global economy. And with improving narratives in China and in Japan, and just last week, in the eurozone, in the form of better than expected PMIs, then risk assets, with commodities at the forefront, would have much improved prospects over H1 2015.

|

Main drivers this week

|

Commodities and Economic Highlights

Commentary by Robert Balan and Alessandro Gelli

Lower prices triggered stronger Chinese crude oil imports

The recent decline in oil prices should have a positive impact on petroleum products demand as lower prices increase incentives to use petroleum products and should boost economic activity, which in turn could lead to stronger demand for petroleum products in the medium term. On the short term, the decline in oil prices has already triggered a rebound in Chinese crude demand.

In September 2014, encouraged by lower oil prices during the summer, Chinese crude oil imports rebounded to 6.7 million b/d, the second highest level ever recorded, only slightly down from the historical record imports reached in April 2014 at 6.8 million b/d. The rise in crude oil imports is also a sharp contrast with the average level of imports reached during the three previous months at below 6 million b/d. Chinese crude oil imports are likely to remain high in the coming weeks, as suggested by the elevated number of VLCC sailing towards China, which reached 80 last week - the highest level in 9 months. This contributed to bringing the front maturity on the Dubai crude oil future to backwardation and to reducing the contango on Brent futures.

There are 2 main drivers behind the strength in Chinese crude oil imports. First, Chinese refining activity is increasing due to the end of the refining maintenance season and the start of new capacity. In September 2014, Chinese crude runs already reached 10.3 million b/d, up 9.1% y/y, the strongest annual growth since the end of 2012. Refining activity needs to rise further to respond to stronger domestic and foreign demand. Domestic demand has already increased in September 2014, when apparent oil demand reached 10.4 million b/d, up 7.1% y/y, compared with a growth of only 3.4% y/y the previous month. Moreover, the stronger economic activity, which we expect for the remaining part of the year, should boost petroleum products demand further.

The second driver, which can explain the rebound in Chinese crude oil imports, is the purchase by the Chinese government or state-owned enterprises (SOE) of crude oil for strategic petroleum reserves. These past few years, China has often seen a rise in its crude oil imports following a large oil price decline due to such opportunistic purchases. The Chinese government and SOE may have about 41 million barrels of spare capacity to store crude oil. Thus, if the Chinese government wishes to purchase this amount in a period of 3 months, this would lead to an increase in Chinese crude oil imports by 450’000 b/d or about 7% of Chinese crude oil imports during these past 9 months. Stronger crude oil demand from China could in turn have a positive impact on crude oil prices.

Platinum prices could stabilise

Following the end of the 5-month strike in South Africa in June 2014 — which took off over 1 million ounces of platinum from the market (24% of 2013 mined supply in South Africa), platinum prices have fallen by 17% to $1255 an ounce – the lowest level since 2009.

The slowdown in economic activity in Europe contributed to the price weakness in platinum as this region is a key market for diesel-fuelled automobiles, which use platinum-based catalytic converter. Large platinum inventories, which were built before the strike, and the expected ramp up in output in South Africa have also contributed to weaker platinum prices. In fact, production at platinum mines in South Africa has recovered more rapidly than initially expected. Three mines of Anglo American Platinum resumed full production a month ahead of schedule in September.

Despite the stronger output, platinum prices stabilised since the beginning of October at around $1255 an ounce. The stabilisation has been triggered by stronger Chinese imports, which reached 277’000 ounces in September 2014, up for the second month in a row, to the highest level since December 2013 before the strike started in South Africa. The recovery of the Chinese economy, which we expect for the remaining part of the year, should contribute to further boost industrial demand for platinum, which typically accounts for about 80% of platinum end-use.

Furthermore, platinum prices have also fallen below the marginal cost of production, estimated at around $1400 an ounce, reducing incentives for mining companies to boost output. Moreover, the platinum-gold ratio fell sharply these past few weeks to around 1.0 – the lowest level since April 2013, down 36.4% from the 14-year average of 1.6 – implying that platinum prices are relatively cheap compared to gold. Finally, net long speculative positions on platinum futures reached in October the lowest level since the end of 2013, with short positions close to record high levels. These factors could contribute to further stabilising platinum prices.

Recovery in grain prices due to delayed planting and crop concerns in Russia

The upward move in the DCI® Grains index since the beginning of October — +7.3% — was the most important 3-week increase since the February-March 2014 price rally. Wheat, corn and soybean prices benefited from delayed plantings threatening the yield of the next crop amid growing concerns about the Russian crop.

The dry weather in Brazil, which already affected coffee and sugar prices, is now affecting the soybean market. Soybean prices benefited from weak spring rains and warmer than normal temperatures in Brazil, which contributed to delayed soybean planting. Rains are required before late October in order to limit yield loss. Delayed plantings could lead to reduced yield and are also increasing the risk of attacks of soybean rust — a fungal infection. These factors have led to a downward revision of the Brazilian soybean production’s estimate made by the government’s agency for agriculture, CONAB, at 88.8-92.4 million metric tonnes, compared with a USDA estimate of 94.0 million metric tonnes. The delayed soybean plantings are also threatening farmers’ ability to plant a follow-on crop, called “safrinha”, which is typically corn.

Contrasting with Brazil, it is the rainy weather in the US Midwest which is leading to a slower than usual harvest for corn and soybean, and to delayed plantings of winter wheat. The delayed harvest increased the risk of frost affecting the crop, while delayed plantings could threaten the next season’s crop yields.

These elements are occurring while concerns about the Russian crop are increasing as persisting dry weather have prevented the development of seeds, making them vulnerable to upcoming freezing temperatures. The wheat crop is in fact in a worse condition than in 2009/10, when the Russian wheat crop fell by 33% y/y. This in turn had contributed to the Russian government’s decision to ban grain exports and had led to a significant rise in grain prices. Grain prices are therefore benefiting from growing concerns about the next grain crops, which might not be as important as previously expected.

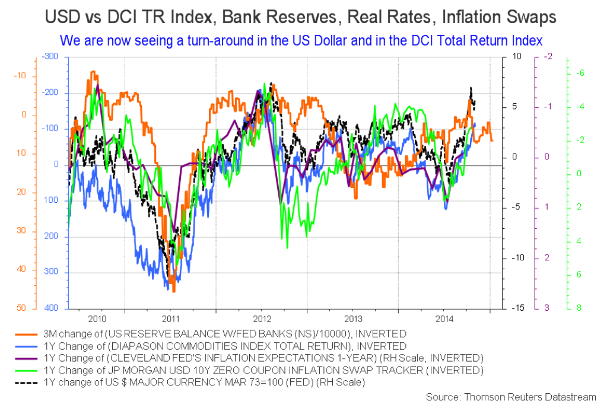

Chart of the week: The US dollar reversal could accelerate on rising bank reserves

|

Growing concerns about the strength of the US Dollar expressed by Fed governors have contributed to halt the rise in the US Dollar. Moreover, the recent rise in bank reserves (inverted in orange on the chart below) are suggesting that the US dollar could start to weaken. This should also add upside pressure on commodity prices (inverted in blue on the chart). A change in stance of the Fed could also trigger a further rise in bank reserves and consequently contribute to add downside pressure on the US dollar. |

|

|

For the full version of the Diapason Capital Markets report, please contact info@diapason-cm.com